Author: Jack Inabinet Source: Bankless Translation: Shan Ouba, Golden Finance

Bitcoin halving is coming! How to seize the opportunity to amplify gains?

The Bitcoin halving is scheduled for Saturday, April 20, but for cryptocurrency enthusiasts, holding Bitcoin is not an exciting event! What measures can you take before this event to gain high beta exposure to BTC and potentially capture a larger upside (or downside) space?

Historically, Bitcoin halvings are often accompanied by a sharp rise in Bitcoin prices, which is attributed to the reduction in inflationary block rewards, which reduces the selling pressure of miners and enables Bitcoin to enter price discovery mode.

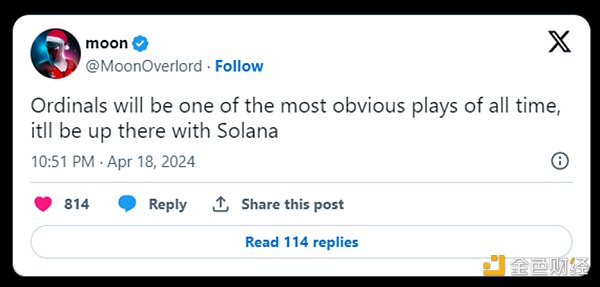

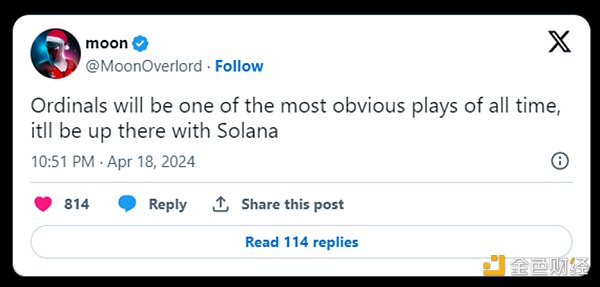

Many cryptocurrency traders expect similar results from this year’s halving, but are unhappy with BTC’s relatively lackluster returns; for them, high-beta alternatives can improve volatility while offering the opportunity to continue holding spot crypto assets, eliminating the complexity and risk of leverage.

For those with large amounts of capital and a willingness to hold less liquid instruments, investing in popular Bitcoin Ordinals, such as Bitcoin Puppets and NodeMonkes, could deliver outsize returns if Bitcoin rises after the halving.

Ordinals NFTs are denominated in BTC, meaning their USD prices rise as BTC prices surge, and rising BTC prices could attract more investors to buy them to capture greater upside from price moves.

Following the news of Bitcoin’s halving, Runes heat continues to rise! The new token standard is scheduled to be launched on the halving day and has the potential to replace BRC-20 as the chain’s official fungible token standard. However, since it has not yet been officially released, market enthusiasm may still be in its early stages.

Although the first batch of Runes has not yet been released, traders (and developers) have already begun trying to profit from this wave of hype!

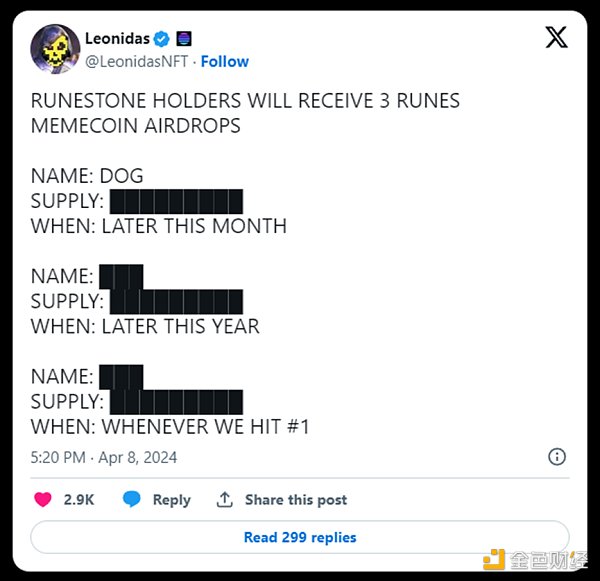

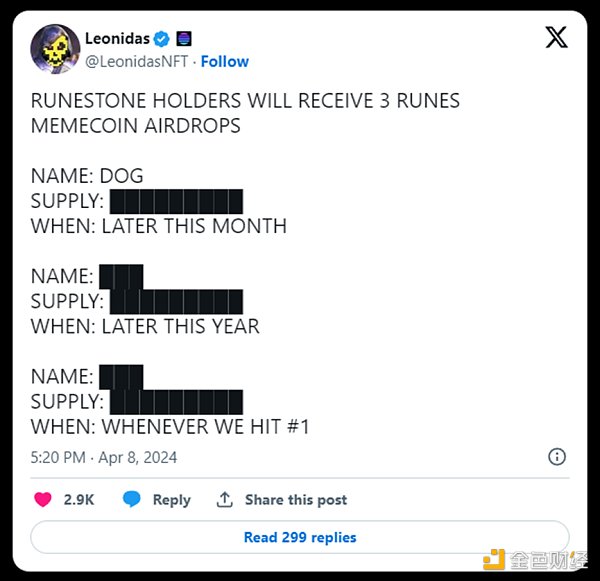

“Runestones” is a collection of 112,000 inscription NFTs created in March, riding on the popularity of Runes not only because of the similarity of the name, but also because its developers promised that holders would receive at least 3 different Runes meme coins airdropped.

Currently, the hottest among the liquidity tokens that offer bullish Runes exposure is PUPS, a meme coin based on the popular inscription NFT project “Bitcoin Dolls”, but the two are not related.

PUPS is currently based on the BRC-20 standard, but the recent announcement that it will transition to the Runes standard has caused its token price to surge by nearly 100%, and many traders are excited that the token may continue to enjoy positive returns after the halving.

Not only is the PUPS token available on the Bitcoin network, but its bridged version has also appeared on the Solana network, which is the undisputed hottest meme coin trading chain.

Alternatively, some hardcore players may choose to stick with a relatively classic play, preferring to emulate the original OG Bitcoin alternative meme coin - ORDI. Notably, market attention seems to be shifting to newer projects, as evidenced by ORDI's drop of more than 40% in April.

Bitcoin's application scenarios are still immature, but for investors who prefer to emulate infrastructure projects with certain fundamentals (similar to the people selling water shovels in the gold rush), Bitcoin Layer2 solutions such as Stacks Network (STX) or bridge infrastructure such as Multibit (MUBI) are still viable plays that can be used to capture more attention that may flow to Bitcoin after the halving.

While stocks of Bitcoin mining companies have historically provided gains that outperform Bitcoin itself, they may be in trouble as their revenue will be cut in half after the halving, so it is best to avoid investing in such stocks before and after the halving.

JinseFinance

JinseFinance