How Arweave works and why it exists

Arweave, Arweave's working principle and significance of existence Golden Finance, this article briefly introduces Arweave's working principle and value.

JinseFinance

JinseFinance

Source: ChainNews, author: Liu Yi, founder of Cdot Network, partner of Random Capital

Arweave is an "atypical" blockchain project, most of which People know nothing about it, and those who know a little about it often regard it as one of the many decentralized storage projects running alongside Filecoin. The very few friends who have the patience to study the white paper and yellow paper of the project will inevitably be confused after reading it. Because the entire article focuses on the unpopular concept of "Permanent storage of information", it is impossible to see expansion, cryptographic innovation, DeFi support, value capture, etc. that can make the currency and chain circles shine. the concept of.

Who will need persistent data storage and >Pay for it? We only live a hundred years, so why should we care about preserving human knowledge and history forever?

The founders and core team of Arweave have their own reasons for being unique. As the Chinese translator of Arweave's Yellow Book, I plan to interpret Arweave from the perspective of a typical currency circle and chain circle, so as to prevent domestic blockchain entrepreneurs and investors from missing this major innovation. First of all, please allow me to transliterate Arweave as "Awei" (although this Chinese name is still under discussion in the Chinese community and has not been finalized) to facilitate encryption in Chinese Community spread.

IPFS is the pioneer in the field of centralized storage and has been online since 2014 At the beginning, it grew freely like BT and already stored a large amount of data. However, in order for IPFS to become a commercially available storage system rather than a casual data sharing platform, it must provide service quality assurance. This is what Filecoin is trying to solve, the economic incentive layer of IPFS. From the proposal of the Filecoin concept to the "imminent" launch of the mainnet this year, it can be said that it has been a long delay. As a Protocol Labs (Protocol Labs) that has developed hard-core technologies such as IPFS and libp2p, why has it been so slow to develop Filecoin?

The Filecoin protocol builds two markets: the datastoragemarket and the dataextractionmarket. Users with storage needs go to the data storage market to declare their needs: I want to store ** size of data, which requires ** copies and storage for ** days. The storage service provider (storage miner) in the market quotes a quotation for this storage demand. When the user accepts the quotation, he signs a contract with the miner and pays the fee. When users need to use data, they go to the data extraction market to make demands; then the extraction miners give quotations to meet the data access needs.

The above process does not seem complicated, but there are several difficulties in implementation:

Miners need to provide storage UnforgeableCryptographic proof of user data;

During the validity period of the contract, the protocol must continuously check that the miners have saved the data as promised. If there is a breach of contract, miners will be fined;

In order to encourage miners to store data, the capacity of stored data must earn more than the idle capacity. Moreincreased issuance rewards. At the same time, it is necessary to prevent miners from defrauding additional issuance rewards by injecting junk data.

Filecoin designed Proof of Replication (PoRe) to solve the first problem, using Proof of Space and Time< /strong>(PoTS) and staking mechanism solve problem 2. The third problem is solved by finely tuning the economic model [1] and introducing authentication of real users.

Although Filecoin solves the above problems to a certain extent, it inevitably produces some adverse consequences. The first is the high complexity of the system. In addition to paying the necessary storage costs, miners also have to bear the high cost of proof and the option cost of pledging Filecoin losses. Be aware that computation is relatively more expensive than storage. According to the recommended configuration suitable for small-scale mining[2] provided by Filecoin[3], an 8TB SSD hard drive only costs US$300, but an AMD 3.5Ghz 16-core high-end CPU costs It requires $700, and at least 128GB of memory which costs more than $500 (for comparison, the recommended minimum memory for Avi mining is 8GB).

High mining costs will inevitably lead to high storage service prices for the Filecoin system. In addition, verifying real users is a delicate issue. If the verification is too strict, it will affect the user experience. If the verification is too wide, it will not prevent miners from pretending to be users, and the verification will lose its meaning. The balance between it is difficult to grasp.

At the same time, as a crypto asset, the price of Filecoin is highly correlated with the overall crypto market conditions, that is, high volatility. If the price of Filecoin plummets, miners may take their losses and leave, causing user data to be lost. In addition, large price fluctuations also increase the implied option cost of miners pledging Filecoin. The implicit option cost has been ignored by most PoS economic model research, and I think that at least the option cost lost during the unlocking period should be taken into account (some people even think that the option cost should be calculated for the entire locking period).

The unlocking period is the period from when an unlocking request is made to when a negotiable token is obtained. During this period, the pledger cannot transfer the token, which is equivalent to giving up a Current Price European Option< em>(Unlike American options, European options can only be exercised on expiration) [4]. Taking Tezos as an example, assume that the current price and exercise price are both $2.53, the annualized volatility is 185%[5], and the unlocking period is 14 days(a longer unlocking period means Higher option cost), the risk-free interest rate is 4%(does not affect the calculation result), use the B-S option calculator[6] to get the The European option is worth $0.363 (since the strike price is equal to the current price, the call and put options are equal), which is equivalent to 14.3% of the principal value. It can be seen that due to the high price volatility of cryptographic tokens, the implicit option costs caused by staking should not be ignored.

The Filecoin protocol divides storage and retrieval into two markets, which requires the establishment of two sets of incentive mechanisms and pricing mechanisms, and users’ data access rights are not guaranteed. Suppose you store important data through Filecoin and pay a certain amount of storage fees. Subsequently, you or other users (such as your customers) access the data, and you will have to pay a fee based on the extraction market. If the extraction market price is very high, it is equivalent to the data being "hijacked< by the miners. /strong>", users are faced with the dilemma of either paying high prices or migrating data.

