Author: CryptoVizArt, Checkmate, UkuriaOC, Glassnode; Compiler: Tao Zhu, Golden Finance

Summary

Since the all-time high of $73,000 in March, the market has actually been moving sideways. According to our estimates, demand momentum has turned negative since the beginning of May.

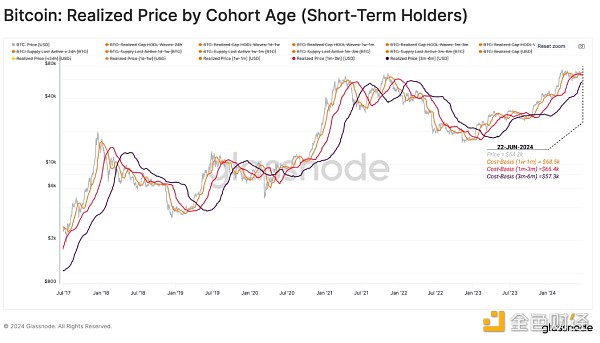

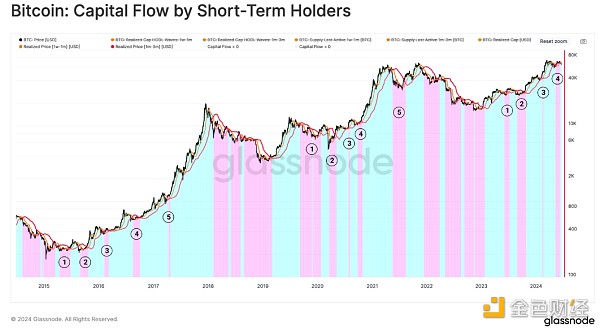

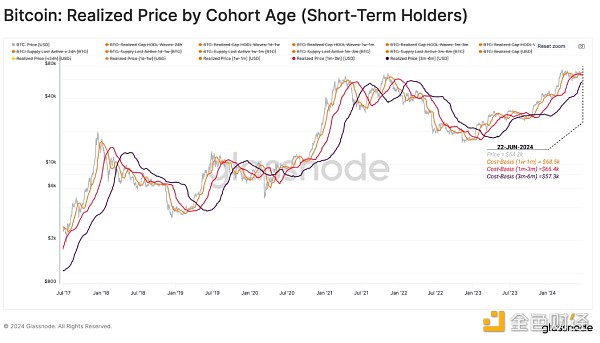

We analyze the cost basis of short-term investors as a way to examine the flow of capital in the market.

In the supply-side analysis, we target long-term holders and find that the concentration of unrealized profits held by this group is far lower than the historical peak.

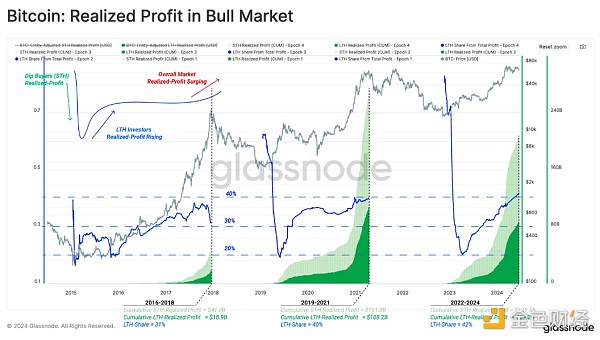

From the consumption behavior of long-term holders, it can be seen that although the consumption of these players accounts for only 4%-8% of the total transaction volume, the profits realized by this expenditure usually account for 30%-40% of the total transaction volume. Cumulative profits realized during the bull market. This finding highlights the concentration of wealth in older cryptocurrencies, which gradually pay off Diamond Hands during the bull run.

Tracking Demand

In WoC 18, we explored a method to determine the direction and intensity of capital flows into or out of the market. We consider a framework that utilizes the average cost basis of different age groups within the cohort of short-term holders:

When the cost basis of these groups is on an uptrend, this indicates that capital is flowing into the market as new buyers acquire tokens at higher prices (and vice versa for a downtrend).

When the spot price deviates above or below the cost basis, we can estimate the extent of unrealized profits held by each group through the MVRV ratio.

We can think of the MVRV value as a measure of investors’ motivation to take profits (high values), or an indicator of seller exhaustion (low values).

We start by comparing spot price to the cost basis of two groups:

From this, we can identify when the macro tides of capital flows change in the early stages of bull and bear markets. The chart below shows how these two price models could provide market support during the 2023-24 bull run.

Since mid-June, spot price has fallen below the cost basis of 10k-1m holders (orange) ($68,500) and 1m-3m holders (red) ($66,400). If this structure persists, it has historically led to a deterioration in investor confidence and has the potential to cause this correction to be deeper and take longer to recover.

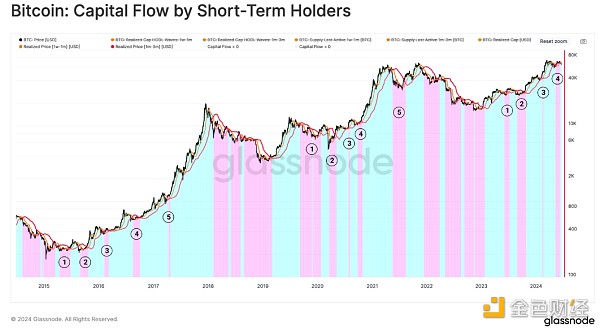

We can also describe the market dynamics by comparing the cost basis of these groups. The chart below highlights:

When the cost basis of 1w-1m holders trades above the 1m-3m cost basis, capital flows in (blue). This highlights the positive momentum of demand and attracts new capital into the market.

When the cost basis of 1w-1m holders falls below the cost basis of 1m-3m, capital flows out (purple). This structure signals weakening demand-side momentum and net capital outflows from the asset.

The negative capital flows structure has occurred as many as five times in previous bull markets. We can also see that this structure was in play from May until early June.

Leading the Supply Side

To fully understand the current market, we can use indicators that describe the behavior of Long Term Holders (LTH). The LTH cohort is a major player on the supply side during bull markets as they distribute tokens and profit. When LTH increases selling intensity until it overwhelms and exhausts demand, a market cycle top is formed.

The chart below compares spot price to a significant multiple (LTH realized price) applied to the average cost basis of the LTH cohort.

1.0 * LTH realized price (green) historically coincides with the bottom formation phase of bear cycles and market recoveries.

1.5 * LTH realized price (orange) depicts the recovery phase of the long equilibrium phase of a bull market. Prices tend to experience a slower rate of growth, with LTHs making around +50% unrealized profit on average.

3.5 * LTH Realized Price (red) provides the distinguishing boundary between the equilibrium and euphoria phases of a bull market. At this point, prices tend to appreciate rapidly and LTH tends to experience increased distribution pressures as unrealized profits reach 250% or more.

If we apply this framework to the recent cycle, we can see that from a macro perspective, the current bull market is very similar to the 2017 cycle. In particular, the recent consolidation phase around the previous ATH is consistent with the equilibrium described by the euphoria boundary when applied to 3.5 times the LTH Realized Price (red).

