Author: William M. Peaster, Bankless; Translator: Tao Zhu, Golden Finance

A new DeFi project is booming - Pendle. With a total value locked (TVL) of $4 billion and deposits growing, the protocol has now become one of the largest projects in the cryptocurrency space.

In short, Pendle stands out for allowing users to tokenize their DeFi assets and trade future returns.

Behind the scenes, the system splits yield-generating assets into two separate tokens: one representing the principal and the other representing future returns. This separation unlocks innovative strategies for earning fixed income or speculating on yield fluctuations.

Pendle’s Core Components

Principal Tokens (PT) — These tokens represent the original capital invested, minus future returns. Holding PT means you expect to get your principal back at a future date, but without generating returns over time.

Yield Tokens (YT) — YT represents the future yield of the underlying asset until maturity. Buying YT is a bet on rising yields, providing a way to earn potentially higher returns.

Voting Custody $PENDLE — By locking up PENDLE tokens, participants receive vePENDLE, which confers voting rights on governance decisions, a share of protocol fees, and potentially higher returns on liquidity provision.

For users, these pillars bring a few different avenues to investing.

For example, investing in PT is akin to a fixed yield on locked assets - ideal for conservative strategies focused on principal protection and predictable returns.

Conversely, for those who are optimistic about the prospect of yield, YT offers a way to leverage that expectation for potentially higher returns, albeit at a higher risk.

In addition to individual tokens, providing liquidity in the Pendle liquidity pool can further increase your returns through transaction fees and PENDLE rewards. You can also hold vePENDLE to earn a share of the protocol's revenue and increase your LP yield.

Try Pendle Earn and Pendle Trade

Pendle Earn is a user-friendly interface, accessible by toggling the switch in the top right corner of app.pendle.finance, for interacting with Pendle's smart contracts.

Through this UI, you can lock in a fixed-income return on selected assets until they expire, or contribute to a liquidity pool to earn a variable return determined by the PENDLE reward allocation and total deposits in the pool.

Get Started:

For fixed income, navigate to the Fixed Income tab on the left side of the Pendle app, select the asset and its maturity, and enter the amount you wish to invest. Your entry will be converted into a PT position, ensuring a fixed return as posted at the time of trading.

For LP’ing, visit the Liquidity section, select the asset and maturity, and then specify your investment amount. The asset will automatically be converted to provide liquidity, but there may be volatility in yields.

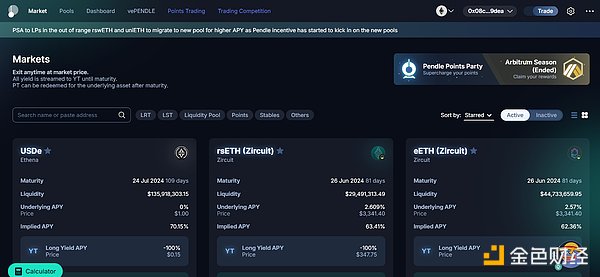

Pendle Trade, on the other hand, is a platform for trading income through Pendle’s PT and YT products. To dive in here, open the Trade button on the top right corner of the app.

Here you can click on the market you are interested in, after which you will have a range of core actions to choose from: minting (creating PT and YT with your assets for different strategies), trading (exchanging PT for fixed income or YT for leveraged exposure), and claiming (retrieving accrued earnings and rewards from your positions).

For example, you can buy PT to hedge against falling yields by locking in an APY at current rates, or you can buy YT to bet on rising yields through capital efficient exposure, potentially increasing returns.

Whatever you decide to do, you can use the dashboard to manage your portfolio and get detailed analysis of your positions, trades, and ability to claim earnings and rewards.

Note that you can also rely on the Pendle calculator to help you target the best yield opportunities, and the Points Trading UI to manage your Points exposure to other DeFi protocols.

What to watch for in the future

Tokenizing and trading future yields is not only useful in its own right, but Pendle is also seeing its assets integrated into an increasing number of DeFi projects.

For example, protocols such as Dolomite, Silo, and Timeswap enable Pendle assets to be used for lending, expanding their use cases beyond simple liquidity mining and allowing users to participate in more complex financial strategies.

Expect more integrations like this to come, and for more new experiments to be built around Pendle. One such experiment I’ve been following is Michi, a novel points trading platform that allows users to exchange points generated by Pendle YT and LP positions.

Pendle’s emergence as the latest DeFi heavyweight demonstrates the growing demand for flexible and innovative financial tools in the crypto space. As it continues to carve out a space for tokenization and trading yields, its infrastructure and assets are likely to become more influential.

Edmund

Edmund

Edmund

Edmund JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Max Ng

Max Ng Cointelegraph

Cointelegraph