DeFi data

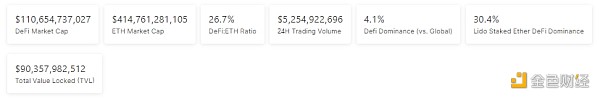

1. Total market value of DeFi tokens: US$110.654 billion

< /p>

< /p>

DeFi total market capitalization data source: coingecko

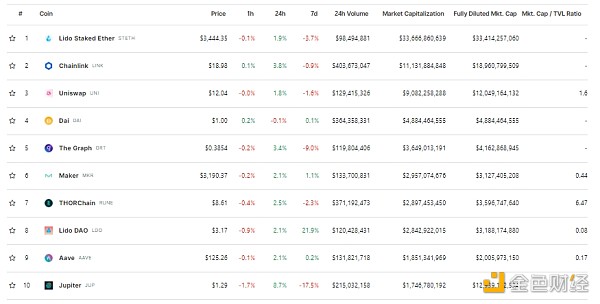

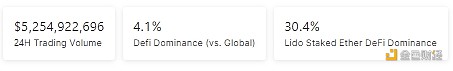

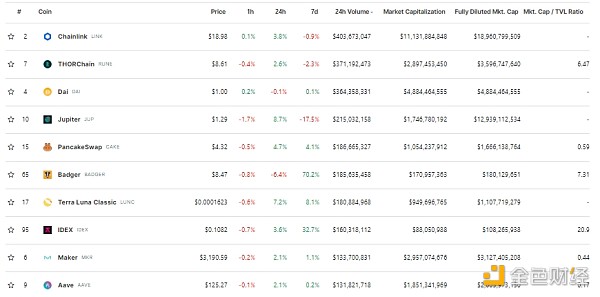

2. The trading volume of decentralized exchanges in the past 24 hours was US$5.254 billion

Trading volume data of decentralized exchanges in the past 24 hours Source: coingecko

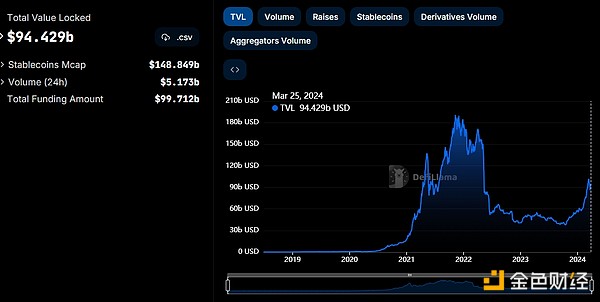

3. Assets locked in DeFi: $9.442 billion

DeFi project’s top ten rankings of locked assets and locked position data source: defillama

NFT data

1 .NFT total market value: US$61.143 billion

NFT total market value and top ten project data source: Coinmarketcap

2.24-hour NFT transaction volume: 4.638 billionUSD >

NFT's total market value and market value rank top Ten project data sources: Coinmarketcap

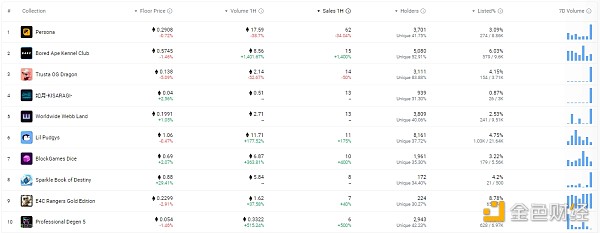

Top NFTs in 3.24 hours

< strong>

Top ten NFT sales within 24 hours Data source: NFTGO

Toutiao

Do Kwon to go on trial in Manhattan on Monday

Terraform Labs and its founder Do Kwon are set to go on trial in Manhattan on Monday on charges from regulators that they were involved in the company’s two crypto Currencies LUNA and UST lied to investors before collapsing, disrupting markets in 2022. Regulators also accused them of falsely claiming that Terraform’s blockchain was used in a popular mobile payment app in South Korea.

Do Kwon will not attend the court hearing. He was arrested in Montenegro last March and is awaiting extradition to his native South Korea, where he faces criminal charges. A Montenegrin court on Friday postponed his extradition after the country's prosecutor's office raised concerns about the process.

NFT Hotspots

1.NFT lending platform Blend’s total transaction volume exceeded 5.5 billion US dollars, and the number of loans exceeded 600,000

Dune’s latest data shows that the total transaction volume of Blur’s NFT lending platform Blend has exceeded US$5.5 billion, reaching US$5,539,191,390 at the time of writing this article, with a total of 610,066 loans; the cumulative number of independent borrowing users is 9,811, and the cumulative number of independent loans There are 4,358 users. The current total active loan volume is 3841, and the active loan amount is approximately 7231 ETH.

2. PlayDapp updates 2024 roadmap: It is planned to launch exclusive NFT on the main network in the second quarter

PlayDapp updates 2024 roadmap, which mainly includes the launch of Marketplace Plus , issuing exclusive NFTs served on the mainnet to facilitate transactions, introducing aggregators - access and compare market data, simplifying the process of purchasing NFTs and supporting bulk trading capabilities. New P2E mobile games will be launched in the second half of 2024. As more and more gamers turn to mobile games, PlayDapp plans to launch a new type of game and will be integrated with the PlayDapp main network.

3. Negentropy Capital announced a donation of US$1 million to the Slerf project to support the latter’s NFT project.

According to official news, Negentropy Capital announced a donation to Slerf The project party donated US$1 million to support Slerf's design and issuance of a new NFT project. The NFT series is planned to be issued and listed in the near future. The funds raised will be used to refund investors who participated in pre-sales of previous Slerf token projects.

4. American comedian Kevin Hart sold BAYC #9258 for 13.26 ETH, losing 66 ETH

Blur data shows that 8 hours ago, American comedian Actor Kevin Hart has sold BAYC #9258, which he bought through MoonPay for 79.5 ETH in January 2022, on Blur for 13.26 ETH, resulting in a currency-based loss of 66 ETH (worth approximately US$231,000).

DeFi Hotspot

1.Mineral, the first BTC native DeFi project on Merlin Chain, completed pre-sale strong>

The first BTC-native DeFi project Mineral’s second-layer treasury token MNER on the second-layer Bitcoin network Merlin Chain has completed pre-sale. The amount reached 150 BTC, worth over 10 million US dollars.

2. StaFi deploys liquidity staking as a service LSAAS testnet, and the mainnet is planned to be launched in Q3

Liquidity staking protocol StaFi announced the deployment of its liquidity The Staking as a Service (LSAAS) testnet will be rebranded and the StaFi 2.0 mainnet will be released later. It is reported that the StaFi 2.0 testnet will support liquid pledged derivatives (LSD) from Ethereum, EVM second-layer network and Cosmos ecosystem. It is then expected to launch its liquidity re-staking token on the testnet in the second quarter of this year, and the mainnet is scheduled to go online in the third quarter of 2024.

3. Orderly Network will start launching a points program next week

DeFi infrastructure provider Orderly Network said that a points program called “Merits” Will start next week. Co-founder and CEO Ran Yi said users can earn points that will be converted into Orderly Network tokens at launch, but declined to comment on the scale because there is "some flexibility" in the program's design. For example as its end date. The total supply of the token will be 1 billion, with the majority of the token supply going to the community, of which airdrops are a key component.

4.Pyth Network releases SHDW/USD price source

Pyth Network announces the release of SHDW/USD price source. SHDW is the native token of the decentralized data storage network GenesysGo. Pyth’s SHDW/USD price information is now available on over 50 blockchains.

5.Acala launches Sinai upgrade proposal to improve sustainable liquidity

Acala, the Polkadot ecological DeFi platform, launches Sinai Upgrade proposal, related upgrades include three tracks, namely: liquidity, infrastructure and aSEED, which are planned to improve sustainable mobility. Liquidity includes one-click multi-chain cross-stack DeFi, Ethereum, Solona and L2 chain liquidity integration, LSTFi ecosystem expansion; infrastructure includes open governance, cross-chain security Sentinel, and performance upgrades (asynchronous support) to achieve more than 4 times Throughput; driving completion of Acala aSEED Vault conversion.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

Clement

Clement

Clement

Clement Coinlive

Coinlive  Davin

Davin Coindesk

Coindesk Bankless

Bankless Cointelegraph

Cointelegraph Cdixon

Cdixon Cdixon

Cdixon Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist