DeFi data

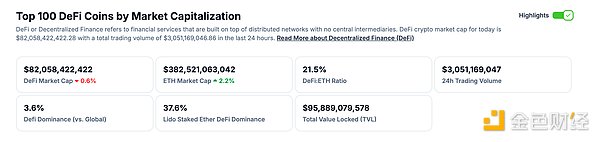

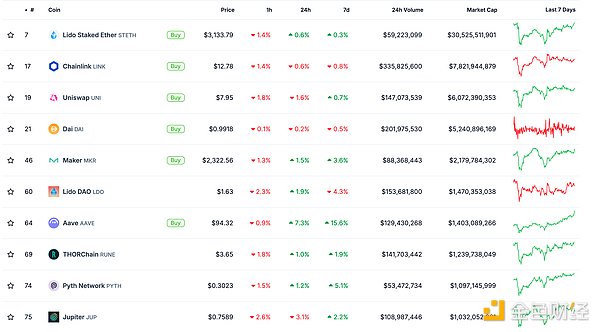

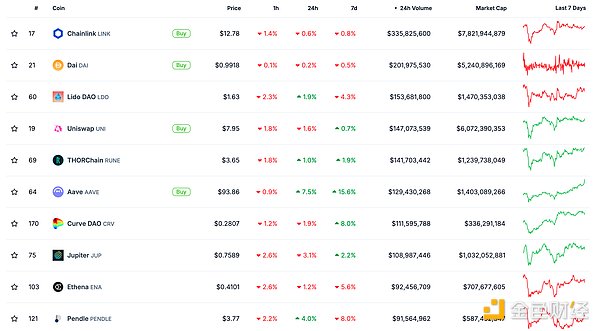

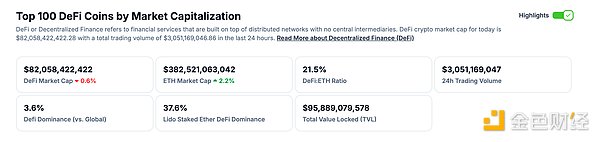

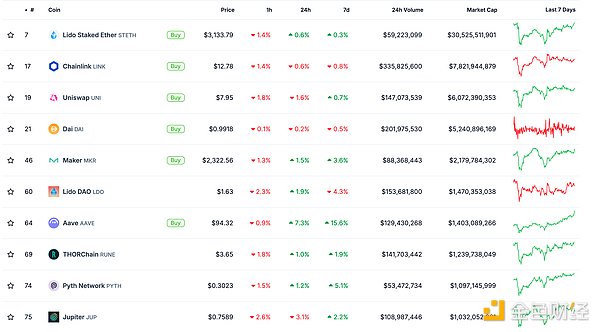

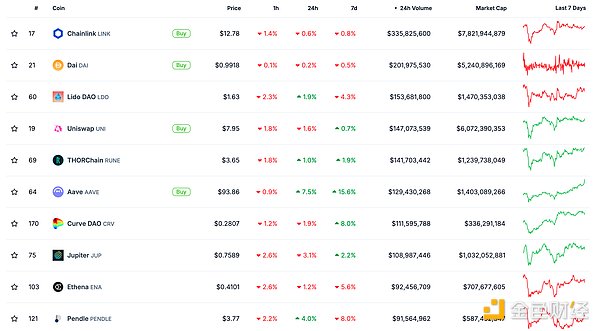

1. Total market value of DeFi tokens: 82.058 billion US dollars

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was 3.049 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

