Introduction

BounceBit is a restaking base layer on the Bitcoin ecosystem. In terms of design, it has worked closely with Binance to build a high-yield CeDeFi component; in addition, it has built its own BounceBit Chain to build specific usage scenarios for Restaking and integrate an interesting system. BounceBit's token BB will be listed on Binance on May 13. According to official information, at the time of writing this article, the TVL exceeded $1BN.

In terms of investment institutions, BounceBit raised a seed round of 6M US dollars in February this year, led by Blockchain Capital and Breyer Capital. In March and April, OKX Ventures and Binance Labs made strategic investments respectively.

In terms of core concept, BounceBit's design is completely different from the current Bitcoin L2. It does not design a new asset type, nor does it attempt to modify any part of the underlying Bitcoin protocol. On the contrary, it clearly knows that the core of the Bitcoin ecosystem is BTC itself, which has a huge market value and the best decentralized properties. What BounceBit does is just to leverage BTC itself. This seemingly lazy and tricky approach, after research and thinking, we vaguely feel that it is a way to get to the essence.

In the following, we will introduce its mechanism in detail and discuss some of its key designs.

Brief introduction to BounceBit mechanism

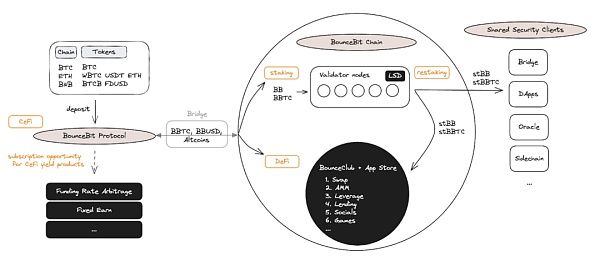

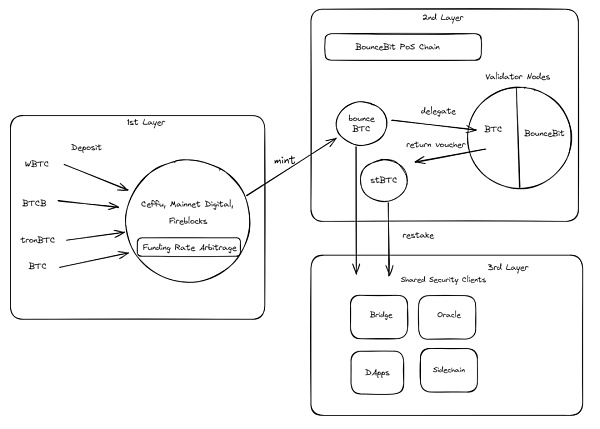

Referring to the above architecture diagram, you can see that BounceBit is mainly composed of three parts:

BounceBit Protocol: CeFi part;

BounceBit Chain: Staking and LSD part;

Share Security Client: Restaking part.

BounceBit Protocol

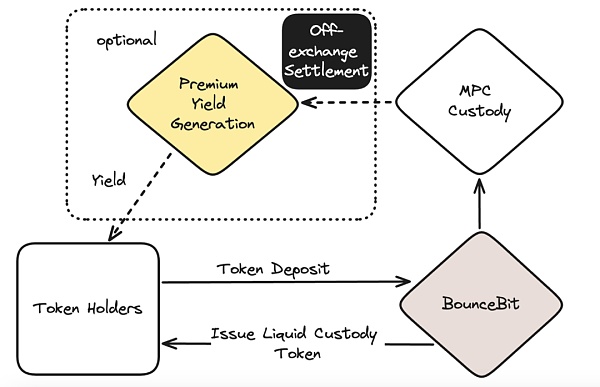

For details of BounceBit Protocol, please refer to this picture: When users deposit BTC into BounceBit Protocol, they will receive Liquid Custody Token (LCT) as proof of deposit in a 1:1 manner. For example, if you deposit BTC, you will receive BounceBTC (BBTC), and if you deposit USDT, you will receive BounceBit USD (BBUSD). According to the official description, the assets currently accepted are: BTC on Bitcoin, WBTC and USDT on Ethereum, and BTCB and FDUSD on Binance Smart Chain.

Then BounceBit Protocol will keep all the assets deposited by users in a multi-party computing (MPC) escrow account (and will not leave), and the assets here will be mirrored into Binance and entrusted to asset management companies to conduct operations such as funding rate arbitrage to generate profits, and then return this profit to users.

Binance and the escrow account will use the T+1 over-the-counter settlement (Off-Exchange Settlement, OES) method to isolate funds for security.

The specific fund escrow service providers here are Ceffu and MainNet Digital. Ceffu was formerly known as Binance Custody, and for a long time, it was Binance's only custody partner (recently several cryptocurrency-friendly Swiss banks have been added). MainNet Digital is a Singapore service provider that started as a fund (MainNet Capital).