I read the Filecoin white paper in 2017 and immediately gave up researching the project. Programmer's intuition tells me that complex extrapolation schemes usually don't succeed. What is an extrapolation scheme? It is a solution that comes naturally to a problem without having to think deeply about it. It can also be called a "taken-for-granted solution". The extrapolation of Filecoin is: since miners need to (continuously) prove that user data has been properly saved, the protocol should include a set of cryptographic algorithms to implement these proofs. As for the highly complex proofs that inevitably bring about high system complexity and high costs, they can only be solved slowly in the future. However, Filecoin’s competitor, centralized cloud storage, does not require proof and verification. A legal contract is signed between the cloud service provider and the customer, and the law guarantees the customer’s right of access and recourse. It can be seen that as long as the cost remains high, it will be difficult for decentralized storage to provide competitive prices.

Sia, Storj and other protocols are technically different from Filecoin/IPFS, but they are all contract-based Decentralized storage protocol. That is, the user and the miner sign a contract through an agreement, the user pays the fees stipulated in the contract, the miner assumes the obligations stipulated in the contract, and the agreement (or the user) checks the performance of the miner (challenge) and impose penalties for breach of contract. Contract-based decentralized storage protocols all face the basic problems analyzed previously.

The normal state of technological development is that when most people try to solve complex problems with "obvious solutions", there are always people who can find another way and use common solutions that others have not expected. is a much simpler way to solve a difficult problem. Sure enough, after observing the field of decentralized storage for three years, I accidentally learned about "Arweave" - the decentralized storage game-breaker.

Only by understanding the difficulties of Filecoin can we understand Avi's ingenuity. Avi is a complete set of decentralized storage protocols, not based on IPFS, or it is equivalent to Filecoin + IPFS. How does Avi solve the problem of miner proof? The answer is no proof required. The Avi protocol encourages miners to store as much data as possible through mechanism design, and gives priority to storing scarce data with few copies. As for how much each miner deposits and what he deposits, that is the miner’s own business and requires neither proof nor inspection. Just like if a school wants students to study seriously, it can use two methods. One is that the teacher keeps an eye on everyone every day to see if they are listening attentively and completing their homework seriously. If they find that they are not serious, they will criticize and punish them. Another way is to pass the exam. No matter how you usually study, you will be judged by your test scores in the end. If you do well in the exam, you will be rewarded. Both methods can improve learning results, but the latter is obviously much simpler.

Contract-based decentralized storage is similar to "marking people", and the Avi protocol is like "Examination". This method is called incentive-based decentralized storage. . Its advantages can be understood intuitively like this: Filecoin manages thousands of different storage contracts, checks the execution of each contract, and provides rewards or execution penalties respectively. Avi Protocol handles only one contract - All data is saved permanently. As a result, the protocol is very simple, the running costs are low, and the price and reliability of the service are better than those of contract-based systems.

Avi's "Proof of Access" (PoA) is a simple extension of PoW. Each round of PoW puzzle is related to a certain past block (Memory Block). Only miners who have stored Memory Block are eligible to participate in the PoW guessing. Since recall blocks are determined randomly and cannot be predicted in advance, the more blocks a miner stores, the greater the chance of participating in the PoW contest and the higher the possibility of receiving block rewards. If a miner has limited storage space and cannot save the entire block history, he will prioritize saving blocks with fewer copies in the network. Because each block has an equal probability of being selected as a recall block, when a scarce block is selected as a recall block, only a few miners are eligible to participate in the PoW competition, so storing scarce blocks is more beneficial to miners .

Some friends may ask, if all nodes do not store a certain block, won’t this block be permanently lost? Yes, this possibility exists. However, we can quantify the risk of permanent loss of a single block[7].

First of all, the concept of replication rate needs to be introduced. The replication rate is the proportion of block history stored by miners on average. For example, if the network produces a total of 100 blocks and each miner stores 60 blocks on average, then the replication rate is 60%. The replication rate is also the probability that any miner will have a certain block selected at random. In turn, if a certain block and a certain miner are randomly selected, the probability that the miner does not have this block is 1-replication rate. When there are N miner nodes in the network, the probability that all miners do not have a certain block is (1-replication rate)^N. The probability that there is a missing block is (1-replication rate)^N * total number of blocks.

Assuming that the Avi network has 200 miner nodes, the replication rate is 50%, and the total number of blocks is 200,000, then the probability of a missing block is 6.223*10^-61, which is negligible An event of extremely low probability that cannot be counted. There are currently about 330 miner nodes in the Avi network, the replication rate is 97%, and more than 510,000 blocks have been produced[8]. There is a probability of block loss It is much lower than the previous calculation result, and is equivalent in order of magnitude to the probability of private key collision. Moreover, the above calculation assumes that miners randomly store block history. Considering that miners will store scarce blocks first, the possibility of losing blocks is lower.

The Avi protocol has only one market, and users only need to paystorage fees, and subsequent access to data is free. This is possible because the Avi protocol adopts a mechanism design similar to BT[9], and all nodes in the network are equal(no distinction is made between miner nodes and user nodes) em>, all nodes try to respond to requests from other nodes as quickly as possible. Like BT, the more upside contribution, the faster the downside. Selfish nodes will be demoted by other nodes and gradually excluded from the network.

