Organization: Golden Finance, data source: Binance, Golden Finance

March 29, 2024, Golden Finance reported that Binance announced that Binance Launchpool will launch the 50th project Ethena (ENA). Users can invest BNB and FDUSD into the ENA mining pool for mining after 08:00 on March 30, Beijing time, for a period of 3 days. In addition, Binance will list Ethena (ENA) at 16:00 on April 2, Beijing time, and open ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD and ENA/TRY trading pairs.

It is not unexpected that Binance Launchpool will list Ethena (ENA). Back on February 19, when EthenLabs opened its synthetic USD stablecoin deposits to the public, Ethena (ENA) became a hot topic of discussion for almost everyone on CryptoTwitter.

In early March, BitMEX founder Arthur Hayes also posted a message praising Ethena (ENA): "I believe Ethena can surpass Tether and become the largest stable currency.". (See the Jinse Finance article "Arthur Hayes: Why Ethena will shock Tether") p>

1. Understanding Ethena (ENA)

Ethena (ENA) is a provider of services worth US$1.3 billion An open-ended hedge fund of USDe tokens, using liquidity to pledge ETH tokens as collateral, and shorting an equal amount of ETH to create a delta 0 portfolio. This configuration ensures that the net value of the assets held by Ethena (ENA) does not fluctuate. It fluctuates with changes in the underlying value of its assets, and at the same time can obtain income from ETH pledges and financing payments for its short positions.

To protect users' collateral, Ethena (ENA) utilizes an over-the-counter settlement (OES) solution to hold funds with a reputable third-party custodian. Only account balances are mapped to CEX to provide trading margin, ensuring funds are never deposited into centralized exchanges.

Since staked ETH can be perfectly hedged with a short position of equal nominal value, USDe can be minted at a 1:1 collateralization ratio, making Ethena (ENA) capital The efficiency is comparable to US dollar asset-backed stablecoins such as USDC and USDT, while also avoiding the reliance on obtaining assets from traditional financial markets, where asset issuers are subject to the regulations of the real world.

While the current model of Ethena (ENA) only uses staked ETH as collateral, the protocol may further use BTC as collateral to achieve larger scale , but doing so may dilute USDe’s earnings because BTC collateral does not generate staking earnings.

Project details

-

Token name:Ethena (ENA)

Maximum supply of tokens:15,000,000,000 ENA

Initial circulation:

strong>1,425,000,000 ENA (9.5% of maximum token supply)Total mining volume: 300,000,000 ENA (2% of maximum token supply)

Research Report:Ethena (ENA) (The research report will be online within one hour of the announcement)

Smart contract details: Ethereum< /p>

Restrictions:KYC required

Personal hourly mining hard cap

BNB mining pool: 333,333.33 ENA

FDUSD mining pool: 83,333.33 ENA

Mining pool

BNB Mining Pool:Total mining available 240,000,000 ENA (80%)

FDUSD Mining Pool: A total of 60,000,000 ENA can be mined ( Accounting for 20%)

Mining time: East Eighth District time March 30, 2024 08 :00 to 07:59 on April 2, 2024

Mining quota phase allocation

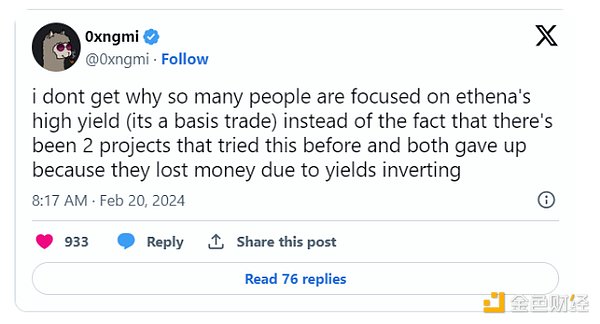

< img src="https://img.jinse.cn/7201194_watermarknone.png" title="7201194" alt="LH0RISF69VbgwQTgHyQVmWG7Dfpx3KVRaIWl9Snm.jpeg">

Note: The above table uses UTC time every day, which is converted into East Eighth District time from 08:00:00 am on that day to 07:59:59 am on the next day.

2. Ethena (ENA) operating mode

Ethena is a comprehensively backed fiat cryptocurrency USD.

Peg

USDe is a stablecoin issued by Ethena and aims to be pegged 1:1 with the U.S. dollar hook up.

Ethena joins various Authorized Participants (APs). AP can mint and burn USDe at a ratio of 1:1 USD.

Coining:

Currently, stETH Lido, Mantle mETH, Binance WBETH and ETH are accepted. Ethena then automatically sells the ETH/USD perpetual swap to lock in the USD value of ETH or ETH LSD. The protocol then mints an equivalent amount of USDe that matches the dollar value of the short’s permanent hedge.

Example:

AP deposits 1 stETH, value $10,000.

Ethena sells 10,000 ETH/USD per swap contract = 10,000 USD/1 USD contract value.

AP receives 10,000 USDe because Ethena sold 10,000 ETH/USD per swap contract.

Burning:

In order to destroy USDe, AP deposits USDe into Ethena. Ethena then automatically covers a portion of its short ETH/USD perpetual swap position, thereby unlocking a certain amount of USD value. The protocol will then destroy USDe and return an amount of ETH or ETH LSD based on the total USD value unlocked minus execution fees.

Example:

AP deposits 10,000 USDe.

Ethena buys back 10,000 ETH/USD per swap contract = 10,000 USD/1 USD contract value

AP receives 1 stETH = 10,000 * $1 / $10,000 stETH/USD minus execution fee

3.Advantages and risks of Ethena (ENA)

1. Advantages

(1) Scalability

Scalability is achieved by leveraging derivatives, which allows USDe to scale with capital efficiency. Since pledged ETH can be perfectly hedged by an equivalent short position, synthesizing USD only requires 1:1 collateral.

(2) Stability

After release Immediate execution of hedging on transferred assets provides stability, ensuring the synthetic dollar value behind USDe under all market conditions.

(3) Censorship Resistance

By converting supporting assets Resist censorship by decoupling from the banking system and storing trustless backing assets in decentralized liquidity venues outside of on-chain, transparent, 24/7 auditable, programmatic escrow account solutions.

2. Risk

(1) Collateral decoupling risk

The main risk with Ethena is a mix of LST collateral and regular Ethereum shorts. While this optimization of ETH basis trading helps the protocol maximize its ability to sustain returns, it increases risk!

If Ethena's LST collateral is decoupled from ETH, Ethena's ETH shorts will be unable to capture the fluctuations, causing the protocol to suffer paper losses.

While LST typically trades close to its peg, we have witnessed multiple decoupling scenarios for these tokens, such as the mid-2022 3AC (Three Arrows) During the black swan liquidation event of Capital), the price of Lido’s stETH was greatly discounted, approaching 8%!

The April 2023 Shapella upgrade enabled Ethereum staking withdrawals, which allowed the 3AC liquidation to create perhaps the most widespread decoupling we have seen in blue chip LST, but the fact remains that any future decoupling Both events will put pressure on Ethena’s margin requirements (the amount of funds that must be deployed to the exchange to maintain its hedging exposure and avoid its positions being liquidated).

Once the liquidation threshold is reached, Ethena will be forced to realize losses.

(2) Financing interest rate risk

Although from a Ethena’s gains may seem staggering at first, but it’s important to note that two previous protocols attempted to scale synthetic USD stablecoins, but both failed because of yield inversions.

To combat negative financing returns, Ethena uses pledged ETH as collateral. This strategy reduced the number of days USDe generated negative returns from 20.5% to 10.8% in the three-year data backtest.

While it is 100% certain that financing rates will invert at some point, the natural state of the crypto market is for futures contango trading to put upward pressure on financing rates. And provide a favorable environment for Ethena to conduct basis trading.

(3) Counterparty risk

Many unfamiliar Those who designed Ethena believed that deploying user collateral to centralized exchanges was a major risk, but using the aforementioned OES custodial account greatly mitigates this risk.

Although unsettled hedging profits against bankrupt exchanges may result in losses, Ethena conducts PnL (profit and loss) settlement at least daily to reduce the risk of trading the firm’s capital exposure.

If one of Ethena's exchanges goes bankrupt, the protocol may be forced to leverage positions on other exchanges, making its portfolio delta neutral, Until open positions are settled, the custodians of affected OES accounts can release funds.

In addition, if one of the custodians of Ethena's OES account goes bankrupt, access to funds may be delayed, requiring the use of leverage on other accounts to hedge investments combination.

(4) General encryption risks

With many early As is the case with crypto protocols, it is important to remember that depositors of Ethena are at risk of the protocol team defrauding users of their funds, as ownership of project keys is not yet decentralized.

While the vast majority of crypto projects face substantial hacking risks in terms of potential vulnerabilities in their smart contracts, Ethena uses OES escrow accounts by eliminating the use of complex intelligence The need for contract logic mitigates this risk.

4. Ethena (ENA)Valuation

1. $14 million

On February 16, Ethena Labs announced that it had completed a strategic round of financing of US$14 million at a valuation of US$300 million, with Dragonfly and BitMEX founder Arthur Hayes’ family office Maelstrom co-leading the investment.

2. 4.5 billion US dollars

L2 derivatives trading platform Aevo was once Social media points out that Ethena (ENA) could be valued at $4.5 billion.

3. US$200 billion

BitMEX founder Arthur Hayes believes that the valuation is more than that.

Arthur Hayes believes: It is expected that the long-term split will be that 80% of the revenue generated by the protocol will be attributed to the pledged USDe (sUSDe), while 20% of the generated revenue will be attributed to Enter the Ethena protocol.

Ethena protocol annual income = total income * (1–80% * (1 — sUSDe supply / USDe supply))

If 100% of USDe is pledged, that is, sUSDe supply = USDe supply:

Ethena protocol annual income = total income* 20%

Total yield = USDe supply * (ETH pledge yield + ETH Perp swap funds)

ETH pledge yield and ETH Perp Swap funds are both variable interest rates.

ETH staking yield - assuming PA yield is 4%.

ETH Perp Swap Funding - Assume PA is 20%.

The key part of the model is that a fully diluted valuation (FDV) of a revenue multiple should be used.

Using these multiples as a guide, the following potential Ethena FDV was created.

At the beginning of March, Ethena's $820 million in assets generated a 67% return. Assuming that the supply ratio of sUSDe to USDe is 50%, extrapolating one year later, Ethena’s annualized revenue will be approximately $300 million. Using an Ondo-like valuation results in an FDV of $189 billion. Does this mean Ethena's FDV will be close to $200 billion at launch?

5. Ethena (ENA) future airdrop plan

This Wednesday, Ethena (ENA) ) announced the airdrop plan and will officially airdrop tokens to users on April 2. Ethena (ENA) plans to airdrop 750 million ENA tokens, accounting for 5% of the total supply. The campaign to earn “shards,” which makes users eligible for token airdrops, ends on April 1. Those who unstake, unlock, or sell all USDe before this date will not be eligible for the airdrop.

Users will be able to claim tokens starting the next day, when ENA will be listed on centralized exchanges. After the airdrop ends, Ethena (ENA) will launch a campaign to provide new incentives for the next phase of the airdrop.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Catherine

Catherine Clement

Clement Others

Others 链向资讯

链向资讯 Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist