Author: Will Ogden Moore, Grayscale; Compiler: Deng Tong, Golden Finance

Abstract

With the approval of a US spot Bitcoin ETF and the upcoming halving in April, all eyes are on Bitcoin. As the deadline for the U.S. Securities and Exchange Commission (SEC) to make a decision on a spot Ethereum ETF approaches in May 2024, we may see the second largest crypto asset: Ethereum take center stage.

Ethereum’s Dencun upgrade is scheduled for March 13, 2024, which is a big step forward that can help Ethereum compete with Ethereum in terms of scalability. Smart contract platforms compete with faster chains in the crypto space such as Solana.

Grayscale Research believes that the favorable factors for ETH include: (1) upcoming upgrade, (2) net deflationary supply, (3) network revenue generation ($2 billion in 2023), (4) the SEC’s May decision on spot Ethereum ETFs, and (5) increasing use cases for leasing security features of the Ethereum network.

In 2009, Bitcoin gave birth to the crypto industry and created the first public blockchain. In 2015, Ethereum applied the concepts of public blockchains to smart contracts, essentially creating an entirely new category within the crypto asset class with a completely different use case than Bitcoin - the smart contract platform crypto space. Ethereum can be considered a decentralized version of Apple’s App Store, as it provides the underlying platform for a variety of applications. These decentralized applications (called “dApps”) range from games or identity protocols to digital artwork and tokenization of stablecoins and financial assets[1].

Today, Ethereum is the leading smart contract platform in terms of market capitalization and many fundamental metrics. That said, Ethereum is facing increasing competition. Ethereum’s performance in 2023 (+90%) lags behind that of the broader smart contract platform crypto industry (+110%) [2] and underperforms certain industry competitors such as Solana (+916%) and AVAX (+255%). [3] Grayscale Research believes that this indicates that Ethereum is going through the well-known “adolescence phase”. With Ethereum scheduled for the Dencun[4] upgrade in March, Ethereum is on the cusp of “growing up” through key transformations designed to address its scalability challenges. We believe recent price performance reflects market expectations for this upgrade, as Ethereum (up 26% year-to-date) has outperformed the broader market since January 1, 2024 smart contract platform industry (up 3% year-to-date). [5]

In this article, we will analyze in detail 1) Ethereum’s current situation and its competitive position in the field of smart contract platform cryptocurrencies, 2) Ethereum’s forward-looking vision and solutions to challenges key catalysts, and 3) tailwinds, opportunities and other challenges ahead.

Competitive positioning: Ethereum benefits from network effects and value accumulation

Figure 1: Ethereum dominates in fees and total value locked (TVL), but transaction volume lags

Source: Artemis and Dapp Radar, data as of February 1, 2024. Daily address and transaction data are averages from January 2024.

Ethereum benefits from its first-mover advantage. Across most fundamental metrics, Ethereum leads all other metrics in the smart contract platform cryptocurrency space.

Ethereum benefits from significant network effects. As shown in Figure 1, Ethereum leads in terms of number of developers (306 per week) and total number of applications (4,400 total dApps), setting the stage for application interoperability and innovation Provides a powerful environment. Ethereum dominates with $45.9 billion in TVL, a key metric of ecosystem liquidity, which is more than 5x that of its next closest competitor. The advantages of network effects and liquidity make Ethereum particularly well-positioned to attract new financial applications and developers.

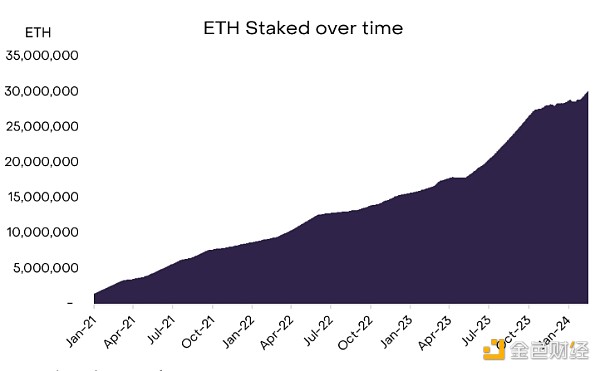

At the same time, Ethereum can be said to be one of the few crypto asset classes that can achieve value appreciation. One of the agreements. The Ethereum network was designed to be expensive, which is why it will be able to generate just over $2 billion in network revenue by 2023. By comparison, Solana generated just $1.2 billion in revenue during the same period (Figure 1). Ethereum network revenue consists of two components: tips and base fees. Offer tips as rewards to stakeholders who help keep your network secure. At the same time, base fees are “burned,” effectively removing supply (and potential selling pressure) from the network. Due to this burning mechanism, ETH supply has been in a net deflationary state since the “merger” in late 2022 (Figure 2). In this way, the use of the Ethereum network and its high fees creates a flywheel that both drives the value of ETH and incentivizes higher levels of network security. To date, this flywheel has helped solidify Ethereum’s position as the most secure[6] and most trusted smart contract platform, as well as the largest market capitalization.

Figure 2: Ethereum supply is in net deflation since the "merger"; ETH appreciation

Ethereum’s revenue, security, liquidity, and network effects contribute to the asset’s unique positioning within its industry.

This begs the question: If Ethereum performs well on so many different metrics It's performing well, so why is its price performance in 2023 being outperformed by its competitors?

In grayscale studies, We believe that this difference is significant This is because Ethereum is still in its “adolescence”. Currently, Ethereum’s performance is hampered by slow transaction speeds, low throughput, and high user costs. As of February 22, the average transaction fee on Ethereum was $2.3, making it significantly more expensive compared to alternatives like Solana. This may drive end users to other chains (see Figure 3 below). However, the Ethereum community has a plan. Core developers are working hard to implement "Ethereum 2.0" with a series of upgrades to address these user cost and scalability issues. With each upgrade, Ethereum effectively “grows” and continues to close its throughput and cost gap.

Figure 3: Ethereum and Solana offer fundamentally different models and different trade-offs, and both are constantly evolving

< img src="https://img.jinse.cn/7181756_watermarknone.png" title="7181756" alt="3kPalDmDNqDiJKSEEx2tdKjlS3SRqmd0pUQgAMuG.jpeg">

Source: Artemis, Messari. Daily trading volume is average for January 2024. Market capitalization and transaction cost data are as of February 20, 2024.

Brief Overview: Solving Scalability Challenges with the ETH 2.0 Vision

Now that we have Knowing Ethereum’s competitive positioning, it’s worth exploring its vision for the future.

Ethereum aims to be the most secure and scalable settlement layer for dApps built on its network. "Ethereum 2.0" has plans to address scalability challenges by dividing the network into specialized parts, such as processing transactions, storing transactions data or ensure all transactions are valid. This “modular” approach allows for targeted innovation and updates in one area of the Ethereum network without disrupting the entire network, allowing the network to solve its scalability challenges while maintaining network security.

This decision to "decompose" the network into specialized parts spawned a series of independent projects, including Layer 2 such as Optimism (OP) and Arbitrum (ARB), as well as Celestia and other data availability solutions (more on this later). These standalone products could spur greater competition and innovation, potentially solving scalability challenges and enhancing the larger Ethereum ecosystem. Ethereum's "modular" model contrasts with the "integrated" model used by competitors such as Solana, which combines all aspects of network operations (transaction processing, data storage and consensus mechanisms) into a simplified layer (i.e. " Layer 1"). ”).

In the multi-step Ethereum 2.0 roadmap, Ethereum has already moved to “Proof of Stake” in September 2022 through its upgraded technical feat called “The Merge” ( proof-of-stake). It sees early signs of success with Layer 2 scaling solutions in 2023. The next milestone in that roadmap is the Dencun upgrade (also known as EIP-4844), which will enable Ethereum Layer 2 Transactions become cheaper and bring Ethereum one step closer to its ultimate goal.

Layer 2 Progress Provides early validation of Ethereum's approach

The introduction of Layer 2 is a substantial step forward in the process of improving Ethereum's scalability. Ethereum's shift to a "modular" model will Its transaction execution is separated from transaction settlement, which allows activity to occur "off-chain" or at Layer 2 outside of the Ethereum mainnet. These Layer 2s process transactions, "batch" them together, and then send compressed versions back to the mainnet network Ethereum for settlement (see Figure 4 for a visual representation). Due to this batch process, Layer 2 can provide users with significantly higher throughput and lower costs than transactions performed on the main chain, while still relying on Ethereum The strength of Ethereum and its network security.

Figure 4: Ethereum architecture diagram

Based on Delphi Digital Graphic.

Initial progress is encouraging. Today, Ethereum Layer 2 Attracting liquidity comparable to some of Ethereum’s largest Layer 1 competitors. As of February 20, 2024, Arbitrum alone leads most Layer 1s with $3 billion in TVL, including Solana, Avalanche, and Polygon (Figure 1). In addition, Layer 2 also helps new users enter the Ethereum ecosystem. As shown in Figure 5 below, while the number of daily users of the Ethereum mainnet remains stable in 2023, the number of daily users of Ethereum Layer 2 (such as zkSync, Arbitrum, Optimism, and Coinbase’s BASE) continues to grow.

We believe that the continued appeal of Ethereum Layer 2 may be a tailwind. The growth of Layer 2 provides early validation of its scaling approach as new users in the ecosystem turn to faster and cheaper scaling solutions. We believe the development of ZK Rollups, a new Layer 2 leveraging zero-knowledge proofs, can particularly facilitate efforts to improve throughput. Still, rival blockchains are not going away, as Solana’s surge in new users in late December showed (Figure 5).

Figure 5: The continuous growth of Ethereum Layer 2 daily addresses illustrates the scaling model

Sponsored Business Content

Next step: Ethereum "grows" and will undergo Dencun upgrade

But Layer 2 is just a starting point. While transacting outside of the Ethereum mainnet has helped users reduce transaction fees by a factor of 10 (Figure 6), Layer 2 costs are still much higher than Ethereum competitors such as Solana and Near (Figure 6). This is primarily due to data fees, as 80% of Layer 2 transaction costs come from publishing transaction data (called calldata) to the Ethereum mainnet. [7] At the same time, data availability solutions like Celestia offer the potential to slash Layer 2 costs (estimated to be around 99% of data costs [8] ), potentially taking away Ethereum’s value accretion.

That’s where the upcoming Dencun upgrade coming in March comes in. This upgrade will provide designated storage space on Ethereum for Layer 2 scaling solutions, reducing their data costs and thereby increasing profits . While it's unclear how much this will reduce transaction costs for Layer 2 end-users when implemented, some estimate it will be by more than 20 times. [9] If all goes as planned, this upgrade may help further narrow the gap between Layer 2 players such as Optimism ($0.23) and Arbitrum ($0.21) and Solana ($0.001), and potentially triple Layer 2 operating profits [10], perhaps alleviating concerns that Layer 2 may look elsewhere for data availability services (Figure 6).

Figure 6: Alternative Layer 1 provides cheaper transaction costs than Ethereum and its L2

Future opportunities and challenges

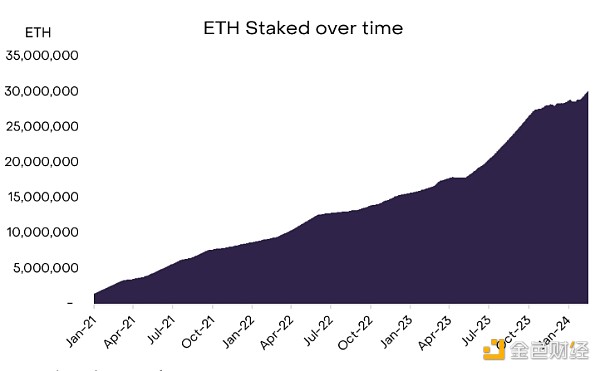

Although Ethereum’s long-term roadmap Technical improvements have primarily focused on improving its relative weaknesses, but it’s also important for Ethereum to double down on its strengths. Ethereum has been regarded as the most secure smart contract settlement network[11], and by 2023, the total amount of staked ETH has increased by 83%. [12] This has increased its resistance to potential cyberattacks and increased its “security budget” to a total of $82 billion (Figure 7). We believe this is primarily driven by demand for passive income in the form of ETH staking rewards and the growth of liquid staking derivatives. However, Ethereum will need to address the centralization of staked ETH in liquid staking provider Lido (as of February 20, staked ETH accounts for 35% of total staked ETH). [13]