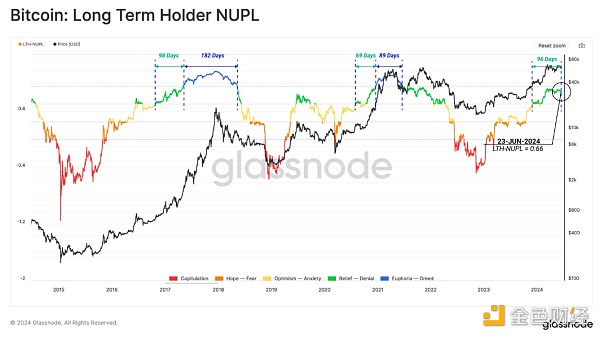

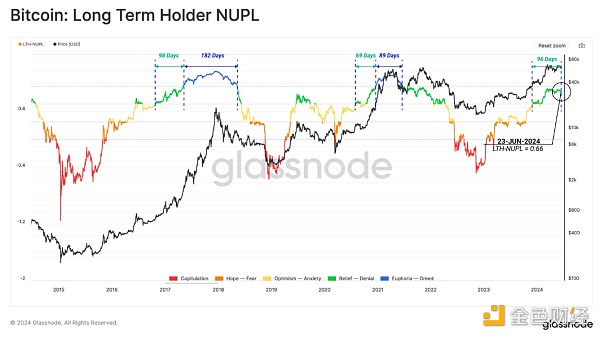

The size of the unrealized profits held by LTH can be seen as a measure of the motivation of this group to spend cryptocurrencies and take chips. We can use the LTH-NUPL indicator to visualize this psychological incentive.

At the time of writing, LTH-NUPL is 0.66, which is between the levels associated with the pre-euphoria phase (green). This situation has lasted for 96 days, which is very similar to the duration of the 2016-17 cycle.

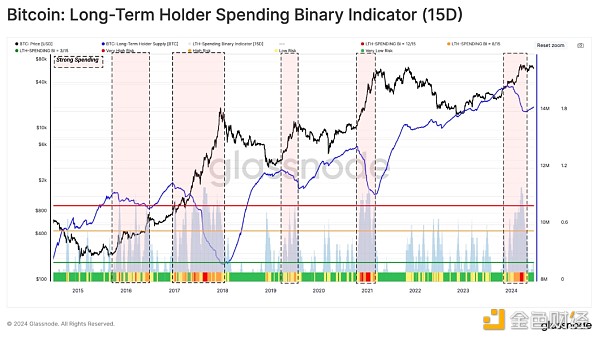

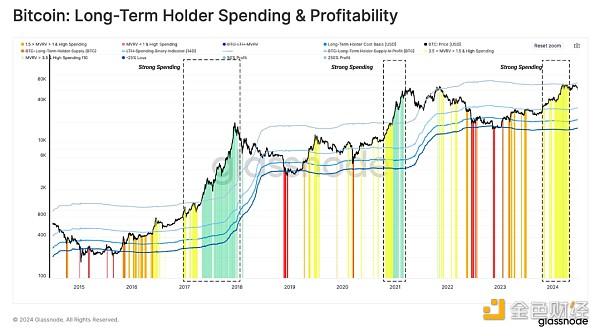

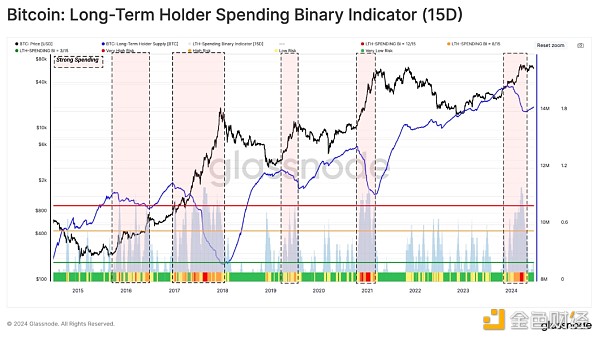

Using the long-term holder spending binary indicator, we can identify periods where this group is engaging in strong spending. During these events, the total balance of LTH held continues to decline significantly.

From this, we can identify the following LTH spending regimes:

Weak spending (green), where LTH supply has declined on at least 3 of the past 15 days.

Moderate spending (orange), where LTH supply has declined on at least 8 of the past 15 days.

Spending is strong (red), with LTH supply falling in more than 12 of the past 15 days.

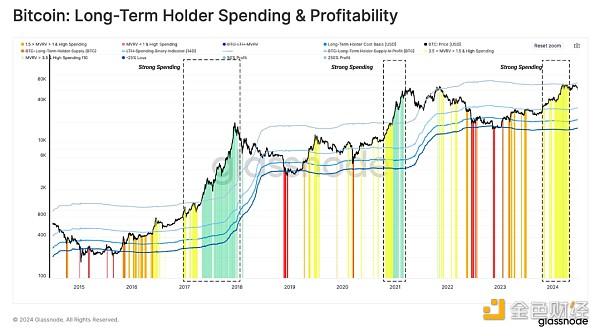

The next chart aims to combine the two previous models to assess LTH sentiment and behavior. This combines the motivation of this group to profit with their actual spending behavior.

We consider four regimes to amplify changes in LTH withdrawals and behavior patterns:

Capitulation (red), spot price trades below LTH cost basis, so any strong spending is likely associated with fear and capitulation.

Transition (orange), price trades slightly above LTH cost basis, and there are occasional small spending. This is considered to be associated with typical daily activity.

Equilibrium after recovery from a prolonged bear market (yellow), the market seeks a new equilibrium between small inflows of new demand, reduced liquidity, and gradual withdrawals by underwater holders from the previous cycle. Strong LTH spending during this phase is often associated with a sudden rally or correction.

LTH-MVRV trades above 3.5 and has historically coincided with the market reaching the ATH of the previous cycle, so euphoria (green). The LTH cohort holds an average of over 250% in unrealized profits. The market entered a euphoric uptrend, which prompted these investors to spend at a very high rate.

Using this template, we can see that LTH's spending profile increased in Q4 2023 and Q1 2024. This puts the market in equilibrium during this period.

Dissecting the Spending Profile of Strong Hands

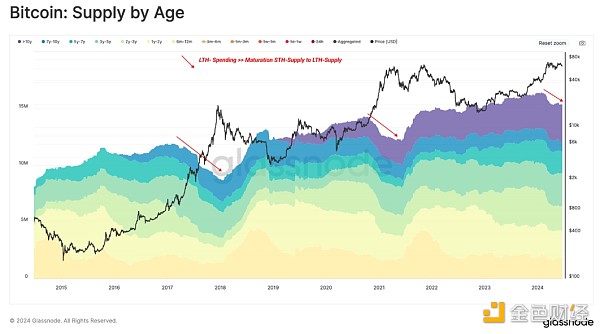

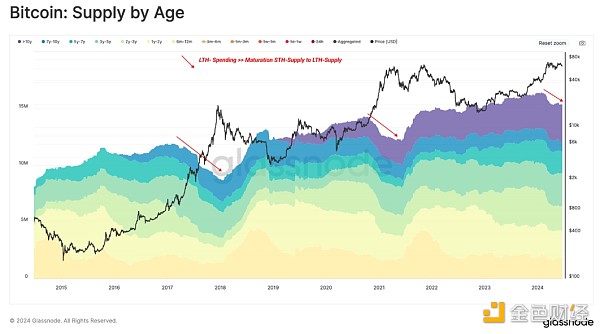

The previous indicator took into account periods of declining total supply for long-term holders. Similarly, for the short-term holder cohort, we can also examine which sub-age groups are responsible for the sell-side pressure.

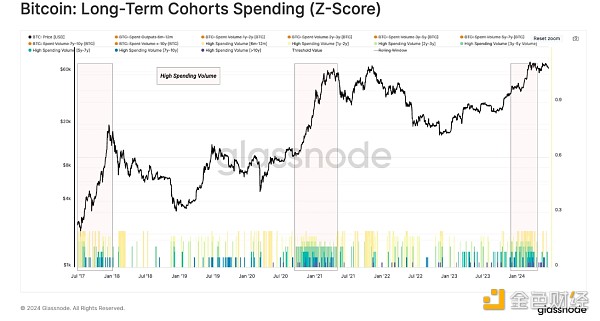

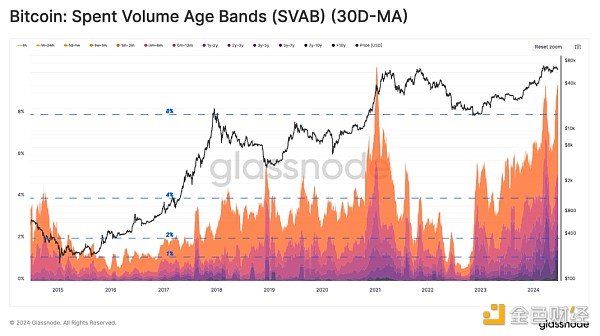

To assess the contribution of each subgroup of LTH spending, we highlight the days when its spending volume is at least one standard deviation above the annual average.

While each group occasionally has bursts of spending activity, the frequency of high-spending days increases dramatically during the excitement phase of a bull market. This highlights a relatively consistent behavioral pattern of long-term investors taking profits during periods of rapid price increases.

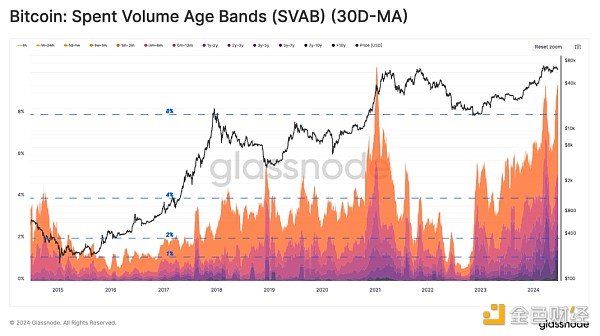

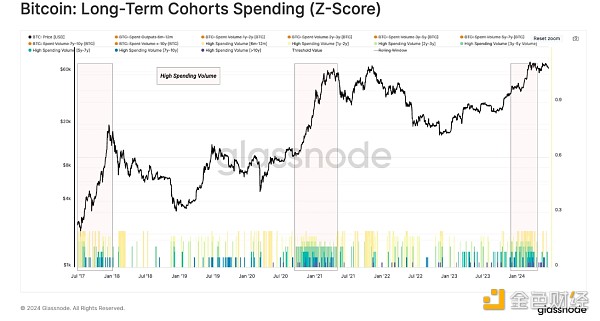

Given that only 4%-8% of daily on-chain trading volume corresponds to LTH, we can use another core on-chain metric to explain the relative weight of these investors on the supply side.

Although LTH tokens account for a small share of consumption, their prices are often much higher (or lower) than when they were initially purchased. Therefore, the size of the profits or losses realized through the spent tokens provides a valuable perspective on their behavioral patterns.

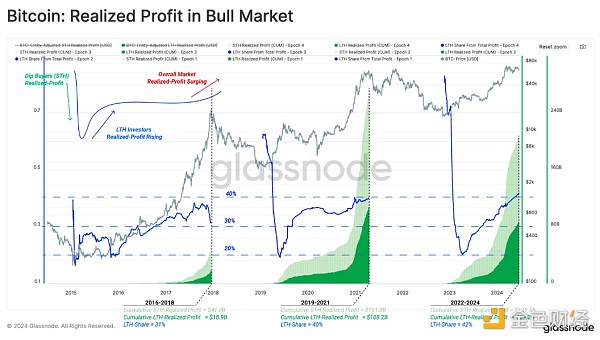

The figure below records the cumulative realized profit volume locked by long-term holders during the bull market. We found that LTH typically accounts for 20% to 40% of the total locked profits over time.

Although LTH's trading volume accounts for only 4% to 8% of the total daily volume, the LTH group accounts for 40% of investors' profit-taking.

Conclusion

Since the beginning of March, as sideways price movements have dominated, we use the cost basis of long-term and short-term investors to assess the current supply and demand in the market.

Using the changes in the cost basis of the short-term investor subgroup, we build a toolbox to estimate the momentum of capital flows into the network. The results confirm that the March ATH was followed by a period of capital outflows (negative momentum).

Next, we segmented the spending of long-term holders into age subgroups. The results show that the frequency of high-spending days increases dramatically during the excitement phase of the bull market. Surprisingly, long-term holders only traded 4% to 8% of the daily total, but this group accounted for 40% of investors' profits.

JinseFinance

JinseFinance