Source: Vernacular Blockchain

With the development of Ethereum to PoS after more than a year, the pledge track of the Ethereum chain has gradually evolved into hundreds of billions. In terms of market capitalization, as of now, the amount of Ethereum locked up has reached 41.8 million, accounting for over 35%. The increase in the amount locked up has made it easier for Ethereum to rise.

In addition, pledge-related projects have been popping up recently, and TVL projects worth hundreds of millions or even billions of dollars have begun to appear, such as BN and a16z Top-level institutions have also begun to cast a wider net, further leading to the emergence of pledge projects. Ordinary investors will also actively participate in pledges for the project side's Airdrop expectations. Today, Baihua will sort out some of the recently popular staking projects.

In addition, pledge-related projects have been popping up recently, and TVL projects worth hundreds of millions or even billions of dollars have begun to appear, such as BN and a16z Top-level institutions have also begun to cast a wider net, further leading to the emergence of pledge projects. Ordinary investors will also actively participate in pledges for the project side's Airdrop expectations. Today, Baihua will sort out some of the recently popular staking projects.

01 The evolution of crypto project governance token distribution

The blockchain industry has experienced several bull and bear rounds since its development. Alternately, although new narratives and new gameplay will emerge in each round, there are some similarities. In order to better understand staking and why it has become popular, let’s first understand what asset issuance methods have emerged in this industry:

Block production —— Representative project: Bitcoin , Ethereum

Anyone can obtain Token rewards while maintaining the security and decentralization of the blockchain network. With the development of the industry, the threshold has gradually become higher, and the production of blocks has also gradually increased. become an industry.

Public sale - representative projects: EOS, BTT

The original "simple and crude" direct sale of chips has also evolved into different ones with the development of the industry. model, the threshold is constantly increasing. For example, you need a token designated by the project party to obtain qualifications and chips.

Liquidity mining - representative project: Uniswap

Users obtain Token rewards by providing liquidity. It can be said that the current on-chain transactions can be as good as today The development is closely related to this mechanism. In the early days, many project parties used it as the main means of chip distribution. The chips were too dispersed, causing the Token price to fluctuate greatly. It was easy for a death spiral to occur, and the project died directly. Currently, it is only used as an auxiliary means for the trading market.

Airdrop - Representative project: Uniswap dydx

Tokens are distributed for free as rewards according to the different levels of user participation in the application. There are fewer early blockchain users. As a reward for using its products, it has gradually developed into a way to attract users to use its products and provide business data to project parties in reverse, and the word "return" has appeared.

Inscription - Representative projects: ORDI, Sats

Most project Tokens are 100% released, anyone can participate, and are completely distributed fairly. As the entire track heats up and begins to involute, the biggest profit maker becomes Bitcoin miners.

Pledge (points) - Representative projects: friend tech, blast

Pledge, only need to participate in the pledge of mainstream crypto assets (increase the TVL of the project party Relevant data), while obtaining pledge income, you can also obtain project party points (as a subsequent Token distribution certificate). Because of the expected existence of Airdrop (the reason why projects with institutional investment are more popular), it only takes up funds, and the risk is relatively low. It is small, free of charge, and the distribution of points is instant, making everyone more willing to participate.

At the beginning, the pledge was only concentrated on Ethereum node pledges, just to earn years of income. But now, it is no longer limited to the interest of Ethereum, and other projects have begun to imitate, as long as there are Earn points, the project is good, and everyone will participate appropriately. At present, points are already one of the important means to attract users to use its products, but for users, it is not so good. Various interactive tasks, There is a possibility of continued PUA by the project party.

It can be seen that due to the characteristics of the blockchain, the chip distribution methods in the industry, especially those that lead the development of the industry in the short term, are low-threshold and easy to participate.

02 Inventory of hot projects on the pledge track

The most important point for pledge projects is of course security: project parties The background is clear and reliable, endorsed by institutions, and the risk of running away is low, otherwise it will become "you care about other people's profits, and others care about your principal."

At present, it is mainly considered from the following three directions:

Amount of funds: The amount of funds pledged for the current project, the funds A large amount means there are many participants and it is relatively safe;

Institutional endorsement:Whether it is supported by a top institution, which will provide a certain degree of protection;

Team background: Whether the members of the project team are public and whether they have worked on other well-known projects.

EigenLayer is an Ethernet-based The main services of Fangfang's Restake protocol include Restake of LSD assets, node operations and AVS services (Active Verification Services), aiming to provide security and reward mechanisms in the crypto-economy. It allows users to re-stake native ETH, LSDETH and LP Token, providing a secure platform for third-party projects to earn more rewards while enjoying the security of the Ethereum mainnet, with the overall goal of promoting the entire ecosystem development of.

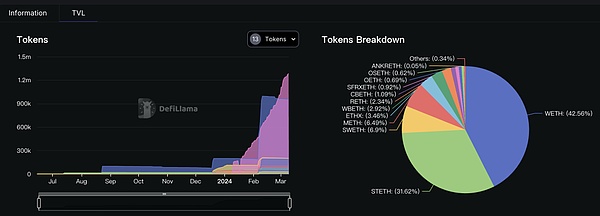

According to Defillama data, as of March 10, EigenLayer’s total TVL was US$11.9 billion (red area on the left side of the figure below), and the top three ETH and its derivatives in the vault were respectively : WETH (42.56%), STETH (31.62%), SWETH (6.9%). It can be seen that EigenLayer’s pledged assets are all related to Ethereum and fully serve Ethereum.

Investment institutions:

A total of four rounds of financing have been completed so far. Investment institutions include a16z, Coinbase Ventures, Polychain Capital, etc., among which a16z invested US$100 million in it on February 22 this year.

Merlin Chain is a Bitcoin L2 solution that integrates the ZK-Rollup network, decentralized oracles and on-chain BTC fraud prevention modules. The goal of Merlin Chain is to improve the efficiency and scalability of Bitcoin transactions and make the Bitcoin ecosystem more active.

The team behind Merlin Chain is Bitmap Tech, which has successfully launched a series of high-value NFT assets, including Bitmaps, Goosinals NFT and BRC-420 blue box and other Bitcoin NFTs, all of which had good results last year. Performance.

Investment institutions:

In February this year, Bitmap Tech, the team behind Merlin Chain, received investment from ABCDE and OKX Ventures. The specific amount is unknown.

TVL: 3 billion US dollars

Official data shows that as of March 2, 23 days after the Merlin Chain mainnet was online, TVL exceeded 3 billion USD, of which Bitcoin accounts for 58% and Ordinals accounts for 33%. The project team pays more attention to community voice and cooperation with the Bitcoin ecosystem.

Blast is An Ethereum-based L2 launched by the Blur team, aiming to provide users with native revenue functions. It is the first L2 network to incorporate native revenue into its design, allowing users’ assets to gain value on Blast. Blast generates revenue through the Staking and Real Assets (RWA) protocol on Ethereum. Compared to the 0% interest rate on other L2 chains, Blast provides an interest rate of about 4% for deposited ETH. Blast’s goal is to make the L2 network profitable. After users deposit assets, Blast will regularly distribute income.

Blast’s main slogan is “L2 network that can help you make money”. Users deposit funds into Blast's L2 network, and Blast then pledges the funds on Ethereum's Layer 1, usually through Lido. Then, Blast will return the earned interest to the user, achieving what is called “making money”. Compared to users staking directly with Lido, using Blast can also earn some additional Blast points.

TVL: US$2.86 billion

The official website shows that as of March 9, Blast TVL has US$2.86 billion and a total of 420,000 users .

Investment institutions:

In November 2023, Blast raised US$20 million in financing, with participation from Paradigm, Lido strategic consultant Hasu, The Block CEO and others.

ether.fi It is a decentralized, non-custodial staking protocol where users can stake their Ethereum (ETH) and obtain corresponding liquid staking tokens (eETH). These staking tokens can be used to participate in DeFi activities and generate additional income. Its main feature is that it allows pledgers to control their own keys, thereby ensuring the security of funds. Ether.fi has also created a node service marketplace that allows users to register nodes and provide infrastructure services. This further promotes decentralization and increases choice and flexibility for stakers and node operators. Recently, ETHFI has issued tokens. Because of Brother Sun, it has been criticized by everyone as a cash machine for large households.

TVL: US$2.2 billion

Defillama data shows that as of March 10, ether.fi TVL reached US$2.2 billion.

Investment institutions:

Completed 2 rounds of financing, totaling US$32 million, from Bankless VC, OKX Ventures, Consensys, BitMex founder Arthur Hayes, etc. Participate in investment.

Puffer is A permissionless native liquidity re-pledge protocol built on EigenLayer, which aims to provide services for node operators (NoOps), re-pledge operators (ReOps) and ETH stakers.

In Puffer, node operators play an important role. They can participate in node verification and the operation of AVSs at low cost. Puffer uses unique anti-slashing technology to enable nodes to safely participate in the verification process and accumulate PoS rewards. At the same time, nodes can also obtain re-staking rewards through the operation of AVSs, increasing their income. Puffer is designed to provide a more flexible and efficient liquidity re-pledge process.

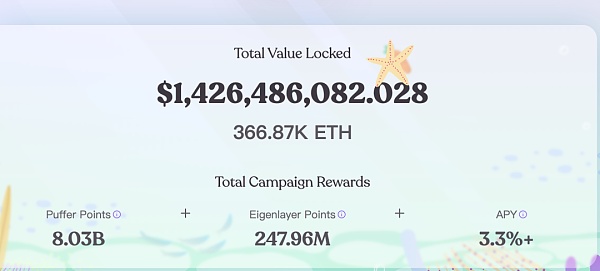

TVL: US$1.4 billion

According to official website data, as of March 10, TVL reached US$1.4 billion and has generated 8 billion Puffer points, 2.4 100 million Eigenlayer points and a comprehensive APY of over 3.3%.

Investment institution:

Investment institution:

Completed three rounds of financing and obtained Ethereum funds in the early stage The funding from the Association was subsequently invested by Bankless Ventures, Animoca Venture, and many KOLs such as the founder of Eigen Layer, Shenyu, and the head of Coinbase’s staking business. The latest round of financing this year was invested by Binance Lab. Puffer’s short-term TVL surge is closely related to Binance Labs’ Investment is closely related.

Renzo is The native re-pledge protocol on EigenLayer introduces a liquid re-pledge token called ezETH. Users can deposit Ethereum or EigenLayer Tokens into Renzo to mint ezETH Tokens. Such operations enable users to participate in liquidity re-staking and use ezETH for other DeFi protocols to earn more revenue.

Renzo’s goal is to lower the threshold for user participation and allow them to easily participate in liquidity re-staking in the EigenLayer ecosystem.

TVL: US$900 million

Defillama data shows that as of March 10, Renzo TVL exceeded US$900 million

< strong>Investment institutions:

Two rounds of financing have been completed so far, with participation from OKX Ventures, Binance Labs and other institutions.

Ethena is The Ethereum-based Synthetic USD (USDe) protocol aims to provide a crypto-native solution to create stable synthetic USD USDe through strategies such as delta hedging and internet bonds, and provide users with income opportunities.

Ethena USDe generates its USD value and yield through two main strategies:

Leveraging stETH and its inherent yield; strong>

Take an ETH short position to balance delta and take advantage of perpetual/futures funding rates.

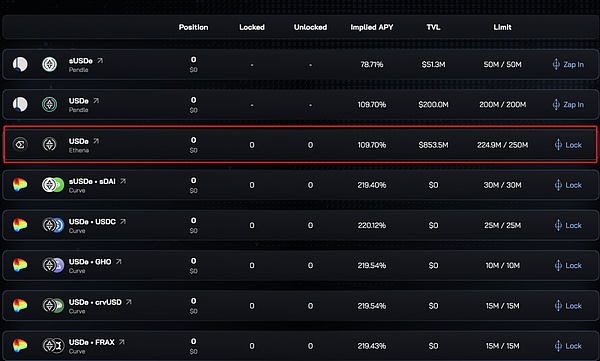

Official website data shows that the current annual growth rate of USDe is 109%.

TVL: US$850 million< /p>

Official website data shows that as of March 10, USDe pool TVL reached US$850 million

Investment institutions:

Completed 2 rounds Financing, with total financing of US$20 million, investment institutions include Dragonfly, PayPal Ventures, Binance Labs, OKX, etc.

Babylon is A Layer 1 developed based on the Cosmos SDK, with the goal of extending the security of Bitcoin to more decentralized applications (DApps) and blockchain networks. To achieve this goal, Babylon introduces BTC assets and allows users to stake Bitcoin on the Babylon network and receive corresponding rewards.

Babylon takes advantage of some of Bitcoin’s core features to enhance security:

First, it uses Bitcoin’s timestamping service to ensure The timestamps of the Babylon network are synchronized with the Bitcoin network, providing higher security and reliability;

Secondly, Babylon uses Bitcoin’s block space to The security of Babylon is extended to other blockchain networks based on the proof-of-stake mechanism, thus forming a more unified and powerful ecosystem;

Finally, Babylon uses Bitcoin as the benchmark for asset value

strong>, achieving interoperability with Bitcoin, making Bitcoin staking and liquidity in the Babylon network more convenient.

The test network just ended a few days ago, and the main network has not yet been launched, so there is no TVL related data. But as a pledge project of the Bitcoin ecosystem, EigenLayer is at the forefront, so Worth focusing on.

Investment institutions:

Currently, two rounds of financing have been completed. The first round of financing is 18 million US dollars. The second round is unknown. The investment institutions include Binance Lab and Polychain. Capital, ABCDE Capital, Polygon, OKX Ventures, etc.

03 Summary

The above is an inventory of the current popular projects on the staking track. It should be noted that although most The project has various halo blessings, but it does not mean that it will not run away with the money, so you still need to pay attention to the risks and do your research before participating.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Beincrypto

Beincrypto Cointelegraph

Cointelegraph Ftftx

Ftftx