Written by: James Hunt Compiled by: Vernacular Blockchain

With the Federal Reserve's expected rate cut approaching, which may be 25 or 50 basis points on Wednesday, decentralized finance (DeFi) yields are expected to pick up, according to analysts at research and brokerage firm Bernstein.

"With the interest rate cut approaching, DeFi yields appear attractive again. This could be a catalyst to restart the crypto credit market and reignite interest in DeFi and Ethereum," Gautam Chhugani, Mahika Sapra and Sanskar Chindalia wrote in a client report on Monday.

DeFi enables global participants to earn returns on stablecoins such as USDC and USDT by providing liquidity to decentralized lending markets, among other means.

Although the DeFi summer craze in 2020 is a distant memory, and the high returns generated by additional application token incentives at that time are long gone, Aave, the largest lending market on Ethereum, still offers 3.7% to 3.9% stablecoin lending returns.

1. DeFi is rising again

Analysts point out that as the interest rate cycle turns to easing, a new round of encryption cycle is accumulating, and the encryption lending market is recovering again.

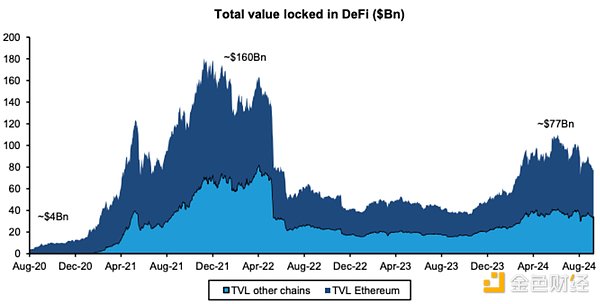

Although the total value locked in DeFi is still only half of the peak in 2021, it has doubled to US$77 billion from the low point in 2022, and the number of monthly DeFi users has increased three to four times since the low point.

Total locked value in DeFi. Image source: Bernstein.

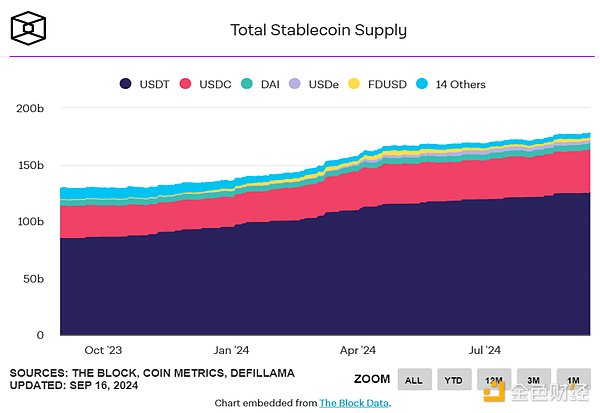

The stablecoin market capitalization also rebounded to a high of about $178 billion, according to The Block's data dashboard, and the number of monthly active wallets stabilized at about 30 million, Chhugani, Sapra and Chindalia said. They added that these "are all signs of a recovery in the crypto DeFi market, and the market is expected to accelerate further as interest rates fall."

If credit demand from crypto traders increases, stablecoin DeFi yields could exceed 5%, surpassing the returns of U.S. dollar money market funds. This would further revive the crypto credit market and drive digital asset prices higher, they said.

2. Bet on Aave and return to Ethereum

To reflect this trend, Bernstein added AaveToken to its digital asset portfolio as an alternative to derivatives protocols GMX and Synthetix. Analysts noted that Aave's total outstanding debt has tripled from its low in January 2023, and despite little or even a slight decline in Bitcoin prices, AaveToken has risen 23% in the past 30 days. The portfolio also includes BTC, ETH, OP, ARB, POL, LDO, SOL, UNI, LINK and RON.

According to TradingView data, Ethereum's performance relative to Bitcoin has been weak due to poor performance of spot ETF funds inflows, with the ratio falling 36% in the past 12 months and falling below the 0.04 mark for the first time since April 2021 over the weekend.

However, analysts said that the recovery of the DeFi lending market on Ethereum could attract large whales and institutional investors back to the crypto credit market, providing a turning point for Ethereum's sluggish performance relative to Bitcoin. "We think it may be time to refocus on DeFi and Ethereum," they added.

Gautam Chhugani holds long positions in multiple cryptocurrencies. In simple terms, he is bullish on the future performance of these cryptocurrencies and has invested in them in the hope that their prices will rise in the future.

Kikyo

Kikyo

Kikyo

Kikyo JinseFinance

JinseFinance Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph 链向资讯

链向资讯 链向资讯

链向资讯 Ftftx

Ftftx 链向资讯

链向资讯 Cointelegraph

Cointelegraph