"Each structured product has its own market conditions that are suitable for it, so how to choose is crucial."

Volatility is an inherent attribute of the market, which brings opportunities and risks to traders.

As the uncertainty of the global economic environment increases,traders’ demand for structured products is gradually shifting from pure pursuit of returns to risk management and diversified configurations, while requirements for product transparency and liquidity are also increasing. In particular, they pay more attention to asset allocation and risk management, and avoid blind following the trend and speculation. For example, after the 2008 financial crisis, risk management awareness increased significantly around the world. The survey shows that in 2023, more than 70% of traders will consider risk management strategies when making investment decisions, while this proportion was only 40% in 2000.

How to find a balance between risk and return as much as possible has become a common thought among participants such as traders and financial platforms. Snowball products have attracted widespread attention in the financial market due to their flexible design, diversified returns and certain risk control mechanisms. Snowball products are structured products linked to market performance. They usually have trigger mechanisms and conditional returns. Traders can obtain predetermined returns or protect principal when certain conditions are met. In the past5years, the global snowball product market has maintained steady growth.

In addition to the traditional financial field, Snowball products are also popular in the emerging crypto market. In order to better respond to and meet the diverse needs of users. OKXFollowing the launch of Snowball, Tunbi Snowball has now been launched to help users trade crypto assets of their choice and earn profits in the rising market. Especially, for many users who hold BTCandETH and are still bullish on them in the future , which can meet the needs of holding currency and achieve diversified income at the same time.

Tuen Coin Snowball

< strong>Currently, theOKXTuen Coin Snowball supports bullishBTC, and bullish ETH 2ways to trade.

Users only need to invest the principal, with zero additional fees. In addition, you can also customize the subscription period, subscription amount, subscription targets, etc. Among them, the starting investment amount of BullBTC product is as low as0.0004BTC, and Bullish strong>ETHThe starting investment quantity of the product is as low as0.005 ETH, the threshold for participation is very low, and it is very friendly to the majority of users. In addition, OKX Tuen Coin Snowball can realize three possible profit scenarios: early profit taking, maximum profit and early warning.

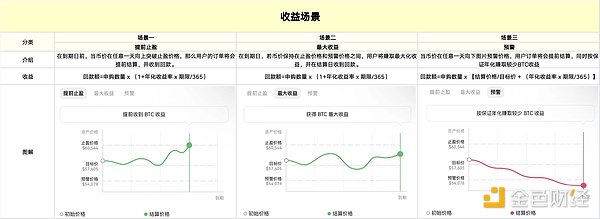

Before introducing three possible revenue scenarios, let us first help novice users quickly understand the Snowball product. To put it simply, bullish snowball products generally set a price range around the target: the lower limit of the range is the warning price, and the upper limit of the range is the take-profit price. Then, before the expiration date, the target price fluctuates in this range. From this, three core scenarios emerged.

p>

Generally speaking, in both scenario one and scenario two, users can earn profits while ensuring their principal.But in scenario three, users The repayment amount may be lower than the subscription amount, and the guaranteed annualized income may not be able to make up for the loss. At the same time, in extreme cases, the settlement price may be far lower than the warning price.

In addition to the zero additional fees and low starting investment threshold mentioned above, OKX Tunbi Snowball also has many core highlights. First, there is no need for currency conversion, that is, no matter whether you invest BTC or ETH, the currency you get back remains unchanged. . Second, daily early profit taking opportunities, i.e. OKXOKXwill observe the profit taking price every day and keep up with market trends. Third, it provides a protection mechanism for currency price drops, that is, if the currency price does not break through the warning price, users will continue to earn profits. If the currency price exceeds the warning price, the order will be settled on the same day.

SnowballVSTuen Coin Snowball< /h2>

Compared to OKX Tunbi Snowball, OKX’s original Snowball product provides bearish options and has a higher annualized rate, but the user’s principal may be converted As a stable currency.

However, considering that many users prefer to hold BTCorETHinstead of a stablecoin, and at the same time bullish on the underlying assets, while the original Snowball does not supportBTC,ETHThe currency standard is bullish. In order to fully meet the diversified needs of different users, OKXOKX has now added Tun Coin Snowball to support users Coin-based bullish demand usingBTC,ETH.

It is particularly worth noting that OKXTuen Coin Snowball is in In a loss scenario, it is better for the user to terminate the transaction immediately upon knocking in because the funds are returned to the user on the same day and the user does not have to wait until the end of the product.

Sponsored Business Content

In short, OKX Tunbi Snowball and the original Snowball products have their own advantages and disadvantages, and users can choose according to their own needs. Each structured product has its own market conditions, so how to choose is crucial.

Tutorial Strategy

How to use OKX Tun Coin Snowball ? The steps are very simple:

1) Open OKX App, select [Finance]-[Earn Coins >]-[Structured Products]-[Tuen Coin Snowball]

2) Taking a bullish view on BTC For example, select your favorite product based on different reference annualizations and periods, and click [Next] to enter the subscription page. Enter the [Subscription Quantity], click [Subscription], and complete [Confirm] to successfully subscribe

3) Notes on the use of Tunbi Snowball: Tunbi Snowball is not a principal-guaranteed product. As the market fluctuates, subscriptions for Tunbi Snowball will face three settlement situations (Profit stop in advance , maximum benefit and early warning). When in the early warning situation, you may suffer some losses, as shown in the figure below

Innovation continues

Market fluctuations are unpredictable. Users can use derivatives in structured products to hedge specific market risks, such as interest rate risks and asset price risks. Through refined risk management strategies, traders can Get a certain amount of income while protecting your principal as much as possible.

Structured products are an innovative financial instrument in the financial market. They are designed to meet the specific risk and return needs of users by combining underlying assets and derivatives. , and increase the trading volume and liquidity of the market, promoting market activity. In particular, structured products with good liquidity can serve as important trading tools in the market and improve market efficiency. Since their emergence, structured products have occupied an important position in the financial sector due to their flexibility and diversity.

As the world's leading cryptocurrency trading platform and Web3 technology company, OKX's structured products are in a leading position in the market, and it has successively launched Dual Currency Win and Seagull , shark fin, snowball, coin snowball, etc. In the ever-changing cryptocurrency market, user needs continue to evolve, driving the pace of platform optimization and innovation. OKX is committed to continuously optimizing products and services through technological innovation to meet the diverse and dynamically changing needs of users.

In addition, through technological innovation, OKX not only improves the performance and security of the trading platform, but also meets users' needs for diversified products and high-quality user experience. In the ever-changing cryptocurrency market, OKX strives to ensure that every transaction made by users on the platform is safe, convenient and efficient.

Continuously meeting the needs of a wider range of users will become the key to the scale of trading platforms and even the encryption industry.

Disclaimer

The content of this article is for reference only. This article only represents the author's views and does not represent OKX's position. This article is not intended to provide (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets, including stablecoins and NFTs, involves a high degree of risk and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professional regarding your specific situation. Please be responsible for understanding and complying with applicable local laws and regulations.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Davin

Davin TheBlock

TheBlock Crypto Briefing

Crypto Briefing Cointelegraph

Cointelegraph