KOLs are undoubtedly very special in the crypto field.

Because they often have a large number of followers, they can usually be used as a tool for traffic diversion under the influence of influence, but they are also powerful targets for cutting leeks. To use an inappropriate metaphor, KOLs can be both referees and athletes.

But for crypto, an industry where emotions and liquidity play an important role, KOLs who are closer to first-line investors than institutions have more advantages than disadvantages to a large extent. After all, the marginal cost of issuing coins is close to zero, but liquidity is priceless. Obviously, the project party has also smelled this east wind.

In recent months, there have been endless discussions about the relationship between KOLs and VCs. Since KOLs often have shorter unlocking periods and lower valuation discounts, compared with VCs, which not only have to invest large amounts of real money but also share resources in sales, operations, and technology, KOLs often seem to have completed their obligations by just sending a few tweets.

Some VCs complained about this, and even retail investors believed that KOLs were more likely to benefit in the bull market. But is this true?

Amid all the controversy, Bloomberg recently published an in-depth report on the KOL round, analyzing the advantages and challenges of KOLs. The following is the full text translation of Gyro Finance:

Back in March, the cryptocurrency market was booming, Bitcoin continued to hit record highs, and billions of dollars continued to flow into spot ETFs. Among them, there was a special group of investors who cheered more than most other investors.

At that time, the startup Monad Labs completed a new round of fundraising, and venture capitalists including Paradigm gave a valuation of up to $3 billion. Mona’s fundraising deal is already very large by cryptocurrency standards, but it has another notable feature: some people known in the industry as “KOLs” were allowed to invest at just one-fifth of Paradigm’s valuation, according to people familiar with the matter.

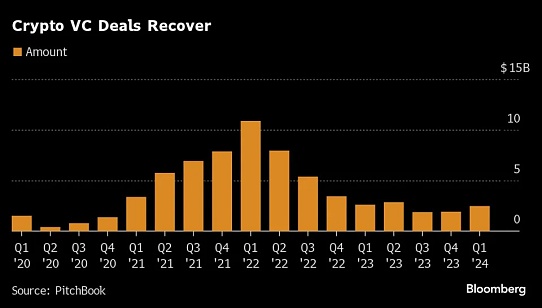

These so-called “KOL rounds” are similar to the celebrity marketing that U.S. regulators have cracked down on in recent years and have sprung up as digital assets emerge from a bear market, becoming a curiosity in the crypto world. Compared with celebrity deals, the investors who get preferential terms are more likely to be crypto authors or influencers rather than the more common marketing targets, athletes or other stars.

In return for promoting cryptocurrency projects, KOLs often receive a variety of preferential terms, including valuation discounts and shorter lock-up periods, according to interviews with KOLs, entrepreneurs and legal experts. Similar deals have become a source of controversy in recent months, with opponents focusing on insufficient information disclosure and potential risks to retail investors.

Several industry insiders familiar with such transactions said that at least some startups did not require KOLs to disclose project affiliations when raising funds, which is obviously a violation of relevant US regulations.

Of course, there is no indication that Monad Labs' financing violated any US securities regulations. One investor said the company did not make any explicit requirements for KOLs, while CEO Keone Hon declined to comment on what lock-in terms and disclosure rules were given to such investors.

San Francisco-based Paradigm, which operates one of the largest crypto venture capital funds, also declined to comment.

KOLs and Cryptocurrency

Michael Selig, a partner specializing in securities law at Willkie Farr & Gallagher LLP, responded in an email: "Including KOLs and influential industry big Vs in a round of financing with the hope that these people will promote the project token may be subject to scrutiny by the SEC."

KOL rounds exist in part because of the uniqueness of the cryptocurrency market. In crypto financing, digital asset startups usually offer equity to raise venture capital funds, while other companies raise funds by selling issuance tokens or affiliated tokens. The valuation of the project depends on the number and price of tokens sold, similar to stock sales, and there are also mixed financing rounds that mix tokens and equity, such as Monad Labs mentioned above.

Buying tokens generally doesn’t give investors the same protections as equity financing, but it does offer one clear advantage: Investors can sell tokens in just a few months, while equity investors are often tied up for years before a liquidity event like an IPO.

KOLs also play a unique role in the cryptocurrency market. Over the years, cryptocurrencies have spawned an altcoin industry as celebrities, athletes and self-proclaimed experts have promoted projects online. During the initial coin offering boom of 2017, having a large number of followers on Twitter could be a ticket to riches, as authors obtained popular tokens at a discount in advance and sold them for huge profits after the price of the tokens rose.

The lure of “making a lot of money”

It’s worth noting that you don’t necessarily need a lot of followers to become a KOL investor.

"Almost anyone who has some influence or community can become a KOL," said Simon Chadwick, co-founder of cryptocurrency platform Eclipse Fi. "For example, this could be someone who has 5,000 followers on Twitter and writes research reports," he said, referring to the social media platform now known as X.

Eclipse Fi's main business is to help projects issue tokens on the Cosmos blockchain. Chadwick mentioned that to make it more convenient to issue tokens, the company has formed a network of more than 400 KOL investors that startups can tap into. "The potential for quick returns is so great that some KOLs try to set up multiple accounts using fake social media accounts, which allows them to invest multiple times in the same round of financing. ” Chadwick emphasized that KOLs who participate in such transactions can get 20% to 50% discounts, as well as a shorter unlocking period. In short, they can sell tokens earlier than other investors. KOL rounds are indeed for the benefit of crypto. “Some KOLs have invested in hundreds of rounds and made a lot of money. " he said.

The U.S. Securities and Exchange Commission, as a regulator, has been cracking down on KOL marketing of cryptocurrency projects. In October 2022, Kim Kardashian agreed to pay $1.3 million to end regulators' allegations that she violated U.S. regulations by promoting digital tokens without disclosing that she was employed, although she did not comment on the allegations. Four years ago, the U.S. Securities and Exchange Commission fined Floyd Mayweather for failing to disclose a similar cryptocurrency marketing plan.

Emily Meyers, general counsel and chief compliance officer of crypto venture capital fund Electric Capital Meyers) said that in view of the US SEC's prosecution on Kardashian and similar cases last year, she would remind the project not to make KOL rounds of financing. In the case last year, the Eight celebrities, including the US Securities and Exchange Commission, accused the eight celebrities including Lindsay Lohan, were paid for the promotion of tokens. = "Text-Align: LEFT;"> Six accused celebrities, including Luo Han, reached a reconciliation without recognition or denied the accusation of the US SEC. >

Pulling and selling ONG>

Regardless of the impact of regulatory, the KOL wheel is undoubtedly controversial in the cryptocurrency field. Body Egirl Capital , a member of X, admitted that she has been receiving recent pitches from cryptocurrency projects hoping to invest as a KOL. CL, who is not based in the United States and requested anonymity due to the sensitivity of the topic, has avoided such transactions due to potential reputational risks.

CL, who has nearly 200,000 followers on X, said the surge in KOL transactions is "an extension of the pump and dump of low-cap tokens, but on a larger scale."

Eclipse Fi's Chadwick said that in large transactions backed by large venture capital firms, KOLs are usually willing to accept longer lock-up periods. But in response, they will ask for higher discount rates in transactions.

Orla Browne, head of strategy at Dealroom, said that because investment details about KOLs are often difficult to be transparent, the statistics of venture capital data do not list separate reports on KOL rounds.

In practice, they often take different forms, such as some transactions outlining the work that KOLs should do in terms of promotion in the form of written contracts, while some transactions are completed through Telegram. Some of them are part of venture capital-backed financing, while others are more early-stage projects, that is, they are not mature enough to attract large venture capital.

While the vast majority of KOL transactions are composed entirely of tokens, some transactions combine equity and digital currency warrants that have not yet been launched.

Bloomberg has reviewed a written contract for KOL financing, which stipulates that KOLs who invest at a discount must promote the project through podcasts and TikTok videos. The agreement also mentions that KOLs must disclose their affiliation with the project when promoting the project.

But many projects choose not to do so.

"It's not a requirement," said 0xJeff, who runs Steak Capital, a cryptocurrency consulting firm that lists KOL management as one of its services. "It really depends on whether the KOL wants to let the community know about their investment relationship and whether they are associated with the project." OxJeff, like CL, asked to post tweets anonymously and not use his real name.

Uneasy mood spreads

Jed Breed, founder of Breed VC, said that large cryptocurrency projects usually do not make explicit requirements for KOL investors. Instead, issuers aim to build so-called "secret networks" in the cryptocurrency KOL community. Breed said: "I have never seen a venture capital deal that is conducted in this way, that if you want to get this allocation, you need to do X, Y, Z, etc."

Of course, there are startups that are so hot that they don't need to offer preferential terms to KOLs.

Humanity Protocol, which is building a blockchain network that uses palm prints to verify identity, raised funds from venture capital firms such as Animoca Brands this month at a valuation of $1 billion. KOLs invested about $1.5 million in March, but their investment conditions were "the same as some venture capital firms," and each person's investment was capped at only $25,000, said Terence Kwok, founder of Humanity.

Parity Technologies product engineer Joshua Cheong, who participated in Monad Labs' financing as a KOL, said the company did not ask him to promote the project when investing. He declined to comment on valuation and lock-up periods.

According to OxJeff, KOLs in the United States are more cautious about SEC scrutiny, so they usually choose to disclose their relationship with the project when promoting a project or token.

OxJeff believes that regardless of where KOLs belong, the uneasiness of the entire community has begun to spread. This is largely because "chain detective" ZachXBT, a Twitter user with nearly 600,000 X followers, has begun to publicly criticize and expose KOL transactions. "I would be lying if I said KOLs don't have to worry, because all KOLs are panicking right now," OxJeff said. "Especially right now, there are so many KOLs, and many of them are not going well."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Cointelegraph

Cointelegraph