拆解现金流叙述:为何BTC作为价值存储手段完胜房产

本文分析房地产为何成为现金流驱动的投资产品,以及为什么比特币最终将成为一种卓越的价值投资存储手段。

JinseFinance

JinseFinance

Part.1 Insight

< p style="text-align: left;">Bitcoin Renaissance: Changes and Changes in Value and Consensus< em>Market hot spots ebb and flow, but the anchor of Bitcoin’s value storage remains unchanged.

Ship of Theseus (Ship of Theseus), also known as the Paradox of Theseus, is a question about identity in the field of metaphysics a paradox. The 1st century Greek writer Plutarch raised this question: If the wood on Theseus' ship was gradually replaced due to age and decay, until all the wood was no longer the original wood, then the ship would still be the same. A ship? If not, when did it start? If so, then all the parts are not original. How to explain it?

Aristotle believed that this problem could be solved by describing the four causes of objects. The constituent materials are material causes, the design and form of matter are formal causes, and formal causes determine what an object is. Based on the formal cause, the ship of Theseus is still the same ship because although the materials have changed, the purpose of the ship has not changed.

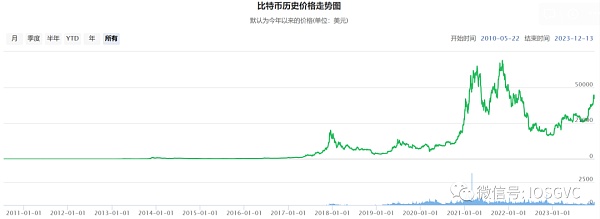

Macro Trend: Bitcoin is the totem of the crypto world, and value storage is its core function. With Bitcoin gaining wider social acceptance, consensus has strengthened, institutional admissions, ETF expectations, Bitcoin halving, interest rate cut expectations and many other factors have combined to push up the price, and the subject of the narrative is quietly shifting; we predict that prices will not rise for a long time. There will be a sharp decline, which is a market manifestation of the currency’s store-of-value function being more widely recognized;

Technology Ecology

Technology Ecology

strong>: The popularity of Ordinals has attracted people’s attention to the Bitcoin ecosystem, which is a new narrative for individual retail investors to participate in Bitcoin investment. However, speculation is still the main force at present. It is undeniable that speculation is one of the driving forces for the development of the industry. However, speculation on the emotional side cannot last long, and the wealth creation effect brings too much bubbles and noise. As a first-level institutional investor, we are aware of the risks of speculation, will maintain a cautious and optimistic focus on new ecological trends, and are willing to support more valuable investors. builder of meaning.In 2008, a user named Satoshi Nakamoto posted a paper in a secretive cryptography discussion group: Bitcoin: A Peer-to-Peer Electronic Cash System (Bitcoin: a peer-to-peer electronic cash system). Since then, the gears of a new world have begun to turn. Later, he developed the earliest Bitcoin issuance, transaction and account management system. Two years later, on May 22, 2010, Laszlo Hanyecz spent 10,000 BTC to buy two Papa John’s pizzas through the Bitcoin Talk forum. He arranged the deal via the Bitcoin Talk forum, and while it was just two pizzas, it was an iconic Bitcoin value moment.

In 2008, a user named Satoshi Nakamoto posted a paper in a secretive cryptography discussion group: Bitcoin: A Peer-to-Peer Electronic Cash System (Bitcoin: A peer-to-peer electronic cash system). Since then, the gears of a new world have begun to turn. Later, he developed the earliest Bitcoin issuance, transaction and account management system. Two years later, on May 22, 2010, Laszlo Hanyecz spent 10,000 BTC to buy two Papa John’s pizzas through the Bitcoin Talk forum. He arranged the deal via the Bitcoin Talk forum, and while it was just two pizzas, it was an iconic Bitcoin value moment.

When did Bitcoin have value? Was it when Satoshi Nakamoto just proposed it? Or when you exchanged five hundred Bitcoins for pizza? Just as the ship of Theseus cannot determine when which log changed the ship, we cannot determine the specific moment when Bitcoin has value. William Stanley Jevons analyzed the four functions of money in Money and the Mechanism of Exchange (1875): medium of exchange, unit of account, store of value, and standard of deferred payment. . Debates surrounding Bitcoin in the past have tended to focus on the latter two functions, especially storing value, with opponents arguing that Bitcoin's violent price fluctuations make it non-currency-like. Today, Bitcoin is at the door of ETFs, and its value has gradually been accepted by mainstream financial institutions. The narrative has changed from a niche geek experiment more than ten years ago to a financial product and currency with consensus value on Blue Star.

From a macro trend perspective, halving, ETF and interest rate cut expectations have given the market strong confidence; various explorations in the Bitcoin ecosystem, including recent retail investments The enthusiasm of readers for the Ordinals ecology is also based on the value of Bitcoin itself. It also shows that the high price of Bitcoin, which is tens of thousands of dollars, makes the pure value storage function no longer the investment purpose of ordinary individuals. The bargaining power and narrative subject are in Gradually there is a shift towards institutions.

And In this narrative change, the emergence and popularity of the Ordinals ecology at the beginning of the year seems to have become an accidental necessity. The high price of Bitcoin has made its value storage function no longer the first demand of ordinary retail investors, and participating in the top narrative of cryptocurrency at extremely low cost seems to be an irresistible temptation. The extremely high-odds speculation frenzy brought about by Meme caused the gas fees on the chain to soar, and miners made a lot of money as a result.

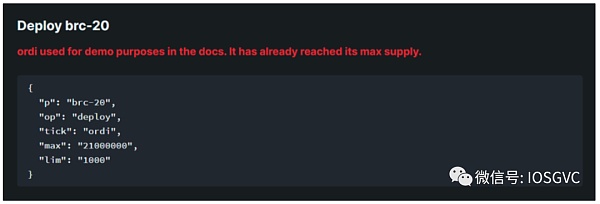

At the end of last year, Bitcoin core contributor Casey Rodarmor created the Ordinals protocol, which introduced the concepts of ordinals and inscriptions, giving birth to Bitcoin. NFT on the network chain. On March 8, 2023, Domo proposed using Ordinals inscriptions in JSON data format to deploy token contracts, mint coins, and transfers.

Simply put, Ordinals numbers the Satoshi, the smallest unit of Bitcoin, and then tracks the Satoshi number, realizing the recording and tracking of Satoshis. Then by burning information in the inscription, the inscription is made. The Cong number corresponding to the inscription is recorded and tracked, and the storage, recording and transaction of the inscription are completed.

BRC-20 specifies a specific information format burned on Satoshi. This format is the rule for the deployment, minting and transfer of BRC-20 tokens. Thus came the BRC-20 token standard. BRC-20 deployment, minting and transfer can be completed according to a specific format. The deployment and minting of tokens follow the principle of "First is First", whichever is deployed first shall prevail and whichever is minted first shall prevail. But this has also resulted in Brc20’s technical imperfections and unsmooth operations—the index relies on a centralized trading platform, and user transactions need to cast transfer inscriptions, making the steps cumbersome and unsmooth. In addition to Brc20, different protocol standards such as Arc20, Runes, and Tap have gradually appeared on the market, trying to innovate more in technology.

As the first brc20 standard experimental token deployed by Domo, $ORDI token has become a special meme, and its huge wealth effect has also This triggered users’ FOMO sentiment towards Brc20 tokens, leading to a series of speculative bubbles in Meme tokens. After all BRC20 tokens are generated, all users who own BTC only need to pay Gas fees to mint them, which is equivalent to allowing ordinary users to participate fairly in the "primary market". This is a low-cost and potentially high-odds participation method. It triggered huge speculative enthusiasm in the market.

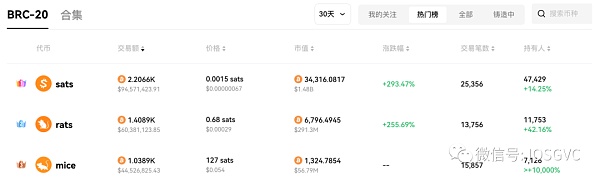

With centralized exchanges such as Binance listing Brc20’s memecoins (ORDI, SATS, etc.), market sentiment and attention are further concentrated. In the past month, the top three Brc20 tokens in the OKX Ordinals trading market were all Memecoin, proving that the market is still dominated by emotions and speculative noise, with large bubbles and risks.

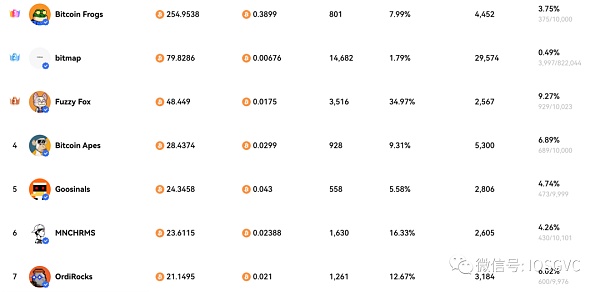

For Ordinals NFT, we compared its 30-day transaction data with its 7-day transaction data. We can find that the volatility of the project is relatively large, and the transactions of the top ten projects within a month are unevenly distributed. During the FOMO time The turnover rate is high during the period, but the liquidity is poor after entering the calm period.

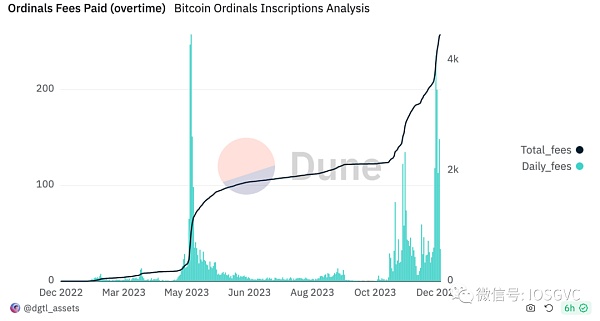

For the miners, the Bitcoin halving is imminent and the incentives for block rewards are reduced. Ordinals' increase in on-chain transaction fees is naturally in line with their interests. Since Ordinals was launched on the Bitcoin mainnet at the beginning of the year, the inscribed handling fees have exceeded 4,000 Bitcoins.

On the other hand, BRC-20 tokens currently lack practical application value. After a cycle, there will be very few "fair sales" left. The remaining long-term development ones are still time-tested and have good financing structures. Old project. Long-term projects require long-term capital risk investment, and short-term and fast "fair sales" are difficult to support long-term ecological development. Hype and memes have brought about wealth effects, but how to not only see these in the encryption market, but also go beyond the hype and memes to support protocols with more value propositions and application prospects will also become an important responsibility and responsibility for industry beneficiaries.

Try: Ecology blooms with a hundred flowers blooming, and its value needs to be verified

Anyway With the market craze caused by Ordinals, more Bitcoin technologies and asset issuance protocols have received more attention from the market. At this stage, there are two main trends in the development of the Bitcoin ecosystem: one is trying to create new asset issuance protocols, such as Ordinals, Atomics, Runes, etc.; on the other hand, there are many attempts in the direction of Bitcoin expansion, trying to improve the Bitcoin network Basic performance, such as Lightning Network, Stacks, RGB, BitVM, etc.

Atomics:

Atomic protocols, including the fungible token ARC20 standard, NFT, Realm and the conceived Atomics Virtual Machine (AVM), etc. The difference between the Atomics protocol and Ordinals in terms of asset transaction ordering is that it does not rely on third-party orderers and can be used to create (mint), transfer and upgrade various digital items, including native NFTs, games, digital identities, domain names and social networks . Currently supported by Unisat Marketplace.

Runes:

Casey Rodarmor has proposed Runes, a new Bitcoin-based fungible token protocol, also known as the Rune Protocol, as a potential alternative to the BRC-20 token standard. Casey Rodarmor believes that FT protocols such as BRC-20, RGB, Counterparty and Taproot have appeared in the market. Most of the on-chain protocols are very complex and may be difficult to bring a good experience to Bitcoin users. Although BRC-20 is very simple, it generates a lot of useless information on the chain and takes up space in Bitcoin. Runes is a simple, UTXO-based FT protocol that enables Bitcoin users to have a good experience. It may attract users from other solutions with worse on-chain footprints and turn the attention of developers and users to Bitcoin. coins, encouraging them to adopt Bitcoin itself.

PIPE:

PIPE protocol is an asset issuance protocol developed by developer Benny after being inspired by the Runes protocol designed by Casey and the Ordinals-based BRC-20 standard proposed by Domo. It includes: Trac Core, Tap, Pipe (TTP for short, collectively known as Trac Systems).

SRC-20:

The Bitcoin Stamps system was released by Mike In Space in March 2023 and was originally a proof-of-concept project on Counterparty. Stamps moved fully to Bitcoin last summer due to an update to its underlying protocol, now known as SRC-20. The main difference between Stamps and Ordinals is the architecture. This is because Stamps store their metadata in multi-signature unspent transaction outputs (UTXO), while Ordinals store their metadata in the "witness" portion of Bitcoin transactions, but this design also makes Stamps Casting costs are more expensive.

CBRC20

v The Ordinals protocol after version 0.10.0 introduced fields for defining "metaprotocol" and "metadata" for inscriptions. The most direct effect of these two new fields is to greatly shorten the BRC- 20 The number of bytes required by the protocol during deployment/casting/transfer, thereby reducing costs and simplifying indexing.

RGB:

The RGB protocol is suitable for scalable and private Bitcoin and Lightning Network smart contract systems. Its purpose is to run complex smart contracts on UTXO and introduce it into the Bitcoin ecosystem. The official description is: A scalable and confidential smart contract protocol suite for Bitcoin and the Lightning Network that can be used to issue and transfer assets and rights more generally.

Lighting:

Lightning Network is a second-layer scaling solution for the Bitcoin network, designed to solve the scalability and transaction speed issues of the Bitcoin network. It is a payment protocol based on smart contracts. Participants can open a multi-signature payment channel and realize instant low-cost micropayments by conducting transactions directly within the channel.

BitVM

On October 9, ZeroSync project leader Robin Linus published a white paper called "BitVM: Compute Anything On Bitcoin", which proposed a situation without changing the Bitcoin network consensus. A Turing-complete Bitcoin contract solution, BitVM enables any computable function to be verified on Bitcoin, allowing developers to run complex contracts on Bitcoin without changing the basic rules of Bitcoin.

Another interesting finding is the geographical extension of the Bitcoin craze led by Inscription. Led by Asian teams such as Unisat and OKX, we have also seen more European and American teams and developers gradually participate. For example, the Cbrc-20 protocol is mainly led by Western communities and developers, and the Bitcoin one-stop DeFi service platform ALEX Tweeted that the ALEX Bitcoin oracle will support Stacks Inscription STX20. At present, many attempts are still in the early stages, and the technology and PMF (Product Market Fit) have yet to be verified. Therefore, it is still unknown which protocols will survive, grow and develop in the long term.

Objection: The battle over the value of Bitcoin

Against Bitcoin For coin fundamentalist conservatives, the “prosperity” of the Bitcoin ecosystem is not worth celebrating. Ordinals work by embedding data within individual transactions in Bitcoin, which can take up a lot of block space. This will lead to a surge in the amount of UTXO information that miners need to store on the Bitcoin network, and will affect the network's processing speed and transaction costs. And those meaningless data engraved and transferred will also exist permanently on the Bitcoin chain.

Bitcoin core developer Luke Dashjr even bluntly stated that inscriptions are an attack on Bitcoin, and stated that he would use a "fixed" version of Bitcoin Knots to filter inscription transactions in the Ocean mining pool he founded. Peter McCormack, founder of the podcast WhatBitcoinDid, also said that these "new assets" issued on the Bitcoin chain have pushed up transaction fees and have not benefited people who use Bitcoin transactions. The high-fee environment reduces the number of people who can afford to store Bitcoin on-chain and complicates opening channels on Lightning. But Ordinals developer Casey Rodamour sees the Bitcoin inscription asset as a solution to Bitcoin’s security challenges. Through the incentives of Bitcoin transaction fees, even in the future where block rewards continue to decrease or even reach zero, miners will still have the motivation to maintain The normal functioning of the Bitcoin network.

In the eyes of Bitcoin "halal" supporters, the "defects" of existing technology are not defects. The value of digital gold does not lie in its high tps and block space. It has been used for more than ten years. The underlying technology for safe operation and the gradually accumulated social consensus are its value. Looking back at the dispute over large and small blocks in the history of Bitcoin, from the Segregated Witness of the Hong Kong protocol to the generation of BCH during the hard fork, discussions on the expansion of Bitcoin technology have continued. Supporters of large and small blocks have their own reasons for insisting. At present It seems that the conservative and stable technical route still dominates. As teacher @mindao said, how to balance the tension between technology and desire may be an issue that currency holders, currency speculators, miners, and exchanges all need to consider. Without a stable and unchanging technical base, Bitcoin cannot become the ultimate store of value, and high handling fees are also a short-lived illusion.

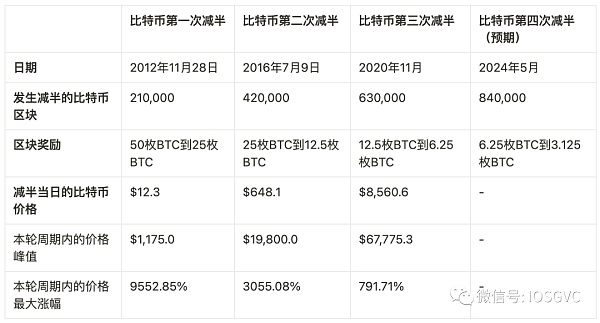

When miners verify a transaction and successfully submit a block to the Bitcoin blockchain, they will receive a certain number of Bitcoins as a block reward. Every time the Bitcoin blockchain validates 21,000 blocks, the Bitcoin rewards miners receive for packaging new blocks will be halved. The next Bitcoin halving is expected to occur in April 2024, when the number of blocks will reach 740,000. Bitcoin block reward will drop from 6.25 BTC to 3.125 BTC.

Judging from historical data, each halving will cause the price of Bitcoin to increase significantly. Its impact is not limited to the Bitcoin network, but drives the entire encryption market upward and becomes a catalyst for the bull market. From an economic perspective, halving reinforces Bitcoin’s scarcity and solidifies Bitcoin’s status as a store of value.

As the number of applications for Bitcoin ETF increases and the process continues to advance, institutions and compliance have become expected benefits, and huge amounts of funds can cross Wallets, private keys, and complex cryptography principles directly become the driving force of the encryption world. Bitcoin ETFs are popping up around the world, including Canada, Brazil, and Dubai. However, so far the U.S. Securities and Exchange Commission (SEC) has rejected all applications for spot Bitcoin ETFs, which offer the opportunity to invest directly in Bitcoin instead of futures contracts. The SEC has repeatedly pointed out possible market manipulation by cryptocurrency traders.

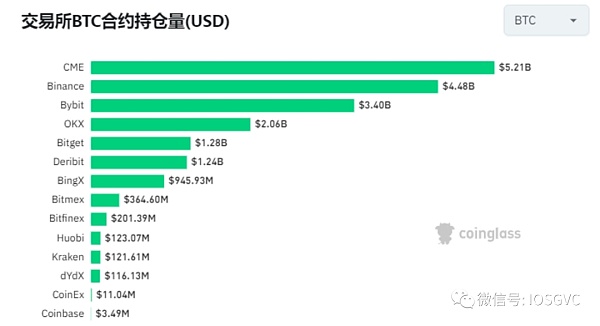

On December 11, 2023, according to Coinglass data, the current CME (CME Group) Bitcoin futures contract holdings surpassed all crypto CEXs and ranked first on the entire network The platform ranks first for the first time since March 2021, when the CME platform's futures contract positions briefly ranked first. The open interest in the Bitcoin futures contract on the CME platform is 120,500 BTC, worth $5.226 billion. Founded in 1848, CME Group is the world's first futures trading platform and began supporting Bitcoin futures trading at the end of 2017.

Many asset management giants have already applied for Bitcoin ETFs, which has also become an important news indicator to boost market sentiment. This is good news for those on Wall Street who are curious about cryptocurrencies, with Javier Rodriguez-Alarcon, chief commercial officer of digital asset platform XBTO, adding: “BlackRock’s approval could provide Many wealth managers and asset managers are opening the door to taking even small positions in Bitcoin, which could be a game-changer." But that may not be the case for others. Longtime believers in cryptocurrencies, who have followed Bitcoin’s development since its early days, told me that a financial revolution was becoming nothing more than a bid for a spot on Wall Street. Charles Story, head of growth at cryptocurrency index platform Future, said: "This is a crazy betrayal of the basic principles of cryptocurrency, a betrayal of traditional finance, and a capitulation of our ideals."

Arthur Hayes also said that if the Bitcoin ETF is too successful, it will destroy Bitcoin. The Bitcoin network requires dynamic maintenance by miners, especially after the halving. Miners’ income increasingly relies on transaction verification rewards. If it is just long-term storage, the Bitcoin network will no longer be active, and the motivation for miners to maintain will disappear.

The expectation of interest rate cuts is another important macro factor for good market performance. At the U.S. Federal Open Market Committee (FOMC) meeting on December 13, 2023, the U.S. Federal Reserve (Federal Reserve, FRB) kept the policy interest rate unchanged. This was the third consecutive time that the policy interest rate was unchanged. In the economic outlook released at the same time, participants expected three interest rate cuts in 2024.

It can be seen that the improvement and progress of the macro environment have caused the main narrative of Bitcoin to change unconsciously: it has changed from a niche extreme The decentralized payment and accounting method favored by customers has become a value currency gradually accepted by mainstream and regulatory authorities.

Conclusion:

Before the Bitcoin Ecological Renaissance In reality, if we look at the overall value narrative of Bitcoin from a higher latitude and longer time perspective, we will find that after more than ten years of development, the function of Bitcoin’s value storage has been widely recognized, regulated, and ETF Macroeconomic factors such as and interest rate cuts have a significant impact on its market performance, indicating that institutions have become an important part of the Bitcoin world; for Bitcoin, social attributes are as important as technical attributes, and in the process of moving towards a universal currency , its social attributes will become stronger and stronger.

With rising currency prices and expectations of halving, Ordinals have become a low-cost opportunity for retail investors to participate in the Bitcoin narrative, and market sentiment has Popularity is inevitable by chance; but through bubbles and noise, everyone clearly knows that the artificially high prices of most memecoins are supported by low liquidity and emotions, and speculation that spreads rumors is definitely unsustainable.

As the social attributes of Bitcoin's value storage are more widely recognized, its derivative financial products and innovations will become more and more abundant, and will change with market sentiment. Large fluctuations. Real value judgment requires a strong enough network effect and a long enough precipitation.

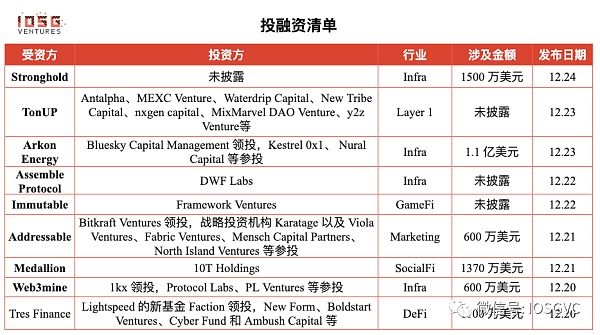

Part.2 Investment and FinancingEvents

BTC mining company Stronghold completes US$15 million in equityequity financing

* Infra

Stronghold Digital Mining, a listed BTC mining company, announced a partnership with an institution The investors signed a $15 million equity purchase agreement, with Stronghold saying it will use the funds to expand its fleet of mining equipment and advance its carbon capture program. The capital infusion was accomplished through the sale of 2.3 million Class A shares at an average price of $6.71 per share. Earlier this year, the company formed a partnership with Canaloupe Digital to boost its computing power. Additionally, Stronghold provided an update on the Panther Creek mining facility, showing the site was operating at 60% capacity between November 20 and December 7, 2023.

TON ecological Launchpad platform TonUP completed a new round of financing

* Layer 1

TON ecological Launchpad platform TonUP on the X platform Promote the completion of a new round of financing. This round of financing was participated by Antalpha, MEXC Venture, Waterdrip Capital, New Tribe Capital, nxgen capital, MixMarvel DAO Venture, y2z Venture and individual industry investors. The funds raised will be used to support product research and development and Expansion of multi-sided markets.

Australian BTC miner Arkon Energy completed US$110 million in financing

* BTC Ecology

Australian Bitcoin miner Arkon Energy completed US$110 million in financing, led by Bluesky Capital Management, with participation from Kestrel 0x1, Nural Capital and others. Of that amount, $80 million will be used for expansion in the United States, and another $30 million will be used for an artificial intelligence cloud services project at a 30MW data center in Norway. Founded in 2019, Arkon Energy closed a $28 million round in November 2022, led by Blue Sky Capital. The company then completed another $26 million in financing in June this year.

Assemble Protocol, a points integration platform, announced that it has received strategic investment from DWF Labs

* Protocol

According to Official blog, blockchain-based points integration platform Assemble Protocol announced that it has received strategic investment from DWF Labs, which will enable it to leverage the resources of DWF Labs’ Web3 Ecosystem Fund to provide Assemble Protocol’s key functions such as points exchange, market and data infrastructure. Provide important funding for continued development. The specific investment amount was not disclosed.

Framework Ventures makes strategic investment in Immutable ecosystem

* GameFi

Framework Ventures announced a strategic investment in the Immutable ecosystem. The specific amount has not yet been disclosed. The Immutable team claims to have over 200 committed Web3 games built on the platform. Following its recent partnership with Polygon, Immutable's market share of funded games has jumped from 35% to 70%, according to Delphi Digital data. Additionally, the foundation has $1.5 billion in funding for grants and incentives, providing the platform with strong ecosystem growth prospects. The funding could put Immutable's developers on track to win Web3 games over the next few years.

Web3 growth marketing services company Addressable completes $6 million in financing

* Marketing

Web3 growth marketing services company Addressable announced that it has completed a new round of financing of US$6 million, led by Bitkraft Ventures, strategic investment institution Karatage, Viola Ventures, Fabric Ventures, Mensch Capital Partners, North Island Ventures and others participated in the investment. It is reported that the company completed a US$7.5 million seed round of financing in January this year, and its total financing so far has reached US$13.5 million. Addressable mainly helps Web3 companies and projects handle paid advertising campaigns. Its business covers advertising networks such as X (formerly Twitter), Unity, Pubmatic and Magnite, and supports seamless integration with Twitter Pixel, DSP Pixel, Mixpanel and Google Analytics to track websites. conversions, wallet connections and on-chain metrics, etc. The new funds will be used to expand more advertising networks and blockchains.

Web3 fan platform Medallion completed US$13.7 million in Series A financing

* SocialFi

Medallion, a platform for artists to directly connect with fans, announced the completion of a $13.7 million Series A round of financing, co-led by Dragonfly and Lightspeed Faction. The platform is committed to filling the gap in online relationship management between artists and fans in the music industry, providing exclusive digital collectible sales and exclusive content sharing to enhance the connection between artists and fans. Currently, 20 artists are using Medallion to build fan communities, and the company plans to expand to more artists in 2024, with plans to open it to a wider range of artists in 2025 or later. Medallion is built on the blockchain and users can log in using email or wallet providers (Rainbow, Coinbase and WalletConnect). Other investors in the round include Coinbase Ventures, Infinite Capital, J17, The Chernin Group, Third Prime and Zeal Capital, as well as music industry investors Bill Silva Entertainment, Black Squirrel, Foundations Artist Management, Method and TAG Music. Medallion has also received support from top artists Jungle, Mt. Joy, Guy Lawrence (Disclosure) and Tiga. The company has raised $22 million to date.

Web3 infrastructure Web3mine completes US$6 million in seed round financing

* Infra< /strong>

Web3mine, a web3 staking protocol that powers open access storage and computing networks, completed a $6 million seed round of financing. 1kx led the investment, with participation from Protocol Labs, PL Ventures and others. web3mine aims to empower the world to collectively coordinate capital and hardware to build open, high-performance and resilient computing infrastructure for everyone.

Web3 tax services company Tres Finance completed US$11 million in Series A financing

* DeFi

Tres Finance, which focuses on providing tax and other financial services to Web3 companies, has raised $11 million in Series A funding. The round was led by Lightspeed’s new fund Faction, with participation from New Form, Boldstart Ventures, Cyber Fund and Ambush Capital, among others. This financing brings Tres’ total funding to $18.6 million. Tres provides accounting, auditing, reporting and other financial services, supporting over 100 layer 1 and 2 blockchains including Bitcoin, Ethereum, Solana, Avalanche, with plans to add more supported blockchains in the future . Tres plans to use the funding to fuel the company's growth, with the goal of growing its customer base by 300% in the US, EU and Asia Pacific within a year.

Part.3 IOSG post-investment Project Progress

zksync Launch of Boojum update coin Grant amount has exceeded US$56 million

*ZKP

Upgrade: The zkSync Era is transitioning to a new Boojum proof system without starting over.

Performance: Boojum demonstrates world-class attestation performance, perfectly integrated with zkSync Era's sequencer, which can already handle over 100 TPS.

Decentralization: The Boojum prover only requires 16 GB of RAM, making it possible to decentralize large-scale provers in the future. Ready: Shadow Proof is now live on Mainnet!

The cross-chain bridge Stargate community has passed the proposal vote on integrating NEAR

* MultiChain

According to the Snapshot voting page, Cross-chain bridge The Stargate community's proposal on "Integrating Stargate with NEAR through Aurora" has been passed, supporting cross-chain native USDC between NEAR and ETH, Arbitrum, Optimism, Polygon and BNB Chain. NEAR becomes the first non-EVM chain to be integrated by Stargate Finance.

Chain game Illuvium updates its 2024 roadmap: striving to launch a public beta version in Q1, which may also be postponed to early Q2

* Payment

Chain game Illuvium has updated its 2024 roadmap, with the launch of a testnet being the primary goal. The team is integrating blockchain technology, finalizing the IMX passport, and completing the Fuel exchange. The goal is to launch an Open Beta version in the first quarter of 2024, but due to the commitment to quality and thorough testing, it may be extended to early second quarter. Regarding parallel progress, the Overworld, Arena and Zero teams will continue to develop new features in parallel with the testnet rollout, ensuring there are no delays.

MetaMask Institutional solution MetaMask Institutional has launched Snapshots 2.0

* Wallet

MetaMask institutional solution MMI (MetaMask Institutional) stated on the X platform that Snapshots 2.0 has been launched, adding new features to the MetaMask institutional portfolio dashboard, including customizable valuation time.

Synthetix has officially ended SNX token inflation

* DeFi

Decentralized derivatives protocol Synthetix said on the X platform that under SIP-2043, investors will no longer receive new inflation rewards today. However, users may still notice SNX rewards available to claim. These are just rollovers of unclaimed rewards. It is reported that the SIP-2043 proposal aims to end SNX inflation. This proposal to end inflation means the redistribution of rights and interests between SNX pledgers and ordinary currency holders. The inflationary incentive of SNX staking will disappear, and the rights and interests of ordinary currency holders will no longer be continuously weakened due to inflation. Related Reading: Synthetix Proposal to End Inflation: Reshaping SNX Pledger Rights, May Become a Deflationary Blue-Chip Project

User deposits of the Ethereum re-pledge protocol EigenLayer have been Over $900 million

*Staking< /strong>

Ethereum re-pledge protocol EigenLayer has exceeded $900 million in user deposits (Currently more than 410,000 ETH). Recently, the protocol increased its limit to 500,000 ETH (approximately $1.1 billion), causing its total value locked to increase from $250 million to over $900 million, and appears to be on the verge of breaking $1 billion and reaching its maximum threshold. EigenLayer allows users to deposit and re-stake Ethereum from multiple liquid staking token projects such as Lido, Rocket Pool, and Coinbase, with the goal of distributing these funds to a third-party network to provide security. The first phase of the protocol went live on the Ethereum mainnet in June. Additionally, EigenLayer now supports LST from six additional projects, including Swell’s swETH, Stakewise’s sETH, Stader’s xETH, Origin’s oETH, Ankr’s ankrETH, and Wrapped Beacon Ether (wBETH). These initiatives have prompted a surge in activity, with many people depositing funds to participate in the network and earn points. These points may give stakers the opportunity to earn Eigen token rewards in the future, although this remains speculative. EigenLayer will suspend all user deposits after reaching the 500,000 Ethereum limit.

Lisk blockchain will transition to Ethereum Layer 2 solution by partnering with Optimism and Gelato

* Layer 1

Layer 1 blockchain Lisk launched in 2016 is working with Optimism and Gelato to transition to Ethereum Layer 2 solution. The new Lisk network will leverage the OP Stack open source framework developed by Optimism, as well as Gelato’s rollup-as-a-service platform. The move aims to more closely integrate Lisk into the Ethereum ecosystem and align it with industry standards to make blockchain technology more accessible. At the height of the bull market in 2017, Lisk was a top 20 cryptocurrency by market capitalization. However, by 2023, as the blockchain industry matured, Lisk's market value fell from US$919 million to US$152 million, and its ranking dropped to 272nd. The Lisk team believes it can further its mission more effectively by moving to Ethereum’s second layer. Lisk’s Layer 2 testnet is expected to be deployed in the first quarter of 2024. The transition also includes migrating the LSK token to Ethereum to increase its usability for dApps and DeFi protocols in the Ethereum ecosystem. Lisk stated that the existing LSK reward sharing mechanism will continue to exist, and the token will also be used for on-chain governance of the upcoming Lisk DAO. Lisk also plans to conduct an initial airdrop of LSK tokens before the mainnet launch to incentivize activity on the new chain.

Manta Pacific adopts Celestia's modular data availability solution

*Infra

Layer 2 blockchain Manta Pacific has adopted Celestia’s modular data availability solution designed to reduce user transactions cost. Manta Pacific will leverage Celestia’s data availability sampling mechanism, which allows light nodes to verify data availability without downloading all data within a block. Kenny Li, co-founder and core contributor of Manta Network, said that by adopting Celestia, they will provide users with a more cost-effective and secure network environment. Since Manta Pacific’s mainnet went live in September, its total value locked (TVL) has grown to $18 million in just two months. Its developer, p0x labs, raised $25 million in a funding round led by Polychain Capital in July.

Dfinity Foundation launches GDPR-compliant European subnet at ICP

*Layer2

Nina Rong, head of ecosystem development at the Arbitrum Foundation, told Celo The community submitted a proposal. The proposal recommends that Celo adopt the Arbitrum Orbit technology stack based on Arbitrum OP technology to build customizable L2 and L3 chains. Rong emphasized that the Arbitrum Foundation team has been paying attention to the cLabs proposal for Celo’s transition to Ethereum L2 and welcomed Celo back to the Ethereum community by proposing the Arbitrum Orbit technology stack as a development direction.

Previously, Polygon and Matter Labs also recommended their respective solutions based on zero-knowledge technology to the Celo community. Celo said it plans to make a selection in mid-January to give community members time to evaluate the various proposals.

Part.4 Industry Pulse

Ethereum’s latest ACDE conference: Cancun/Deneb upgrades have been set to be activated on three public test networks Tentative Dates*Infra

Galaxy Vice President of Research Christine Kim posted a post summarizing the 177th Ethereum Core Developer Executive (ACDE) meeting. This week, developers set the stage to activate the Cancun/Deneb upgrade on all three public Ethereum test networks. The tentative dates and testnet upgrade schedule are as follows: Goerli fork on January 17, 2023, Sepolia fork on January 31, and Holesky fork on February 7.

Avail provides data availability for Starknet Layer 3 application chains on the testnet

*Chain

Modular blockchain Avail is partnering with StarkWare to increase data availability for validity-driven application chains within the Starknet Layer 2 network. The data availability solution will be integrated into a chain of Starknet applications developed using Madara, a customizable sequencer. These application chains will run as "Layer 3" within the Starknet ecosystem. According to a statement, Layer 3 will be able to leverage Avail for data availability in various modes. These modes include Validium and Sovereign Rollups, each of which offers unique benefits in terms of transaction processing efficiency and finality. This infrastructure will be available for use by the Madara chain following the mainnet launch, scheduled for Q1 2024. Currently, developers can begin experimenting with Madara’s data availability interface on the testnet.

DWF Labs: Institutional-grade OTC trading platform DWF Liquid Markets will be launched in January 2024

< p style="text-align: left;">*OTCDWF Labs co-founder Andrei Grachev posted that the institutional-grade OTC trading platform DWF Liquid Markets will be launched in January 2024. According to Grachev’s previous introduction, DWF Liquid Markets is an institutional-level OTC/RFQ (over-the-counter/request for quotation) platform with no counterparty/platform risks and supports instant settlement.

New York financial regulators approve Paxos expansion to Solana, allowing it to issue stablecoins other than Ethereum for the first time

*Legal< /em>

Stablecoin issuer Paxos has received approval from New York financial regulators to expand its stablecoin to the Solana blockchain, with a planned launch on January 17, 2024. This is the first time the regulator has allowed it to issue stablecoins outside of Ethereum.

本文分析房地产为何成为现金流驱动的投资产品,以及为什么比特币最终将成为一种卓越的价值投资存储手段。

JinseFinance

JinseFinance由于面临新的法律挑战,加密货币交易所正在为忠实客户提供优惠。

JinseFinance

JinseFinance特斯拉,BTC,特斯拉又购入价值7000万美元的BTC? 金色财经,马斯克和特斯拉对这一资金变化始终保持沉默。

JinseFinance

JinseFinance加密货币,BTC,观点:BTC深度价值时代结束 开启扩张期 金色财经,一个激动人心的新篇章已经开始。

JinseFinance

JinseFinance欧洲央行官员Ulrich Bindseil和Jürgen Schaaf最近在欧洲央行博客上发表了一篇博文,对BTC进行了严厉的批评,断言BTC未能实现其作为全球去中心化数字货币的承诺。

JinseFinance

JinseFinance自2023年9月底以来,微策略公司收购了大量BTC,同时利用市场波动,使平均收购价格低于BTC目前的价格。

JinseFinance

JinseFinance这是迄今为止德国缴获的最大规模的Crypto资产。

JinseFinance

JinseFinance有些Crypto资产可以做一些有价值的事情,另一些却什么都不能做。

JinseFinance

JinseFinance美国领先的拍卖行Phillips将于5月拍卖Baqueirat的一件藏品。可接受的支付方式包括比特币和以太坊。

Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph