Author: Riyue Xiaochu Source: mirror

BounceBit's biggest feature is the introduction of a unique double Pos pledge system, mortgaging BTC tokens and BounceBit network native tokens to ensure security.

With the sudden wealth effect brought by inscriptions, the market has focused its attention on BTC-related public chains include second-layer networks/side chains, etc. We know that from the perspective of Ethereum, the market value of ETH itself is 350 billion, while the market value of its related layer2, Dapp tokens, etc. has exceeded 100 billion US dollars. And with the arrival of the bull market, many ecological projects have emerged one after another, and the market value will increase exponentially.

In comparison, the market value of BTC has reached 1 trillion, but related projects The total market value is only tens of billions of dollars. This means that the overall ecological project still has room for at least dozens of times, including several projects worth tens of billions of dollars and countless projects worth billions of dollars.

However, due to the limitations of BTC in performance and smart contract support, BTC main The chain cannot bear the heavy responsibility of ecological explosion. Therefore, BTC’s related networks include second-layer/side chains and have high hopes. So after Inscription became popular, a large number of projects emerged, and heroes from all walks of life competed in the Central Plains to compete for the world. After all, the leaders of ETH’s second-layer network all have a market value of tens of billions of dollars.

Nowadays, there are three protagonists who have begun to show their talents, one of which I want to introduce BounceBit. BounceBit, created by the Bounce team, marks the first public chain focused on heavy staking of BTC.

BounceBit basic introduction

BounceBit’s biggest feature is the introduction of a unique double Pos pledge system, mortgaging BTC tokens and BounceBit network native tokens to ensure safety. BounceBit's architecture is fully compatible with the Ethereum Virtual Machine (EVM) and Solidity language, which means that a large number of ETH projects can be seamlessly migrated to the BTC ecosystem.

The asset security of BTC is a relatively big issue and will directly affect large BTC owners participation intensity. The security of BTC is not like the code vulnerability problem of Ethereum’s smart contracts. Mainly because BTC itself does not support smart contract functions. Many second-layer solutions now are to transfer to multi-signature wallets. But in essence, the project party has the authority to directly transfer the user’s assets. Although large project parties should be trustworthy, large BTC users will definitely have concerns, which will affect the overall asset participation. BounceBit offers a new solution with CeFi custody powered by Mainnet Digital and Ceffu, Binance’s only institutional custody partner. Ensure the security of BTC assets by adopting the asset management method of centralized exchanges.

At the end of January this year, BounceBit launched the Water Margin activity, similar to Blast’s Deposit mode. Two networks accept deposits: Ethereum and BNB Chain. On the Ethereum network, supported tokens include WBTC, Auction, Mubi, and DAII. As of today, it has a TVL of 450 million US dollars.

BTC Restake Mechanism

span>

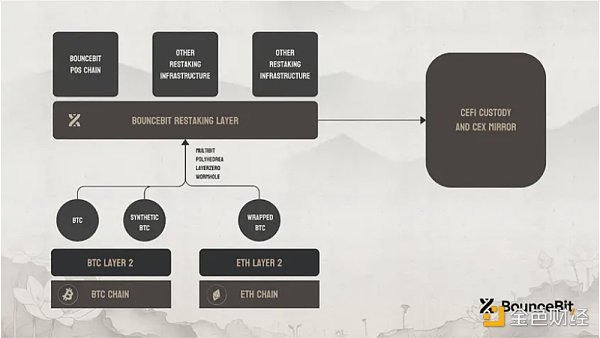

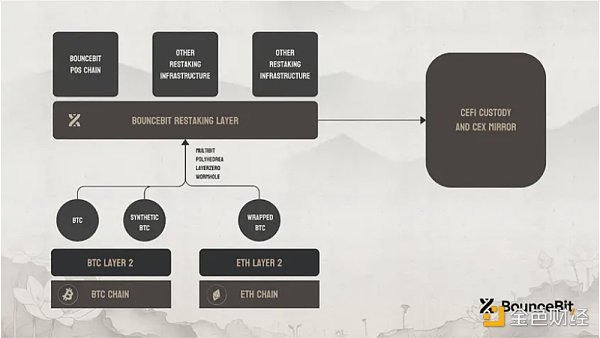

BounceBit’s core innovation is the BTC Restake mechanism. Simply put, the assets on the BounceBit chain can Divided into three layers

In the field of blockchain, BounceBit has introduced an innovative technology , BTC Restake mechanism, which opens up a new path for the appreciation of Bitcoin assets. This mechanism covers three levels of asset management, providing a multi-dimensional income ecosystem for Bitcoin holders.

First, we see the base layer of the Bitcoin asset. Here, Bitcoin itself, as well as tokens such as BTCB and WBTC on BNBChain, can be stored in central financial (CeFi) custody services powered by Mainnet Digital and Ceffu. The Mirror X technology provided by Ceffu ensures on-chain tracking capabilities of assets and regular financial audits to maintain the integrity and trust of the system.

Second, custodial Bitcoins can be converted into encapsulated versions on the BounceBit chain. Here, Bitcoin becomes so-called bounceBTC, which can be delegated to the network’s node operators in exchange for stBTC credentials, or directly used in various applications.

The third level is the re-pledge of stBTC. Users can re-pledge stBTC to other SSCs, such as side chains, bridges and oracles, or directly use it for various applications in the ecosystem. The BounceBit chain is fully compatible with the Ethereum Virtual Machine (EVM) and the Solidity programming language, allowing developers to easily migrate their projects to this new ecosystem.

Triple Benefits

Based on the above description, you can realize that BounceBit is a parallel generation of CeFi and DeFi revenue. Users can utilize LSD for BTC staking and on-chain mining while earning CeFi earnings, a process known in Bitcoin as “re-staking.” The ecosystem provides Bitcoin holders with a triple benefit: Original Cefi earnings , node operation rewards for staking BTC on the BounceBit chain, and opportunities to participate in on-chain applications and Bounce Launchpad.

Double Pos mechanism

BounceBit also uses a unique dual PoS (Proof of Stake) mechanism that emphasizes the importance of Bitcoin’s asset-driven infrastructure. Rather than relying on existing second-layer solutions, BounceBit As an independent PoS first-layer network, network security is secured through validators staking Bitcoin and BounceBit's native tokens. This dual-token PoS architecture not only increases the security of the network, but also increases participant participation.

BounceBit’s PoS architecture contains 50 validators, evenly divided into two parts: One for BTC stakers and the other for BounceBit token stakers. This dual-token system not only expands the stakeholder base, but also weaves an additional layer of resiliency and security into the network’s consensus fabric. Establishing a dual-token security system not only strengthens the network, but also enhances the intrinsic value of BTC by allowing it to play an active role in network verification and revenue generation.

BounceBox

BounceBox is an on-chain Web3 domain. BounceBox acts as a central hub, allowing users to customize their specific needs by selecting various tools and components from the BounceBit app store. Custom Web3 projects. Enables users to design, launch and enjoy decentralized applications (dApps) within the BTC ecosystem.

BounceBox includes decentralized exchanges (DeX), initial DEX products (IDO ) and marketplace, all reviewed for security and efficiency. Additionally, it includes assistive tools for bot prevention and artificial intelligence for customer service, as well as necessary security plugins.

Weiliang

Weiliang