BounceBit Chain

BounceBit Chain is an independent Layer 1 that uses the Delegated-Proof-of-Service (DPoS) consensus mechanism and is compatible with EVM.

The core of PoS lies in many nodes, who become stakeholders of this blockchain by staking their funds. Through verification, they contribute to the security of the overall blockchain and receive corresponding rewards. (To borrow Xu Mingen's vivid words, this is a reward for digital labor.)

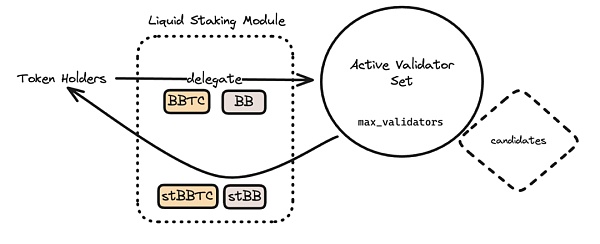

In the design of BounceBit Chain, users can freely choose to delegate their BBTC or/and BB to any specific validator nodes in the Active Validator Set (AVS) to earn rewards.

Validator nodes can freely set commission fees to compete in the market. In the current setting, AVS will have 50 validator nodes (25 accepting BTC pledges and 25 accepting BB pledges) in each 24-hour Epoch. The number 50 is confirmed by governance. As for which validator nodes will be selected into AVS, they will be reconfirmed in each Epoch based on performance.

The above entire staking process will be executed through the Liquid Staking Module, and the corresponding stBBTC and stBB will be given to users as proof of staking (that is, LSD).

This LSD will have two uses:

Get it and use it in the dApp on BounceBit Chain. The scenarios that can be imagined are: as collateral for the CDP stablecoin protocol, as collateral for the Lending protocol, and to form liquidity on DEX (and earn LP rewards)

Let Share Security Clients (SSCs) rent the security of BounceBit Chain, such as Bridge, Oracle, Sidechain, etc., which is the Restaking part. The logic here is consistent with EigenLayer. However, no client cases have been seen yet. It is estimated that the early rewards will also be given in the form of points to give users the expectation of airdrops. As for whether it will be a story of carrots and donkeys, it remains to be verified by time.

Total, the relationship between the complete architecture and each structure is as follows:

Tokenomics

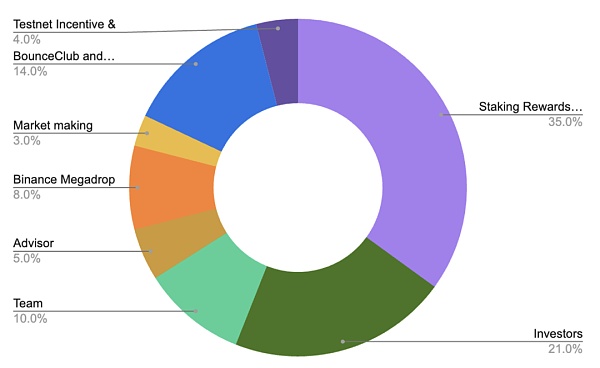

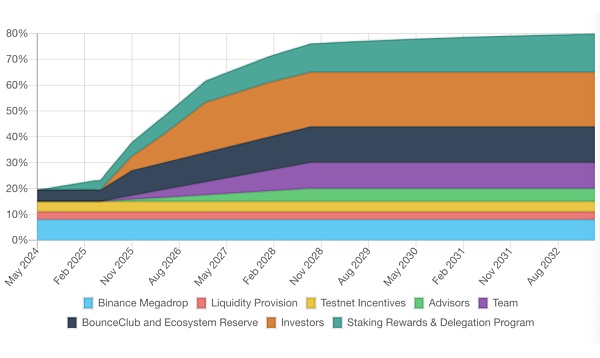

As the native token of BounceBit Chain, the total supply of BB is 2,100,000,000. The specific allocation and unlocking schedule is as follows:

BB The TGE is expected to take place in May 2024. The circulating supply at the time of listing will be 409,500,000, accounting for 19.50% of the total token supply.

There are two points that caught our attention here:

Investors account for 20%, slightly higher than the common 10%~15% of Web3.

Binance Megadrop accounts for 8%, and all will be released at the TGE.

Combined with 1) BounceBit is the first project of Binance Megadrop, 2) it supports Bitcoin (BTCB) in BNB format from the beginning, etc., we can see that BounceBit has a deep connection with Binance. It is conceivable that such an airdrop will attract a large number of users and TVL from Binance in the initial stage, but whether it can achieve sustainable development after a large number of airdrops depends on whether BB has corresponding actual profit scenarios to support competitive APY.

Marketing Strategy

In terms of marketing, BounceBit has promoted "Water Margin" on the test network to reward TVL, attracted users to participate in BounceClub's "Journey to the West", and recently joined hands with Binance "Megadrop".

Water Margin is a TVL incentive activity similar to Blast, which also has elements such as depositing TVL to earn points, inviting new users, and rankings, but has newly added game elements such as acceleration cards, point bonus cards, team activities, and lucky draws.

Journey to the West allows users to build their own clubs, which is a tool that allows users to customize the connection of different dApps.

Megadrop is an event deeply tied to Binance. On the one hand, it attracts traffic to BounceBit, and on the other hand, it also provides BNB usage scenarios and lock-up motivations. The specific rules can be found here. It is a relatively novel and intuitive way of playing.

In general, marketing is an indispensable part of web3 products, and the BounceBit team seems to be very good at this xDD

Ecological Progress

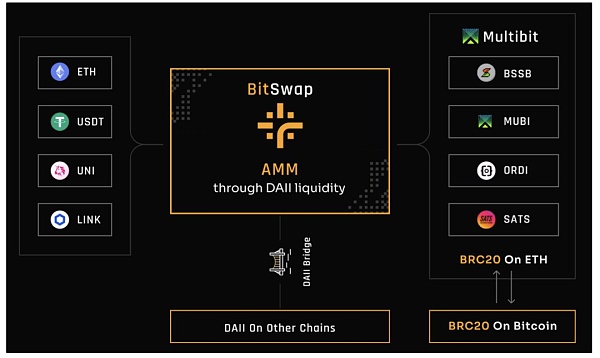

There are already some DeFi projects in the BounceBit ecosystem, including BitSwap (DEX), MultiBit (BTC EVM two-way bridge), BitStable (stable currency), etc.

Take BitSwap as an example. As the first DEX built on BounceBit, it hopes to simplify cross-chain transactions and become the liquidity center of BRC-20 assets by cooperating with MultiBit and DAII. Users can exchange any ERC20 token (ETH/USDT/etc.) for DAII on BitSwap, which is paired with other bridged BRC20 assets. In addition, by integrating MultiBit's CCIP, users can seamlessly transfer bridged BRC20 to Bitcoin.

ERC20 <–> DAII <-> bridged BRC20 <–> BRC20

https://twitter.com/BitSwap_xyz/status/1750015734216864145

Some extended thoughts on BounceBit

After understanding the basic design of BounceBit, there are several interesting points for us to discuss:

CeDeFi model has its application scenarios

Decentralization has a spectrum. Centralized exchanges, such as Binance, are often a safer and more reasonable behavior for novice users than managing their own wallets and trading on DeFi Protocol. For large users, CeDeFi also provides them with a compromise option to increase their income through centralized service providers while relatively ensuring the security of their assets.

Source of income and sustainability

Source of income and its sustainability are the core of any Web3 product. From BounceBit's perspective, it can be simply divided into three types of income:

a. Asset management income from accessing Binance on the BounceBit Protocol side

Binance's asset management income is currently mainly Funding Rate Arb. Under the premise of correct execution, this strategy can almost achieve Delta Neutral, which is a low-risk and controllable trading strategy.

b. Staking rewards on the BounceBit Chain

The staking rewards on the BounceBit Chain come from the transaction fees on the chain and the BB tokens issued through POS.

c. Ecosystem DeFi income

DeFi income depends on the activity of DeFi in the BounceBit ecosystem.

In addition, given that the Boucebit ecosystem is now in its early stages of development, the development of SSC's subsequent re-staking ecosystem is the key to observing BonuceBit's stamina. It is speculated that the team will launch related activities or hackathons to encourage the development of applications, so that SSC's subsequent re-staking rewards are at an attractive level.

Value for BTC L1

In the recent period of Bitcoin's ecological explosion, inspired by Mezo's design ideas, we also use the first principles framework to evaluate any new project: what value does this chain/protocol bring to BTC L1?

If the essence of PoS/DPoS is to use decentralized capital to protect the blockchain network, then it can be strengthened in two aspects: one is more capital, and the other is more decentralized capital. The second point is difficult to prove, but in terms of the first point, if PoW assets can also be included, the blockchain that uses PoS as consensus will have stronger protection. BounceBit's design idea of creating new usage scenarios for BTC (only) at the asset level is simple, violent, and direct in our opinion, which is in sharp contrast to many other chains in the Bitcoin ecosystem.

At first, we thought this method was lazy, and we didn't consider how to make the native EVM well, nor how to use the native UTXO architecture. But after research and thinking, we think this is a way to get to the essence: it clearly tells users that this is a product with centralized components, and only uses BTC as an asset to use on the BounceBit chain. After all, the key is to use BTC in a way that BTC holders can trust and increase its usage scenarios, and the specific means can be flexible.

Conclusion

How to use BTC effectively is undoubtedly the focus of BTC ecology. Different project parties have submitted different answers in this essay. BounceBit's solution is simple and direct, and it creates value around BTC revenue. At the same time, the project has been running for less than half a year and has become the first phase of Binance Megadrop. The team's resource operation and integration capabilities are evident. However, in the long run, whether its SSC can be well developed is the key to measuring BounceBit's true success. Let's wait and see.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph