Author: Cregis

1. Introduction

The cryptocurrency market in 2023 exhibited a paradoxical phenomenon: despite tepid investor activity, market prices experienced significant increases. Although most financial institutions are wary of serving cryptocurrency users, recent ETF applications mark significant progress in the adoption of cryptocurrencies by institutional investors. Regulators have issued warnings about market risks and taken corresponding enforcement measures. However, the judicial department has countered this excessive supervision. At the same time, the upgrade of Ethereum enables the withdrawal of pledged assets, which in turn promotes the growth of the total amount of ETH pledged.

In terms of blockchain platforms, Ethereum continues to solidify its leadership as a Layer 1 blockchain and is focused on development to ;Rollup is the core scalability strategy. At the same time, competing blockchains such as Solana, Avalanche and Cosmos have gradually expanded their market share through their own unique expansion strategies, with Solana's integrated approach achieving significant results at the end of the year.

In the field of on-chain applications, although blue-chip lending and trading protocols have performed stably, liquidity staking providers such as Lido have dominated the market . DeFi has achieved substantial development in aspects such as the tokenization of physical assets. The non-fungible token (NFT) market has experienced intense competition, causing platforms like OpenSea to significantly lose market share, while the introduction of Ordinals on the Bitcoin network has inspired NFTs and memes Token growth. Additionally, the rise of decentralized social protocols heralds a new era in blockchain application development.

In this contradictory year, the blockchain industry has presented a series of compelling innovations and growth. This article will provide an in-depth analysis of the core development and main trends of the blockchain industry this year, providing readers with a comprehensive and profound industry perspective.

2. Blockchain platform and extension

(1) Layer 1

In 2023 Ethereum continues to be the market leader in smart contract-based Layer 1 networks. Whether it is in terms of total value locked (TVL), transaction volume or transaction fees, Ethereum occupies a dominant position compared to other smart contract-based Layer 1 networks. By looking at the level of transaction fees, we can measure user demand for different blockchain networks. It is clear that in 2023, most of the demand is focused on the Ethereum network, which is evident from its higher transaction fees.

(Source: DefiLlama)

Tron and BNB Chain

In 2023 Ethereum’s main competitors have experienced Some noticeable changes. From the beginning of the year to the end of the year, Tron's total value locked (TVL) increased by approximately 100%, while BNB Chain's TVL fell by approximately 38% during the same period. These changes are primarily due to the impact of macroeconomic factors and regulatory events. For example, Tron 's TVL increase is mainly attributed to the trend of stablecoin users switching from USDC related to regulatory policies.

( Source: DeFiLlama)

In 2023, as stablecoin users switch from USDC to USDT, Ethereum’s share of the stablecoin market will be As a result, Tron gained a larger market share. By December 2023, Ethereum's share of the total stablecoin supply dropped from 62.1% at the beginning of the year to 51.6%.

Meanwhile, BNB Chain faces a series of regulatory issues in 2023 including the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) lawsuit. Along with the suspension of Binance USD (BUSD), the supply of stablecoins on BNB Chain continues to decrease. By November, regulatory issues surrounding Binance reached a fever pitch, leading its CEO Changpeng Zhao (CZ) to reach a plea deal with the United States and resign. From the beginning of 2023 to the end of the year, BNB's market value fell by more than $4.5 billion.

Solana and Celestia

2023 One of the market hot spots is about two opposite blockchain expansion solutions: Modularity and Integration. The token price market valuation of a Layer 1 network reflects the health of its ecosystem, as we can observe in the historical prices of modular and integrated blockchain representatives Celestia (TIA) and Solana (SOL) , modular blockchain Celestia market value increased by approximately 300% within one month after launching TIA token in November , integrated blockchain Solana (SOL) market value An increase of approximately 800% in 2023 year.

(Source: CoinMarketCap)

One of the most notable trends of 2023 is the resurgence of Solana, both in terms of its valuation and market acceptance of its integrated scaling approach. Among the smart contract protocols with the highest total value locked (TVL), Solana is unique for its use of a custom execution environment, the Solana Virtual Machine (SVM), which enables the network to execute transactions in parallel. In order to achieve high throughput and scalability while reducing user costs, Solana validators must be able to coordinate with other validators in the network to complete complex processing tasks. This is due to a series of custom technologies, such as the Proof of History synchronization mechanism and the Turbine block propagation protocol, all of which ultimately lead to the Solana validator being more competitive than other Layer 1 (L1) ) network has higher requirements.

Sui and Aptos

2023 , Solana has become one of the most widely used integrated architecture blockchains. In the past two years, some Layer 1 blockchains that adopt integrated architectures and achieve parallel execution at low cost have begun to emerge. Among them, Aptos and Sui are particularly obvious. Both platforms are derived from Meta 's Diem project and use the Move virtual machine as the execution environment. As of December 2023, the total value locked (TVL) of these two chains is approximately US$377 million.

Especially Sui has shown faster growth than Aptos over the past year, with its TVL to At the end of December it was almost twice as high as Aptos. Trends in 2023 show that the integrated architecture of Layer 1 blockchain may play an increasingly important role in the field of smart contract platforms. However, these emerging platforms still have a long way to go before they can surpass the dominance of the EVM (Ethereum Virtual Machine).

(Source: DeFiLlama)

Cosmos and Avalanche

The Cosmos community has been embracing the concept of modularity since its inception. Launching a new blockchain in the Cosmos ecosystem is easier than any other, thanks to native infrastructure and tools like its Blockchain Communication (IBC) protocol and Cosmos SDK . Developers can customize chain parameters according to their needs, such as inflation rate, pledge unbinding time, verifier rewards, governance voting parameters, etc. At the same time, the IBC protocol can realize the interoperability of different Cosmos chains.

The inherent advantages of modular blockchains come at the expense of fragmented user attention and Cosmos inter-chain liquidity. While IBC allows assets to be transferred between Cosmos chains, these assets must go through the same IBC channel. If not, these assets remain non-fungible. For example, an ATOM sent from Osmosis to Canto via IBC is different from an ATOM sent from Cosmos Hub to Canto. Therefore, in terms of composability and liquidity, the Cosmos application chain still has certain disadvantages compared to the general Layer 1 blockchain.

2023 The number of active subnets in the Avalanche ecosystem continues to grow, but user activity compared to the main Avalanche C chain Still lower. By the end of the year, the total TVL of the two active subnets, DFK Chain and Beam, reached approximately $13.8 million.

(Source: DeFiLlama)

The Avalanche subnet and the newly launched Cosmos chain face similar challenges when it comes to cybersecurity. In the initial stage, these networks need to accumulate enough funds as a moat to prevent economic attacks. On Avalanche, validators are required to stake 2,000 AVAX at a price of approximately $35 per AVAX. However, most Avalanche subnets currently have no more than 10 validators in total. Among these subnets, the largest is the MELD subnet, which only has 16 validators. A smaller number of validators will potentially impact the security and decentralization of the network.

(2) Layer 2

As the demand for Ethereum transactions continues to grow, Its expansion problem has become increasingly urgent. Currently, Ethereum's processing capacity is approximately 15 transactions per second (tps). Such throughput is obviously unable to meet the growing demand for large-scale use. This limitation could become a key obstacle to Ethereum’s future development.

The expansion of Ethereum has always been a controversial topic. The core difficulty lies in the so-called "impossible triangle" theory, namely decentralization, security and scalability. In a distributed network, it is difficult to optimize these three characteristics at the same time, and usually only two aspects can be optimized. Enhancing scalability often requires making certain sacrifices in decentralization or security. However, the Ethereum community is cautious about making this trade-off choice and is unwilling to sacrifice decentralization or security easily.

(Source: DeFiLlama)

Ethereum's expansion methods are mainly divided into two types: on-chain and off-chain. On-chain scaling involves modifications to the core Ethereum protocol, while off-chain scaling involves building additional protocols and infrastructure on top of Ethereum. Currently, off-chain expansion is developing faster than on-chain expansion. Especially for most of the period from 2021 to 2022, off-chain expansion solutions based on optimization and rollups have received continued attention in the venture capital market.

(Source: The Block)

Optimistic Rollups

Arbitrum One

Among the current four major categories of Layer 2 solutions in Ethereum, Optimistic Rollups (ORs) have the largest total locked value (TVL), among which Arbitrum One ’s TVL ;Number one. Arbitrum One was already the highest TVL Layer 2 platform before launching the ARB governance token. Following the launch of the ARB token, over $2 billion of liquidity was introduced into the Arbitrum One ecosystem, with approximately $1.25 billion of tokens already unlocked, further solidifying the ;Arbitrum One Leading position among all Layer 2 platforms.

(Source: l2 beat)

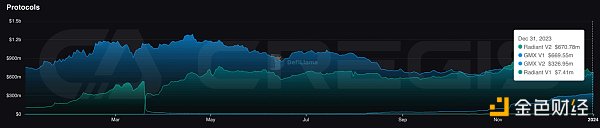

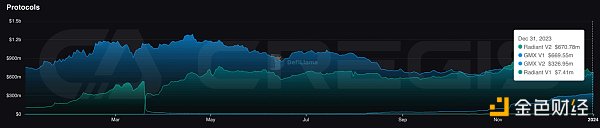

The liquidity introduced by the ARB token has facilitated the growth of Arbitrum One’s decentralized applications (Dapps). On the Arbitrum One platform, the Dapp with the highest total value locked (TVL) is the exchange GMX, followed closely by the lending platform Radiant. These two applications account for most of the TVL market share on Arbitrum One.

(Source: DeFiLlama)

OP Mainnet

Ranked 2nd in Total Value Locked (TVL) among Optimistic Rollups (ORs) OP Mainnet, formerly known as Optimism, has assets in excess of $3.4 billion. OP Mainnet's governance token OP was airdropped in May 2022, a year earlier than Arbitrum One's airdrop. Although OP Mainnet 's TVL growth rate is slower than Arbitrum One 's, its growth trend is more stable.

With WorldCoin launching its token WLD on OP Mainnet in July 2023, the network ;TVL significantly increased. WorldCoin co-founded by Sam Altman, co-founder of OpenAI, aims to build the largest digital identity and financial network. The WLD airdrop is designed to guide the development of the network and encourage new users to sign up for the application. So far, more than 700,000 users have received the WLD airdrop.

(Source: DeFiLlama)

OP Mainnet An important development milestone of the mainnet is the open source OP Stack in August 2022. OP Stack is a development stack powering OP Mainnet , built and maintained by Optimism Collective . The current version of OP Stack, also known as Optimism Bedrock, enables developers to develop their own optimistic rollups projects using the same technology as OP Mainnet.

With the open source of OP Stack , many projects developed based on OP Stack have emerged, the most eye-catching of which is Coinbase The Base mainnet will be launched in August 2023. Base aims to provide decentralized application (Dapp) services to exchange users. Base has rapidly grown into the third largest Layer 2 network in terms of total locked value (TVL).

(Source: l2 beat)

Zero-Knowledge Rollups

In Zero-Knowledge Rollups (ZKR), there are currently no Clear leader. Although dYdX 's TVL share previously occupied the first place in ZKR , it has now begun to transition to Layer 1 's Cosmos The current TVL of ZKR's zkSync Era and Starknet's TVL is US$539 million and US$145 million respectively. While the zkSync Era 's TVL is significantly higher than Starknet's, some of its TVL comes from the original zkStnc Lite.

(Source: l2 beat)

Rollups as a Service

As the Rollup ecosystem matures, we begin to see ;rollups are used as a tool for versatility, not just as a means of expansion. Applications that wish to have a custom execution layer can choose to launch their own rollup, sacrificing a certain degree of decentralization and security in order to gain sufficient block space. Based on this demand, Rollups-as-a-Service (RaaS) applications began to emerge, which provide decentralized application (dapp) developers with the ability to quickly launch new rollups for deployment. Notable examples include Altlayer, a RaaS framework focused on the Ethereum Virtual Machine (EVM), and dYmension, a RaaS framework focused on Cosmos.

Layer 3

Currently, the second layer ( Layer 2) The network has also begun to experiment with Layer 3 technology. For example, both Starknet and zkSync Era have mentioned that in theory they can build a third-layer network on top of the existing second-layer infrastructure by leveraging the recursiveness of validity proofs. However, these solutions are currently not a priority as both Starknet and the zkSync Era are focused on the development of their second layer technologies. In addition, the use of third-layer technologies is designed to allow developers to quickly deploy customizable execution environments, similar to what is provided by Rollups-as-a-Service (RaaS).

(4) Cross-chain bridge

Although Multichain at 7 The month has hit a safe patch, but bridging technology retains its importance throughout 2023. In particular, the Portal bridge, which uses a locking and casting mechanism, has grown steadily and has become the cross-chain bridging platform with the highest total locked value (TVL). The main driver of this growth was Solana's resurgence in the fourth quarter, making the Portal the primary gateway into the Solana ecosystem.

In addition, Stargate bridging based on LayerZero technology and capital pool model followed closely behind and became the second largest cross-chain bridging platform. Total Value Locked (TVL) remains stable. Throughout 2023, the cross-chain ecosystem has shown a growth trend, mainly due to the continued development of Layer-2 technology.

(Source: the block)

(5) BTC Layer 2

Lightning Network

Bitcoin’s Lightning Network is its most well-known scaling solution. Starting from the beginning of 2023, the total number of Bitcoins in the Lightning Network has increased from approximately 5,000 to a maximum of approximately 5,400. In the same year, its total value locked (TVL) grew from an initial US$80 million to approximately US$200 million at the end of the year, an increase of approximately 150%. Among them, the growth of TVL is mainly driven by the increase in Bitcoin price.

(Source: bitcoinvisuals)

Rootstock, Stacks and DeFiChain

In addition to the Lightning Network, Bitcoin has other scaling solutions The solution is mainly based on the second layer (Layer 2) technology of side chains. For example, Rootstock, Stacks, and DeFiChain, etc., their total locked value (TVL) at the end of 2023 was US$116 million, US$054 million and US$1.28 million respectively. billion, their total locked value is much lower than the Lightning Network’s $200 million. It is worth noting that the TVL of DeFiChain and Rootstock also includes the value of their respective native tokens DFI and RSK. Looking at this data, the adoption rate of these sidechain solutions is significantly lower compared to the Lightning Network.

(Source: DeFiLlama)

Ordinals and BRC-20

Bitcoin's Ordinals protocol allows Satoshis ( The smallest unit of Bitcoin) is assigned a unique identifier, and with SegWit and Taproot upgrades, transaction fees for storing metadata in satoshis are reduced. This protocol enables users to issue non-fungible tokens (NFTs) on the Bitcoin network. Subsequently, the BRC-20 standard based on the Ordinals protocol further expanded its functionality to enable the minting of tokens. BRC-20 tokens and Bitcoin NFTs have sparked a lot of speculation, increased on-chain activity on the Bitcoin blockchain, and resulted in a significant increase in the portion of miner fees that comes from transaction fees.

(Source: bitinfocharts)

Although the technical architecture of the Ordinal NFT and BRC-20 tokens themselves are not designed to extend the functionality of Bitcoin, they do demonstrate the possibilities for innovation on the Bitcoin blockchain . Considering the limitations of Bitcoin’s scripting language, we expect to see more innovation on the Bitcoin blockchain in the future.

BitVM

BitVM is in 2023 One of the latest Bitcoin upgrade plans proposed at the end of the year aims to introduce Turing completeness to Bitcoin. According to BitVM's white paper, the technical implementation described is through "bit-value commitment" and the method of constructing logic gate commitments, so that Bitcoin contracts have Turing-complete expression capabilities. This method can achieve Turing completeness without changing the consensus mechanism of the Bitcoin network.

(Source: BitVM White Paper)

Under the BitVM architecture, any logic can be encapsulated and published to the Bitcoin chain, while its execution occurs off-chain. A "fraud proof" mechanism will be used during off-chain execution to verify execution results. If an entity wants to challenge the proposal of an on-chain publisher, they can implement a fraud proof on-chain. This mechanism allows the logic of any smart contract to be expressed and verified on-chain while being executed off-chain. Although this approach is more complex than Ethereum's smart contracts, it brings huge potential for Bitcoin's Turing completeness, which exceeds the limitations that Bitcoin currently exhibits. Over time, BitVM may bring a new wave of innovation to Bitcoin.

3. Applications on the chain

(1) Decentralized Finance (DeFi)< /h3>

Decentralized Finance (DeFi) is a form of financial services that does not rely on traditional financial institutions, such as banks or exchanges. It provides users with an open and borderless financial service experience, allowing users to enjoy these services without going through the approval of traditional financial institutions. Since 2020, DeFi has attracted widespread attention and has experienced a series of peaks and troughs. During the previous bull market, DeFi demonstrated its huge potential as an alternative financial system.

However, events like Luna the crash expose the potential risks of DeFi systems. At present, DeFi is still in its early stages of development, and many aspects are still not mature and stable enough. In addition, because DeFi is separated from the regulatory system of the traditional market, it also brings some inherent risks.

Although 2022 the cryptocurrency market experienced a winter-like bear market, 2023 The DeFi ecosystem will be characterized by integration and resilience. Salient features. This year has witnessed the integration of major areas of DeFi, covering key parts such as decentralized exchanges (DEX), lending markets, liquidity staking and collateralized debt warehouses. It is particularly worth noting that liquidity staking accounts for the largest total value locked (TVL) in the DeFi ecosystem, which not only highlights the stability of liquidity staking yields, but also reflects its strong performance in the competition. .

(Source: DefiLlama)

Decentralized Exchange

In the first half of 2023 due to the bankruptcy of FTX Concerns about the reliability of centralized custodians have led many spot traders to flee from centralized exchanges (CEX) to decentralized exchanges (DEX). The explosion of cryptocurrency centralized projects in 2022 highlights the importance of decentralization and emphasizes the unique advantages provided by DeFi.

Affected by the bear market, market interest continues to be sluggish, DEX spot trading volume fluctuated in 2023, and then the market showed signs of recovery in the fourth quarter. In 2023, Uniswap still maintained its leading position, accounting for 53% of the transaction share throughout the year, with most of the transaction volume coming from Ethereum and Arbitrum One.

In contrast, Curve 's market share dropped from 10% last year to 3.7% this year. The main reason is that the shrinking market hinders the diversity of stablecoins, thus reducing the market demand for stablecoin swaps DEX.

(Source: the block)

Loans

In the lending space, Aave continues to maintain its dominance, accounting for a majority of total outstanding debt With more than 60% of the market share, Compound is close behind in second place. In 2023, lending activities will gradually recover from the deleveraging in 2022 and show a steady recovery trend.

A development worthy of attention is that in May , SparkLend , which is affiliated with the Maker brand, entered the lending market. At the same time, a fork project of Aave quickly gained market attention and quickly grew into the third largest lending protocol in terms of total outstanding debt. Six months after its launch, the total outstanding debt exceeded 6 ;One hundred million U.S. dollars. SparkLend is unique in that it provides borrowers with DAI, the largest decentralized stablecoin by market capitalization, a predictable interest rate by directly leveraging Maker's line of credit to achieve.

Ethereum Liquidity Staking

In 2023 In 2019, Ethereum’s liquidity staking sector showed remarkable resilience and became a highlight in the DeFi sector. This is mainly due to two aspects: First, in a bear market characterized by low volatility, the returns generated by liquidity staking are more attractive than those generated by other DeFi activities. Second, the development of “liquidity staking finance” protocols enhances the utility of liquidity staking tokens.

While liquidity staking demand for ETH appears to have peaked in the second half of 2022 , in 2023 Showing a rapid growth trend, this growth has not been affected by the Ethereum Shanghai upgrade and pledge withdrawal functions implemented in April. In the field of liquidity staking, Lido continues to maintain its leadership position, occupying 78% of the market share, while Rocket Pool is firmly in second place with 10% of the market

With the increasing development of liquidity staking finance, several other segments in DeFi have also begun to emerge in 2023. In particular, the real-world asset (RWA) tokenization market has seen explosive expansion. RWA collateralized debt positions have issued 2.8 billion DAI, accounting for more than half of the entire 5.4 billion DAI supply. Fees from these RWA positions account for 80% of Maker's revenue

Derivatives

In 2023 , decentralized perpetual contract (perps) exchanges have shown a vibrant development trend. Especially in November, the trading volume of perpetual contracts reached The highest point of the year. dYdX Although its market share has decreased, it still maintains its leading position as a mature decentralized perpetual contract exchange (DEX). The battle for second place has become fierce, with platforms such as Vertex, GMX, Synthetix, ApeX and others. dYdX is gradually migrating from the Ethereum-based StarkEx ZKR to the Cosmos side chain, which brings new competitive factors to the perpetual contract DEX market.

Meanwhile, decentralized options trading is starting to gain momentum with the launch of Aevo in the third quarter. Aevo has quickly become the leading decentralized options exchange, with trading volume far exceeding Lyra. The dynamics of decentralized derivatives trading volumes throughout the year demonstrate the early-stage nature of the industry and hint at the huge potential within the market as it continues to grow and mature.

(2) Non-fungible tokens (NFT)

2023 The non-fungible token (NFT) market is undergoing a critical transformation, which means that NFT assets are moving toward financialization.

OpenSea and Blur are two platforms active in the NFT market, each with different business models. OpenSea's business model relies on transaction fees. It charges a certain percentage of fees from each NFT transaction as its source of revenue. However, the drawback of this model is that it will have an impact on market liquidity. Blur's business model disrupts the industry by prioritizing efficiency and liquidity over traditional fee structures that reward creators.

At the beginning of 2022 , OpenSea became a giant in the NFT ecosystem, with a valuation of after completing a $300 million round of financing. 13.3 billion US dollars, accounting for more than 80% of the transaction volume of all secondary markets. Its revenue model relies heavily on platform fees, with monthly revenue ranging from $5 billion to $120 million, and annualized revenue will exceed $1 billion by early 2022.

However, by mid-2023, the situation had reversed, with their platform revenue reduced to less than $2 million per month. This significant drop (down nearly 90% from previous earnings) is largely attributed to the rise of "zero-fee platforms," where users have moved transactions from platforms such as OpenSea to zero-fee platforms such as Blur. The NFT market is re-evaluating traditional fee models in favor of liquidity-focused strategies.

(Source: the block)

In OpenSea 's fee structure, the NFT royalty range usually ranges from 2.5% to 10% of the final sales. Sellers are required to pay royalties and transaction fees that OpenSea charges on each transaction. Although Blur 's business model has increased liquidity and transaction volume, it has also significantly reduced royalties for NFT creators, triggering market concerns about sustainable development.

(Source: galaxy)

NFT Finance

2023 is a critical turning point in the non-fungible token (NFT) market, marking the market The shift to innovative liquidity solutions. NFT lending platforms have played an important role in the transformation, providing asset holders with a new ability to unlock the value of their digital assets. This marks an important step forward in the financialization of NFTs, especially for non-personal image (PFP) collectibles that have traditionally been less liquid.

In the field of NFT trading, platforms such as OpenSea mainly focus on retail transactions. In contrast, NFT loan platforms are committed to serving user groups who are risk-averse and frequent transactions, and bring more richness to the ecosystem by introducing new leverage methods similar to traditional asset endorsements. This market shift resulted in significant growth in loan volume, exceeding $3.3 billion.

In the NFT financial field, the Blend platform launched by Blur occupies a dominant position. Its 2023 Loan volume in the second quarter reached $197 million. With over 6100 borrowers and 3300 lenders onboarded, Blend 's activity has significantly driven overall loan volume growth, which has increased by 270% since the beginning of the year. But in-depth analysis shows that 10% of lenders and 26% of borrowers contribute the majority of transaction volume

Bitcoin NFT

The Ordinals protocol developed by Casey Rodarmor allows data to be embedded directly into the Bitcoin area on the blockchain. This protocol numbers the smallest unit of Bitcoin - Satoshi (Sats for short) and allows various content to be burned on these Satoshis, from pictures to code, thus creating a new type of Bitcoin NFT. During the roughly 10 months of Ordinals development, Bitcoin developers built similar to other major Layer 1 blockchains such as Ethereum, Polygon and Solana ;NFT Tools.

Throughout 2023, the Bitcoin ecosystem has undergone major changes due to the development of inscriptions. Since the beginning of the year, miners have earned more than $530 million in total fees, of which approximately $90 million came from activity related to Ordinals. These burning activities led to increased fees and congestion in the Bitcoin mempool (transaction pool), with the total byte size of transactions awaiting confirmation reaching an all-time high.

In order to achieve faster transaction confirmation, users began to pay higher fees, intensifying competition for the limited space in each block. Transaction fees began to grow significantly in early 2023, reaching a peak around April, driven primarily by the creation of the BRC-20 meme token.

(Source: blockchain)

(3) Decentralized social networking

FriendTechSoFi

FriendTech is a social media platform that incorporates cryptocurrency features and calls itself a "friend market." Similar to other non-encrypted social media platforms that are still in the testing phase, Friend.tech implements an invitation code system, and users need to obtain the invitation code of an existing user to complete registration. The platform has introduced a unique mechanism that allows users to purchase “keys” that enable them to send messages to other users. This novel feature has attracted many users to join. In less than three months since its launch, Friend.tech has attracted widespread attention from the community. The number of platform users has exceeded 900,000, and the transaction volume has reached US$475 million.

(Source data: Dune)

FriendTech 's success is rooted in the fundamental human need for social interaction. On this platform, users can publicly display their "score" or value, and gain recognition and respect from other users in this way. This not only satisfies users’ inherent desire for social recognition and affirmation, but also strengthens their sense of participation and belonging on the platform.

JinseFinance

JinseFinance