To fully understand the design of the Avi protocol, the best way is to read the Yellow Paper (https://github. com/toliuyi/arweave_notes/blob/master/arweave-yellow-paper-cn.pdf). Although the Yellow Book is long and contains many formulas, don't worry, you can understand it if you have a basic middle school mathematics foundation.

Compared with Filecoin, Avi Network has two major advantages. One is low cost. Although the Filecoin mainnet has not yet been launched, I will make a prediction in advance: One year after the Filecoin mainnet is launched (the economic model enters a stable state), 1MB files will be permanently stored in hundreds of copies on the Avi Network. The price will be lower than the price of storing 5 copies for 5 years on the Filecoin/IPFS network, and data access to the Avi Network is permanently free. Second, the incentive mechanism of the Avi protocol makes both data storage and accessmore reliable. Avi mainnet has been online for more than two years by concisely and cleverly solving the biggest problem of decentralized storage without requiring $200 million in fundraising and three years of development.

Avi is not a runner of Filecoin/IPFS, but the most promising encryption protocol to make large-scale decentralized data storage a reality.

Avi is rarely compared with Ethereum. After all, < In the strong>Web3.0 protocol stack, they are at different levels and appear to be complementary. But delving deeper into the Avi Accords reveals even more possibilities.

Ethereum (and other smart contract public chains) was born to support decentralized applications DApp . DApp is an Internet application that is executed fairly and transparently and cannot be controlled by individuals or a few people. From the perspective of software architecture, network applications (including Internet applications and DApps) can be divided into three layers: presentation, business logic and persistence (data). We might as well analyze the development bottlenecks of DApp and the application potential of the Avi Protocol from these three layers.

So far, the presentation layer of DApp still remains in the same state as centralized web applications, that is, it is deployed by developers on a cloud server and then downloaded to the user client for execution. Therefore, developers and cloud service providers still have the right to stop and review DApps. Network interruptions, server downtime, DNS hijacking and other failures and attacks still threaten the availability and security of DApps. In addition, the cost of IT infrastructure for DApps will increase as the number of users increases, forcing developers to adopt some kind of monetization method to maintain the operation of DApps. The monetization method is either Web2.0-style, that is, selling traffic; or it has the characteristics of an encryption protocol, that is, issuing tokens. Once monetization fails, developers may give up running DApps, and users can only turn to alternatives. And even if a replacement survives, it still faces the same problem. DApps that can maintain operation often encounter the problem of "Forced upgrade", that is, the new version is not necessarily less popular with users than the old version, but users cannot prevent them from upgrading, nor can they continue to use the old version.

To sum up, the presentation layer of decentralized applications is still centralized and can still be controlled by individuals or a few people.

The application layer of the Avi protocol is called Permaweb(permaweb), and its main (not the only) The application architecture is Serverless (Serverless) style. The development of serverless DApp is similar to the front-end development of traditional Web. Developers use HTML, Javascript and CSS to develop the presentation layer of DApp. The difference is that the deployment of the presentation layer is not uploaded to the cloud server, but packaged and stored in Avi Network. The storage fee is very low, and it is a one-time paid permanent service. Users still use the original method to access DApp. Avi DNS and TLS are compatible with ordinary browsers and do not require users to install and learn to use new clients. No matter how DApp users grow, there will no longer be any overhead for developers.

Since Avi is a decentralized network, neither developers nor Avi miners can prevent or censor users from using DApp. Developers can develop new versions of DApps, but the new version cannot overwrite the old version. The choice of which version to use lies with the user. It can be seen that Avi has realized the decentralization of the DApp presentation layer, so more and more DApps have transplanted the presentation layer to Avi, including: Synthetix Exchange, Tokenlon, KyberSwap, UniSwap, Oasis App, Curve.fiand others[10].

It should be noted that the concept of using decentralized storage to achieve decentralization of the DApp presentation layer is not a creation of Avi Protocol. As early as 2014, Dr. Gavin Wood listed "Static content publishing" in his paper [11] describing the form of Web3.0 network. It is one of the four basic components of Web3.0. The practical result of this reflection was theSwarm project[12]. Both Swarm and IPFS have been highly anticipated to solve the decentralization problem of DApp presentation layer. However, due to various reasons, this wish has not yet been realized. It was not until the emergence of the Avi protocol that the decentralization of the DApp presentation layer had a practical solution.

Smart contract public chains such as Ethereum have achieved decentralization of the DApp business logic layer and data layer, but it is well known that there are scalability bottlenecks. Scalability and price are two-sided issues. Scalability limitations stem from the scarcity of computing and storage resources. In a decentralized network, the result of competition for scarce resources is high prices. Since price is easier to quantify, this article chooses to analyze from the perspective of price.

Let’s look at the data layer first. Ethereum consumes 20,000 gas to store 256-bit integer data, and 625 million gas to store 1MB of data. Based on the gas price of 20gwei (the writing of this article coincides with the DeFi boom, the gas price is often as high as more than 100gwei), and the unit price of ETH is 400 US dollars, the cost of storing 1MB of data on the Ethereum chain is as high as 5,000 US dollars. It is obviously an unaffordable high price. Most DApps with data storage requirements adopt hybrid storage solutions, that is, the hashes of high-value data such as encrypted assets and attachments are stored on the chain, and detailed data, multimedia data, etc. are stored off-chain. If centralized off-chain data storage is used, such as relational databases or NoSQL databases, the DApp will still be partially centralized and will still be used by individual or a small number of people (cloud service vendors and developers) )control. Therefore, many DApps prefer decentralized storage, such as IPFS.

In this link, Avi provides completely decentralized, low-cost, high-reliability permanent data storage, thus becoming a powerful assistant to Ethereum. No need to sacrifice decentralization, Avi currently stores 1MB of data for just 0.1 cents. You read that right, one five millionth of Ethereum. At current prices, the cost of storing 1MB of data in Alibaba Cloud for 100 years is 2.6 cents. Moreover, only intra-city redundant replication is supported, and the network overhead of data synchronization and data access is billed separately. The Avi Network is redundantly replicated with hundreds of nodes on five continents around the world, and data synchronization and access are free of charge. You read that right, the decentralized Avi Network is already price lower than centralized cloud storage. No wonder Solana[14], SKALE[15], Prometeus[16] and other Layer 1, Layer 2, and DApp protocols choose Avi Serves as a data storage layer. There are also NFT projects such as InfiNFT, Mintbase.io and Machi X that use Avi to store NFT media resources, metadata and code[17].

Smart contracts are the business logic layer of DApp. Similar to the data layer, the bottleneck of smart contracts is the scalability/computation cost issue. According to estimates by Vitalik Buterin, the computing and storage costs of Ethereum are about 1 million times that of Amazon Cloud Services [18]. The previous estimate of the cost of the DApp data layer can also be confirm this estimate. The fundamental reason for the high cost of public chain computing and storage is its fully redundant architecture, that is, all on-chain data is stored by every full node, and all calculations are performed on every full node. There are three ways to achieve public chain expansion: representative system, layering and sharding.

Avi's Smartweave smart contract [19] is a completely different approach. Smartweave smart contracts are programs developed in Javascript and stored on the Avi network, so they are immutable. Submitted to the network for storage at the same time as the contract code, is also the creation status of the contract. Unlike smart contracts in Ethereum (and other public chains), Smartweave is not executed by miner nodes, but downloaded to the computer of the contract caller. The execution process starts from the creation state of the contract, executes all transactions in the history of the contract in a determined order, and finally executes the transaction of the contract caller. After completion, the contract caller submits the input of his transaction and the executed contract status to the Avi Network and enters permanent storage. Subsequent contract calls repeat the above process.

In other words, for a smart contract transaction, Avi Network only needs one node—the caller’s own node to execute it(note that Avi Network does not Distinguish between full nodes and light clients). Since the caller node executes (and verifies) all transactions in the history of the contract, he does not need to trust or rely on any node to get credible calculation results< em>(i.e. the new state of the smart contract). Therefore, each Smartweave contract can be regarded as Avi's Layer 2 chain. Executing the smart contract is the full synchronization and verification of the Layer 2 chain. This design solves the scalability/computation cost problems of the DApp business logic layer. Smart contracts can contain almost unlimited complex calculations at very low marginal cost, because usually the caller's computing equipment has been purchased or rented for a long time.

Some friends may ask: As the number of transactions increases, doesn’t the execution of smart contracts become slower and slower? That's true, but there are ways to do it. For example, the caller names the result status of the contract to form a contract status snapshot. If the caller is trustworthy (for example, if the caller is a smart contract developer), subsequent callers can specify the state snapshot as the initial state and only need to execute the transactions after the snapshot. State snapshots do not necessarily lead to the expansion of the trust set. After all, the premise for the reliability of smart contracts already includes trust in the initial state.

Of course, Smartweave is still under development and the current version is V0.3. The above should be considered an exploration of Smartweave’s potential. To achieve commercial use, Smartweave still needs to solve many issues, such as composability.

From my understanding of the operating mechanism of Smartweave, there are no special technical obstacles to achieving composability. However, I have always believed that the composability of Ethereum smart contracts is "too powerful", making it difficult to limit the exponential growth of the complexity of the contract system. Look forward to more surprising innovations from the Smartweave team and make good use of the double-edged sword of composability.

To sum up, Avi Protocol supports DApp to truly achieve comprehensive decentralization and solve the scalability/cost issues that have plagued the public chain field for many years. . In this sense, Avi should be classified as the "Web3.0 full-stack protocol" advocated by Blockstack [20] , rather than just decentralized storage .

Bitcoin is the pioneer of encryption protocols and the king of cryptocurrencies. There has always been a controversial topic in the industry: Is Bitcoin’s king status likely to be replaced? Even Bitcoin loyalists admit that after 10 years of development, Bitcoin is no longer the most technologically advanced cryptocurrency. But they believe: Super-sovereign store-of-value currencies are the biggest use case for cryptocurrencies. The Bitcoin protocol has been running the longest, is the most well-known, and has the best security. Moreover, the competitive barrier of cryptocurrency is not technology, but liquidity. Liquidity has network effects, which are mechanisms whereby the utility of a product or service increases as users grow. The Bitcoin protocol has established a liquidity advantage that will only continue to grow as cryptocurrencies gain popularity. Therefore, Bitcoin’s king status is unshakable.

