Author: Matt Crosby, Bitcoin Magazine; Compiler: Tao Zhu, Golden Finance

Since breaking through the $60,000 mark, Bitcoin has been climbing steadily and is currently hovering near the $70,000 level, a price that has not been reached in months. As market sentiment heats up, investors wonder if Bitcoin has the strength to reach new all-time highs or if it will have difficulty breaking through key resistance levels.

Healthy Sentiment

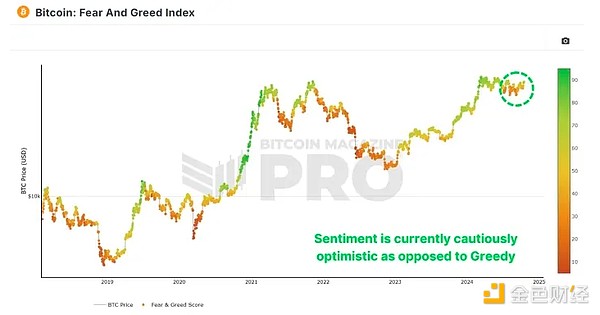

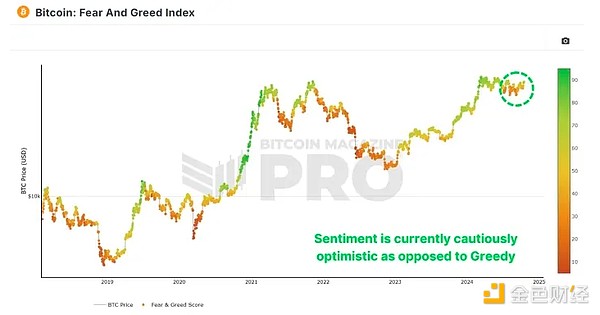

The Fear and Greed Index is a useful tool to understand market sentiment and how traders view Bitcoin's trend. Currently, the index is at the "greed" level of around 70, which is historically seen as a positive signal, but it is still quite far from the extreme greed levels that may indicate a potential market top. The index measures market sentiment, with lower levels indicating fear and higher levels indicating greed. Typically, when the index exceeds the 90+ range, the market becomes overly bullish, raising concerns about overextension.

Figure 1: The Fear and Greed Index shows healthy positive sentiment.

It is worth noting that last year, when the Fear and Greed Index reached similar levels, Bitcoin was trading at around $34,000. From then on, it more than doubled to $73,000 in the following months.

Key Support

The Short-Term Holder Realized Price measures the average price that new Bitcoin investors pay for their Bitcoin. It is crucial because it usually acts as a strong support level during bull markets and resistance during bear markets. Currently, that price is around $62,000 and Bitcoin has managed to hold above that price. This is a promising sign as it shows that new market participants are taking profits and that Bitcoin is holding above a key support area. Historically, a break below this level has led to market weakness, so holding this support is key to any sustained rally.

Figure 2: Short-term holders have reclaimed realized price.

We have seen this dynamic in past cycles, particularly during the 2016-2017 bull run, where Bitcoin retraced to this level several times before continuing to climb higher. If this trend continues, Bitcoin’s recent breakout could set the stage for further gains.

Market Stability

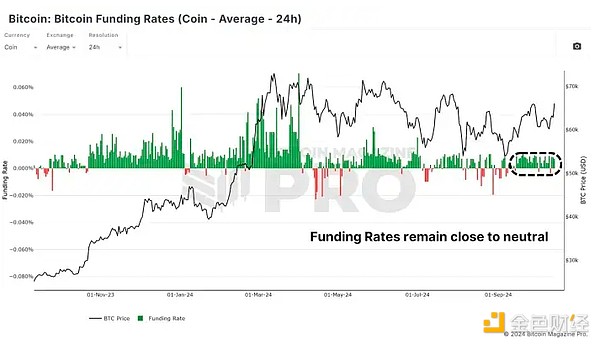

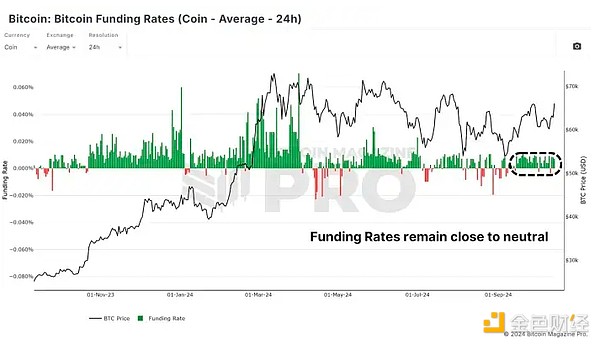

One area traders often watch is the funding rate, which indicates the cost of holding a long or short position in Bitcoin futures. The funding rate has been volatile over the past few months, swinging between overly optimistic long positions and overly pessimistic short positions. Thankfully, the market has now stabilized, with the funding rate at a neutral level. This is a healthy sign as it shows that traders are not over-leveraged in either direction.

Figure 3: Futures markets have deleveraged and returned to healthy levels.

In the neutral zone, there is less risk of liquidation cascades, which is a common phenomenon when over-leveraged positions are wiped out, causing the market to fall sharply. As long as the funding rate remains stable, Bitcoin can have the breathing room it needs to continue to rise without large fluctuations.

The Hard Road to $70,000 and Beyond

While market sentiment and technicals suggest that Bitcoin is in a healthy state, there are still significant resistance levels above. First, the current resistance trendline is one that Bitcoin has struggled to break through. This descending trendline has been tested multiple times, but each time, Bitcoin has pulled back after hitting it.

Beyond this, Bitcoin faces some additional hurdles, such as $70,000. This level has served as resistance in the past and represents a psychological level that traders are likely to keep a close eye on. Above this, the all-time highs are between $73,000 and $74,000. Breaking through this level would be a significant bullish sign, but it may take multiple attempts for Bitcoin to clear this level.

Figure 4: Bitcoin has significant resistance at $70,000 and above.

A positive technical factor is the recent recapture of the 200-day moving average. This is a key level for investors to watch, as it has been a resistance level for Bitcoin over the past few months.

Macro Environment: Institutional and ETF Inflows

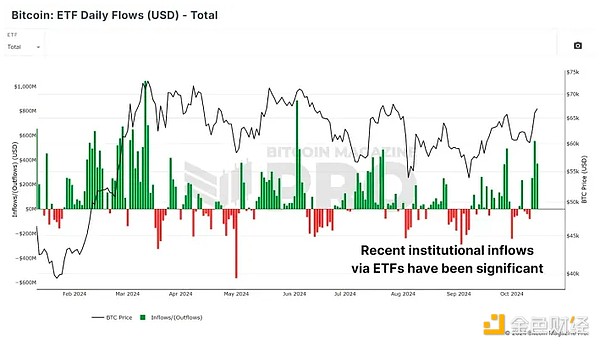

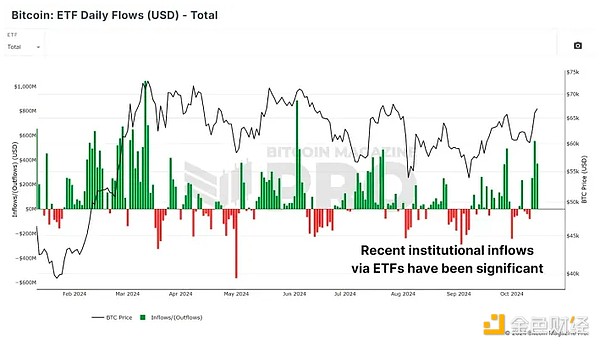

In addition to technical indicators, the macro environment is increasingly favorable for Bitcoin. Institutional funds continue to flow into Bitcoin exchange-traded funds (ETFs). Over $1 billion has flowed into Bitcoin ETFs in the past few days, reflecting growing confidence in the asset. Over the past few weeks, we have seen hundreds of millions of dollars in ETF inflows, indicating that smart money, especially institutional investors, are bullish on the future of Bitcoin.

Figure 5: Bitcoin ETFs have seen massive inflows recently.

This is important because institutional money tends to take the long view and provide a more stable support base than retail speculation. In addition, as the stock market and even gold have risen in recent months, Bitcoin seems to have lagged slightly. This could set the stage for Bitcoin to rise, especially if investors rotate out of traditional assets and into riskier Bitcoin territory.

Conclusion

Bitcoin’s price action, funding rates, and sentiment all suggest a healthier market than it has been in months. Further bullish momentum is being fueled by institutional inflows into ETFs and an improving macro environment. However, there is significant resistance ahead, and any rally is likely to be challenging before Bitcoin can truly break out to new highs.

Jasper

Jasper