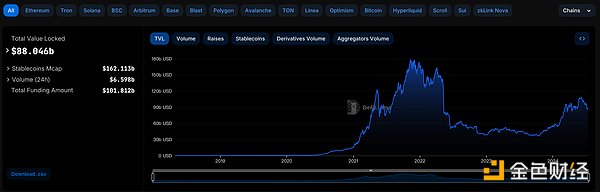

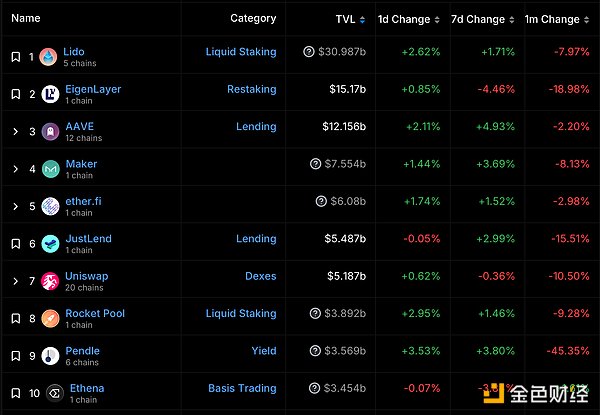

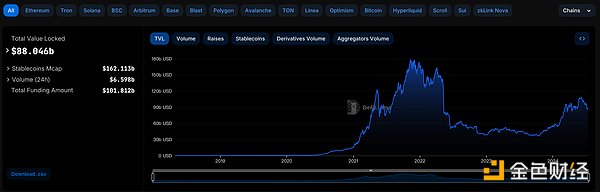

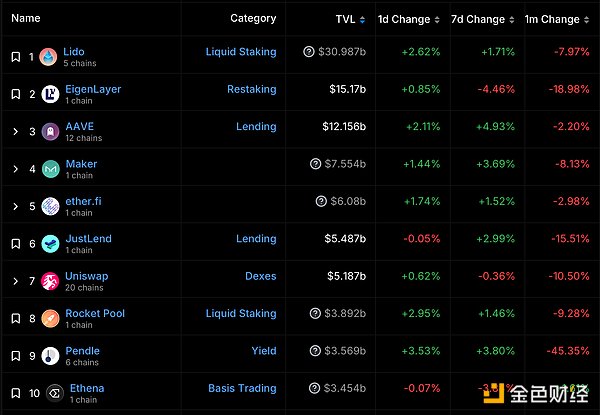

3. Assets locked in DeFi: 88.046 billion US dollars

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

NFT data

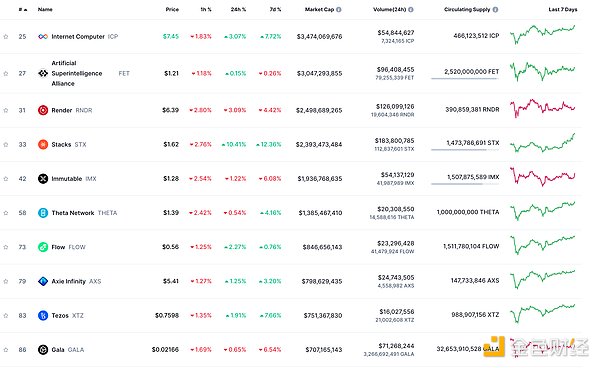

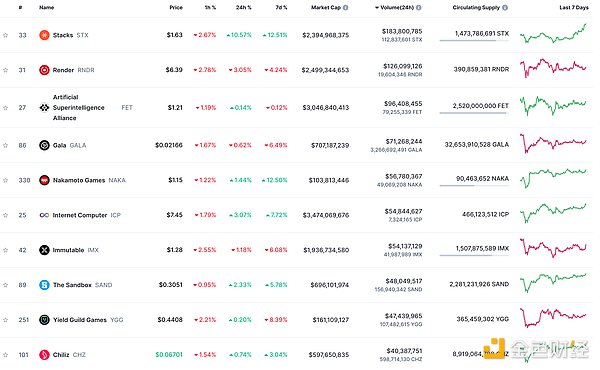

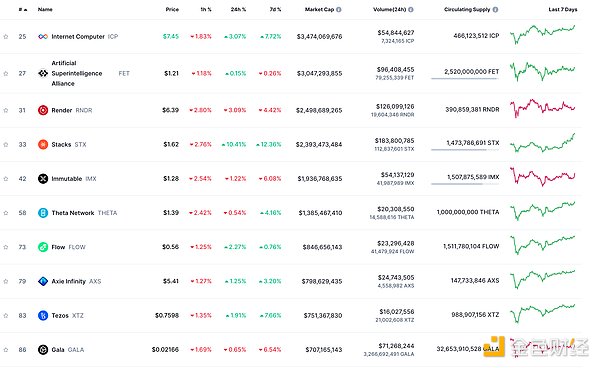

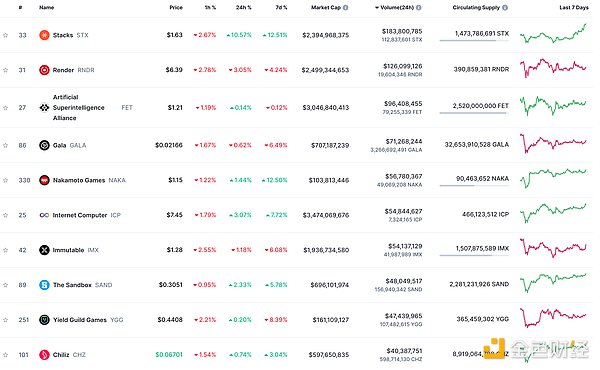

1. Total market value of NFT: US$32.026 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 1.726 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

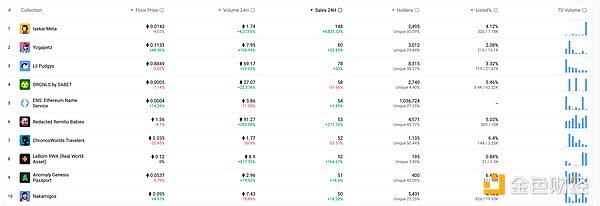

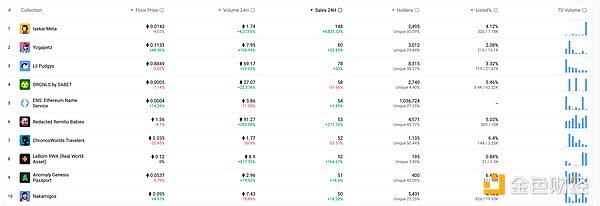

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales volume in 24 hours. Data source: NFTGO

Headlines

Market news: CZ may be released soon

Golden Finance reported that according to market news, former Binance CEO CZ will be released and return soon.

DeFi Hotspots

1.DWF Labs announced a strategic partnership with well-known singer Iggy Azalea

Golden Finance reported that DWFLabs announced its latest strategic partnership with well-known singer Iggy Azalea, committed to supporting innovative projects in the Web3 field.

2.Lido community pledge module testnet is now open

Golden Finance reported that Lido announced that its community pledge module testnet is now completely permissionless and open to everyone.

3. Ethereum liquidity re-pledge agreement TVL is currently $11.578 billion

Golden Finance reported that DefiLlama data showed that Ethereum liquidity re-pledge agreement TVL is currently $11.578 billion, of which the top five agreements by TVL are:

-ether.fi TVL is $5.663 billion, with a 7-day increase of -3.04%;

-Renzo TVL is $1.723 billion, with a 7-day increase of -9.35%;

-Puffer Finance TVL is $1.542 billion, with a 7-day increase of -3.69%;

-Kelp DAO TVL is $799 million, with a 7-day increase of -15.91%;

-Eigenpie TVL is $761 million, with a 7-day increase of -15.91%; The daily increase was -5.73%.

4. Stablecoin trading volume on centralized exchanges hit a 7-month low in June

On July 11, the stablecoin trading volume on centralized exchanges fell to a seven-month low in June, falling to $97 billion, a decrease of 18%. Despite the decline in trading volume, the total market value of stablecoins increased by 0.53% to $161 billion, the highest level since April 2022, although the growth rate has slowed since May. The market share of stablecoins rose from 6.22% in May to 6.83% in June. USDT dominated with a market share of 70%, and other stablecoins such as Ethena's USDe also achieved significant growth. The overall slowdown in trading volume reflects broader market uncertainty.

5. Stablecoin protocol Usual launches mainnet

On July 11, the stablecoin protocol Usual announced that its mainnet has been officially launched, and the points activity has been launched simultaneously. Early participating users can obtain more points Usual Pills by providing liquidity or by minting and holding USD0++. With these points, they can obtain USUAL tokens during the airdrop. It is reported that Usual is a stablecoin protocol. The USD it launched is a permissionless and fully compliant stablecoin supported by real-world assets (RWA) 1:1, and USUAL is the governance token of the project.

6. Mantle v2 Sepolia test network v1.0.1 has been successfully upgraded

Golden Finance reported that Mantle Network v2 Sepolia test network v1.0.1 has successfully completed the hard fork upgrade. Officials said that Sepolia node operators must upgrade, otherwise the nodes will not be available.

Game hot spots

1. Camp Network launches test network games

On July 11, Web3 user identity layer Camp Network announced that it had launched a self-developed test network game on July 2. When users complete a series of tasks through the platform, they can get the test network's unique token NUT as a reward. The tokens obtained can be used as points for the coin toss game, providing a differentiated experience by adding gamification elements in the testnet environment.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase risk awareness.

Kikyo

Kikyo