In the future, Ethereum’s “security as a service” model can Expand to other networks such as bridges or oracle networks to significantly enhance the blockchain ecosystem. Innovations like EigenLayer, which introduces the concept of rehypothecation, may play a key role in furthering this vision. EigenLayer adds value to Ethereum by diversifying its utility and strengthening its position as a foundational security layer for the broader crypto ecosystem. As of February 20, EigenLayer has attracted $7.6 billion in ETH re-staking. [14]

Figure 7: In 2023, Ethereum network security experienced a compounding effect due to increases in staked ETH and ETH price.

We believe that Ether Fang will continue to face increasingly fierce competition from a wider range of fields such as smart contract platforms. To some extent, this seems inevitable because cryptocurrency incentives solve the cold-start problem [15] and encourage new innovations and design choices. To some extent, this is structural, as Ethereum’s modular design provides a fundamentally different model than other integrated chains such as Solana. These results present different trade-offs for developers and users to consider (Figure 8 below).

When Ethereum matures, the smart contract platform cryptocurrency industry may not be a winner-take-all market. If Ethereum can maintain its position as the most trustworthy chain, perhaps it won’t need to overtake but simply compete with faster chains in terms of scalability. If Ethereum can become more competitive in terms of throughput and cost, it could position itself to capture smart contract applications that require high levels of security and censorship resistance, such as stablecoins or tokenized financial assets, even if Lower-cost chains capture more retail-friendly use cases, such as non-fungible tokens (NFTs).

Figure 8: Trade-off analysis of modular chain and integrated chain

Conclusion

Ethereum is at a critical moment, about to emerge from adolescence and enter maturity. This upgrade, along with the broader Ethereum 2.0 plan, marks an important milestone in Ethereum’s journey to become a more scalable, efficient and user-friendly platform. Despite increasing conflicts with competitors, Ethereum faces many headwinds, including network effects and billions of dollars in network revenue, the Dencun upgrade, a thriving Layer 2 ecosystem, and continued Increased security budget use case. Additionally, the potential of an Ethereum ETF spot could bring ETH as an asset further into the consciousness of institutions and the public at large.

We believe that Ethereum is entering a new era. With its “modular” design decision, Ethereum no longer looks inward but opens outward, welcoming outsiders to provide new product ideas and expertise, expressing its values of collaboration, competition, and innovation. Finally, “Ethereum 2.0” embodies an optimistic outlook that today’s technological challenges may also represent tomorrow’s opportunities. While the future remains uncertain, we believe the Ethereum ecosystem remains well-positioned to solidify its position as the preeminent smart contract platform.

Reference materials

[1] Refers to the process of converting the rights of an asset into digital tokens on the blockchain, promoting its ownership, Transfers and Transactions.

[2] Based on the performance of the FTSE Grayscale Crypto Industry Index Series.

[3] Artemis and Bloomberg.

[4] Dencun is a compound word of Deneb (the upgrade of the Ethereum consensus layer) and Cancun (the upgrade of the execution layer).

[5] Based on the performance of the FTSE Grayscale Crypto Industry Index Series. Artemis and Bloomberg, data from January 1, 2024 to February 13, 2024.

[6] The most secure, as it requires the most monetary resources to attempt to control the network (see the Staking ETH section later in this article).

[8] Celestia.org.

[9] oplabs.co.

[10] Artemis.

[11] With the largest number of native currencies staked in the proof-of-stake smart contract platform, Ethereum will spend the most money trying to disrupt the operation of the network.

[12] Glassnode.

[13] Glassnode.

[14] Defi Llama.

[15] The cold start problem for a startup refers to the initial challenge of gaining traction and establishing a user base or market presence without existing customers or data.

Huang Bo

Huang Bo