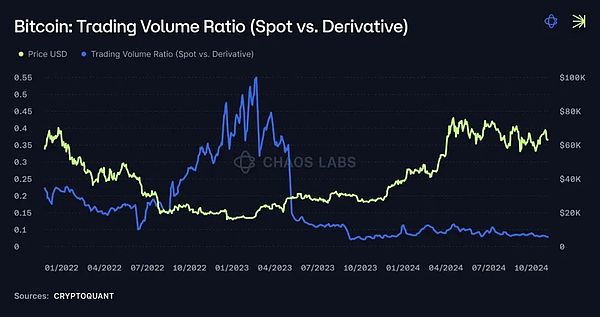

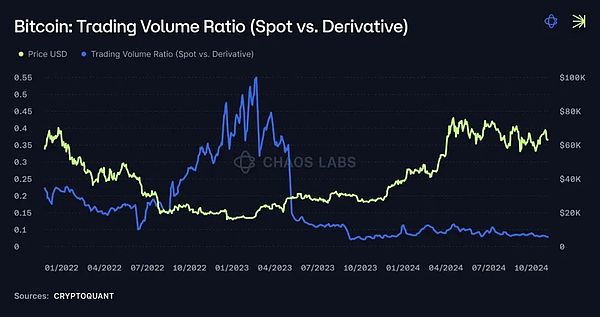

Whether in traditional finance or crypto, the scale of the derivatives market is far greater than the spot market, usually several times larger than the latter. For example, as of today, Bitcoin's daily spot trading volume is about $4 billion, while its derivatives trading volume is as high as $53.89 billion (Cryptoquant.com data).

Bitcoin: Volume Ratio (Spot vs Derivatives) - Data Source: CryptoQuant

This trend has accelerated since the beginning of 2021 and is still continuing. In traditional finance, derivatives markets have long outpaced spot markets, with derivatives on centralized cryptocurrency exchanges (CEX) not far behind. However, in the decentralized finance (DeFi) space, derivatives have yet to surpass the spot markets on decentralized exchanges (DEX). For example, in the past 24 hours, Uniswap v3 facilitated $1.3 billion in spot trades, while Hyperliquid processed about $1 billion in derivatives trades (Coingecko data).

Nevertheless, the gap is narrowing. It is foreseeable that as the ecosystem matures, on-chain derivatives are likely to surpass spot markets, just as they have happened in other mature markets. While demand is moving towards derivatives, this growth must be supported by secure and efficient trading venues and models.

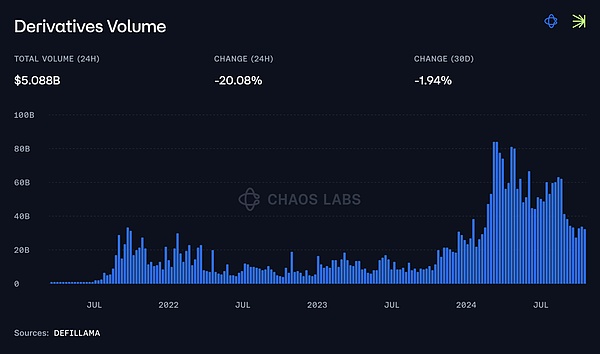

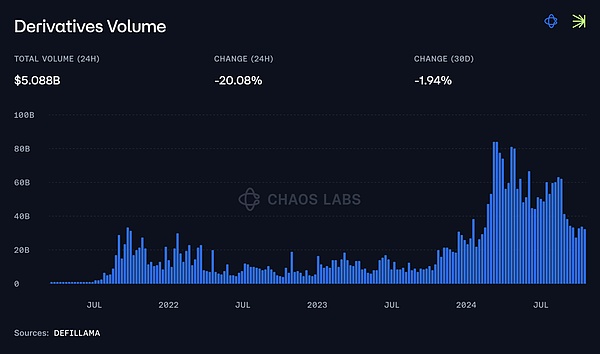

Derivatives Trading Volume - Data Source: DefiLlama

Understanding the various models that support the derivatives market is critical to building the infrastructure needed to support this shift. In this article, we will discuss hard liquidity backed models and synthetic asset models.

Hard Liquidity Backed Models

In a hard asset backed model, traders interact with "real" assets (such as tokens or stablecoins) deposited in a liquidity pool. These assets are actually loaned to traders to establish margin trading positions.

GMX, Jupiter, Gearbox PURE and Contango all use this approach. Liquidity providers (LPs) who deposit hard assets are rewarded through trading fees and/or as counterparties to traders. Therefore, LPs' returns depend on the performance of the assets in the pool, the utilization of the pool (if there is no mechanism in the pool to maintain a balance between long and short positions, LPs' returns also depend on the profit and loss of traders).

Advantages

1. Lower risk of bankruptcy: Since transactions are backed by real assets, the risk of system bankruptcy is lower.

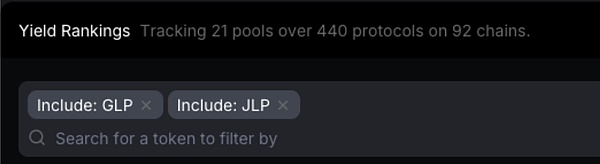

2. Composability in the DeFi ecosystem: For example, the models of GMX and Jupiter support rehypothecation of liquidity pool tokens: $GLP and $JLP tokens can be used as collateral or staked in other DeFi applications, thereby improving capital efficiency.

3. Lower trading and market making incentive requirements: Since LPs act as counterparties and/or market makers, the importance of direct incentives is reduced. Although LPs are usually also rewarded through token incentives in the early stages, in the long run, the return for providing liquidity comes mainly from trading fees, which eliminates the difficulty of developing a balanced trading incentive plan.

4. Deepening market liquidity: The real asset-backed model helps deepen market liquidity by requiring real asset support to create a liquidity basket. In recent years, this has also made protocols like GMX one of the most efficient places to exchange spot assets, with liquidity concentrated in a liquidity pool that can serve both derivatives and spot markets, significantly increasing trading depth and market efficiency.

DefiLlama screenshot showing the number of pools and protocols containing GLP and JLP benefits

The physical asset backing model is implemented differently in different protocols, mainly based on the differences in mainly based on the accessibility and sharing of liquidity, and can be divided into two main sub-models:

GMX v1 & Jupiter: These protocols use global shared liquidity pools, that is, all assets are pooled together. This model ensures deep liquidity and enhances composability by allowing LPs to use their single token across DeFi protocols.

GMX v2 & GearboxPURE: Introduced isolated liquidity pools with a modular architecture, where each asset or market has its own dedicated liquidity. This reduces the systemic risk of the protocol, allowing it to support a longer tail, higher risk assets. The risk (and return) of each asset is isolated, preventing a single asset from affecting the liquidity of the entire protocol, and providing different risk/return combinations, attracting LPs with different risk preferences.

In this "real asset-backed" model, we can also include protocols like Contango. While not a standalone model, Contango operates on top of existing lending protocols such as Aave, enabling a decentralized leveraged trading experience by borrowing real assets and leveraging flash loans.

Synthetic Asset Models

Unlike physical asset-backed models, which prioritize security and composability by requiring real assets as collateral for trades, synthetic asset models take another approach.

In synthetic asset models, trades are typically not backed by real assets; instead, these systems rely on order book matching, liquidity vaults, and price oracles to create and manage positions.

Synthetic asset models are not one size fits all — their designs vary, from models that rely more on peer-to-peer order book matching (with liquidity provided by active market makers, which can be professional market makers or algorithmic vaults, which are pools of liquidity automatically managed by algorithms, which can be globally shared or market-segregated) to models that operate in a purely synthetic manner (where the protocol itself acts as the counterparty).

What is a liquidity vault?

In synthetic derivatives models, a liquidity vault is a mechanism for pooling liquidity as a source of funding to facilitate trading, either by directly backing synthetic positions or acting as a market maker. While the structure of a liquidity vault may vary slightly from protocol to protocol, it is generally used to provide liquidity for trading.

These liquidity vaults are typically either managed by professional market makers (such as the Bluefin stablecoin pool) or managed by algorithms (such as Hyperliquid, dYdX unlimited, Elixir pools). In some other models, they are purely passive counterparty pools (such as Gains Trade). Typically these pools are open to the public, who can provide liquidity in exchange for rewards generated by participating in platform activities.

Liquidity vaults can also be shared globally between listed markets, like Hyperliquid, or partially segregated, like dYdX unlimited, SynFutures, and Bluefin, with similar risks and rewards as mentioned previously.

Some protocols, like Bluefin, adopt a hybrid model of these mechanisms, with both a global liquidity vault managed by market makers and segregated algorithmic pools.

In synthetic asset models, liquidity is usually provided by a combination of active users (P2P matching), liquidity vaults (as a backup), and market makers (placing orders on the order book). As mentioned earlier, in some pure synthetic asset models, such as Gains Network, the liquidity vault itself acts as the counterparty to all trades, eliminating the need for direct order matching.

Advantages

The trade-offs of synthetic asset models are different from those of real asset-backed models, but it also brings a series of advantages:

1. Capital Efficiency: Synthetic asset models are highly capital efficient because they do not require direct 1:1 backing from real assets. The system can operate with fewer assets as long as there is enough liquidity to cover the possible outcomes of active trading.

2. Asset Flexibility: These systems are more flexible in terms of tradable assets because positions are synthetic. Not requiring direct liquidity backing for every asset allows for more diverse trading pairs and faster — even semi-permissionless — listing of new assets. This is particularly evident in Hyperliquid’s pre-listing market, where the assets traded do not even exist yet.

3. Better price execution: Because trading is purely synthetic, it is possible to achieve better price execution, especially when market makers are active on the order book.

Disadvantages

However, these models also have significant disadvantages:

1. Dependence on Oracles: Synthetic asset models are highly dependent on price oracles, making them more susceptible to related issues such as oracle manipulation or delays.

2. No contribution to liquidity: Unlike physical asset-backed models, synthetic asset trading does not contribute to the global spot liquidity of the asset, as liquidity is only provided to the derivatives order book.

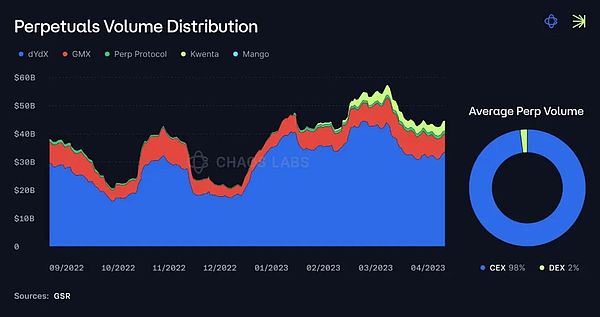

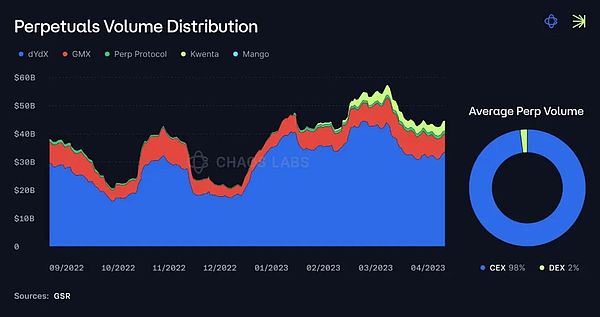

While decentralized exchanges still only account for a small portion of the overall perpetual contract trading volume compared to centralized exchanges (about 2% of the market share), the diversity of available models lays the foundation for real growth in the future. The combination of these models, coupled with the continuous improvement of capital efficiency and risk management, will be the key to helping decentralized exchanges gain a larger share of derivatives.

Perpetual contract trading volume distribution - data source: GSR annual report

In summary, as the DeFi ecosystem continues to develop, the real asset-backed model and the synthetic asset model provide different paths for the growth of the decentralized derivatives market. Both have their own advantages. The real asset-backed model focuses on security and capital efficiency, while the synthetic asset model provides higher flexibility and potential capital efficiency. In the future, the success of the derivatives market will rely on the effective combination and continuous optimization of these two models to meet the ever-changing needs and challenges.

Miyuki

Miyuki