Written by: InnoMin Capital

I. Summary

1. Review of the 2024 Market

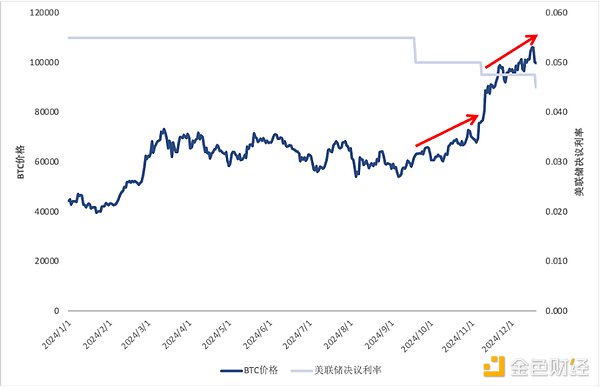

The bull market of Bitcoin continued in the first quarter of 2024, and with the policy benefits, the market showed strong upward driving force. The first quarter of 2024 started strongly. The first batch of spot Bitcoin ETFs in the United States were approved for listing on January 11. In addition to GBTC and Hashdex, the 11 newly approved spot ETFs had a net inflow of US$1.9 billion in the first three trading days, reaching a peak of about US$63.4 billion in the first half of the year in March. By the end of the first quarter, the spot price of BTC rose by 62%. Entering the second quarter, Bitcoin experienced its fourth halving event on April 20, with the reward per block reduced from 6.25BTC to 3.125BTC. After BTC hit a new high of nearly $73,800 in March, the overall market entered a long adjustment period, fluctuating between 52,000 and 72,000 points. By the end of the second quarter, the BTC market ended in a slump with a downward shock due to the negative impact of special events such as the German government's sell-off and Mt.Gox's compensation. In the third quarter of 2024, Bitcoin measured key support and resistance levels, forming an overall volatile trend, and market trading activity decreased. Among them, BTC fell 4% quarter-on-quarter, and ETH fell 24.5% quarter-on-quarter. The overall encryption field was relatively weak in price performance. Until September, the Federal Reserve announced its first interest rate cut policy, which was beneficial to the market and trading sentiment gradually warmed up. In the fourth quarter of 2024, Trump won the US election and the first cryptocurrency accounting standards formulated by the FSAB (Financial Standards Advisory Board) came into effect. The cryptocurrency industry gained more regulatory clarity and released unprecedented policy signals. As of December 17, BTC's price exceeded $100,000 for the first time in December, reaching an all-time high of 108,366.80. BTC rose 71% quarterly, and ETH rose 52% quarterly, and continued to maintain a high level. November is a turning point for the crypto industry. We believe that the current Bitcoin price has fully reflected the market's optimistic expectations for policy shifts. It is expected that BTC will drive other currencies to usher in a dual resonance of sentiment and policy, and the industry will continue to be bullish.

Figure 1: BTC daily K-line

Figure 2: ETH daily K-line

2. Review of BTC historical cycle

From historical data, the cryptocurrency market shows obvious four-year cycle characteristics.BTC prices have significant statistical momentum characteristics, that is, the upward trend tends to continue the previous upward trend, while the downward trend tends to continue to fall. This characteristic makes the periodic fluctuations of prices predictable. However, the driving factors of each cycle are different, such as macroeconomics and technological progress, so future price trends are also different. However, investors can better understand the statistical characteristics of Bitcoin by analyzing past price trends and refer to these laws when making decisions to deal with market fluctuations.

In the cycle from January 2015 to December 2017, the price of Bitcoin rose more than 100 times. In the cycle from December 2018 to November 2021, the price of Bitcoin rose about 20 times, and then fell to a cyclical low of $16,000 in November 2022. The current price increase phase started in November 2022 and lasted for two years. From the perspective of the increase, Bitcoin has currently increased by 6 times in this cycle, which is far lower than the returns achieved in past cycles.

From the perspective of BTC on-chain indicators, BTC's unrealized net profit/loss indicator is currently at a benign level of around 0.62 (in the faith stage), which is consistent with the level in the mid-term of the bull market. It is currently at the peak stage, lower than the peak of 0.75 in the previous cycle. The MVRV indicator also shows the same situation. The peak in December was 2.67 (in the "gradually high" range), and it is currently in the continuous stage. From the perspective of total market value/accumulated revenue of miners, the position of the yellow line in 2024 is far from entering the red high range, indicating that the market has not yet reached the overheated state of the bull market. The current ratio is at a medium level. From the black line, we can see that the price of Bitcoin is gradually recovering, which is consistent with the performance in the mid-term of the past bull market. According to the market value level and the historical performance of Bitcoin prices, it can be judged that the cryptocurrency market still has a lot of room to go before the peak of the bull market. Investors should pay attention to the further development of the market at this stage. Figure 3: BTC price cycle chart Figure 4: BTC unrealized net profit/loss chart, currently at 0.62 level, in the confidence-denial stage (Note: BTC unrealized net profit/loss is the difference between relative unrealized profit and relative unrealized loss, with thresholds set to 0.0, 0.25, 0.5 and 0.75, respectively, to show the entire Figure 5: BTC MVRV peaked at 2.67 in December (Note: This method calculates the proportion of days in history when MVRV traded below or above certain levels. Only results since 2017 are considered in the figure, and the criteria are as follows: Extreme Lows: MVRV has been below 0.8 on approximately 5% of trading days; Gradually Lower: MVRV has been below 1.0 on approximately 15% of trading days; Gradually Higher: MVRV exceeded 2.4 on approximately 20% of trading days; Extremely High: MVRV exceeded 6% on approximately 6% of trading days. 3.2. )

Figure 6: BTC MCTC currently still has room to go from the red high range

(Note: MCTC market value / miners' cumulative income, the red range represents the high, and the green range represents the low)

3. Main market data

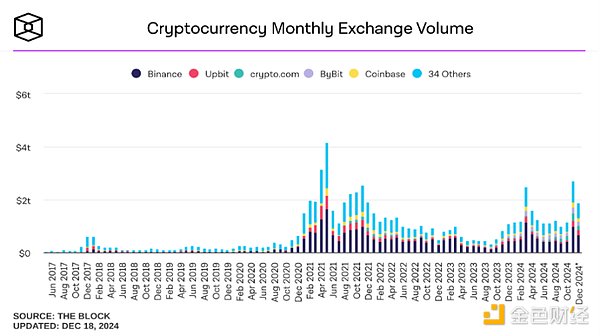

(1) Cryptocurrency exchange trading volume

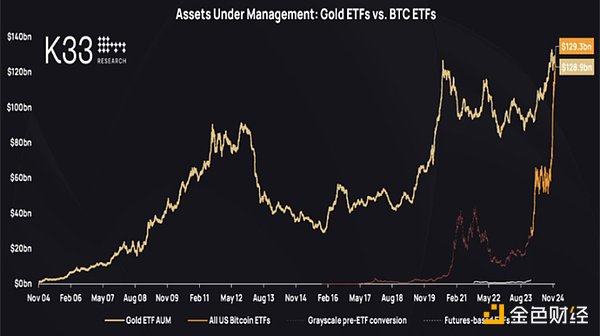

As of December 18, 2024, the average monthly trading volume of cryptocurrency is 1.47t USD, with a standard deviation of 0.54t, and the trading volume fluctuates greatly. The maximum trading volume is 2.71t USD, reaching peaks in March and November 2024, respectively. This level is already close to the second largest peak in the previous cycle (November 2021). Overall, the trading volume shows great volatility, mainly concentrated between 1.1t USD and 1.8t USD.

Figure 7: Monthly cryptocurrency exchange trading volume (USD)

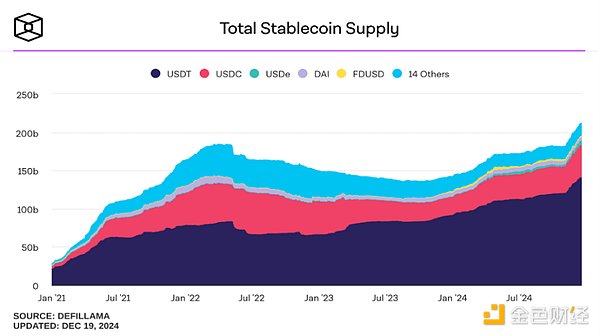

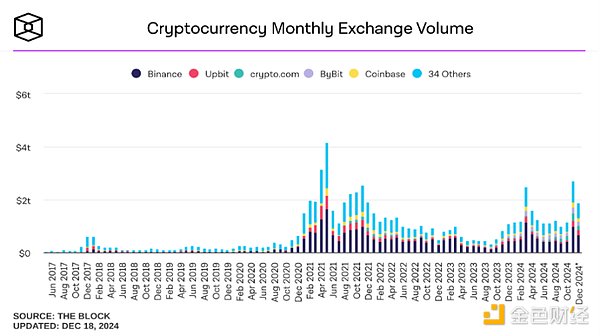

(2) Total supply of stablecoins

The total amount of stablecoins is currently US$211 billion. From the beginning of this year to December, the overall growth trend is roughly linear, with an overall growth of 43.8%, especially in November and December, showing a large increase, indicating that capital is accelerating into the crypto ecosystem.

Figure 8: The total supply of stablecoins, of which USDT accounts for 71.1% and the proportion is gradually stabilizing

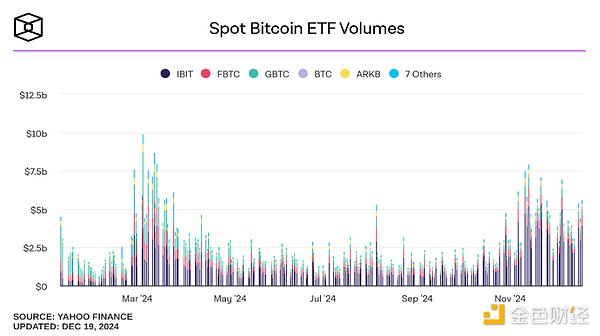

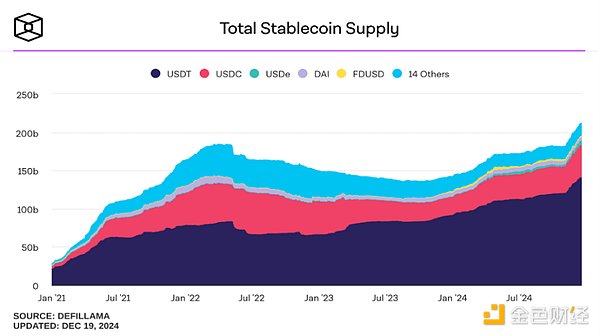

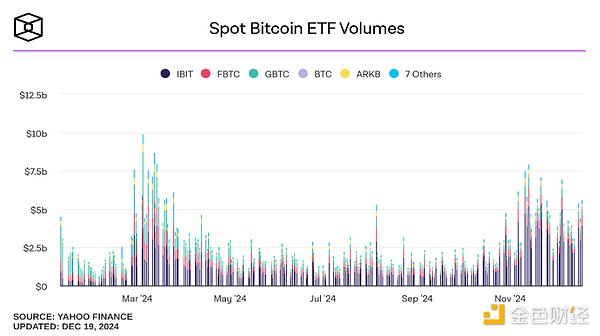

(3) Spot ETF trading volume

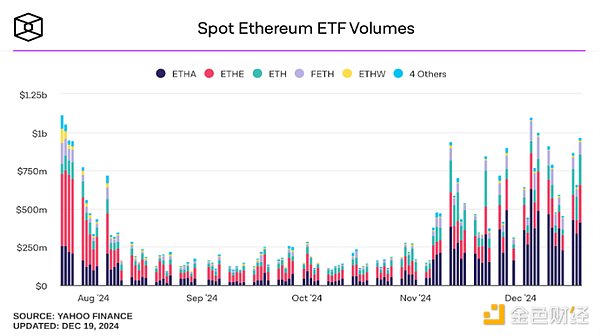

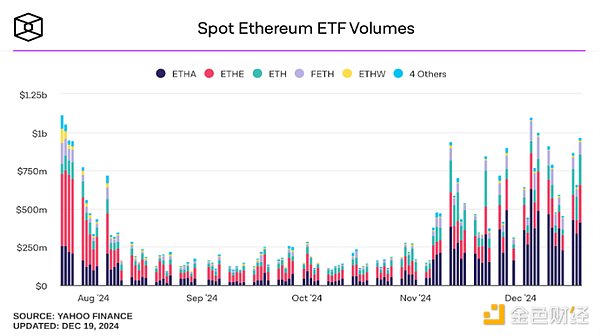

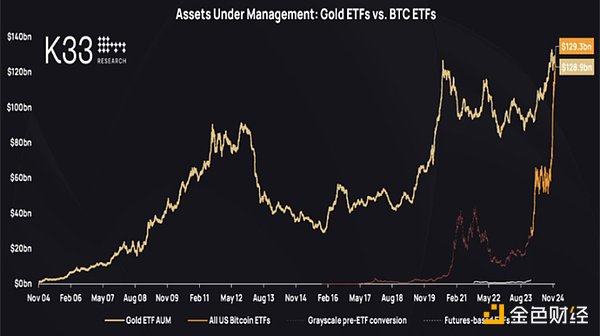

As of December 18, Bitcoin spot ETF continued to perform strongly, with a single-day fund volume of US$275 million, maintaining a net inflow for 12 consecutive months. On December 17, according to data from investment institution K33 Research, the fund size of Bitcoin spot ETF exceeded US$129.3 billion in less than a year since its listing, exceeding the US$128.9 billion of traditional gold ETFs. From July to November, the trading volume of ETH ETF showed a trend of first decreasing and then recovering, and investors' confidence in Bitcoin spot ETF and Ethereum spot ETF continued to strengthen.

Figure 9: Spot BTC ETF trading volume (USD)

Figure 10: Spot ETH ETF trading volume (USD)

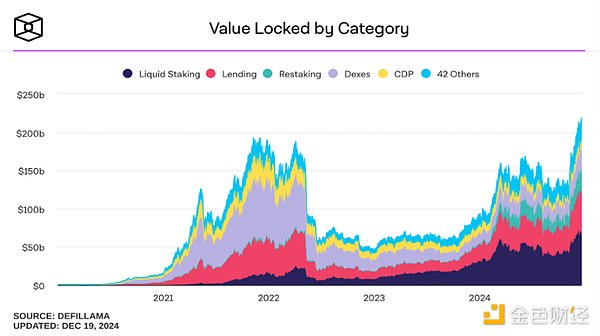

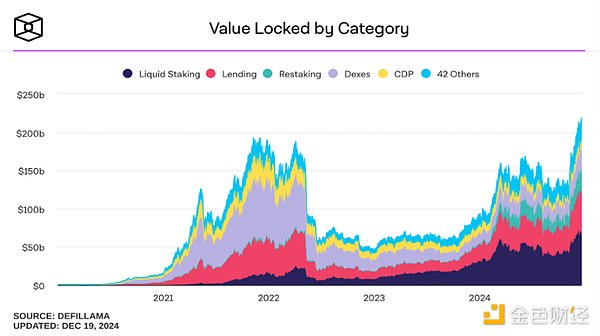

(4) DeFi total locked volume

The total locked volume of DeFi in 2024 showed a continuous upward trend, especially in the fourth quarter, when TVL (total value locked volume) rose rapidly. As of December On the 17th, it reached a record high of about $218.7 billion. As the interest rates offered by decentralized lending platforms such as Aave and Compound are usually higher than traditional bank deposit rates and the decentralized operation can greatly reduce risks, the DeFi protocol has shown broad potential and has become a highlight of the crypto market. Among them, the increase in Liquid Staking compared with the beginning of the year indicates that the Proof of Stake (PoS) protocol has a stronger driving effect on the locked volume.

Figure 11: DeFi Total Locked Volume (USD)

Summary: Overall, the current indicator group shows that the crypto market is in the mid-stage of a bull market, and the main market indicators are all well above the cycle lows, but have not yet reached the level that marked the previous market top. High trading volume and continued growth in DeFi lock-up represent further increases in market activity. The growth in the total amount of stablecoins and the accelerated capital inflow indicate that the market funding environment is loose and liquidity is increasing, providing basic support for the rise of the cryptocurrency market and driving prices up.

4. Risk Warning

Risk 1: Policy delays or failure to meet expectations

At present, the price of Bitcoin has largely reflected the market's optimistic expectations for policy shifts. However, this also means that if policies are delayed or fail to meet market expectations, it may have a significant impact on market sentiment. For example, the replacement of the SEC chairman or the relevant release process of the Bitcoin Strategic Reserve Plan may become potential risk points.

Risk 2: Adjustment of the Federal Reserve's Monetary Policy

Any unexpected changes in the Federal Reserve's monetary policy path, especially the re-acceleration of the interest rate hike process or the significant tightening of the policy stance, may have a direct impact on market liquidity, thereby suppressing the performance of BTC and other crypto assets.

Risk 3: Market Bubbles and Emotional Fluctuations

The cryptocurrency market is dominated by retail investors and is highly susceptible to emotional influences. This characteristic makes the market prone to speculative bubbles, and the risk of drastic price fluctuations under emotional fluctuations is significantly increased.

II. The Trump 2.0 Era Kicks Off

Trump has not yet officially entered the White House, and the crypto market has ushered in a carnival in advance, and policy expectations continue to release positive news.

1. How will the three most critical crypto "promises" affect the market outlook

Trump's election has brought expectations of loose regulation to the crypto industry, including the announcement of the establishment of a Bitcoin reserve and the nomination of a crypto-friendly SEC chairman.These measures have boosted Bitcoin prices in the short term, but more importantly, they have led to medium- and long-term legislative progress. If the three key bills are passed, the US crypto industry will usher in a new stage of development.

(1) The FIT 21 bill will be promoted as a priority, and DeFi innovation may "return" to the United States

The FIT 21 bill is regarded as a milestone in the crypto field, aiming to clarify the commodity and securities attributes of cryptocurrencies and resolve regulatory disputes between the SEC and the CFTC. After Trump's election, the progress of the bill is expected to accelerate. After its passage, more compliant trading platforms and financial products may emerge in the United States, enriching the types of spot ETFs and paving the way for more crypto asset ETFs. At the same time, innovation in decentralized applications is encouraged, especially in the DeFi track. The bill stipulates that tokens that meet decentralized standards can be exempted from regulation, attracting more projects to return to the United States. The combination of traditional capital and the RWA (real asset tokenization) track will promote the integration of on-chain finance and real assets.

(2) US stablecoin legislation may return to the agenda

The 2023 Payment Stablecoin Clarity Act failed to pass due to political differences. Trump's election and his opposition to CBDC may inject new impetus into stablecoin legislation. Clear compliance standards will benefit compliant stablecoins such as USDC and accelerate the adoption of traditional payment institutions. As the role of stablecoins in cross-border payments increases, their market share and user scale will continue to grow.

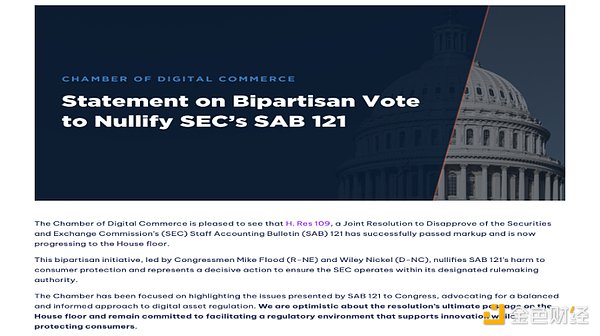

(3) Repeal of SAB 121 proposal and restart, crypto asset custody problem will be solved

The SAB 121 announcement issued in 2022 has strict accounting requirements for crypto assets, which hinders the development of custody services. Trump promised to repeal SAB 121, reduce the compliance costs of financial institutions entering the custody business, and attract more institutional investors and traditional custodians to participate in on-chain business. Stablecoin and RWA tracks will benefit, promoting the trend of digital management of traditional assets.

Figure 12: Bipartisan vote to reject SEC SAB 121 initiative

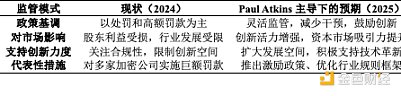

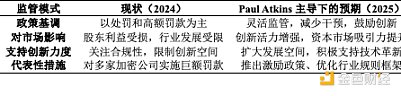

2. Paul Atkins leads regulatory reform, cryptocurrency regulation enters a new era

The Trump team’s recent financial regulatory policy trends show clear support for the crypto market, especially after nominating Paul Atkins, who has an industry background, as SEC Chairman. This choice demonstrates the Trump team’s determination to build an inclusive and innovation-driven capital market.

(1) Paul Atkins’ position and influence

Paul Atkins is widely recognized for his support for market innovation and openness. He has long advocated reducing regulatory intervention to unleash the potential of innovation and promote economic development. As co-chairman of Token Alliance, he has accumulated rich experience in the field of crypto assets and blockchain. In its nomination statement, the Trump team emphasized Atkins' recognition of crypto assets and technological innovation, as well as his commitment to promoting a strong capital market. This move marks that the SEC may shift from penalty-driven to flexible regulation.

(2) Supportive tendencies of other team members

According to statistics, more than 60% of the members of Trump's cabinet nominations publicly support the development of crypto assets and financial innovation. Some of them have expressed their holdings of Bitcoin or other crypto assets and advocated loose policies to promote industry development. The presence of these supporters indicates that future policies will further promote the development of the crypto market and ensure the implementation of new policies with more efficient execution.

Table 1: Comparison of regulatory thinking

III. The start of a new round of interest rate cuts

1. Overview of the US economic situation

Since 2022, in response to the inflation caused by the epidemic, the United States has launched the most aggressive quantitative tightening policy since the financial crisis. Under the leadership of Powell, the Federal Reserve raised the benchmark interest rate from 0.08% to 5.33% in July 2023. High interest rates promote fixed income investment, but are unfavorable to risky assets such as stocks and cryptocurrencies. However, high interest rates have failed to effectively curb domestic inflation and have not reached the Federal Reserve's 2% target. This high interest rate has been maintained for more than a year, during which the market has continued to worry about a possible recession and stagflation. In 2024, the US macroeconomy began to turn around. Since April, the core CPI has gradually declined, indicating that inflation has cooled; non-farm payrolls have also exceeded expectations for five consecutive months, reflecting a recovery in the job market. These indicators show changes in the inflation trend and the need for policy adjustments. On July 31, 2024, the Federal Reserve announced that it would cut interest rates in September, four and a half years after the last rate cut in March 2020.

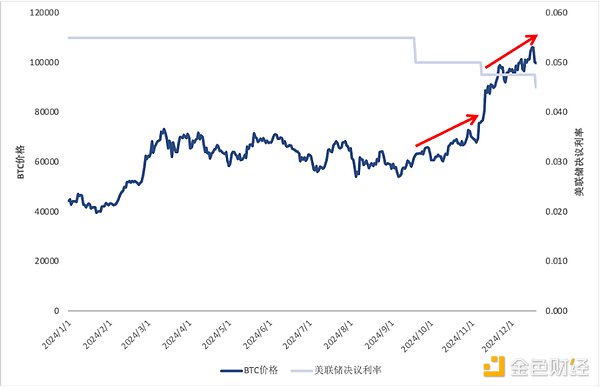

2. The impact of three interest rate cuts in 2024 on cryptocurrencies

On September 18, the Federal Reserve officially decided to lower the target range of the federal funds rate by 50 basis points, opening a monetary easing cycle. The good news of large-scale interest rate cuts was quickly realized in the cryptocurrency market. Since September 18, the price of Bitcoin has continued to rise by 9.0% in 11 days before the market gradually cooled down and ushered in some corrections. Some investors began to make large-scale layouts the day before the resolution, pushing the price of the currency up 3.6% in a single day before the announcement of the interest rate cut. On November 8, the Federal Reserve announced another 25 basis point interest rate cut. This interest rate cut basically met market expectations. According to CME Federal Reserve observation data, since October 4, the probability of a 25 basis point interest rate cut has always remained above 80%. The Bitcoin market has also started to fluctuate and rise since October, with the price of the currency rising by 11% within a month. This round of sentiment has almost been digested by the market before the results are announced. Although the entire market is still immersed in the good news of Trump's election, the Fed's announcement of a rate cut did not arouse a strong reaction from the market on the same day, and the price of the currency fluctuated by only 2% within 24 hours after the announcement.

Since the beginning of December, CME's forecast of a 25 basis point rate cut has always been at a high probability, and various macroeconomic indicators have met or exceeded market expectations. The market determined the rate cut forecast time early and completed advance betting and pricing before the Fed officially announced the rate cut. After the Fed officially announced a 25 basis point rate cut on December 19, the market did not rise because it had digested the good news in advance. Instead, it fell sharply due to the Fed's decision to slow down the pace of rate cuts next year. Bitcoin fell by nearly 4% in 2 hours.

[uploading100%]

Figure 13: BTC price and Fed rate in 2024

Looking at the price changes in 2024, the price trend of the currency has been in a state of shock after the bull market subsided at the beginning of this year. Since the announcement of the interest rate cut in September, compared with the price trend from March to September, the price of the currency has begun to show a volatile upward trend. After the second interest rate cut was announced in November, excluding the short-term surge in the market caused by the news of Trump's election, the market's increase in November and December increased again compared with September to November. The first two interest rate cuts this year have had a significant boosting effect on the long-term coin price. Although the December interest rate cut brought a slight correction, in terms of the correlation between the coin price and the interest rate in 2024, the coin price will not fall below the current level in the next few months, and it is more likely to continue to rise with the reduction of interest rates and the favorable cryptocurrency policies implemented after Trump takes office next year.

3. The impact of the release of macroeconomic data on the cryptocurrency market

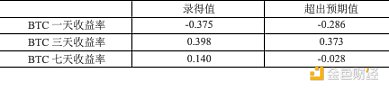

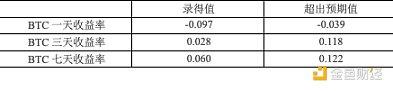

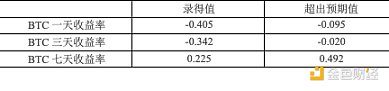

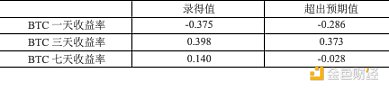

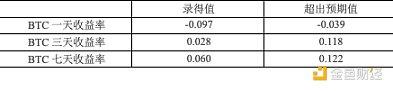

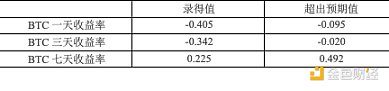

In addition to the Fed's 8 interest rate adjustments each year, the macroeconomic data released regularly by the United States can also reflect the economic situation under the current monetary policy. The market usually predicts monetary policy reforms or economic cycle changes based on these data, thereby affecting the coin price. Important macroeconomic data include changes in the seasonally adjusted non-farm payroll population in the United States, the number of initial unemployment claims, the annualized quarterly rate of real gross domestic product (GDP), and the monthly rate of the core consumer price index (CPI). The table below shows the correlation between the short-term returns of Bitcoin prices in 2024 and the recorded and exceeded values of each macro indicator on the day, three days, and seven days after these indicators were released.

Table 2: Changes in seasonally adjusted non-farm payrolls in the United States

Table 3: Initial jobless claims in the United States

Table 4: Annualized quarterly rate of real gross domestic product (GDP) in the United States

Table 5: Monthly rate of the core consumer price index (CPI) in the United States

Among the four indicators, the number of initial jobless claims in the United States has a low overall correlation with the BTC yield, and its reference value is relatively small.

The change in the seasonally adjusted non-agricultural employment population in the United States is positively correlated with the three-day and seven-day yields of Bitcoin. The increase in the number of employed people indicates a strong labor market, which promotes consumption and economic growth. In this case, the Federal Reserve may cut interest rates to stimulate investment and consumption. Market optimism and expectations of interest rate cuts will prompt investors to increase their holdings of Bitcoin, driving up the price of the currency.

The monthly rate of the US core consumer price index (CPI) is basically negatively correlated with the BTC yield in the short term. Since the CPI index represents the overall inflation level in the United States, high inflation may hinder or slow down the process of interest rate cuts, thereby reducing the market's expectations for future interest rate cuts. Some investors will choose to sell in advance, causing the price of the currency to fall.

The annualized quarterly rate of the US real gross domestic product (GDP) exceeding the expected value is strongly positively correlated with the BTC yield. This is because GDP is the most direct indicator to describe the country's overall economic level and development momentum. The excess of this indicator will bring a more obvious positive signal to the market, driving the market's optimism about the US economy, thereby driving up the price of the currency.

The December rate cut marks the end of the first phase of the Fed's rate cut cycle. After three consecutive rate cuts, CPI has rebounded to 0.3 since September. Although there is no sign of further rise for the time being, the market and the Fed are worried that continued rate cuts may further push up inflation. The non-farm data fell sharply in November and rebounded in December, reflecting the destabilizing impact of consecutive rate cuts on the labor market. At the December meeting, despite a 25 basis point rate cut, it was announced that the pace of rate cuts would be slowed in 2025, and the market predicts that there will be no more than two rate cuts next year. Currently, CME predicts that the probability of a rate cut in January is only 8.3%. In the next few months, the Fed is more likely to stop the pace of rate cuts and make a longer assessment based on the economic situation in the United States under the current interest rate, and decide whether to continue to cut interest rates after the Fed meeting at least three months later. If various economic indicators do not deviate significantly from expectations, US interest rates will no longer be a key factor affecting the cryptocurrency market in the first half of next year. The cryptocurrency policy implemented by Trump after taking office and classic macroeconomic indicators such as GDP will become key factors in determining currency prices.

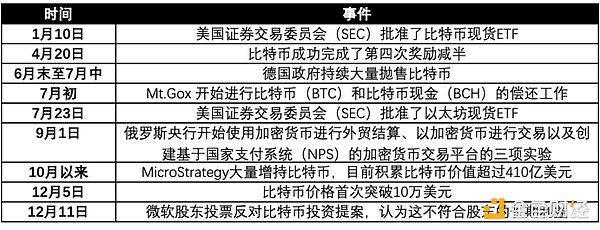

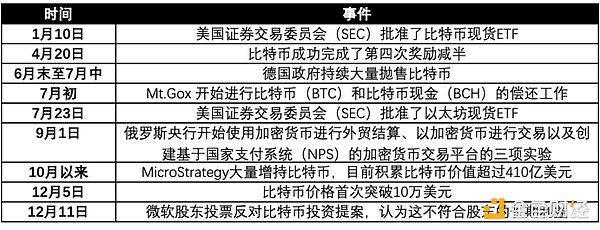

IV. Review of Important Events in 2024

Table 6: Important Events in the Cryptocurrency Circle in 2024

1. Review and Outlook since the Issuance of Bitcoin and Ethereum ETFs

ETFs (Exchange Traded Funds) are a popular investment tool in traditional financial markets, allowing investors to indirectly invest in assets without directly holding them. The launch of Bitcoin (BTC) ETFs and Ethereum (ETH) ETFs is a key step in the integration of the crypto industry with traditional financial markets.

(1)Event Overview

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin spot ETF. At the end of July 2024, the SEC approved the Ethereum spot ETF. This marks the formal acceptance of Bitcoin and Ethereum by the mainstream financial market, making investment in these two virtual currencies more convenient and formalized.

(2)Fund Review

This year, 670 ETFs were launched in the financial market. Ranked by assets under management (AUM), 9 of the top 10 are related to cryptocurrencies. This highlights the growing influence and integration of digital assets in the financial field, and reflects the widespread acceptance and interest of institutional and retail investors in cryptocurrencies.

Table 7: Top 11 financial market ETFs by asset management scale as of December 7, 2024

(3) Bitcoin ETF

After the Bitcoin spot ETF was approved in January this year, the scale of assets under management grew rapidly, reaching a peak of US$63.4 billion in the first half of the year in mid-March, and then fell back. In the second half of the year, the scale of assets under management of Bitcoin spot ETFs expanded twice in mid-November and late November. In early December, the inflow of Bitcoin spot ETFs surged, with IBIT leading the way, pushing the total scale to exceed US$100 billion. By December 18, the assets under management of the US spot Bitcoin ETF reached $129.3 billion, surpassing the 20-year-old gold ETF.

Figure 14: Total assets under management curve of gold ETF and Bitcoin spot ETF

(4) Ethereum ETF

From its launch in July to the end of October, the growth of the assets under management of the Ethereum ETF was not as good as that of the Bitcoin ETF, with daily net inflows and net outflows alternating. After November, the assets under management of the Ethereum ETF began to increase significantly. At the end of the year, Ethereum (ETH) once again became the focus of the market. On-chain data shows that giants such as BlackRock and Fidelity are accelerating their hoarding of Ethereum. Since November 21, the Ethereum ETF has maintained net inflows almost every day, with trading volume reaching a record high, attracting $1.29 billion in funds. The asset management scale (AUM) of BlackRock's ETHA fund has expanded to $3.55 billion, while the Fidelity ETH ETF has grown to $1.56 billion. This trend shows that the demand for Ethereum ETF investment is growing significantly at the end of the year. Especially as the price of ETH approaches $4,000 recently, the recovery of spot purchases and the surge in ETF inflows are forming a virtuous circle.

Currently, Grayscale is still the largest ETH holder, with its Ethereum Trust holding $5.56 billion worth of ETH. BlackRock knows that the number of ETH wallets on the chain exceeds 820,000, and the speed of capital inflow has significantly accelerated. This trend is very similar to the initial enthusiasm of the launch of ETH ETF in the summer of 2024. The active layout of these giants shows that they are preparing in advance for the bull market that may come in 2025, while attracting traditional investors to join this wave of market.

(5) Future Outlook

ETF combines virtual currency investment with traditional financial instruments, allowing investors with stock accounts to easily purchase Bitcoin and Ethereum. Compared with directly purchasing virtual currency coins, ETF trading is simpler and investors have higher trust. With the US interest rate cuts and Trump's promulgation of policies that are favorable to cryptocurrencies, Bitcoin may further increase its price, and the scale of Bitcoin ETF and Ethereum ETF will then further expand.

In addition, Ethereum's staking function adds a unique appeal to its ETF. ETH can generate passive income through staking, but most current ETF products only passively hold ETH due to asset liquidity requirements and do not involve staking. Some market views believe that ETF products that allow staking may appear in the future to achieve higher returns. However, staking involves a longer lock-up period and potential hacker or vulnerability risks. Even so, the scarcity of the Ethereum network due to staking, liquidity lock-in, and fee destruction mechanism (EIP-1559) may further drive ETH prices up. In anticipation of a bull market in 2025, the global economy will recover, and Ethereum, as the second largest crypto asset, may usher in a rapid catch-up in price. Compared with other currencies, the downturn in the altcoin market may further consolidate Ethereum's position as the preferred investment target besides Bitcoin.

As the ETF landscape continues to develop, the strong performance and popularity of cryptocurrency ETFs indicate that market dynamics may change. This trend may have an impact on the launch of future cryptocurrency ETFs and asset management companies' strategic investment in cryptocurrencies. The integration of digital assets with mainstream financial products may shape a new investment landscape. It is worth noting that since the price of Bitcoin ETF directly reflects the market performance of Bitcoin, it is highly volatile and investors need to have a certain risk tolerance. Moreover, most Bitcoin ETFs do not distribute dividends, so they cannot provide investors with a stable cash flow, which is different from traditional high-dividend ETFs.

2. The current situation and trend of BTC adoption by national institutions or listed companies

(1) National-level adoption

i. Percentage of legal countries

Currently, about 120 countries and 4 British overseas territories have legalized cryptocurrencies, accounting for more than 50% of the global total. 64.7% of the countries that have legalized cryptocurrencies are from many emerging and developing countries in Asia and Africa. Among these countries where cryptocurrencies are legal, about 52.1% of the countries (i.e. 62 countries) have introduced comprehensive cryptocurrency regulations. This figure has increased by 53.2% since 2018, reflecting the gradual deepening of legal awareness and acceptance of cryptocurrencies around the world. In particular, the acceptance and frequency of use of cryptocurrencies in emerging markets have continued to increase.

ii. Attitude of major powers

In the second half of this year, under the influence of international geopolitics, Russia officially legalized Bitcoin and passed a series of related bills, turning to digital assets such as Bitcoin in a high-profile manner. From September 1 this year, the Central Bank of Russia conducted three experiments on using cryptocurrencies for foreign trade settlement, trading in cryptocurrencies, and creating a cryptocurrency trading platform based on the National Payment System (NPS); Russian President Putin hinted at turning to holding alternative assets including cryptocurrencies as foreign exchange reserves. Similar to Russia, the United States has also undergone significant changes in its cryptocurrency policy. Trump's inauguration has been good for the cryptocurrency market, and the United States has ushered in an era of relaxed regulation of cryptocurrencies and digital assets. Trump hinted at plans to establish a US Bitcoin strategic reserve similar to the strategic oil reserve. At present, some states in the United States (such as Pennsylvania and Texas) have launched Bitcoin reserve bills, showing the positive attitude of local governments towards the adoption of Bitcoin.

(2) Institutional adoption

i. US listed companies actively deploy

Companies represented by MicroStrategy continue to expand their Bitcoin reserves and significantly increase their market value with the "Bitcoin strategy"; many US listed companies including Genius Group, Cosmos Health, and Semler Scientific have officially announced Bitcoin reserve plans, reinforcing the importance of Bitcoin as a corporate asset reserve. Many US companies, including those in the technology, pharmaceutical, consumer goods and other industries, have incorporated Bitcoin into their financial management strategies as a reserve tool to resist inflation and diversify risks.

