Author: 912212.eth Source: X, @1912212eth

The extent of the market crash is still beyond the imagination of most people. After BTC lost $60,000 at 10 pm last night, it fell sharply to below $53,000, and the lowest price dropped to $52,300. The 24-hour drop exceeded 10% and hit a new low for BTC since March this year. BTC has now stabilized above $54,000.

ETH also fell to a minimum of $2,111 after losing $3,000, with a 24-hour drop of more than 20%. It has now stabilized above $2,300. This price almost wiped out all the gains in ETH this year. The decline of altcoins is generally around 20%.

According to Coinglass data, the entire network had a 24-hour liquidation of $808 million, of which long orders had a liquidation of $705 million. The decline of US crypto concept stocks in the night market widened, among which CleanSpark fell more than 20%, MicroStrategy and Marathon Digital fell more than 16%, and Coinbase and Riot Platforms fell more than 13%.

BTC failed to set a record high after breaking through $70,000 at the end of July. With funds sluggish, what factors accelerated the plunge in the crypto market?

Non-farm data raises concerns about a US recession

Last Friday, the non-farm payrolls data released by the United States were unexpectedly lower than expected, triggering a series of chain reactions on Wall Street. The weak performance of this key economic indicator not only led to a sharp drop in US stocks, but also triggered widespread market concerns about the outlook for the US economy. As an important indicator of the health of the US economy, the unexpected performance of non-farm data has caused shocks in the financial market. The US unemployment rate has soared by 0.6% from its low point this year. After the unemployment rate has continued to surge beyond expectations for several months, it has finally triggered the "Sam's Rule" for predicting recessions based on the unemployment rate.

The rule states that when the 3-month moving average of the US unemployment rate rises by more than 0.5 percentage points relative to the lowest point in the past 12 months, a recession may begin. This rule has been 100% accurate since the 1970s. After the unemployment rate data was released in July, it has reached the 0.5% threshold, which means that the United States may have entered a recession. Since 1950, among the 11 signals sent by the Sam recession indicator, only the recession in 1960 occurred 5 months later, and the United States was already in recession when the remaining 10 signals appeared.

In his report, Jan Hatzius, chief economist at Goldman Sachs, raised the probability of a U.S. recession in the next year from 15% to 25%. Goldman Sachs expects the Fed to cut interest rates by 25 basis points each in September, November and December. In addition, Goldman Sachs said that if its forecast is wrong and the August employment report is as weak as July, a 50 basis point rate cut in September is likely. In contrast, JPMorgan Chase and Citi have adjusted their forecasts and expect the Fed to cut interest rates by 50 basis points in September.

Users in the market who believe in the recession story will choose to sell their assets because they are unwilling to bet on whether a recession will really happen, and the funds in the crypto market are negatively affected after being withdrawn.

Global stock markets fall in panic

The day after the Federal Reserve's interest rate meeting, U.S. stocks began to plummet. The most direct cause was the ISM manufacturing data for July released on August 1, which was only 46.8%, lower than previous market expectations. The index reflects factory activity in the United States and is generally considered to be a signal of economic recession.

Subsequently, the non-farm payrolls data released on Friday continued to increase investors' concerns. The July data showed that the US unemployment rate rose to 4.3%, the highest level since 2021. Combined with the number of first-time unemployment claims in the week announced the day before, which hit the highest level since August 2023, it showed that the US job market began to show obvious signs of slowing down. US stock futures fell collectively, with Nasdaq 100 futures down 2.21% and S&P 500 futures down 1.23%.

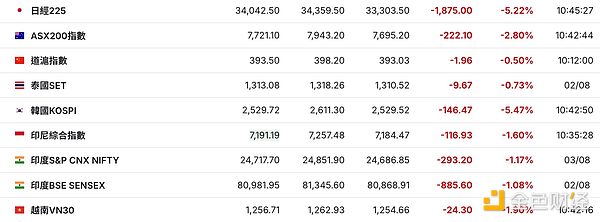

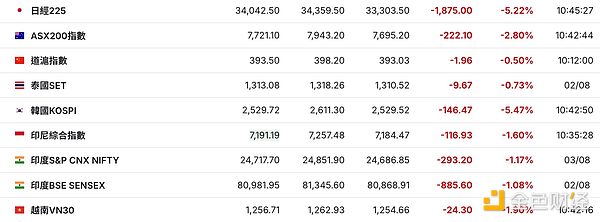

Today, Asian markets were also affected by US stocks and began to fall. Japanese stocks plunged, with the Nikkei 225 index falling 6% and a three-day cumulative drop of more than 12%. The decline of the Topix Index triggered the circuit breaker mechanism, and it has fallen 20% from its high in July, and is about to enter a technical bear market. Banking, financial and mining stocks led the decline. South Korea's KOSPI index fell 5%, and Samsung's stock price fell 6%, the biggest drop since 2020. Singapore's Straits Times Index fell 3%, Australia's S&P 200 fell 3%, and the Philippine stock index fell 2%.

Large liquidations in the crypto market accelerated the decline

On June 20, the market rumored that Jump Trading was investigated by the U.S. Commodity Futures Trading Commission (CFTC). Just four days later, Jump Crypto President Kanav Kariya announced his resignation on his social platform, without clearly mentioning the reason for his resignation. Recently, Jump Trading redeemed a $410 million wstETH (120,000) in batches into ETH and then transferred it to trading platforms such as Binance/OKX. In the past 24 hours, Jump Trading has transferred another 17,576 ETH (about $46.78 million) to CEX. According to Scopescan monitoring, Jump's positions are currently dominated by USDC and USDT.

BitMEX co-founder Arthur Hayes just posted on social media that he learned through news channels in the traditional financial field that a "big guy" fell and sold all crypto assets. And this so-called "big guy" is most likely Jump Trading.

In addition, after the market continued to fall in price due to severe selling pressure, there were several large-scale liquidation and on-chain liquidation events today. In the morning, four whales were forced to liquidate a total of 14,653 ETH, worth approximately $33.54 million, due to the rapid decline in the market. According to Parsec data, the lending liquidation volume on DeFi exceeded $320 million in the past 24 hours, setting a new high for the year.

Centralized exchanges also reported large liquidations. A Binance user had a single long order liquidated at 10:17 am today when the Ethereum price was $2,197, with a total of $10.9074 million. The contract trading pair was ETH/USDC.

While the market was continuously liquidating leverage, it also increased selling pressure, causing a sharp drop in the crypto market.

Joy

Joy