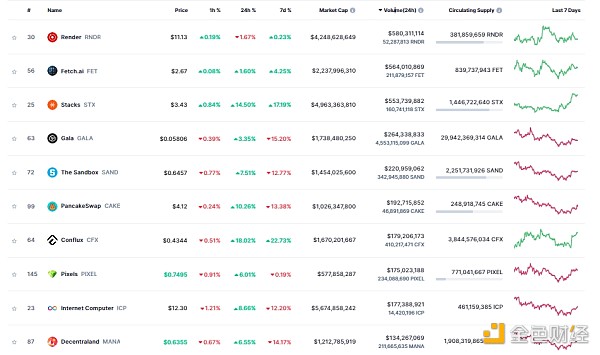

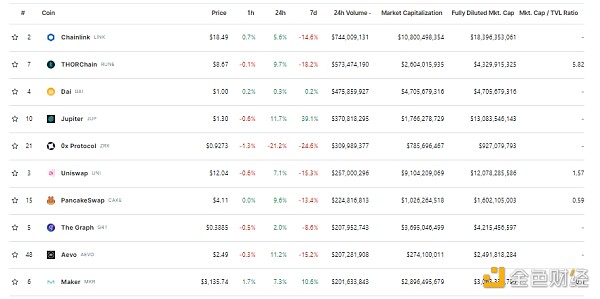

DeFi data

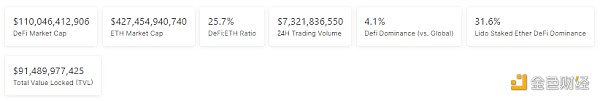

1. Total market value of DeFi tokens: US$110.046 billion

< /p>

< /p>

DeFi total market capitalization data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$7.321 billion

< span style="font-size: 14px;">Transaction volume data source of decentralized exchanges in the past 24 hours: coinecko

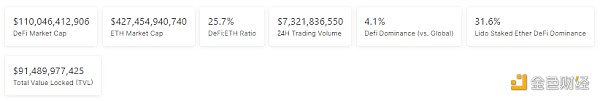

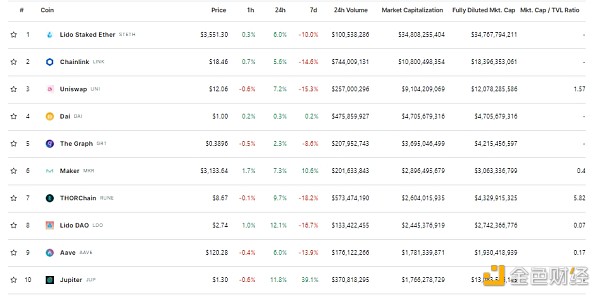

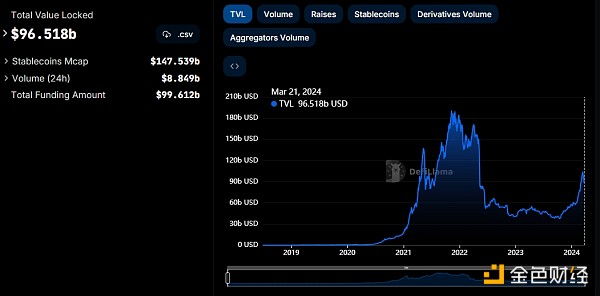

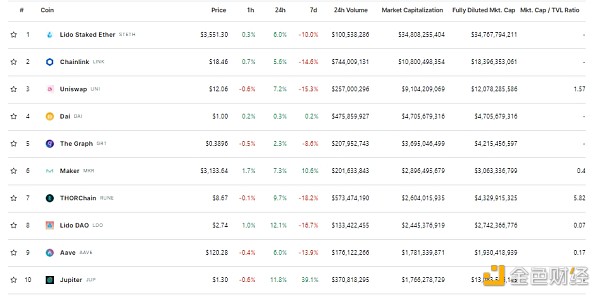

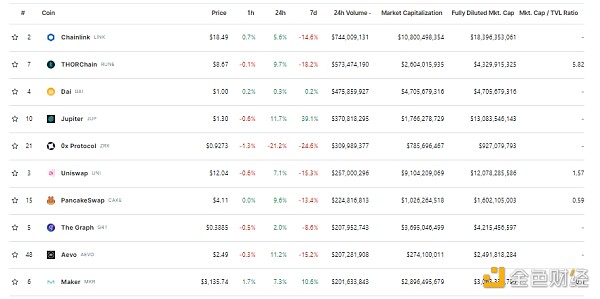

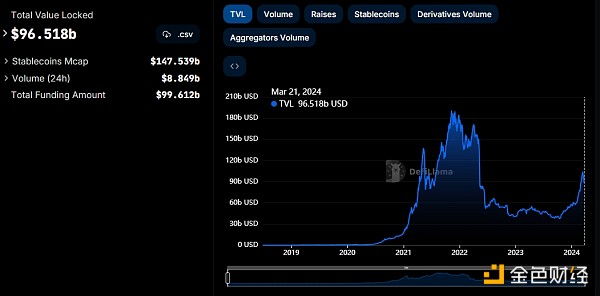

3. Locked assets in DeFi : US$9.651 billion

DeFi project’s top ten rankings of locked assets and locked positions data source: defillama

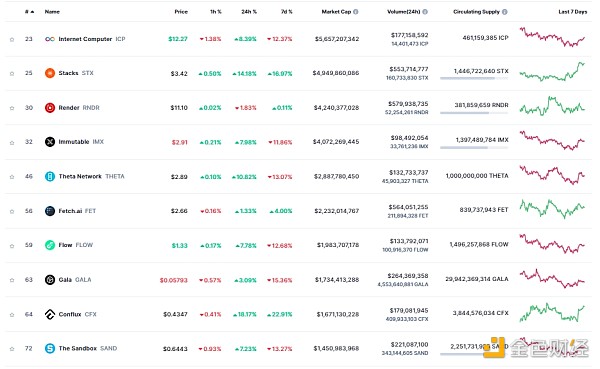

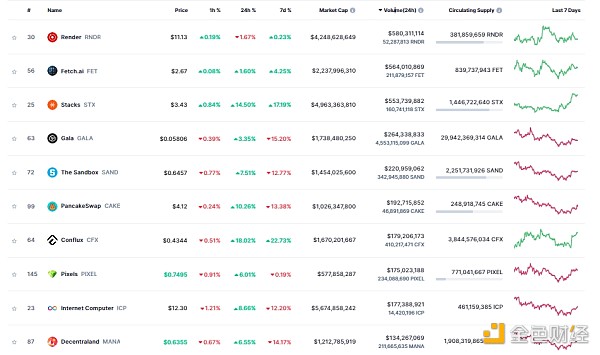

NFT data

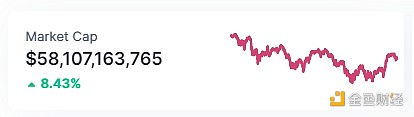

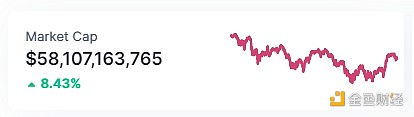

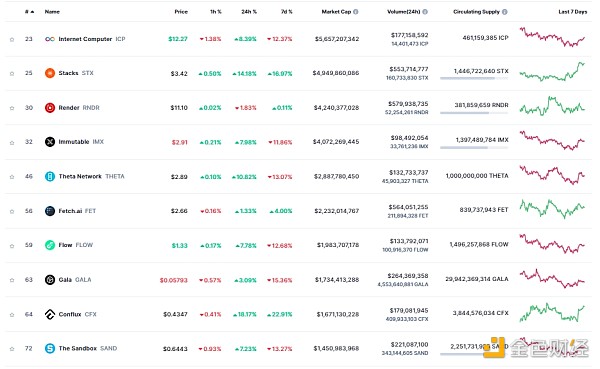

1. NFT total market value: US$58.107 billion

< /strong>

< /strong>

NFT total market value and market value of the top ten projects Data source: Coinmarketcap

2.24-hour NFT transaction volume: 5.572 billionUSD

< p style="text-align: center;">

NFT total market value and market value of the top ten projects Data source: Coinmarketcap< p>

Top NFT in 3.24 hours

Data source for the top ten NFTs with the highest sales increase within 24 hours: NFTGO

Headlines

Global X is about to launch a BTC futures strategy ETF with the code BTRN

Bloomberg ETF analyst James Seyffart said on social media that Global X’s BTC futures strategy ETF will be launched on March 21, 2024, with the code BTRN.

The Global

According to the prospectus, the Fund will invest at least 80% of its total assets, plus borrowings, if any, for investment purposes in the constituent stocks of the CoinDesk Bitcoin Futures Benchmark Futures Index and as determined by the Advisor. Other securities have economic characteristics that are substantially the same as those of the constituent stocks that make up the underlying index, such as the U.S.-listed Bitcoin Futures ETF. In addition, in order to track the Underlying Index, the Fund may invest in debt securities, cash and cash equivalents or money market instruments that are not included in the Underlying Index, such as repurchase agreements and money market funds.

NFT hot spots

1.Opensea launches NFT market protocol Seaport 1.6

Opensea on the X platform According to the release, the Seaport 1.6 NFT market protocol was officially launched. Seaport 1.6 introduced a new feature enabled by the Ethereum Dencun upgrade, called Seaport Hooks. Similar to Uniswap v4 hooks, the Seaport hooks feature allows developers to build related applications that extend the utility and liquidity of NFTs. In some operations, Seaport 1.6 gas charges are 5% cheaper than Seaport 1.5.

2. Founder of SLERF: Soul-bound NFT will be distributed to affected pre-sellers and refund contributors

Founder of Meme project SLERF @Slerfsol posted on the X platform that it plans to release Soul-bound NFT to the wallet addresses of affected pre-sellers and refund contributors. This will allow other projects to easily airdrop tokens or NFTs and provide them with a souvenir of SLERF’s history.

3.BlackRock currently holds at least $40,000 worth of MemeCoin and NFTs

Asset management giant BlackRock BlackRock now owns at least $40,000 worth of memecoin and non-fungible tokens (NFTs), and data shows that since March 19, unnamed cryptocurrency users have sent at least 40 to BlackRock tag addresses. tokens and 25 NFTs, from the Bitcoin-based Ordinals Pepe (PEPE) token to the CryptoDickbutts S3 NFT, in addition 500,000 unshETHing_Token (USH) and 10,000 Realio Network (RIO) tokens were also transferred to the company worth 10 Trillion-dollar asset manager, BlackRock also received significant amounts of Mog Coin (Mog) VoldemortTrumpRobotnik-10Neko (ETHEREUM) and Shina Inu (SHI).

DeFi Hotspot

1.Defi comprehensive service platform OpenStamp received seed round financing led by Animoca Ventures

OpenStamp, a comprehensive service platform based on the STAMP protocol, completed a seed round of financing at a valuation of US$50 million. Animoca Ventures led the investment, and KuCoin Ventures, MH Ventures, VitalTao Capital, Lotus Capital, Brotherhood Ventures, Blue Node Capital, D64 Ventures, Luminescence Capital, Spicy Capital, Halvings Capital, SPEC Capital and YM Capital also participated. OpenStamp provides various products including Mint/Deploy services, SRC-20/SRC-721 marketplace, Indexer, Explorer and Launchpad.

2. Ethereum liquid pledge agreement Lido TVL is $34.3 billion

The Block data dashboard, the total locked value of Ethereum liquid pledge agreement Lido (TVL) is $34.3 billion and is currently the largest validator on Ethereum, accounting for 30% of the total amount of pledged Ethereum.

3. Polygon completed the Napoli hard fork upgrade and introduced the RIP-7212 proposal

Polygon announced the completion of the Napoli hard fork upgrade, and Polygon PoS became the first Activating the Rollup Improvement Proposal (RIP) chain using RIP-7212 provides new precompiled support for the secp256r1 curve, making progress towards interoperability with mainstream technologies.

The upgrade also aligns with Ethereum’s recent Dencun hard fork improvements, which improved block space efficiency, limited self-destruct opcode scope, and reduced memory copy technology overhead. RIP-7212, developed by the RollCall Working Group, promotes collaboration between L2 solutions to consolidate Ethereum’s scaling and innovation efforts and improve user experience.

4. AirDAO: 35.2 million AMB and 125.51 ETH were stolen from the AMB/ETH Uniswap pool.

AirDAO issued a statement stating that the AMB/ETH Uniswap pool 35.2 million AMB tokens and 125.51 ETH were stolen. We are working with exchanges and relevant departments to recover the stolen funds.

The hackers used social engineering techniques to gain access to the LP, impersonating its partners and sending emails with malicious attachments. The exchange used has been contacted to track and freeze the stolen funds. Additional liquidity will be added back to uniswap LP as soon as possible and the situation has been alleviated.

5. JUP DAO will inject 10 million USDC and 100 million JUP to accelerate the growth of Jupiverse

According to the official announcement, JUP DAO will be officially launched next week Inject 10 million USDC (for operating funds) and 100 million JUP. Funds will be transferred to a separate DAO wallet. 10 million USDC comes from income, and 100 million JUP comes from community distribution. This will enable the DAO to participate in public goods funding and carry out its mission of growing Jupiverse.

6. DeFi Saver launches CurveUSD hard liquidation protection function

One-stop asset management solution DeFi Saver tweeted that it has launched CurveUSD hard liquidation Protective function. Officials stated that users can now set a trigger health ratio value (such as 10%) and the amount of crvUSD that is automatically repaid from their EOA (such as 10,000). At the trigger moment, if the crvUSD amount in EOA is lower than the configured repayment amount, the strategy will use all available crvUSD to repay the debt. If there is no crvUSD, or if the repayment amount exceeds 50% of the gas cost, the strategy will not be executed. Currently available automatic options for CurveUSD include: automatic leverage management (automatic promotion and automatic repayment) and hard liquidation protection (automatic repayment from wallet).

Game Hotspot

1.Starknet: Chain Game Influence The test network will end on April 10th

Starknet said on the X platform that the NFT chain game Influence is currently in the final stage of the test network. The test network will end on April 10, and will be Online on Starknet mainnet. In addition, the Influence team will release a live demo of the game at 23:00 today.

2. WEMIX will apply new token economics from July 1st

The South Korean game public chain WEMIX Foundation announced that it will apply new token economics from July 1 New token economics will be applied starting from the 1st. The WEMIX Foundation will destroy approximately 400 million of the total reserves held by the foundation at one time. 40% of the ecological development fund will be used for community promotion and marketing to promote the WEMIX ecosystem, and the remaining 60% will be used for investment and cooperation to develop the ecosystem.

35% of the revenue generated by the Ecosystem Development Fund will be used to increase the value of WEMIX by purchasing and destroying WEMIX. Principal is returned to the ecosystem fund and reinvested. At the same time, the foundation will introduce halving to change the block minting structure of WEMIX 3.0. Halvings occur 16 times every two years, and block minting is permanently suspended when the total supply reaches 590 million. Therefore, the maximum supply of WEMIX will be reduced by 60% from the current 980 million.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

Bernice

Bernice

< /p>

< /p>

< /strong>

< /strong>