Author: David C, Bankless; Compiler: Deng Tong, Golden Finance

Over the past four months, we have rated a range of Solana ecosystem altcoins in our Token Hub product , a large portion of which received bullish ratings.

These include Kamino (KMNO), Drift (DRIFT), Sanctum (CLOUD) and Jito (JTO). While most companies have posted significant gains (Kamino's is up 111%), we still believe they still have room to rise.

With the market becoming increasingly positive, it’s time to revisit these coins, delve deeper into their bull cases, and examine what forces could support them moving forward.

Kamino

Kamino Finance on Solana is a top platform for yield on major assets such as stablecoins and LST; recent growth has brought its TVL to $1.6B.

Tools such as leveraged LST staking, liquidity provision, and lending markets have helped Kamino leapfrog other protocols, solidifying its leadership position as ecosystem activity and competition increase. The rise of stablecoins on Solana, especially the launch of PYUSD, has made Kamino a top destination for yields, with PYUSD yields reaching 30% in July before gradually declining. This solid foundation sets the stage for Kamino’s Lend V2, which will introduce new primitives, products, and upgrades to evolve Kamino into a comprehensive DeFi layer.

The first primitive in V2 will be the market layer, which allows the creation of different lending and borrowing markets without permission. These can be customized to include new assets not currently supported by Kamino’s four live markets to suit a wider range of user risk profiles.

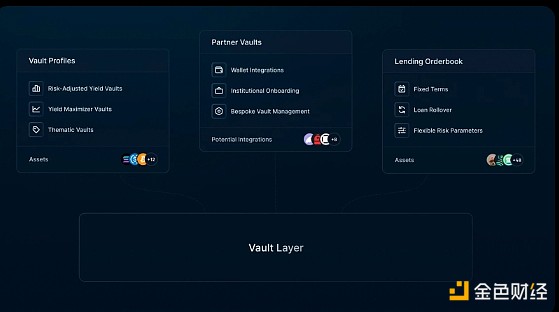

The second primitive is the Vault Layer, which will optimize yields across multiple markets. For example, stablecoin vaults can switch between JLP and Ethena Markets for optimal returns. It can also be customized based on risk tolerance, such as deploying only to markets with high liquidity and low volatility. With the emergence of the vault layer comes the partner and curator vaults, opening the door to further institutional use. Through tailored yield strategies, institutions can set their own risk and liquidity preferences, while retail users have access to expert-managed vaults who will share in the interest generated by these vaults. The upgrade also lays the foundation for future use cases, including real-world assets (RWA) and peer-to-peer lending, unlocking more practical applications for DeFi.

Additionally, Lend V2 introduces new products to Kamino such as spot leverage, lending order books, and limit orders. These product innovations are supported by other key upgrades in V2, such as Scam Wick Protection and Liquidation Auctions, which help protect users during market volatility and reduce liquidation penalties. In addition, segregation and cross-mode improve risk management, ensuring safer lending across different asset types.

Overall, These innovations and upgrades are likely to help Kamino strengthen its fundamental role in the Solana DeFi ecosystem, provide enhanced revenue opportunities and expand its ability to become the chain’s core financial primitive.

Sanctum

Building on its foundation, Sanctum offers whitelisted validators the ability to launch their own liquid staking tokens, thereby increasing the attractiveness of its protocol because On Solana, the greater the value of the protocol, the higher the priority of its transactions.

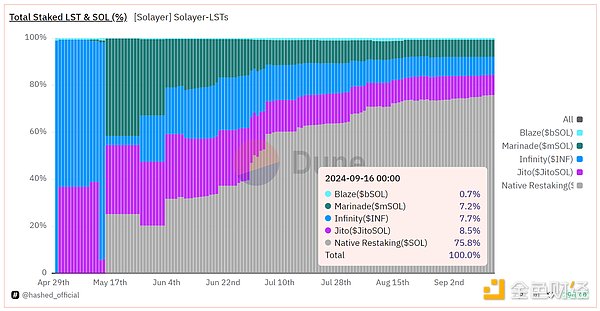

This has attracted many players, such as Jupiter’s JupSOL, which already controls 10% of all staked SOL, and Sanctum-backed LST, which accounts for at least 23% of all LST on the network. This rapid adoption highlights Sanctum’s ability to unlock value in Solana’s staking economy. Given that Solana has ~$62B of staked capital, accounting for 68.7% of its total supply, it exceeds Ethereum in total pledged volume, but lags far behind in terms of liquid pledges - 65% of Ethereum's pledged ETH is in liquid form, while Solana's This proportion of only 6.5% of staked SOL exists in LST - there is a huge growth opportunity for Solana, which has attracted the attention of major players such as Binance, Bybit and BitGo, all of which have or will launch Solana LST with Sanctum , thereby adding hundreds of millions of dollars to the TVL of the LST launched by Sanctum.

This will affect CLOUD in several ways. First, if we expect Sanctum's list of whitelisted validators to continue to grow, it will have a direct deflationary effect on CLOUD, as validators must stake CLOUD to launch LST with Sanctum, and must stake to vote which validators become Sanctum Partners. Additionally, while less concrete, there is more room for CLOUD to play an active role in Sanctum’s growing network of products, which range from free LST to creator coins with ecosystem-tied rewards programs and Debit card.

All in all, there is a huge capital opportunity for LST on Solana, and Sanctum is uniquely positioned as a protocol to help validators, companies, and everyone involved capitalize on this liquidity staking expansion, in the process capture value from it and enhance its role in the ecosystem.

Drift

Drift Protocol becomes the first platform to bring prediction markets to the network, cementing its position as a leader in the Solana ecosystem.

The newly launched BET feature allows users to speculate on future outcomes using a capital efficiency model similar to perpetual futures trading. Users can bet not only through USDC, but also through SOL and long-tail ecosystem assets, expanding the appeal and use cases of Solana’s native market.

Prediction markets have already found success on other chains, such as Polygon’s Polymarket, but Drift’s first-mover advantage on Solana puts it in a prime position to attract the attention and liquidity of the chain’s active user base. With its ability to leverage Solana for fast, low-cost transactions, Drift’s BET offering could become a major driver of user engagement, especially ahead of the U.S. election in November.

Drift’s introduction of account margin for prediction markets enhances the usability of the platform, but also increases inherent risks. Still, Drift’s bullish outlook is driven by its ability to leverage Solana’s degen levels, making the protocol a prime contender for capital and user attention this election season.

Jito

Leading Solana Liquid protocol Jito is rumored to be developing re-staking synergies with its existing staking infrastructure. On July 25, the protocol announced the launch of Jito Restake, It is a vault-managed restaking concept that enables users to gain cryptoeconomic security by providing applications that use any Solana-based token.

Jito Restake’s code is now open source for public review and the contract has now entered a formal audit and verification process, but the timeline for its mainnet deployment is unclear. While the collateral quality of long-tail Solana’s native assets is lower than that of Ethereum, the blockchain’s faster network speeds can create a unique value proposition for high-performance heavy-collateral applications.

As the leading Solana staking infrastructure provider, controlling one-third of all liquid staking SOL, Jito’s simple business model is particularly well-positioned to benefit from SOL price increases as its revenue is denominated in the token .

Since Jito also provides MEV relays infrastructure and plans to offer restaking, so it is often described as Solana's "Lido x Flashbots x EigenLayer." Given that Solana’s native staking yields are higher than those offered by Ethereum, and Jito’s functionality beyond a normal liquidity staking protocol, many industry observers believe that Jito’s trading valuation should be compared to adjacent competitors higher.

Future Outlook

Over the past four months, we have observed a positive trajectory for a range of Solana-based altcoins, with many showing continued growth potential.

Kamino has become a leader in yield generation and a DeFi hub, a role that will likely only expand with the upcoming launch of Lend V2. With its unique whitelisted validator structure, Sanctum is committed to driving the scaling of LST on Solana, unlocking massive capital opportunities for its staking economy. Drift is a pioneer in bringing prediction markets to Solana, providing Solana with the potential to drive massive user engagement amid the hype surrounding the upcoming election season. Meanwhile, Jito continues to develop into a key player in the ecosystem despite its poor performance to date, which combined with JitoSOL’s dominance makes it central to staking as the blockchain evolves.

Together, these protocols serve as an integral growth catalyst for the Solana ecosystem and will outperform other tokens in the ecosystem.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya Xu Lin

Xu Lin Jixu

Jixu Aaron

Aaron Hui Xin

Hui Xin Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph