Author: Bitke Editor: Daheilong

The Lunar New Year is approaching, and just as January is coming to an end, Tesla, a listed company on the US stock market, announced its latest quarterly financial report. Data shows that this manufacturing giant No Bitcoin is currently being sold, and the net digital asset value as of the fourth quarter of 2023 was unchanged from the third quarter.

Coincidentally, just a week before Tesla released its financial report, Bloomberg revealed that Michael Saylor, co-founder of MicroStrategy, another US listed company, "kept a low profile" before the US Securities and Exchange Commission approved the listing of a spot Bitcoin ETF. "Sold 3,882-5,000 shares of the company's stock to cash out over US$20 million. In fact, this is the first time Michael Saylor has sold his company holdings in the past 12 years, and it is reported that he will use the funds to invest in Bitcoin.

The question is, Tesla insists on holding on to Bitcoin, and MicroStrategy continues to increase its investment in Bitcoin. Is the market giant really coming?

Micro-strategy and Tesla’s Bitcoin layout “hint” that the Bitcoin bull market is approaching?

For "chain people" who are familiar with the cryptocurrency market, the name MicroStrategy must be familiar. This "veteran" software company began to explore investing in Bitcoin as early as 2020. And this road lasted four years:

Compared with MicroStrategy’s more aggressive Bitcoin “accumulation” strategy, Tesla seems to be relatively conservative. However, although there is no aggressive “buying”, Tesla has held shares for two consecutive years. There is Bitcoin, which means that if an investor buys Tesla stock, it is equivalent to buying Bitcoin! Koala Finance has sorted out the information of the five major listed companies with the largest current Bitcoin holdings (note: the data statistics time is February 4, 2024):

Tesla’s “hold on” and MicroStrategy’s “continuous increase” can be said to give those Long-term investors who want to add more funds bring confidence, coupled with macro developments and the current Bitcoin price trend, investors have been thinking about the trend in the next direction, that is - is the big bull approaching?

Technical analysis: A new bull market for cryptocurrency is about to begin

With the approval of the spot Bitcoin ETF by the U.S. Securities and Exchange Commission, and the next decline in Bitcoin With the semi-event set to take place in April of this year, 2024 is already shaping up to be a transformative year for digital assets, especially Bitcoin. Historically, "halving" will cause the price of Bitcoin to rise sharply in the following months and years. If all goes well, the Bitcoin halving will help the cryptocurrency market start a new round of bull market.

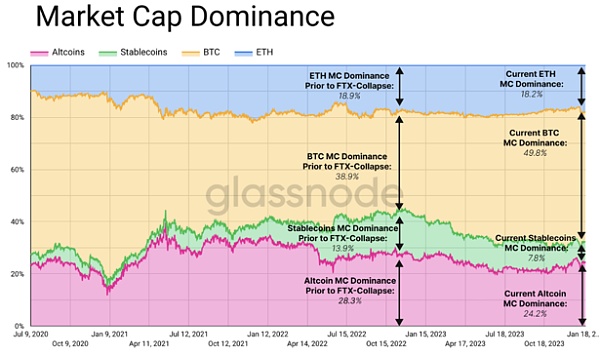

Frankly speaking, after entering 2024, Bitcoin’s performance is pretty good , the market capitalization dominance increased from 38.9% to 49.8%. ETH, on the other hand, maintained its market capitalization dominance, remaining between 18.9% and 18.2%. It was mainly altcoins that lost market share in the cryptocurrency market, with their market capitalization dominance falling from 28.3% to 24.2%, while the share of stablecoins also fell from 13.9% to 7.8%.

It is worth mentioning that the price of Ethereum has also been rising relative to BTC in recent days. Weekly surged more than 20%, the strongest performance since late 2022 on a quarterly, monthly and weekly basis. The market capitalization advantage of ETH and altcoins also saw a slight rebound. Compared with Bitcoin, ETH's market capitalization share increased by 2.9%. At the same time, the net profits locked by ETH investors also reached a new high in many years, indicating that the market's optimism for ETH is quietly rising, but at the same time, the market Tends to pause and digest profit selling pressure.

After the approval of the Bitcoin ETF, all indices rose slightly, which also showed some risk appetite. Although there was a short-term sell-off after the news was released, at this stage, BTC and The ETH-dominated crypto backend market has been fundamentally strong, emerging as a short-term winner, with investors’ realized net profits hitting multi-year highs.

However, Bitcoin may first “test investors’ determination” before hitting new all-time highs

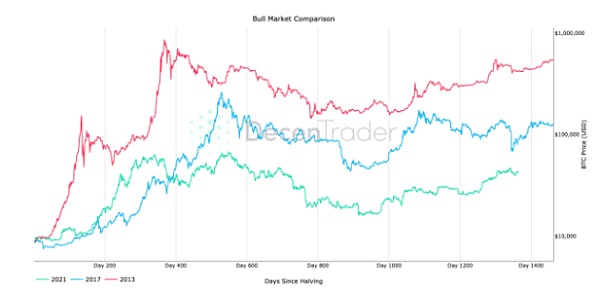

According to predictions by crypto trading strategy service provider DecenTrader Price behavior for the next BTC “halving” shows that Bitcoin price will experience sideways fluctuations for about a month before the market begins to react to the upcoming block subsidy halving.

DecenTrader CEO and co-founder Filbfilb said he expects a surge in buying volume about two months before the April 18 halving date, which will be followed by another "sell news event," Market reaction similar to the launch of a spot Bitcoin ETF last month could push BTC/USD to the current two-year high of $49,000, followed by a sell-off in the ETF. Filbfilb added:

“There are approximately 75 days until the Bitcoin halving, which is expected to occur around April 18, 2024. If we make a simple assumption that after the halving It’s important to note that there will be buying interest some time ago, and this is expected to be no later than 6 weeks before the halving, around the second week of March, which means Bitcoin has approximately 30 days from now to spend its correction phase before the expected FOMO demand can be discovered."

However, the road to price discovery may not materialize before the end of 2024 - a phenomenon that occurred during Bitcoin's last halving year (i.e. 2020). Historical trends show that it usually takes 220 to 240 days for Bitcoin to break through to a new all-time high after halving. If a similar situation occurs this year, Bitcoin may hit a new all-time high in the middle to late fourth quarter of 2024, which gives some time. adjustments to test investors’ responsiveness.

In short, cryptography led by Bitcoin in the Year of the Dragon The currency market should have a better outlook.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance

Bitcoinist

Bitcoinist