Is it possible that the liquidity network effect advantage will be broken? Answering this question requires quantitative research on network effects. I believe many people will immediately think of Metcalfe's Law, which states that the value of a network is proportional to the square of the number of users. Metcalfe's law is the first quantitative model of network effects, but research in recent years has shown that the value of no network grows according to Metcalfe's law, at least when the number of users is large, the network value growth curve < strong>Necessarily become flat[21].

Research has shown that [22], parts of the Internet The network effect of the business is n*log(n), part of which is theS curve. The S-curve is the growth of network value with users. It is an exponential growth that is slow at first and then fast. After reaching saturation, the growth rate slows down. The important corollary of the S-shaped curve is that the strong get stronger, but it does not mean that the winner takes all. If the network effects of all Internet platforms comply with Metcalfe's law, then a single oligopoly situation will be formed in every segment of the Internet industry. But the reality is that no matter in the global or Chinese Internet industry, most segmented fields have more than one platform that has existed for a long time.

Then what curve (formula) does the liquidity network effect use to grow? Assume that for a certain crypto asset, the average daily trading volume of each participant accounts for one ten thousandth of the total market value of the asset. With 10,000 investors, the daily average turnover rate is 100%, and with 20,000 investors, the daily turnover rate is 200%. That is to say, with the addition of 10,000 new investors, the turnover rate has doubled. If the number of investors increases from 100,000 to 110,000, the turnover rate increases from 1000% to 1100%, which is only an increase of one-tenth. Therefore, the more investors have, the contribution proportion of new investors to liquidity will be smaller, and the network effect is related to log(n) with the number of participants.

The above quantitative models and pictures about the liquidity network effect are all from Multicoin Capital's research[23]. The conclusions of this study are very important. For example, exchanges compete for liquidity. After the leading exchange reaches a certain scale, the value growth brought by the liquidity network effect will slow down, giving latecomers a chance to catch up. If the liquidity were n*log(n) or even n square network effects, there would be no Binance, Kucoin, or MXC coming from behind, nor would there be tens of thousands of exchanges. The quantitative relationship of log(n) shows that the greater the liquidity, the stronger, but it does not guarantee that the strong will always be strong.

There is another factor that makes Bitcoin's liquidity advantage easier to break, which I call "Liquidity transmission". That is, new cryptocurrencies can use the established global trading network to share liquidity with existing cryptocurrencies. For example, when Ethereum was born, industry infrastructure including exchanges and payment platforms had been developing for 6 years, and they could easily integrate ETH. As long as ETH forms a highly liquid trading pair with Bitcoin, it will indirectly have liquidity with major legal currencies. Therefore, Ethereum no longer needs to go through the long market introduction and infrastructure construction stages to become a highly liquid cryptocurrency. currency.

In a state of free competition, currencies are compared based on their monetary nature. Currency includes scarcity, fungibility, verifiability (difficult to counterfeit, easy to identify), accessibility, divisibility, as well as the cost of preservation, carrying and transfer, etc. All cryptocurrencies are direct descendants of Bitcoin and have inherited Bitcoin’s strong currency. Before Ethereum, the theme of cryptocurrency innovation was "Better Bitcoin", which is to create a cryptocurrency with stronger monetary value. For example, Litecoin, Dash, StellarTransfers are faster and transaction fees are lower. ZCash and Monero have better privacy and more guaranteed fungibility, but they do not threaten the status of Bitcoin. Because quantitative improvements are not enough to challenge the advantages of network effects, qualitative innovation is necessary to achieve "Paradigm Shift". For example, Microsoft didn't invent a better mainframe to beat IBM, and Apple didn't beat Microsoft with a better PC. Revolutionary innovators have become new kings only by implementing dimensionality reduction attacks on the old overlords.

The industry generally agrees that Ethereum is the representative of blockchain 2.0, because Ethereum is a new level of innovation. Through the introduction of EVM, the cryptocurrency has a powerful Programmability. Generational innovation is not about what I can do better, but what I can do that you cannot do.

Ethereum smart contracts can realize decentralized asset issuance, fund raising and asset transactions. In the last wave of ICO, ETH was used as the main currency and value storage Using it, the demand for ETH has skyrocketed, pushing its market value up to 60% of BTC. Of course, ICOs suffer from serious information asymmetry, which inevitably leads to widespread adverse selection and moral hazard problems, and bubble bursting is an inevitable result. Highly programmable cryptocurrencies have endless room for innovation, and the rise of DeFi will be a new round of challenges for Bitcoin from Ethereum. Unfortunately, ETH's value capture mechanism is not sound. If EIP1559 had been implemented a few years earlier, ETH should have entered a deflationary stage, and the DeFi boom is likely to push its market value beyond BTC.

There are two major investment themes in the cryptoasset market: Sound Money and Web3.0. Sound money is a decentralized, supra-sovereign cryptocurrency, represented byBitcoin. Web3.0 applies blockchain technology to reconstruct social production relations. The representative project is Ethereum. I believe that the two major investment themes of sound currency and Web3.0can have both, that is, a decentralized, highly programmable blockchain platform that can not only support Web3.0, but also its native crypto assets. With the properties of a sound currency, you can have your cake and eat it too and become the king of cryptocurrency in the future. The new king should have the following properties: highly decentralized (implying super-sovereignty), widely used, low externalities of consensus protocols, good scarcity, highly programmable, and compliant.

Given the scalability issues of Ethereum 1.0, even if it ascends to the throne, it will not last long. Which project is the representative of Blockchain 3.0? Ethereum 2.0, Polkadot, Cosmos, and Avi Protocol are all serious contenders. Avi Protocol also has the potential to become the King of Cryptocurrency:

Decentralization High degree of globalization, the network will not be controlled by individuals, institutions or governments;

Wide range of uses, as a Web3.0 full-stack protocol , is an ideal platform for all kinds of decentralized application innovation;

PoA consensus will not consume a lot of extra electricity. See the next chapter for detailed discussion;

The issuance rate of AR, the native token of Avi Protocol, is low and scarcity is good. See the next chapter for detailed discussion;

Highly programmable, smart contracts are Turing complete. Both DApps and smart contracts use mature web technologies such as Javascript, which is conducive to the formation of a wide and diverse developer community;

Avi is very similar to Ethereum and is carried out before the main network is launched. ICO. Functional tokens were distributed after the mainnet went online. The function of ETH is to pay the computing and storage fees of Ethereum; the function of AR is to pay the storage fees of the Avi Network. As time goes by, AR is used by more and more people, and currency holdings become more and more dispersed, meeting the legal definition of bulk (virtual) commodities.

The economic model of the encryption protocol is how to coordinate services The interest relationship between providers (miners), service users (users) and currency holders. Miners provide computing, bandwidth and storage resources for the encryption protocol network to ensure the security and availability of the protocol. Users must pay the miners for using the protocol. Miners' income is divided into two parts: one is the transaction fee paid directly by users; the other is the protocol's distribution of newly minted tokens to miners, that is, additional issuance rewards. The additional issuance reward is the seigniorage tax shared by all coin holders according to the number of coins they hold. In almost all encryption protocol economic models, the main income for miners is the additional issuance reward (seigniorage). For example, although Bitcoin has experienced three additional issuance reward halvings, the additional issuance rewards still account for 95% of the total revenue of miners, and transaction fees only account for 5%. This is actually a mechanism for currency holders to subsidize users’ use of the protocol.

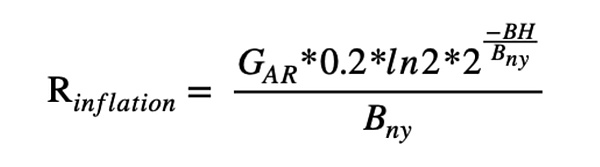

Among all the economic models of encryption protocols that I have studied, the economic model of Avi Protocol is the most friendly to currency holders. In the genesis block, the protocol generated 55 million AR, and then additional AR will be issued every block. The formula for calculating the additional issuance is as follows:

Among them:

< img src="https://img.jinse.cn/3906272_image3.png">

Introducing constants, the formula is simplified to:

Avi protocol blocks one block every 2 minutes on average. After the genesis block, each block will issue approximately 29 additional ARs, and the additional issuance will be halved every year. A total of A maximum of 11 million additional ARs can be issued. In other words, every year after the Avi mainnet goes online in June 2018, half of the remaining AR will be mined, that is, 5.5 million AR will be mined in the first year, and 275 AR will be mined in the second year. , and 1.375 million were mined in the third year...(Avi mainnet was launched in June 2018, and there was a lag of more than two months in the issuance of block rewards).

At the time of writing, Avi Network is facing the Second Halving (expected to be around September 10, 2020). The issuance rate one year after the second halving (i.e. the third year) is 137.5/(5500+550+275) = 2.17%. By the fourth year, AR’s issuance rate will be lower than Bitcoin’s during the same period.

Another scarcity indicator may be more convincing, the unmined rate = unmined amount / total amount. There are currently only about 1.98 million unmined ARs left, with a unmining rate of 3%. For comparison, there are currently approximately 2.55 million BTC that have not yet been mined, with a pending mining rate of 12%. It can be seen that the amount of additional issuance of AR is small, the speed of additional issuance decays quickly, and it has the typical characteristics of high scarcity of sound currency.

However, readers should note that according to the figures provided by the Avi team, the current circulation of AR is about 38 million, which means that there are approximately 26 million ARs in >Uncirculated status. I don’t know the ownership structure and unlocking plan of this part of the token. I can only speculate that it belongs to early investors, teams and foundations. If anyone knows anything about this please let the author know, it would be greatly appreciated.

The principles of Avi’s economic model can be roughly summarized as follows: users pay enough for storage services; miners’ revenues exceed costs, maintaining basic Roughly fixed profit rate; currency holders receive almost all the benefits from the appreciation of AR tokens. Based on AR’s previous long-term consolidation of the currency price of US$4, Avi miners’ income from the additional issuance this year will be 5.5 million US dollars, and these profits will be shared by hundreds of miner nodes around the world. By comparison, Bitcoin miners earn more than $10 million per day from additional issuance, or more than $3.6 billion per year.

Avi PoW (as part of the PoA access proof) adopts the RandomX algorithm [24]. RandomX is a CPU-friendly algorithm that requires large amounts of memory to execute and offers little benefit from dedicated hardware. Following the Avi protocol, Monero upgraded the PoW algorithm to RandomX [25] in November 2019 as a response to ASIC mining ’s latest (and perhaps final) resistance. Given that Avi’s mining is not simply a competition for computing power, and the overall benefits of mining are limited, Avi is likely not to form a dedicated mining industry chain, but will maintain hundreds of mining nodes around the world (some nodes Will become a mining pool)and Higher replication rate level, the network power consumption is not high. The mainstream mining hardware will most likely not be ASIC miners, but ordinary commercial computers.

Of course, it is not ruled out that someone will promote the Avi mining machine after the popularity of AR increases. At that point you should understand that it is almost impossible to make a decent return on the purchase of an Avi mining machine. In the long run, Avi may become a Web3.0 decentralized CDN network. By then, enterprise-oriented CDN services will be the core business model of Avi miners.

I started investing in Bitcoin in early 2013. In the more than 7 years since then, I have heard many people talk about it How to learn about Bitcoin, your first impression of Bitcoin, how to pass by huge wealth, etc. A question that has always bothered me is:What determined our view of Bitcoin at that time? Most people don’t care. Some people believe that Bitcoin is a fund disguised as high-tech. A few people invest in Bitcoin or start mining out of various psychological reasons, and a very small number of them persist. , fate was changed by Bitcoin.

These few people are often regarded as geniuses who have foreseen the future. But you must know that for any novel event, there is a group of early participants, but among countless novel events, only a few have a broad impact on society. Instead of considering those who participated in Bitcoin early and became big players as geniuses, it is better to say that they are lucky ones. But the question is, does such good luck happen to everyone randomly with roughly equal probability? Based on my thinking on this issue over the years, this may not be the case.

To most people, the crypto asset market is a casino at best. The profits earned several times or higher in a bull market can easily be returned to the market in a bear market, and the principal may even be lost. The fundamental reason is that encryption protocols have a very high failure rate. Direct evidence is that most of the cryptocurrencies that were among the top ten by market capitalization five years ago [26] have returned to zero or are close to zero today.

Encryption protocols are not a universal solution to all problems. There are thousands of encryption protocols on the market today, trying to build various trustless Internet platforms. But after five to ten years, the starting point of a considerable part of the encryption protocols will be proven to be wrong, that is, the encryption protocols are not suitable for these fields. In those applicable fields, since encryption protocols have network effects and can serve global users without geographical restrictions, the number of successful encryption protocols in the same field should be very few. Therefore, within five to ten years, the vast majority of the thousands of cryptoassets on the existing market will return to zero or close to zero.

Why are rational investors willing to risk zero by investing in crypto assets? In mid-2014, when Bitcoin was at the trough of the previous bear market, the U.S. Attorney’s Office held a public auction of 100,000 Bitcoins in four separate installments. Tim Draper, a well-known Silicon Valley venture capitalist and head of DFJ Investments, photographed most of them. After the auction, Tim Draper gave an interview to the media and explained his logic for buying Bitcoin. He said that Bitcoin is likely to return to zero, but there is also a certain probability that it will rise hundreds of times, so it is a good investment. Assume that five years after he started buying, Bitcoin has an 80% probability of returning to zero and a 20% probability of rising 100 times. The expected rate of return on this investment is then82% per year, which is clearly higher than the risk-free rate of return on long-term Treasury bonds.

I saw the news about the auction and heard Tim Draper’s interpretation of his investment logic. I agreed with his logic, so I used a sum of funds that I could afford to lose to increase my position in Bitcoin. Facts have proved that this investment logic is tenable.

People who are successful in the crypto asset market are optimistic and long-termists who focus on big issues. The so-called big issues are basic issues that affect the development of the Internet and even human society. In 2011, 2013, or even 2015, you could have listed hundreds of reasons why Bitcoin would fail, and they would all be valid. But if you pay attention to the following big issues (or one of them) - the Internet needs native, value transmission that does not depend on specific institutions; Internet platforms and Financial intermediarieshave captured most of the profits from all social and economic activities; the central bank continues to issue more money to promote economic development, which is no longer sustainable, etc. - you will realize the cross-generational emergence of Bitcoin significance. Moreover, an optimist must believe that although Bitcoin has hundreds of reasons to fail, it may also succeed. As for long-termism, focusing on big issues is two sides of the same coin. If someone liquidates his Bitcoin position after making a few times profit, it's hard to believe that he really cares about big issues.

The permanent preservation of human knowledge and history is certainly a big issue, and probably of unparalleled importance to humanity. After all, in terms of intelligence and physical ability, modern humans are no different from their ancestors tens of thousands of years ago. The only reason why we live a completely different life from our ancestors is that we have inherited and utilized the knowledge and experience that humans have accumulated over tens of thousands of years of history.

For the rulers of the Ptolemaic dynasty, theBibliotheca Alexandrinamay have been just an embellishment of the country's riches. But for later generations, the Library of Alexandria was far more important than the Ptolemaic dynasty. Although Caesar is called by the historian Monson: the only creative genius in the Roman Empire. But Caesar's long-term achievements cannot make up for the fault of burning down the Library of Alexandria. Has today's technology reached a critical point where the world can no longer rely on individuals, institutions, or nations, no matter how powerful, to permanently preserve the knowledge and history of all mankind? If this unprecedented great achievement is achieved in this generation, we will be so lucky to be able to participate in it!

So Avi is not a substitute or competitor of Filecoin/IPFS. The goal of Filecoin/IPFS is to subvert the monopoly of centralized cloud service vendors on the storage market. This is of course an important issue in the Internet industry, but compared with Avi's goal, it is far from a "big problem< /strong>". When I finished reading the Avi Yellow Book, I felt like I traveled back in time and space to the time when I first learned about Bitcoin. Will a miracle happen this time?

Citations

1. https://filecoin.io/zh-cn/2020-engineering-filecoins-economy-zh-cn.pdf

2. Labs, P. A Guide to Filecoin Storage Mining. Filecoin Available at: https://filecoin.io/blog/filecoin-guide-to-storage-mining/.< /span>

3. https://pcpartpicker.com/user/tperson/saved /H2BskL

4. Venturo, B. The economics of Ethereum's Casper. Medium (2018). Available at: https://medium.com/@brianventuro/the-economics-of-ethereums-casper-6c145f7247a2.

5. https://www.reddit.com/r/CryptoCurrency/comments/982x9l/top_100_cryptocurrencies_ranked_by_annualized/

6. http://app.czce.com.cn/cms/cmsface/option/Calculator/utCal.jsp

7. Project, T. A. Decentralized storage: Incentives vs Contracts. Medium (2019) . Available at: https://blog.goodaudience.com/decentralised-storage-incentives-vs-contracts-b74ee0b7eff1.

8. https://viewblock.io/arweave/stats

9. Bram Cohen. Incentives build robustness in bittorrent. In Workshop on Economics of Peer-to-Peer systems, volume 6, pages 68{72, 2003. [19] Matt Corallo. Compact block relay. bip 152, 2017.

10. Project, T. A. Arweave News: July. Medium (2020). Available at: https://medium.com/@arweave/arweave-news-july-7905d5e0c84f.

11. ĐApps: What Web 3.0 Looks Like Available at: http://gavwood.com/dappsweb3.html.

12. Swarm Available at: https://swarm.ethereum.org/.< /p>

13. G. Wood, Ethereum: A secure decentralized generalized transaction ledger, In: Ethereum Project Yellow Paper 151 (2014).

14. Solana - Arweave Bridge: ArweaveTeam Funded Issue Detail. Gitcoin Available at: https://gitcoin.co/issue/ArweaveTeam/Bounties/30/100023463.

15. SKALE Network - Arweave Bridge: ArweaveTeam Funded Issue Detail. Gitcoin Available at: https://gitcoin.co/issue/ArweaveTeam/Bounties/27/4468.

16. Labs, P. New primary storage for Ignite. Medium (2020) . Available at: https://medium.com/prometeus-network/new-primary-storage-for-ignite-94096e2e8506.

< span style="font-size: 14px;">17. Project, T. A. NFT Permanence with Arweave. Medium (2020). Available at: https://medium.com/@arweave/nft-permanence-with-arweave -35b5d64eff23.

18. Wang, B. Ethereum is about 1 million times less efficient for storage, network and computation. Next Big Coins (2018). Available at: https://www.nextbigcoins.io/ethereum-is-about-1-million-times-less-efficient-for-storage- network-and-computation/.

19. Project, T. A. Introducing SmartWeave : building smart contracts with Arweave. Medium (2020). Available at: https://medium.com/@arweave/introducing-smartweave-building-smart-contracts-with-arweave-1fc85cb3b632.

20. https://www.blockstack.org/

21. Odlyzko, Andrew & Tilly, Benjamin. (2020). A refutation of Metcalfe's Law and a better estimate for the value of networks and network interconnections.

22. The Network Effects Bible. NFX (2020). Available at: https://www.nfx.com/post/network-effects-bible/.

23. Kyle Samani, On the Network Effects of Stores of Value. phoenix Available at: https://multicoin.capital/2018/05/09/on -the-network-effects-of-stores-of-value/.

24. tevador. Randomx. https://github.com/tevador/RandomX, 2019.

25. Shevchenko, A. & Shevchenko, A. Monero Penalizes GPU and ASIC Mining with RandomX Upgrade. Crypto Briefing (2019). Available at: https://cryptobriefing.com/monero-penalizes -gpu-mining-randomx/.

26. muhammedabdulganiyu42@gmail. com The Rise & Fall (And Rise & Fall) Of The Top 10 Cryptocurrencies... Merchant Machine (2018). Available at: https://merchantmachine.co.uk/cryptocurrencies/.

Arweave, Arweave's working principle and significance of existence Golden Finance, this article briefly introduces Arweave's working principle and value.

JinseFinance

JinseFinanceIn this article, we discuss in detail how storage donation works and then study its characteristics and risk profile by simulating its execution using Markov chains.

JinseFinance

JinseFinanceThis article will explore the redundancy mechanisms of Arweave and IPFS, and which option is safer for your data.

JinseFinance

JinseFinance100 billion WhatsApp messages are sent every day. Most blockchains are not designed for storage. If you want to store 100 billion WhatsApp messages on Ethereum or any blockchain, it will be extremely expensive.

JinseFinance

JinseFinanceThis article explores how Arweave and IPFS store, maintain, and access files, and how this affects the reliability and durability of digital assets.

JinseFinance

JinseFinanceArweave is a decentralized data storage solution that provides permanent and immutable data storage services through its Blockweave technology and native cryptocurrency AR token.

JinseFinance

JinseFinanceThe Succinct Proof of Access (#SPoA) game can be used by any participant to prove that they actually store some data at a specific location in a dataset. This pattern can also be used to create a second game, which we call a concise proof of replication.

JinseFinance

JinseFinanceArweave is a new type of blockchain storage network designed to solve the problem of permanent data storage and access.

JinseFinance

JinseFinanceDuring this Chinese Spring Festival, a big event happened in the Arweave ecosystem.

JinseFinance

JinseFinance JinseFinance

JinseFinance