Source: Archetype; Compiled by: BitpushNews Yanan

One of the highlights of ETHDenver 2024 was observing the heated debate between participants from different camps on a topic.

In the debate, one camp has an aggressive and risk-taking attitude, predicting that the entire industry is about to usher in a super cycle. The other side is struggling to understand the current craze of market sentiment and looking for fundamental support.

In the short term, I think both sides may be right. Although the current high public/private market sentiment may have deviated from fundamentals, the crypto market still has the potential for significant and sustained gains.

But upon closer inspection, this cryptocurrency bull market may be different from the past.

Although previous bull markets stimulated user growth, this growth was more akin to the market fluctuation effect amplified by leverage rather than true market acceptance.

Today, the waves of liquidity that drove market volatility are about to give way to three major positive, permanent structural shifts:

1. Dramatic changes in the macro environment drive correlation between the global market and the encryption market

2 . Decentralized infrastructure & middleware is gradually approaching the level of Web2

3. Open source artificial intelligence based on blockchain

3. Blockchain-based open source artificial intelligence strong>

Macro environment and cryptocurrency mainnet

The recent boom in artificial intelligence and the economy The public and private market boom driven by a combination of optimism masks several long-term structural changes that are taking place. In fact, the current global landscape is evolving in a completely different direction than before the epidemic, showing the characteristics of fragmentation and cross-border competition.

These new developments will pose a major challenge to the existing mainstream forces, and at the same time provide a golden opportunity for the global application of cryptocurrency. Cryptocurrency’s first decade can be viewed as a remarkable testnet phase, marked by grassroots community development, feverish highs, and difficult lows. After more than a decade of development, cryptocurrencies are now poised to become the mainnet of a global interoperable network. In an era when economic exchanges and technological innovation are urgently needed, it will become a neutral platform to accommodate various economic activities and technological innovations.

Why?

For cryptocurrencies, these long-term structural changes come at the right time and are like a powerful wind in their favor.

The underlying architecture that has underpinned global trade over the past two decades is undergoing a real structural shift, accelerated further by the breakdown in international relations. process. In 2023, the pace of restructuring global supply chains and trade channels has accelerated significantly, and has become a core issue of concern for both businesses and governments.

The reshoring trend of enterprises and the differentiation of trade patterns

At the same time, more than half of the world’s population Countries and regions that account for nearly 60% of global gross domestic product (GDP) are about to usher in elections. With several major military conflicts taking place in real time, trade protectionism has become the main focus.

Also closely related to the encryption industry is the evolution of international competition. Competition between countries is no longer limited to traditional military means, but extends to finance, technology and other fields.

For example, the United States imposed international financial sanctions on Russia for sending troops to Ukraine. In turn, OPEC and Russia used energy resources to counterattack.

In addition, with the rise of technological nationalism, countries have adopted subsidies and sanctions to promote the development of their own semiconductors and other key industries.

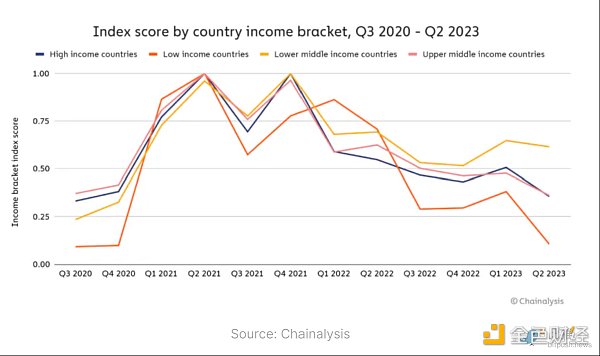

These factors have led to the fragmentation of global trade channels and intensified the formation of trade barriers. Profit margins in developed countries are under pressure, and low- and middle-income countries, where nearly 40% of the global population is located, face more severe survival challenges.

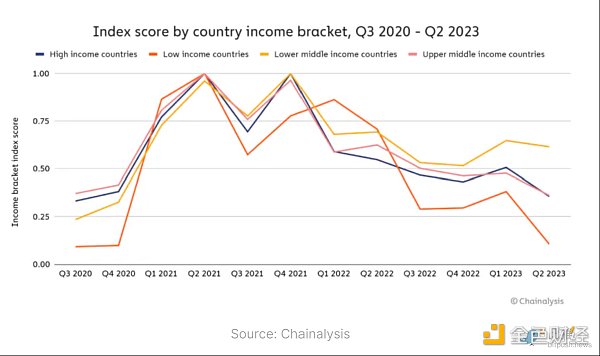

For individuals in low- and middle-income countries, cryptocurrency has become a weapon to solve daily economic problems, and the importance of this weapon has also increased. The systemic challenges faced by these countries have become increasingly prominent. Relevant data also supports this point: when geopolitical tensions intensify, the adoption rate of cryptocurrency at the grassroots level not only does not decline, but shows an accelerated growth trend.

Similarly, for private companies, the confluence of factors mentioned above significantly increases operating costs and limits their access to new consumer markets, all of which All occurred in an era when capital was no longer free.

Trade wars and tariff barriers over the past few years have had a negative impact on businesses and the domestic economy, and these negative impacts are likely to continue as businesses adapt to new trade realities. further intensified.

Therefore, companies and individuals need to make a decision quickly:

It is Struggling in an increasingly fragmented economy and market, or embracing a decentralized future built on permissionless markets based on modern technology?

This intersection reminds me of an interesting historical analogy:

In the 15th century, Constantinople fell to the Ottoman Empire, and new rulers took over the geographical hub that linked East-West trade along the "Silk Road." However, the Ottoman Empire subsequently took steps to restrict the overland trade routes that had flourished for centuries. This move forced European countries to turn to the sea to seek new trade routes, thus starting the "Age of Discovery" that shaped the modern world.

This time, the blockchain will become the gathering place of wealth and risk in the new world, waiting for those explorers who dare to set sail.

Cryptocurrency moves towards enterprise-level applications

In addition to the above Beyond the argument, we also need to focus on another important aspect: Cryptocurrencies have always been a testing ground for large companies to explore new technologies.

However, given the various factors described in this article, traditional companies’ exploration of cryptocurrency is moving from the research and development stage to the production application stage.

Companies will accelerate their exploration of digital assets and the pace of the on-chain ecosystem, viewing it as a key means to open up new markets. Blockchain application projects that were once regarded as showing off are now increasingly evolving into important missions related to the survival and development of enterprises.

Capital allocators will increase crypto-native deployment and participation to withstand the "beta" brought about by global risks and uncertainties "Exposure (Translator's Note: beta exposure, measures the risk of asset volatility relative to the broader market). In the old world, there will be few safe havens left to escape risks.

Systemic challenges in different regions (inflation, capital controls, cold/hot war, etc.) will further enhance the relevance of digital assets sex and needs. Permissionless blockchain infrastructure will emerge from grassroots communities and eventually go global.

Admittedly, economic and geopolitical challenges have been important factors driving users to embrace cryptocurrencies, especially in developing markets.

However, the scale and scope of the challenges that the world will need to address in the coming years will make it difficult for cryptocurrencies to become the "de facto standard" in free trade and culture. Provides a once-in-a-lifetime opportunity.

Institutional capital inflow

Achieve the above The key to the vision is to introduce institutions to participate in on-chain funding activities.

Approval of spotBitcoinETF marks an important turning point in the field, Ethereum seems to be facing a similar situation.

To date, Bitcoin ETFs have attracted more than US$7.5 billion in net inflows, of whichBlackRock Related products launched by Fidelity achieved the largest amount of funds raised by any ETF in the past 30 years in the first month.

This incredible momentum will ultimately enable large institutions to join the on-chain economy, joining more than 52 million Americans and others around the world. 500 million users working side by side.

Major changes at the macro level are like the spark that ignited the golden age of cryptocurrency, and the inflow of institutional funds will act as an accelerant.

Middleware and infrastructure upgrades drive growth

The external environment is favorable frequently So, are we ready for the opportunity?

Sponsored Business Content

I believe the answer is yes.

Following the 2022 crash that caused a large number of speculators to flee in panic, the crypto-native community conducted a deep introspection and examined the excesses and shortcomings that led to the formation of the bubble.

As capital and talent coalesce around the concept of "comprehensive system upgrades," tremendous progress is being made at all levels of the stack to prepare for the upcoming The foundation is laid for the coming large-scale application cycle.

The flow of private equity funds throughout the year also reflects this trend. At the beginning of the year, financial infrastructure accounted for the largest share of funding, followed by wallets, and the former dominated again at the end of the year, with L2/interoperability projects in second place.

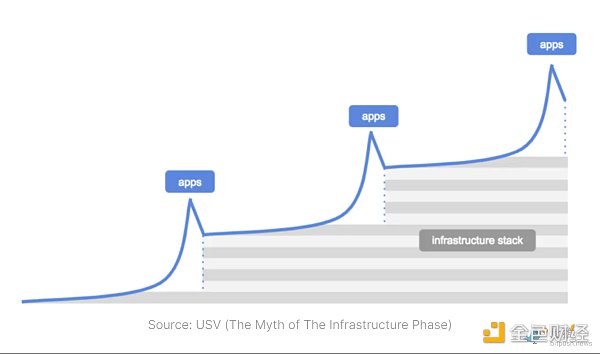

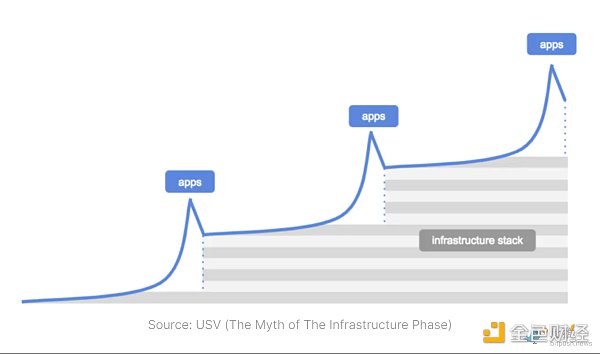

Amidst all this, what is particularly striking is the flywheel effect between infrastructure and applications (Translator's Note: The flywheel effect refers to the continuous A small amount of effort that adds up to big results) comes into play, and the intention is more focused than ever.

The growing needs of crypto natives are driving targeted and focused improvements to the technology stack, and these improvements are in turn spawning new use cases and application scenarios.

Excellent user interface/user experience helps popularize encryption

In the first quarter of 2023, the ERC-4337 standard was released, aiming to transform external ownership accounts (EOA) into smart contract wallets to achieve customizability, better private key recovery mechanism and a more simplified user experience.

More impactful, teams like Privy* simplify The user registration process not only minimizes user friction, but also allows developers to design more contextual experiences.

Privy helped Friend.Tech quickly acquire 100,000 addresses in just a few weeks. Achieved explosive early user growth. Since then, Privy has continued to work for OpenSea, Zora, Blackbird and other platforms provide support for user registration, and its services have covered more than 2 million users in more than 150 countries around the world in the past 13 months.

