On the evening of March 8th, Beijing time, Bitcoin exceeded US$70,000, setting a record high. It is currently up about 4% during the day, and has risen by 65% cumulatively this year.

It is worth noting that this is the second time that the price of Bitcoin has reached a record high within a week. On the evening of March 5, Beijing time, Bitcoin once exceeded US$69,000, setting a record high. Bitcoin had previously set a record of US$68,999.99 per coin in November 2021.

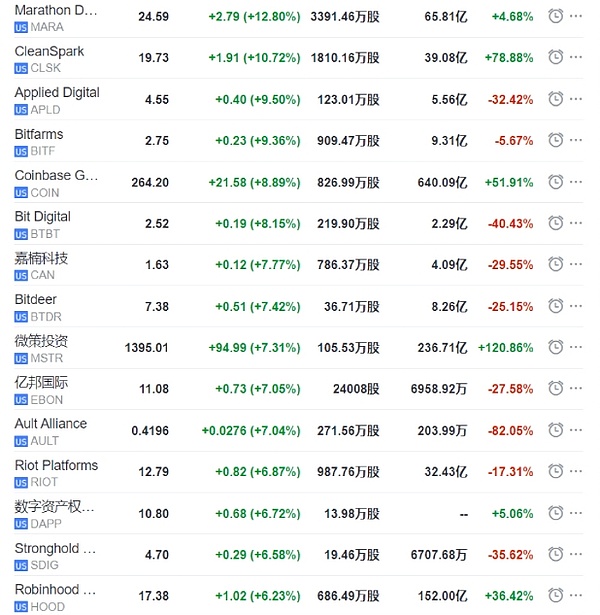

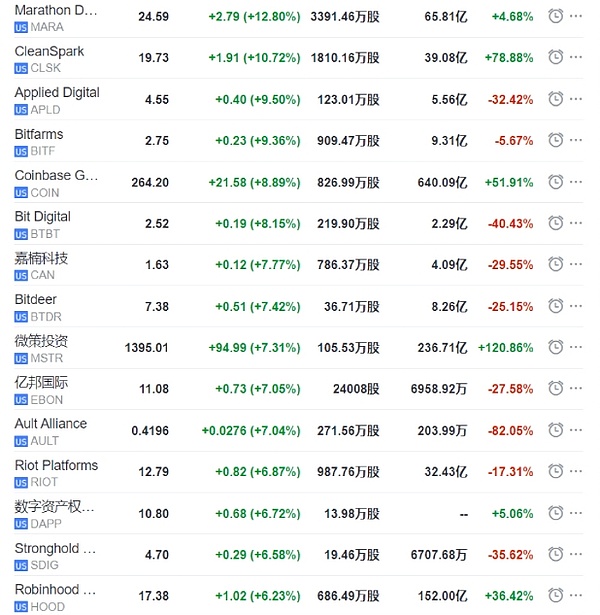

US digital currency concept stocks generally rose, Marathon Digital rose by more than 11.5%, Bitfarms rose by 9.8%, Applied Digital, CleanSpark, and Yibang International ADR rose by at least about 9.1%, digital currency exchange Coinbase rose by more than 7.9%, Bit Digital and Jia Jia Nanli Technology's ADR rose by more than 7.7%, and Weichi Investment rose by about 6.9%.

The Bitcoin genesis block was mined by Satoshi Nakamoto on a small server in Helsinki, Finland on January 3, 2009. On May 18, 2010, Bitcoin was priced by the market for the first time when Laszlo Hanyecz, a programmer in Florida, purchased a pizza. The initial transaction price was approximately US$0.003. He spent 10,000 Bitcoins to purchase 2 pizzas, which was approximately Total $30.

"Daily Economic News" reporter noted that Bitcoin will usher in a new round of "halving" next month (April 2024). Historically, the "halving" has been an important factor in driving the price of Bitcoin.

"Halfing" refers to the halving of the rewards obtained after producing a new block. It occurs approximately every four years, and the specific time depends on the Bitcoin network. Block generation speed. This will reduce the supply of Bitcoin, with the block reward expected to drop from 6.25 BTC to 3.125 BTC on April 23, 2024.

For the upcoming "halving", Kevin, founder of Web3 CD and CEO of Full Speed Innovation Capital, was interviewed by a reporter from "Daily Economic News" pointed out, “The difference between this round of Bitcoin’s market and the previous one is that the previous cryptocurrency bull markets were all after the ‘halving’, but this time it is before the halving, so this round of market may be different. It will come out in a different way from the previous times. However, at least for now, the cryptocurrency market as a whole is still in a relatively disordered state, and no one can better predict the next trend."

Bitcoin prices continue to rise, is there room for further upside?

According to the International Finance News, Gao Chengshi, executive member of the Blockchain Committee of the China Computer Society, believes: “In the short term, the price of Bitcoin will further increase. The possibility of rising is still great, and there will be a certain amount of room for growth. In the long term, as the Bitcoin consensus further expands, more and more institutions and individuals will use it as an asset management and allocation tool. Therefore, , its price will inevitably rise further in the long run.”

Yu Jianing, co-chairman of the China Communications Industry Association Blockchain Special Committee, also expressed his views on the future of digital The development of asset markets is "optimistic". He said that the impact of the Bitcoin spot ETF can be compared to that of the gold ETF. Since the launch of gold ETFs, the gold market has experienced a long period of positive growth and witnessed significant price gains. Bitcoin spot ETFs may also follow a similar trajectory, bringing long-term growth potential to the market.

However, Yu Jianing also pointed out that macroeconomic conditions, especially global monetary policy and inflation rates, must be taken into consideration. These factors have historically had an impact on the price of Bitcoin. deep influence. Therefore, while some institutions are optimistic about Bitcoin's future performance, there is significant uncertainty in this prediction. This requires potential investors to see the high risk behind the high yield when considering investing in Bitcoin, and not to be controlled by FOMO (fear of losing opportunity).

Alex

Alex