It is worth noting that Microsoft, a technology giant with the second largest market value in the US stock market, is not considering allocating Bitcoin at present. Microsoft shareholders rejected the proposal to hold Bitcoin again in December this year, saying that the current strategy has evaluated Bitcoin-related assets, and its high volatility conflicts with the company's demand for stable investment and is not in the long-term interests of shareholders. However, this vote still sent a strong signal to the crypto market. Microsoft's statement showed that they did not completely rule out cryptocurrencies as a potential investment option in the future, but regarded them as an area that needs to be continuously monitored, which increased the expectation of future crypto adoption.

ii. Financial institutions accelerate entry

Traditional financial investors and hedge fund managers gradually increase their holdings of financial instruments linked to Bitcoin, further promoting Bitcoin's penetration into the mainstream financial market. For example, Tudor Investment Group holds BlackRock's iShares as the third largest non-option position in its portfolio, second only to the S&P 500 Index ETF Trust and Nvidia. At the same time, the approval of Bitcoin ETFs in the United States and Hong Kong this year has provided a compliant channel for institutional investment, driving the continuous improvement of Bitcoin's acceptance in the global market.

3. Bitcoin breaks through the $100,000 mark

(1) Event Overview

On December 5, 2024, the price of Bitcoin (BTC) broke through $100,000 for the first time, becoming a milestone event in the global financial market and the cryptocurrency industry. Since the birth of Bitcoin in 2009, this decentralized digital currency has gradually grown from a technical experiment to a mainstream choice for global investment, payment, value storage and safe-haven assets. Bitcoin's breakthrough of $100,000 marks a new stage in the global recognition of its asset status, and has also attracted widespread attention from the financial market, the crypto industry and all sectors of society.

(2) Key driving factors

The Bitcoin price breaking through $100,000 is the result of a combination of factors, including the macroeconomic environment and policy expectations brought about by the US presidential election:

i. Bitcoin halving effect

On April 20, 2024, Bitcoin ushered in the fourth block reward halving, reducing the miner reward from 6.25 BTC to 3.125 BTC. This mechanism reduces the supply of new Bitcoins and can significantly improve the supply and demand relationship. Historical data shows that after each halving event, the Bitcoin market usually experiences a sharp rise in prices.

ii. Approval of Bitcoin Spot ETF

In 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot ETF applications submitted by several financial institutions (such as BlackRock, Fidelity, etc.). This event greatly enhanced the institutional investment attractiveness of Bitcoin, provided traditional investors with a convenient and safe investment channel, and attracted a large amount of capital inflow. ETFs have brought transparency and liquidity to the Bitcoin market, further driving up prices.

iii. Trump was elected as the new president of the United States

In the 2024 U.S. presidential election, Trump was successfully elected as the new president. His skeptical attitude towards the traditional financial system and support for decentralized technology have brought favorable policy expectations to the cryptocurrency industry.

iv. Fed rate cut policy

In 2024, the US economy responded to inflationary pressures and slowing economic growth by adopting a rate cut policy in multiple meetings. This policy significantly reduced the risk-free rate of return, prompting funds to flow from low-yield assets such as bonds to high-risk, high-return assets such as cryptocurrencies such as Bitcoin.

v. Uncertainty in the macroeconomic environment

The global economic environment in 2024 is full of uncertainty, including geopolitical conflicts, the depreciation of the US dollar, and high inflation in some countries, which further enhances the attractiveness of Bitcoin as digital gold and a safe-haven asset. Especially in developing countries, Bitcoin is increasingly seen as a store of value alternative to fiat currencies.

vi. Technological upgrade and network effect

Bitcoin’s technological development, such as the widespread application of the Lightning Network, has reduced transaction costs, increased payment speed, and enhanced Bitcoin’s practicality. In addition, its decentralization, security, and limited supply of 21 million coins further consolidate its scarcity and value storage function.

(3) Impact analysis

i. Impact on the global financial system

Cryptocurrency is further integrated into the mainstream financial market. Bitcoin has exceeded $100,000, with a market value of more than $2 trillion, which is closer to the market value of traditional assets such as gold and stocks. Financial institutions regard Bitcoin as a "must-have" for asset allocation, and more global banks and asset management companies provide Bitcoin-related services. The popularity of spot ETFs has driven traditional investors to enter the crypto market in large numbers, and cryptocurrencies have gradually become part of mainstream investment portfolios. The rise of Bitcoin has created significant competitive pressure on traditional safe-haven assets such as gold. Some funds have flowed from the gold market to the Bitcoin market, especially the younger generation of investors prefer Bitcoin. The Fed's interest rate cut policy has directly reduced the attractiveness of the US dollar, and Bitcoin, as an anti-inflation tool, has become an important choice for investors to hedge against the depreciation of fiat currencies. The pattern of capital flows will change. The high price of Bitcoin has attracted a large amount of international capital inflows, especially from emerging markets and institutional investors. High-net-worth individuals and companies regard Bitcoin as an important tool for cross-border capital transfer, further promoting the globalization of funds.

ii. Impact on the cryptocurrency industry

Industry confidence has increased. The price of Bitcoin breaking through $100,000 has greatly boosted the confidence of the entire crypto industry, attracting more developers and companies to participate in the application and innovation of blockchain technology. Other cryptocurrencies (such as Ethereum and Solana) have achieved positive spillover effects, promoting the development of decentralized finance (DeFi), NFT and Web3 ecology. The popularity of Layer 2 solutions (such as the Lightning Network) has accelerated the development of the Bitcoin payment ecosystem, and the functional boundaries with smart contract platforms such as Ethereum have gradually blurred. In terms of the expansion of the decentralized ecosystem, more countries and companies have incorporated Bitcoin into the payment and value storage systems, promoting the further development of the decentralized financial system.

iii. Impact on asset recognition

The consensus on Bitcoin becoming "digital gold" has increased. Bitcoin's breakthrough of $100,000 further verifies its value storage function, and global investors' recognition of it as "digital gold" has significantly increased. It has become an important asset allocation tool in countries and regions with high inflation. Legal status and mainstream acceptance will be enhanced. The Trump administration's policies may prompt more US states and institutions to accept Bitcoin payments, promoting Bitcoin's transformation from a "speculative asset" to a "value storage asset and payment tool." Some countries in Africa, the Middle East, and Latin America may include Bitcoin in legal tender or legal means of payment. In terms of public awareness, the continued rise in Bitcoin prices has attracted more public attention, promoting its transformation from a speculative tool to a mainstream asset. Education and technology popularization are accelerating, especially in emerging markets, where Bitcoin may become an important tool for financial education and inclusion.

iv. Impact on other fields

For macroeconomics and geopolitics, the rise of Bitcoin poses a challenge to the sovereign currency system. In particular, Bitcoin may be seen as an alternative currency in economically unstable countries. The Trump administration may use Bitcoin as a tool to counter other countries' central bank digital currencies (CBDCs) and further promote their globalization. In terms of environment and energy, the rise in Bitcoin prices may trigger more mining activities, which will put pressure on energy consumption and environmental issues. At the same time, clean energy mining projects may emerge to alleviate environmental problems. Regarding technology and innovation, the success of Bitcoin may further promote the research and development and application of blockchain technology, especially in the fields of financial technology, logistics, and medical care.

(4) Future Outlook

After Bitcoin breaks through $100,000, short-term market volatility will increase. After breaking through $100,000, profit-taking may lead to short-term price fluctuations. In addition, the high price of Bitcoin may trigger further strengthening of supervision by various countries. In the long term, the price of Bitcoin may rise further. If institutional adoption and global acceptance continue to increase, Bitcoin could reach $150,000 to $200,000 in the next few years.

Bitcoin’s breakthrough of $100,000 is a major milestone for the crypto industry, marking a new stage in the global recognition of this decentralized asset. This event was driven by multiple factors such as the macro economy, the Fed’s interest rate cut policy, Trump’s election, and technological upgrades. Its impact is not limited to the financial market, but also affects multiple fields such as the crypto industry, asset recognition, macroeconomics, and technological innovation. Although there may be challenges in the future due to regulation and market volatility, Bitcoin’s scarcity, decentralization, and anti-inflation properties give it great potential for future development.

V. Summary and Outlook

1. Market Summary in 2024

In 2024, the overall crypto market experienced a strong rise and adjustment. This year, the crypto market showed some key trends and characteristics that were different from previous cycles:

(1) Strong rise driven by regulation, monetary policy and political influence

The legalization and compliance of spot BTC ETFs and the positive news of the election dust settling became the biggest catalyst for the market in 2024. Combined with the liquidity brought by the Fed's shift to monetary easing in the third quarter, the price of Bitcoin hit new highs in the first and third quarters. The shift in US policy is the most important influencing factor throughout the year.

(2) Institutional funds enter the market faster, and the proportion of ETFs increases

The launch of ETFs has attracted widespread participation from institutional investors. Asset management companies and mainstream funds have significantly increased their allocation of crypto assets. The proportion of institutional wallet addresses has continued to increase. The total net asset value of ETFs and the total market value of BTC/ETH have risen to 5.76% and 2.94% respectively.

(3) Track differentiation, new narratives emerge

Assets related to Bitcoin and Ethereum have received the most attention from funds, while the DeFi and NFT tracks that performed well in the past cycle are facing growth bottlenecks and have performed mediocrely in this cycle. More capital has flowed to the Meme and AI sectors with hot narratives. At the same time, real asset tokenization (RWA) and stablecoins are also on the rise.

2. Outlook for 2025

Looking back at the historical cycle and looking forward to next year, the market in 2025 may present the following phased development path:

(1) The first stage: shock consolidation (December 2024-January 2025)

The market will experience a short-term shock correction from the end of 2024 to the beginning of 2025. Part of the high-level profit-taking funds at the end of the year will be cashed out. In addition, the market needs time to digest the Fed’s possible hawkish turn and policy expectations of reducing the number of interest rate cuts at the beginning of next year. In the short term, there is a lack of new driving force, and prices may fluctuate between US$90,000 and US$105,000.

(2) The second stage: accelerated rise (January 2025 - June 2025)

After the consolidation stage ends, funds re-enter the market, and the negative news is gradually digested, the market will usher in a new round of rise in the first quarter of the first half of the year. The price of Bitcoin may break through the $120,000 mark in this stage, and even reach $150,000 to $200,000 in an optimistic scenario.

(3) The third stage: peak adjustment (July 2025 - December 2025)

Looking at the historical cycle, the Bitcoin bull market usually enters the adjustment period about 15 to 18 months after the halving, which also means that the market is likely to enter the adjustment stage after hitting a new high in the middle or second half of the year.

Optimistic Path

The favorable macro liquidity environment continues, favorable policies such as supervision are fulfilled and implemented as scheduled, and the national-level Bitcoin reserves and institutional adoption rates continue to rise. The market buying demand continues, which continuously pushes up the spot price. It forms a top between 200,000 and 250,000 US dollars and then falls back to 110,000 to 150,000 US dollars.

Neutral Path

The favorable policies are gradually implemented, but the global macroeconomic environment is still uncertain. Liquidity will not be tightened, but the overall risk assets may be under pressure, and exit behavior will gradually occur. After the Bitcoin price hit a new high of 150,000 to 200,000, it may fall back to 100,000 to 120,000 US dollars and fluctuate.

Pessimistic Path

If the policy benefits are not as good as expected, the monetary policy path turns to tightening, or the macroeconomic environment deteriorates, the market may undergo a large adjustment in the second half of 2025. In the pessimistic case, the spread of fear after the market bubble bursts may cause the market to fall rapidly in the short term, and the price of Bitcoin may fall back to the range of 80,000 to 100,000 US dollars.

Conclusion

The crypto market in 2025 will be dominated by the following key drivers:

Regulatory policy implementation: The legalization and institutionalization process of the crypto market will continue to deepen, especially against the backdrop of gradually clarified US policies.

Macroeconomics and interest rate policy: Monetary policy will remain relatively loose, providing liquidity support for risky assets, while the weakness of the US dollar index may attract more safe-haven funds to flow into Bitcoin.

Institutional adoption: The compliance of ETFs and stablecoins will attract more traditional financial capital to enter the crypto market. At the same time, attention can be paid to new narratives and the new growth points that may be brought about by the linkage between on-chain assets and traditional finance.

New narratives ignite the cottage season and key tracks: The trend of the cryptocurrency market in the fourth quarter of 2024 shows that Bitcoin and Ethereum continue to dominate the market. In addition to Bitcoin, which has a clear upward trend, Ethereum's future technological upgrades, the increasing application demand in the DeFi and NFT fields, and the expansion of the ecosystem may usher in new growth.

BTC breaking through the 100,000 mark indicates that the crypto market has officially entered a new era, and the environment at the macro, meso and micro market levels has changed. Although the BTC market may face short-term adjustments in 2025, the medium- and long-term trend of the market is still positive, and the bull market will continue in the first half of the year. However, after the middle of the year and the third quarter, it is necessary to be vigilant about the risk of peaking and callback, and grasp the opportunity to exit. From the perspective of cyclical characteristics, with the continuous entry of institutional funds in this cycle and the continuous standardization of future supervision, the overall market cycle may be lengthened in terms of time, but at the same time, the shocking fluctuations brought about by previous cycles will also be partially smoothed

Miyuki

Miyuki