After months of sideways trading, Bitcoin has begun its deepest correction since the end of 2022. The trading price has fallen below the 200-day moving average and has caused a large number of short-term holders to suffer unrealized losses.

Summary

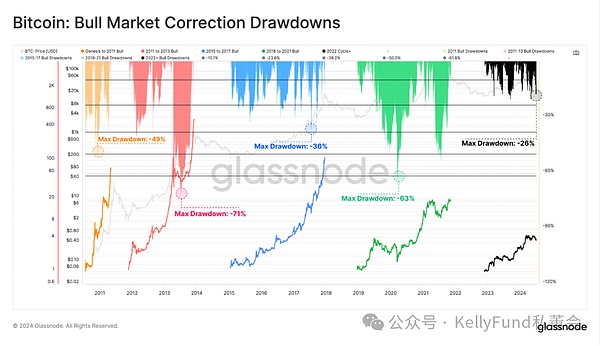

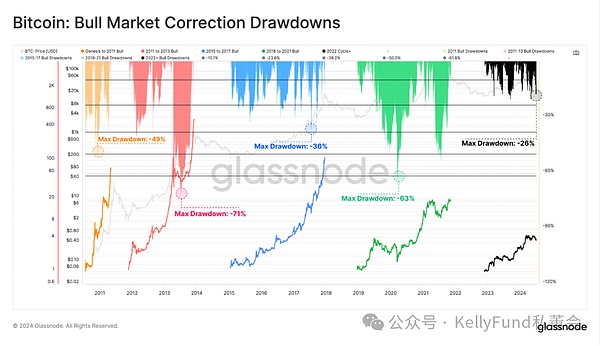

Bitcoin has recorded its largest drop in the current cycle - the current trading price is more than 26% below the all-time high. But compared with past cycles, this drop is still not particularly huge.

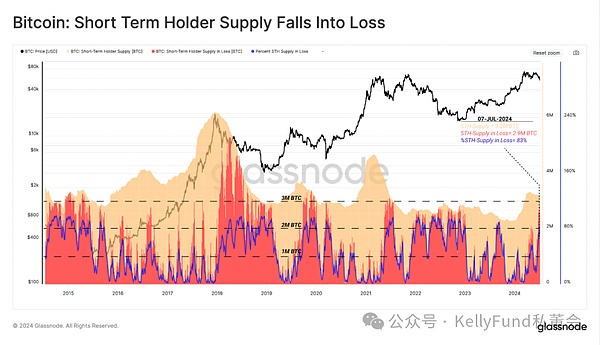

The price drop has caused a large number of short-term holders of supply to suffer unrealized losses, and more than 2.8 million Bitcoins are currently in a loss based on their cost basis.

This article analyzes the price performance, market structure changes, investor behavior and future trends of the Bitcoin market in depth, revealing that the bull market still shows a certain resilience under pressure.

Price Performance and Market Structure

In the 2023-24 cycle, the Bitcoin market has complex and volatile trends. After the FTX crash, the market ushered in a stable rise for about 18 months until the approval of ETF products pushed the price of the currency above $73,000. However, the market then entered a three-month range-bound fluctuation and experienced the largest correction of this cycle from May to July, with a drop of more than 26%.

Although the impact of this correction is significant, its depth is shallow compared with historical cycles, reflecting that as the Bitcoin asset matures, the underlying market structure has become relatively stable and its volatility has also decreased.

Figure 1: The retracement amplitude of bull markets in various cycles

By comparing the retracement amplitude of bull markets in different cycles (as shown in Figure 1), we find that the market performance in 2023-24 is similar to that in 2018-21 and 2015-17 cycles, which provides analysts with a reference for predicting market cycles.

Figure 2: Price performance at cycle lows

However, when looking at the performance of each cycle based on the halving date (as shown in Figure 2), the current cycle is relatively weak and one of the worst performing cycles in history, especially after the halving, the price trend is not as expected, highlighting the challenges facing the market.

“Flooded” new investors

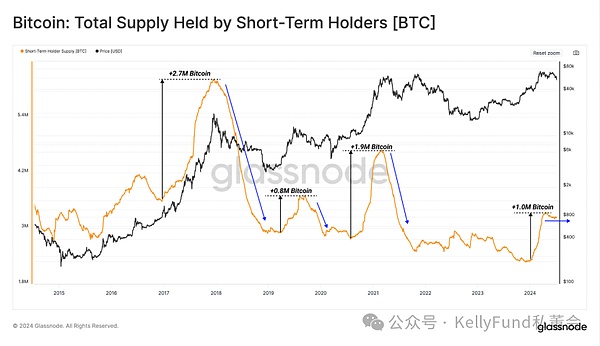

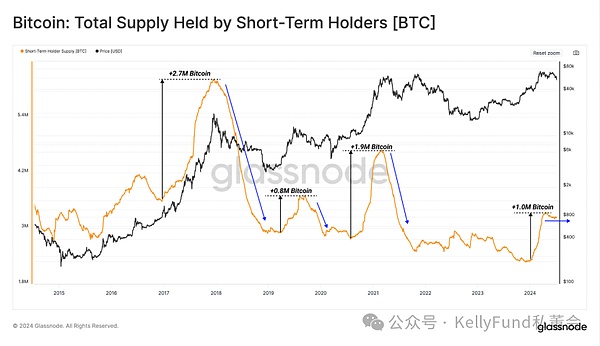

When analyzing the supply from short-term holders, we can see that this indicator has started to grow significantly since January 2024. This increase is consistent with the surge in Bitcoin prices after the launch of the Bitcoin ETF, which together reflect the strong inflow of new demand.

However, this demand surge has worn off after a few months - in the second quarter of 2024, the market has reached a balance between supply and demand. Since then, the original excess demand has turned into excess supply as long-term holders have taken profits and new buyers have lost interest in increasing their holdings.

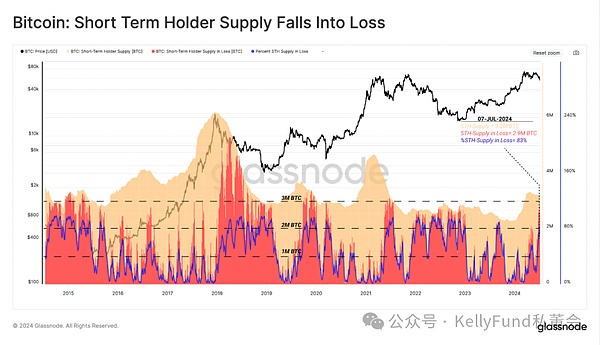

Figure 3: Short-term holders' holdings

In a sustained bull market, the market may form a local bottom when the loss supply held by short-term holders usually reaches 1 million to 2 million coins.

The current situation is even more serious, with more than 2.8 million coins in loss supply, and more than 2 million coins in loss state (which happened once in August 2023) for more than 20 days (as shown in Figures 4 and 5). This can't help but remind people of the situation in the second and third quarters of 2021, when a similar loss period lasted for 70 days, which eventually triggered a market crash.

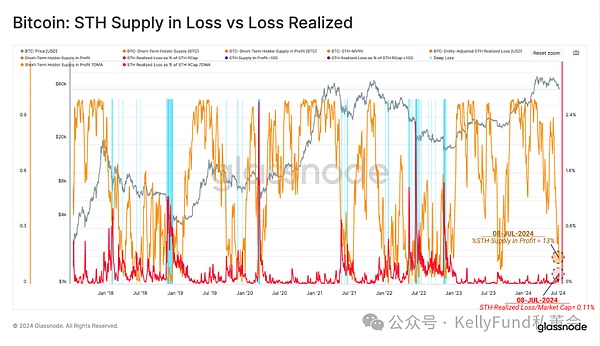

Figure 4: Short-term investors' assets are in loss

However, the current cycle is still developing and future trends remain to be seen.

Figure 5: Short-term investors' blood loss period

Investor behavior and market supply and demand

The financial situation of short-term holders has been severely impacted in the callback. According to analysis, more than 2.8 million bitcoins are currently in a loss state, reflecting the vulnerability of new investors in the price fluctuations.

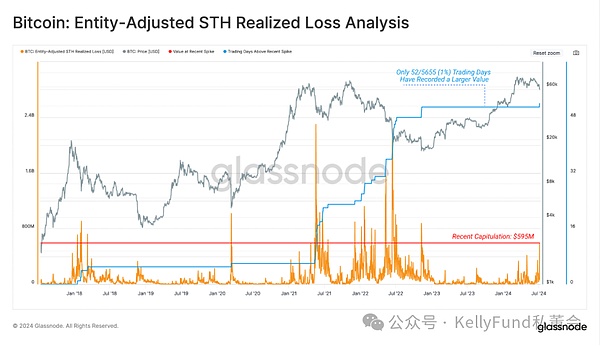

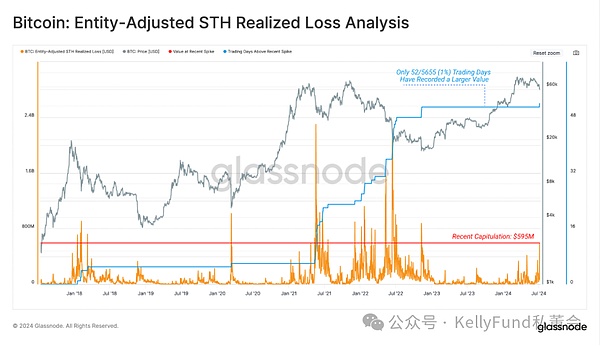

If we analyze the losses of short-term holders specifically, we can see that the locked losses of this group this week are as high as US$595 million. This is the largest loss since the cycle low in 2022.

Furthermore, only 52 trading days (<1%) in the previous 5,655 trading days had larger losses than this, which fully highlights how terrible the depth of this correction is.

Figure 6: Analysis of short-term holder losses after entity adjustment

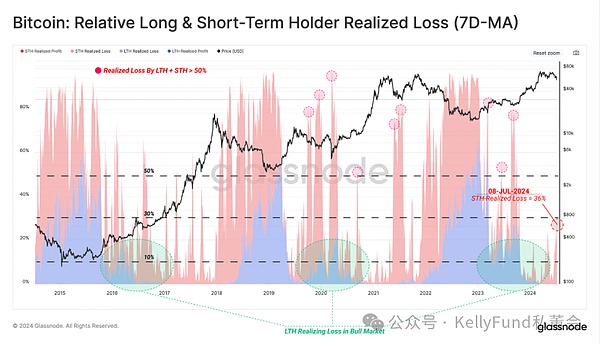

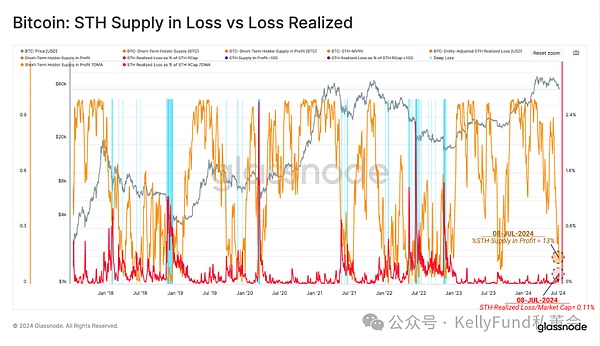

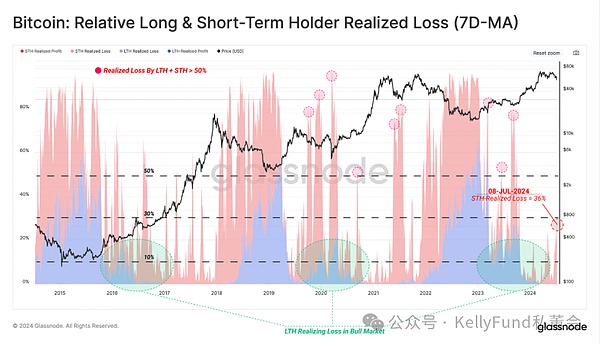

However, compared with the overall market size, these losses do not yet pose a systemic risk. Looking at the losses locked by long-term and short-term holders, we note that this week's loss events account for less than 36% of the total capital flow of the Bitcoin network.

Figure 7: Supply losses vs realized losses for short-term holders

In contrast, in the past, when investor confidence collapsed, such as in the big sell-offs in September 2019, March 2020, and May 2021, losses accounted for more than 60% of total capital flows in just a few weeks. Both long-term and short-term holders were severely affected by such collapses.

Therefore, it can be said that the current market contraction is more similar to the period when the market peaked in the first quarter of 2021 than the beginning of a collapse. Nevertheless, the demand side still needs to do its best to prevent prices from falling, otherwise investors' profitability will become worse.

Figure 8: Realized losses of long-term/short-term holders (7-day moving average)

Summary

Despite facing many pressures, the Bitcoin market still shows a certain degree of resilience.

First, the maturity of the market structure and the reduction of volatility provide investors with a relatively stable trading environment.

Second, although short-term holders face greater financial pressure, the overall market size is large and can absorb some losses. In addition, with the continuous development of the cryptocurrency market and the gradual improvement of regulatory policies, mainstream cryptocurrencies such as Bitcoin are expected to gain wider recognition and application.

The sharp contraction of the market has caused a large number of short-term holders to suffer serious floating losses, which undoubtedly brought them great financial pressure. However, the size of the locked-in losses is still relatively small compared to the size of the market.

In addition, the vast majority of long-term holders did not lose money in this wave of decline, which shows that although there will be panic in the market, sophisticated investors can still make money.

JinseFinance

JinseFinance