Author: YBB Capital Researcher Ac-Core Source: medium Translation: Shan Ouba, Golden Finance< /p>

Eclipse Background

Eclipse founder Neel Somani once served as a software engineer at Airbnb and a software engineer at Citadel Quantitative researcher who founded Solana-based startup Eclipse in 2022. The startup is backed by Solana co-founder Anatoly Yakovenko and Polygon (Architecture), among others. Rollup blockchain is compatible with Polygon and Solana). According to a CoinDesk report on September 28, 2022, Eclipse successfully closed a $6 million seed round led by Polychain and a $9 million seed round co-led by Tribe Capital and Tabiya, bringing the total funding raised to $15 million. In addition, Eclipse received a development grant from the Solana Foundation to support Rollup powered by the Solana virtual machine.

Founder Somani took advantage of her network and proximity to Solana's headquarters in Chicago to successfully create a unique blockchain using Solana's virtual machines. His vision is to enable developers to deploy Rollups powered by the Solana virtual machine, with plans to launch a public testnet in the Cosmos ecosystem in early 2023 with a view to supporting Aptos’ Move language in the future.

Solana co-founder and Eclipse angel investor Anatoly Yakovenko commented: "Eclipse paves the way for Solana to communicate with Cosmos through Inter-Blockchain Communication (IBC) "As large companies and governments start to enter the blockchain space, Eclipse becomes key to promoting their use cases," said Niraj Pant, partner at Polychain Capital. Infrastructure, such as Web2-scale consumer and financial applications."

Eclipse Architecture

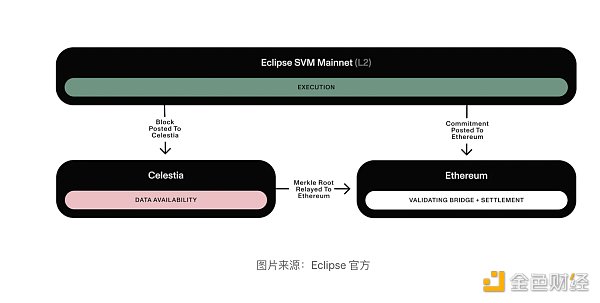

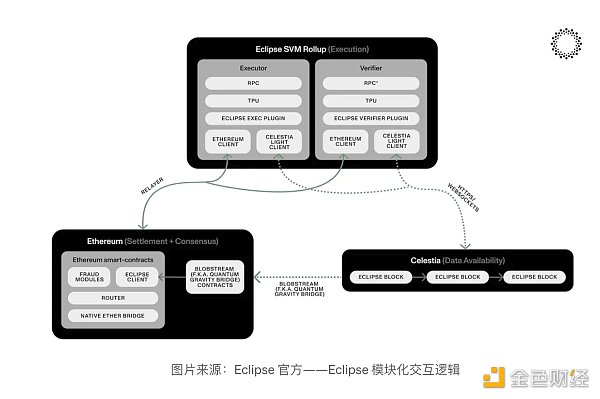

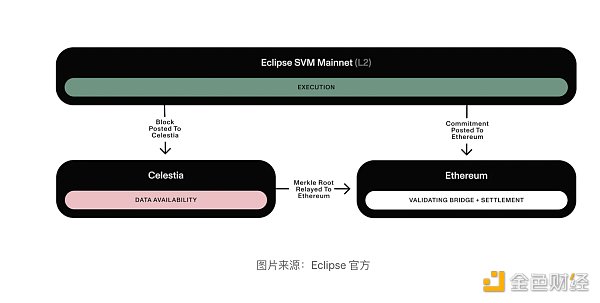

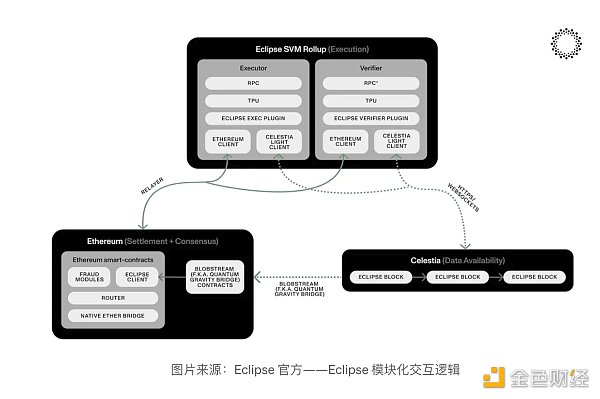

The following content is based on the official explanation: Eclipse Mainnet is Ethereum's first SVM-centered general L2, which combines the essence of a modular stack with the goal of becoming the fastest and most versatile Layer 2 driven by SVM. The project's architecture involves using Ethereum as the settlement layer with an official verification bridge built in; Celestia as the data availability layer; RISC Zero for generating zero-knowledge fraud proofs; and finally, Solana's SVM as the execution environment for this modular Layer2 project. The following is a detailed explanation based on the official description.

Settlement layer - Ethereum: Eclipse will perform settlement on Ethereum (i.e. using an embedded verification bridge on Ethereum), using ETH gas consumption, and submit fraud proof on Ethereum;

Execution layer - Solana Virtual Machine (SVM): Eclipse will run a high-performance SVM as its execution environment, specifically the fork of the Solana Labs client (v1.17);

Data availability layer - Celestia: Eclipse publishes data to Celestia to Achieve scalable data availability (DA);

Proof mechanism - RISC Zero: Eclipse will use RISC Zero for ZK fraud proof (no intermediate state sequence required ization);

Communication protocol - IBC: Eclipse will complete the bridge with non-Eclipse chains through Cosmos' inter-blockchain communication standard IBC;

p>

Cross-chain protocol — Hyperlane: Eclipse partners with Hyperlane to bring Hyperlane’s permissionless interoperability solution to Solana Virtual Machine (SVM)-based blockchains middle.

p>

Settlement Layer: Get Ethereum Security and Liquidity

Like other Ethereum Rollups , Eclipse uses Ethereum as its settlement layer. This process involves integrating Eclipse’s verification bridge directly into Eclipse, where its nodes must check the correctness of the verification bridge and the correctness of the transaction sequence, thus providing users with Ethereum-level security.

L2BEAT defines Layer2 as “a chain that derives its security entirely or partially from the first layer of Ethereum, so that users do not have to rely on the honesty of Layer2 validators to ensure The security of its funds." The Eclipse Verification Bridge can enforce ultimate validity and censorship resistance under certain failure scenarios. Even if the sequencer fails or starts censorship on L2, users can still force transactions through the bridge and burn Ethereum as transaction gas.

Execution layer: achieving Solana’s transaction speed and scale

In order to improve efficiency, Eclipse mainly The network adopts Solana's execution environment, utilizing SVM and Sealevel (Solana's technical solution for building horizontal scalability, a hyper-parallel transaction processing engine that scales horizontally across GPUs and SSDs). Compared with the single-threaded operation of the EVM, its advantage is that transactions can be executed without designing overlapping state transactions, rather than executing them sequentially.

In terms of EVM compatibility, the Eclipse mainnet cooperates with Neon EVM, allowing developers to use Ethereum tools and build Web3 applications on Solana. According to official data, its throughput is significantly higher than single-threaded EVM, reaching 140 TPS. EVM users can interact natively with applications on the Eclipse mainnet through the MetaMask wallet’s “Snaps” plugin.

Data Availability: Leveraging Celestia’s bandwidth and verifiability

Eclipse mainnet will leverage Celestia to achieve data availability and establish long-term cooperation, as Ethereum is currently unable to support Eclipse's target throughput and cost, even after the EIP-4844 upgrade, providing an average of ~0.375 MB of blob space per block (the per-block limit is ~0.75 MB).

According to official data, for ERC-20 transactions based on Rollup extensions, calculated as 154 bytes per transaction, this is equivalent to a total of about 213 TPS for all Rollups. For Compression Swaps, each transaction is about 400 bytes, and the total TPS is about 82 TPS for all Rollups. This compares to Celestia’s 2MB blocks, which Blobstream expects to grow to 8MB as the network proves stable and more DAS (Data Availability Sampling) light nodes come online.

Eclipse believes that, with the support of Celestia DAS light nodes, considering the trade-off between cryptoeconomic security and highly scalable DA throughput, Celestia becomes The current choice for the Eclipse mainnet. Although there is a view that using Ethereum’s DA is the orthodox way of Layer 2, the project will continue to pay attention to the progress of DA expansion after EIP-4844. If Ethereum can provide larger scale and higher throughput DA for Eclipse, the possibility of migrating to Ethereum DA will be re-evaluated.

Proof mechanism: RISC zero fraud proof (no intermediate state serialization required)

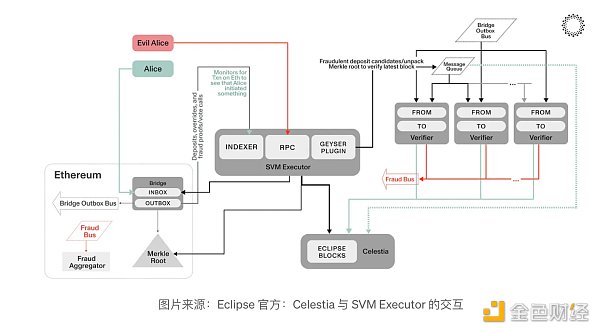

Eclipse The proof method is similar to Anatoly's SVM fraud proof SIMD (see extended GitHub link 2), consistent with John Adler's insight to avoid the high cost of state serialization. To prevent the reintroduction of Merkle trees (hash trees) into SVMs, early attempts were made to insert sparse Merkle trees into SVMs, but updating the Merkle tree with each transaction would greatly impact performance. Without the use of Merkle trees for proofs, existing general-purpose rollup frameworks (such as OP stacks) cannot serve as the basis for SVM rollups, and a more creative error-proofing architecture is required.

Failure-proof requirement: The transaction's input commitments, the transaction itself, and re-executing the transaction will result in a proof that is different from the output specified on the chain.

Input promises are typically implemented by providing the Merkle root of a Rollup state tree. Eclipse's executor will publish a list of inputs and outputs for each transaction (including account hashes and associated global state), generate a transaction index for each input, and publish the transaction to Celestia, allowing any full node to follow up from Its transactions extract the input account's own state, calculate the output account, and confirm that the commitment on Ethereum is correct.

Two main types of errors can occur:

Sponsored Business Content

Incorrect output: validation The server provides ZK proof of correct output on the chain. Eclipse uses RISC Zero to create a ZK proof of SVM execution, continuing the project's previous work of proving BPF bytecode execution (see extended GitHub link 3). This allows our settlement contracts to ensure correctness without having to run transactions on-chain.

Input error: The validator publishes historical data on the chain indicating that the input state does not match the declared state. Celestia's quantum gravity bridge is then used to allow Eclipse's settlement contract to verify whether there is fraudulent historical data.

Eclipse’s connection with ETH and Celestia

Data availability (DA) is the main cost expenditure of Rollup One of the components. Currently, the data availability of Ethereum L2 mainly relies on two methods: Calldata and DAC (Data Availability Committee).

· Calldata: For example, Layer2 solutions like Arbitrum or Optimism publish transaction data as calldata directly to Ethereum's highly censorship-resistant blocks. Ethereum prices attribute data as well as computation and storage to a single unit: Gas, which is one of the main costs incurred by Ethereum rollups. In order to improve efficiency, the EIP-4844 upgrade introduces Blobspace to replace calldata, providing a target of 375 KB per block for all Rollups;

· DAC: with direct in-chain Compared to publishing call data, DAC provides higher throughput, but users need to trust a small committee or a group of validators to avoid malicious withholding of data. DACs, including heavy-staking based solutions, introduce significant trust assumptions for L2, forcing DACs to rely on reputation, governance mechanisms, or token voting to inhibit or punish the behavior of hiding data. Therefore, using an external DA requires using a DAC to some extent.

It is worth noting that Eclipse leverages Celestia's Blobstream, a proof-of-stake consensus network, to allow Layer2 to access Celestia's Blobspace. Depending on the compression scheme, this enables up to 8 MB of blob space, which roughly equates to 9,000 to 30,000 ERC-20 transfers per second. However, using Blobstream's Layer2 will rely on proofs from the Celestia validator. If light nodes detect that 2/3 of Celestia validators are withholding malicious data, they can punish them. Objectively speaking, the credibility of DAC still has shortcomings compared to the native chain DA, but from the perspective of innovation and market narrative, such shortcomings are inevitable.

p>

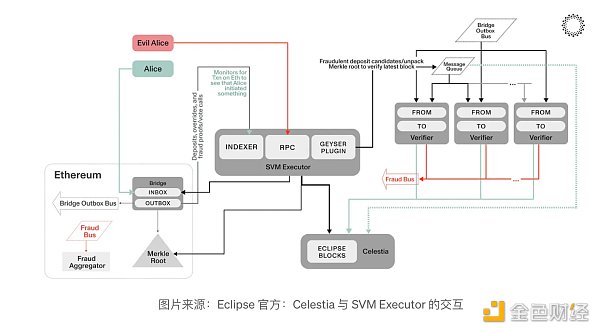

As explained in the official documentation and shown in the image above, Eclipse demonstrates Ethereum's modular DA solution based on the DAS extension via Celestia's Blobstream (as mentioned above scheme) data proven to Ethereum. This enables the bridge to verify the data security provided for fraud proofs based on Celestia's signed data root. Users deposit funds into Eclipse through the native Ethereum bridge. The process is as follows:

1. The user calls the Eclipse recharge bridge contract on Ethereum (extension link 1) Contract address);

2. Eclipse's SVM executor (calculates SVM results and outputs them to the new Eclipse state node) and relay (ETH to Eclipse channel ) Complete the cross-chain data interaction between the sender and receiver addresses;

3. The relay calls the SVM bridge program and is responsible for sending user recharges to the target Address;

4. The relayer verifies the deposit transaction through the zk-light client (to be implemented);

5. Finally, the transaction block containing subsequent deposits is completed and published via the Solana Geyser plugin.

In this process, each Eclipse slot will be published to the message queue by the SVM executor through Geyser. These slots are then published to Celestia as data blocks, and Celestia validators submit these committed data blocks to prove that the transaction is included in the Eclipse chain and corresponds to the data root. Finally, each block of Celestia data is relayed via Blobstream to the Eclipse bridge contract on Ethereum.

p>

Similar to other Ethereum Layer 2 solutions that use fraud proofs, withdrawing funds from Eclipse to Ethereum also requires a challenge period, allowing the validator to transition to an invalid state Submit proof of fraud below.

· The SVM executor periodically submits Eclipse slot epochs on Ethereum (the process follows a predetermined number of batches) and posts collateral;

· Eclipse's bridge contract performs basic checks to ensure the integrity of the published data format (see the Fraud Proof Design section in the reference article [2]);

· If the submitted batch passes basic checks, a predefined window is generated. If within this window, the batch commitment indicates that the state transition is invalid, the validator can issue a fraud proof;

· If the validator successfully issues a fraud proof, they will win the execution Without the pledger's collateral, the submitted batch will be rejected and the Eclipse L2 specification state will be rolled back to the last valid batch commit. At this time, the administrator of Eclipse has the right to choose a new executor;

· However, if the challenge period expires without any successful proof of fraud, the executor will Reclaim their collateral and rewards;

· Finally, Eclipse's bridge contract finalizes all withdrawal transactions included in the batch.

Summary

Eclipse is currently in the early stages of development and testing, signaling that Ethereum Go to the first SVM Layer2. Its testnet has been launched and the mainnet is planned to be launched in the first quarter of 2024. Ethereum still considers Rollups a core part of its development roadmap. Putting aside the debate over orthodoxy, this more or less means that Ethereum leaves the broad definition of Layer 2 to the market. While openly empowering, it also subtly introduces various forms of competition. Eclipse leverages this by combining the security of Ethereum, the high performance of Solana, and the DA narrative of Celestia through modular development to form a powerful market narrative.

Looking back at the development of Ethereum, an interesting phenomenon is that in the last market cycle, under the hype of DeFi Summer, "DeFi Nesting" and "DeFi Lego" A surge in innovation and enhancement has led to the explosive development of the ecosystem. The combination of LSD and Re-stake in this round has led to a surge in "staking nesting" and "staking Lego" combinations, and the TVL of EigenLayer, Blast, and Merlin in the BTC ecosystem has increased rapidly in a short period of time. If nesting and Lego are considered the main theme of market sentiment, then modularity will also be able to play its unique nesting and Lego melody in the future.

The charm of modularity lies in the benefits of component decoupling, thereby achieving innovation at each layer of the stack, allowing the optimization of each module to amplify the optimization of other modules. Perhaps in the future, modular development processes can provide developers and users with a plethora of competing options.

JinseFinance

JinseFinance