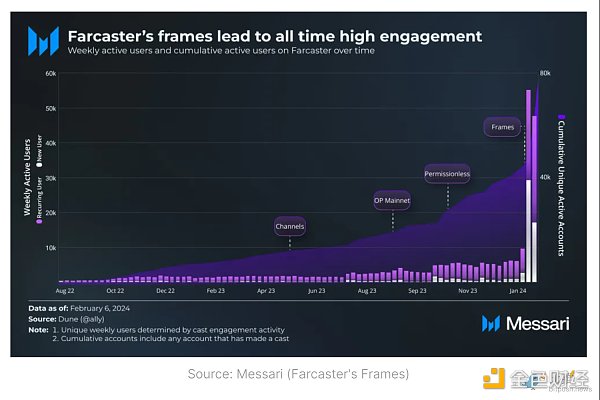

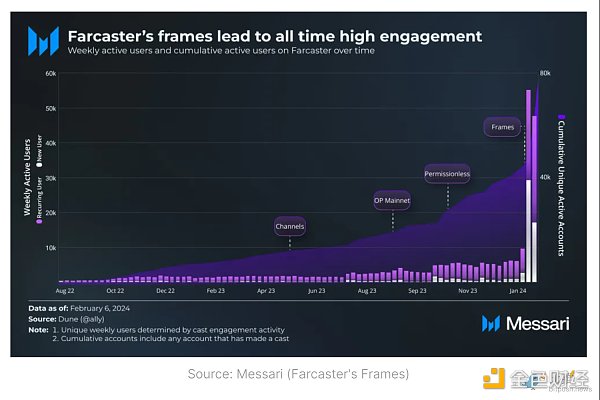

At the same time, Farcaster* launched the Frames function - a method that allows users to directly cast New primitives that embed interactive experiences in them are having a transformative impact and have greatly stimulated platform activity.

Farcaster has more than 4 million Casts and more than 8 million interactions, which may indicate that crypto-native consumer applications are approaching a critical mass and are ready to take off. .

The emerging design space under the modular wave is becoming bigger and better

Ethereum was originally designed to break through the limitations of Bitcoin. Now, a new generation of projects is targeting the architectural flaws of Ethereum itself, setting off a wave of modularization.

Alternative L1 and side chains have appeared in previous cycles, but none of them can shake the Ethereum main network in terms of users, total lock-up volume (TVL), and developers. and activity dominance.

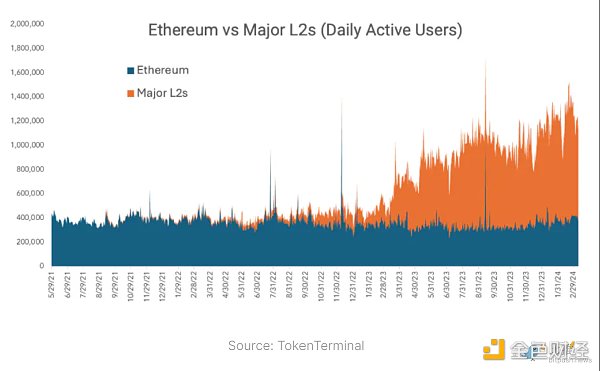

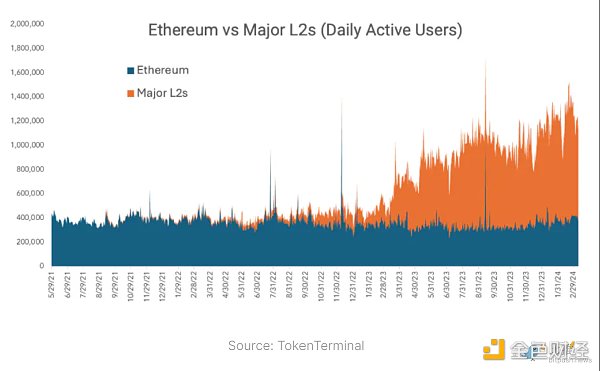

This situation is accompanied by Arbitrum and Optimism< /span> Waiting for the rise of Rollup to change. These projects achieve higher throughput and lower fees by offloading computing tasks off the Ethereum chain.

While these emerging L2s are already comparable in scale to, and in some cases even surpassing, Ethereum itself, blockchain Application developers are still exploring the possibility of further optimizing the L1 stack, and their ambitions are even more ambitious.

The reason is that although the number of daily active users on L2 has increased 8 times in the past year, most of the actions users actually perform are not the same as historically. L1 activities are not much different. As a result, there is a growing consensus in the industry that simply moving transactions to cheaper execution environments is not enough to enable a truly novel on-chain experience.

In fact, we need to rebuild the underlying blockchain from various aspects such as data availability (DA) to state access bottlenecks and parallel execution. Component architecture.

Independent data availability (DA) layers are being introduced to the market, with the goal of scaling to a level comparable to Web2 performance (such as EigenDA , Celestia, Avail). These DA layers will be used with upgraded VMs, some based on EVM and others using alternative engines such as Move (Move Labs*) or Solana VMs (Eclipse). Some of these projects are building L2 just for optimized execution (MegaETH), while others are launching entirely new L1 from scratch (Monad).

At the same time, EigenLayer provides a shared security layer through re-staking, allowing a new generation of projects to launch in a way that minimizes the need to launch native liquidity. Thereby reducing the need to deviate from the core security model of Ethereum itself.

All of this means that the underlying infrastructure, tools, and design options available to Web3 builders are maturing and performing at an unprecedented rate Near the top.

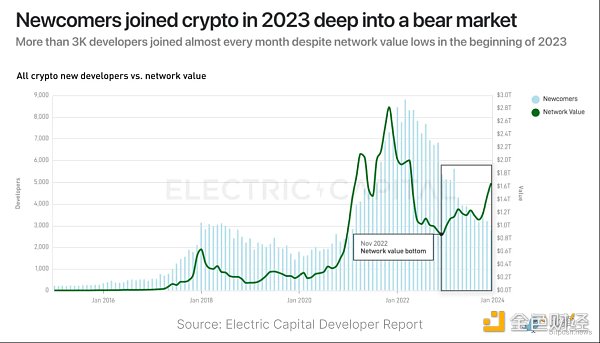

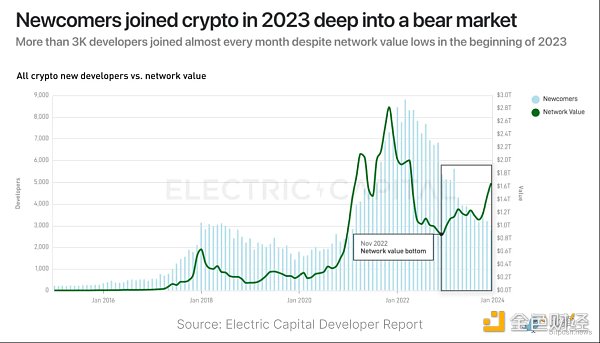

The values of cryptocurrency and the upgrade of infrastructure, tools and middleware promote each other, and also lead us to pay attention to a positive signal:Developers are moving into crypto.

Developing on the blockchain should not only be a more meaningful undertaking; An initiative with better technical performance, thus effectively empowering developers to design the future of the open Internet.

The high retention rate of existing developers and the influx of new developers, even in difficult market conditions, is a strong testament to the success of blockchain The industry's efforts to attract and develop developers are paying off.

Open source artificial intelligence and encryption track

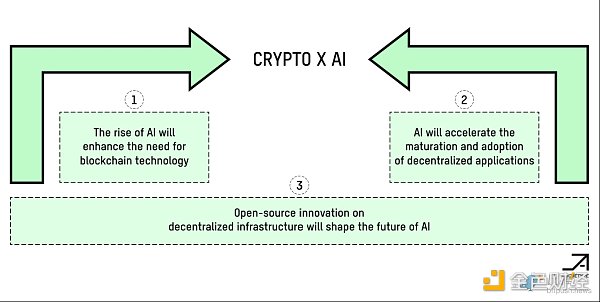

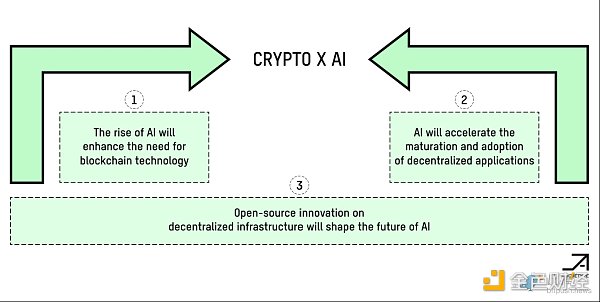

Finally, we firmly believe in cryptocurrency and artificial intelligence The convergence of these two technologies, which in their own right represents a paradigm shift, will be one of the most transformative moments in modern history.

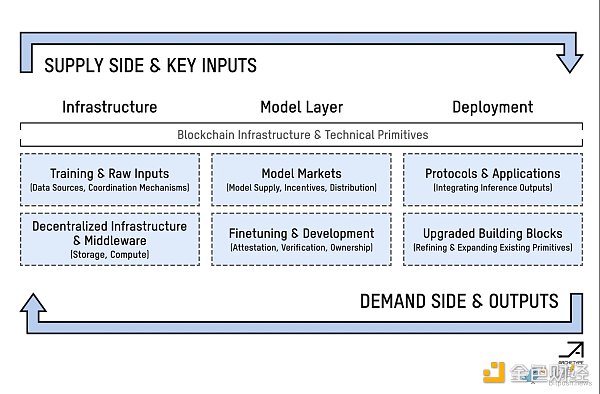

After years of stress testing, the blockchain track has successfully designed a permissionless system suitable for the digital age, especially the era of generative artificial intelligence. Cryptocurrency toolkits can solve a range of related problems, such as resource and liquidity coordination, asset ownership, data provenance, certification, and more. Crucially, the blockchain ecosystem and technology stack mature at the right time to meet the demands of the AI revolution.

While blockchain has a lot of potential to streamline existing machine learning (ML) processes, the most exciting opportunities will arise in cryptocurrencies and A field where artificial intelligence is integrated to achieve new results.

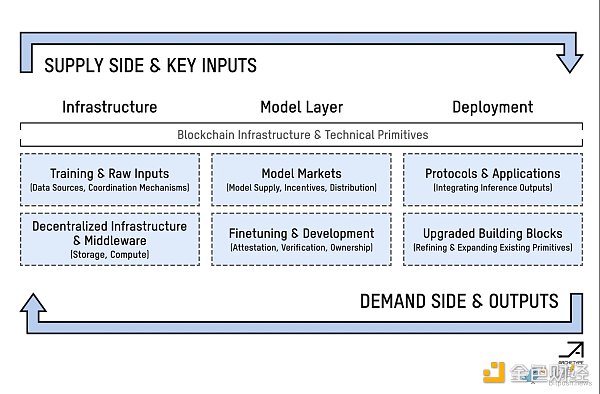

The most exciting new design spaces will cover the following areas:

Supports decentralized storage of shared, permissionless data repositories, better achieved through Retrieval Augmented Generation (RAG) technology training or a higher performing model.

Zero-knowledge proof is used for model or content verification, training or user data privacy protection, or to support edge computing and local (client )reasoning.

New information markets and better mechanisms to collect higher quality data - the basic model requires more professional data input capabilities continue to develop.

Autonomous agents conduct transactions through smart contracts, enabling them to accumulate resources, knowledge, and assets using machine-operated private keys.

As the encryption track affects everything from computing supply to data markets to the collective creation and monetization of powerful basic models, etc. In all fields, the performance of open source artificial intelligence/machine learning will be greatly improved by cryptocurrency, thereby promoting the development of human productivity and the creation of an open collaborative ecosystem in the next few years.

Cryptocurrency will become the best way for people to access the rise of artificial intelligence. Investors can either invest indirectly through blue-chip assets like ETH, hold directly or speculate through proxies, models, networks and datasets.

What’s next?

We are at an inflection point in the industry. After years of struggle and overcoming numerous obstacles from the market, existing forces and regulations, the situation has finally changed.

A series of important trends have gathered together to lead us towards a decentralized future - it can be said that the era of encryption has arrived. Infrastructure and middleware are reaching a peak of development, enabling on-chain experience to achieve step-by-step development, but we still need to pay attention to one thing.

In an ideal world, modularity not only enables professional division of labor, but also spreads control and failure points among multiple participants. However, each of these new frameworks involves different technical and security assumptions, incentives, token distribution roadmaps, VCs, foundation structures, and internal politics.

The efforts of the builders of the crypto space during the brutal economic recession of the past year have been admirable, and we should not ignore their contributions. However, as the industry picks up, some tokens will be packaged as "partnerships" with other projects in order to gain popularity, but in fact there is no real technology or business combination. In addition, some projects will create false prosperity through public relations means, such as paying trolls to post promotions, or encouraging users to participate through incentives, but these behaviors do not mean that the project has truly gained user recognition. Therefore, we need to be wary of industry information cocoons and false signal activities, not to be fooled by appearances, and to rationally judge the value of the project.

In the coming years, we collectively have a responsibility to the projects that will continue to emerge, requiring them to improve on technology design choices, token concentration, value distribution, philosophy and Maintain a responsible attitude in governance and other aspects.

This is the way for cryptocurrency to overcome obstacles and reach glory.

XingChi

XingChi