Author: Ben Strack, Casey Wagner, Blockworks; Translator: Deng Tong, Golden Finance

Second-quarter earnings from Bitcoin miners have trickled out over the past few weeks, giving investors a clearer picture of where they stand after the halving.

The Bitcoin halving in April helped push mining difficulty to new highs, while hash prices (a measure of mining revenue potential) are lower than ever before.

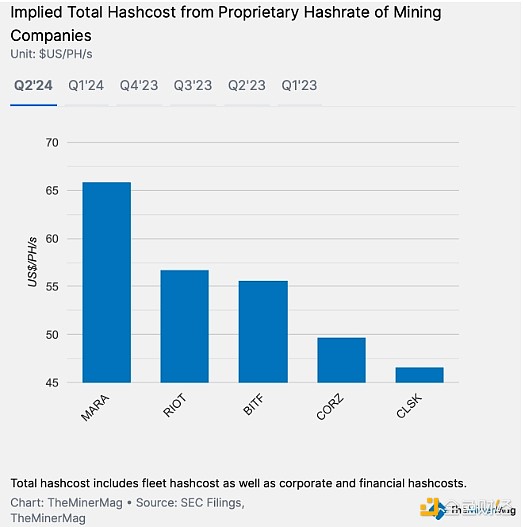

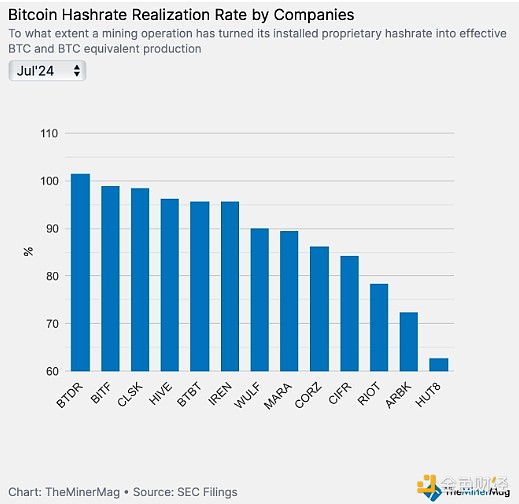

Nishant Sharma, founder of BlocksBridge Consulting, noted thatthe companies that are best positioned in their niche (on a pure mining basis) are those with low hash costs and high hash rate realizations.

"A lower hash cost means that the company's mining machines are more efficient than others and/or the company has received relatively low energy prices," he told Blockworks. "At the same time, a higher hash rate achievement rate means that the company is able to utilize most of its installed mining capacity." CleanSpark beat its largest competitor in the second quarter with lower hash costs, according to BlocksBridge Consulting. Marathon Digital, meanwhile, is at a higher level in this metric.

In terms of high hash rate realization (which is a good thing), Bitdeer, Bitfarms, and CleanSpark ranked in the top three in July.

Bitfarms announced some board member changes yesterday. Rival Riot Platforms said Tuesday it increased its stake in Bitfarms to 18.9% after offering to buy the company outright earlier this year.

“We continue to believe BITF’s growth potential is underappreciated and the acquisition of interest provides downside protection to the share price,” Compass Point Research & Trading analyst Joe Flynn said in a research note.

Beyond mining-focused metrics, some mining stocks may be more attractive to investors because they have BTC reserves or are betting on the growth of artificial intelligence.

Flynn noted in an Aug. 2 note that Marathon loses money when mining BTC. Nonetheless, the company bought $100 million worth of BTC in July as part of its new HODL strategy. The company said Monday it is raising $250 million through a private placement of convertible senior notes — proceeds that can be used to buy more bitcoin.

Flynn added that Marathon is currently “a leveraged play on BTC,” similar to MicroStrategy. He reiterated his buy rating on the stock but cut his MARA price target to $21 from $27.

Then, there are also companies that are turning to high-performance computing (HPC) and/or AI to diversify their revenue streams.

Flynn believes that Core Scientific is “the best pure-play name for BTC miners to convert to HPC.” After all, the company expanded its deal with CoreWeave last week to provide an additional 112MW of infrastructure for HPC operations.

Smaller miner Terawulf noted in its July production report that it continues to advance its 2MW AI/HPC infrastructure proof-of-concept build. WULF shares are down more than 40% from a month ago, but have gained since reporting second-quarter earnings on Monday.

“We believe the equity sell-off seen over the past few weeks provides an interesting opportunity to trade off the option value of HPC,” Flynn said.

Then there’s Hut 8, which, according to Benchmark analyst Mark Palmer, has multiple upside opportunities despite missing Wall Street expectations for second-quarter revenue and profit.

As of June 30, the company held 9,102 BTC, so it’s well positioned to benefit from a rise in the price of Bitcoin. Then there’s Hut 8 CEO Asher Genoot, who previously noted that the company would seek to build out its HPC vertical to support AI applications.

“We believe HUT shares could receive a meaningful boost if it announces that it has signed a significant new AI partnership or has placed a significant order for next-generation bitcoin mining equipment,” Palmer wrote in a note on Tuesday.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Others

Others Coindesk

Coindesk Beincrypto

Beincrypto Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph