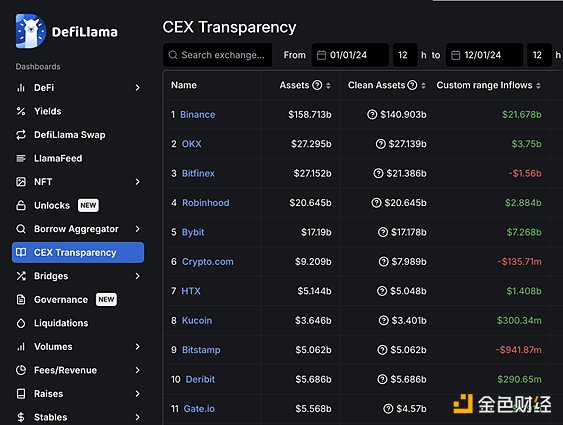

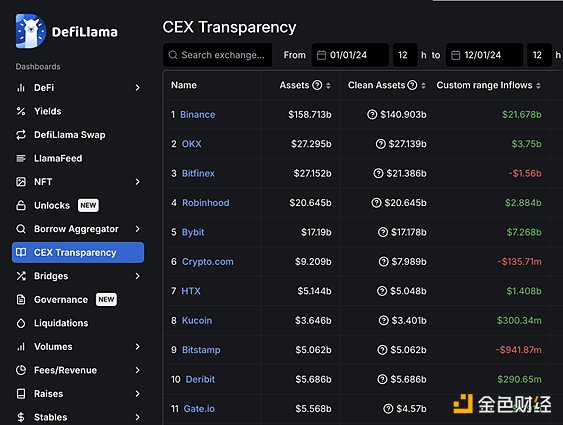

Binance, the world’s largest digital asset exchange by registered users and trading volume, has seen nearly 40% more user inflows so far this year than the next 10 crypto exchanges combined, according to DefiLlama’s rankings. Binance is on pace to see $21.6 billion in inflows through 2024, while the next 10 exchanges are set to see $15.9 billion (36% more), according to the data platform.

Binance inflows have been supported by growing global optimism around digital assets this year, driven by significant regulatory developments, growing adoption, and historical price milestones. As more users move their funds to the exchange to participate in what could be a golden age for crypto, Binance’s global user base has grown to 244 million. Another strong driver of inflows could be the success of this year’s Binance Launchpool program, reflecting growing user interest in new tokens. Binance has observed that these funds tend to stay on the platform.

In 2024, the crypto industry reached a historic milestone. Bitcoin ETFs have been approved in major markets such as the United States, Brazil, Hong Kong, and Australia, signaling a wider acceptance of digital assets. In just one year, net inflows into BTC ETFs have surpassed those of gold ETFs, a testament to the growing role of cryptocurrencies in finance and their deeper integration with more traditional institutions and systems.

The launch of Bitcoin ETF options has made it easier for institutional investors to gain exposure and hedge risk, contributing significantly to the recent rally. As large amounts of money flow into these ETFs, Bitcoin is expected to further integrate into mainstream financial markets.

"2024 is a landmark year for the cryptocurrency industry, and we are extremely grateful to our 244 million users, and counting, who continue to trust Binance as their trading platform of choice. Their unwavering support and confidence drive us to innovate and deliver the best experience in the world of digital assets." - Richard Teng, CEO of Binance

Binance's leadership in the cryptocurrency market was further highlighted by another milestone recently recorded, as it became the first centralized cryptocurrency exchange to exceed $100 trillion in lifetime trading volume, according to digital asset data provider CCData.

CryptoQuant, a provider of on-chain and market data analytics, highlighted that this year “marked a significant shift for the cryptocurrency industry, with exchanges reporting sharp increases in average Bitcoin and USDT deposits, indicating increased institutional participation. Average Bitcoin deposits across all exchanges have risen to 1.65 BTC from 0.36 BTC in 2023, while USDT deposits have surged from $19,600 to $230,000. These larger deposits reflect growing interest from professional and corporate investors, distinguishing institutional activity from retail trading.”

“Binance led the industry in institutional growth, with the largest increase in average Bitcoin deposits among major exchanges,” their report stated.

JinseFinance

JinseFinance