Author: Michael Zhao; Compiler: Block unicorn

Bitcoin has historically exhibited cyclical behavior, with distinct "bull" and "bear" phases.

The current bull cycle in Bitcoin appears to be driven by a combination of technical drivers, such as inflows into spot Bitcoin ETFs, as well as strong fundamentals such as increased inflows of stablecoins and growth in total value locked (TVL) in DeFi applications.

Bitcoin's cyclical indicators suggest that we are currently in the middle of a bull market (probably around the fifth inning to use a baseball analogy), and there is still room for continued growth based on current trends.

Given a series of positive fundamental developments, the bull run is likely to continue. However, investors may want to remain vigilant by monitoring Bitcoin spot ETF flows and macroeconomic indicators for signs of a market shift.

Are We in a Bull Market?

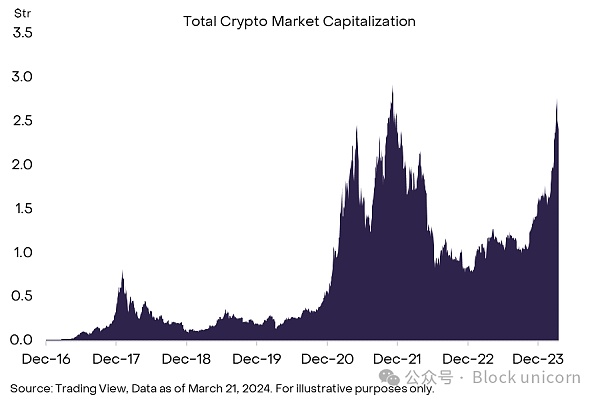

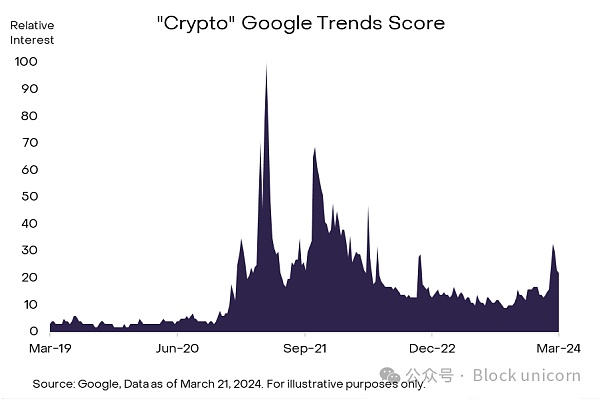

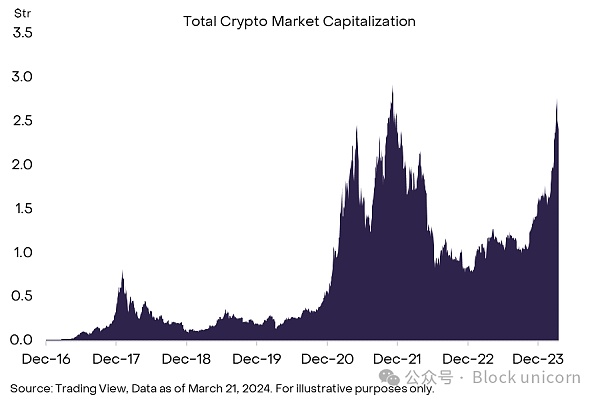

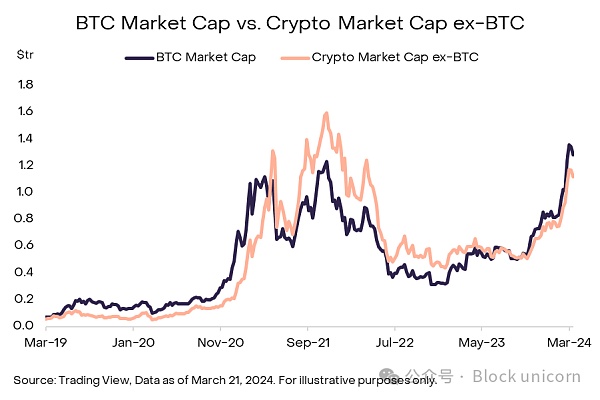

Over the past month, Bitcoin prices have surged rapidly in the U.S., breaking through multiple all-time highs, rebounding rapidly from the 2023 lows. In more than 30 currency pairs, Bitcoin even reached new all-time highs earlier. This recovery has attracted the attention of the news media, with reports on Bitcoin's price action appearing every day. But it doesn't seem to stop there: traditional investment managers have even begun analyzing meme coins in their research notes - historically a clear sign of growing mainstream attention to cryptocurrencies. With the overall cryptocurrency market capitalization approaching all-time highs (Chart 1), we must ask ourselves: are we witnessing the beginning of a new bull market?

Chart 1: Total cryptocurrency market capitalization near record high

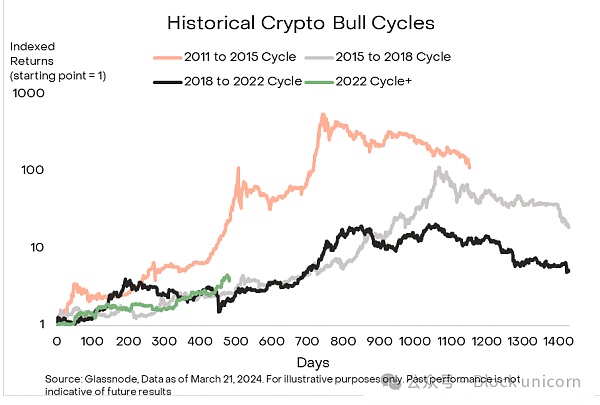

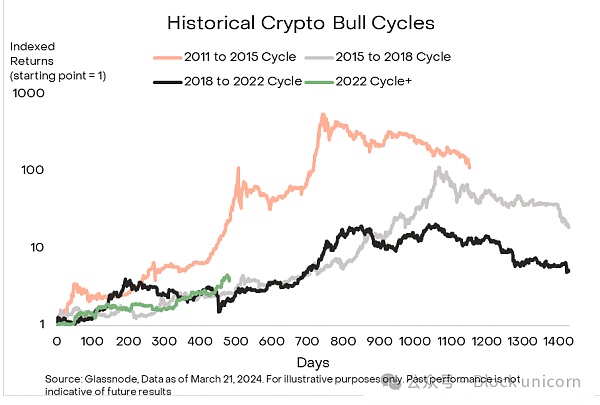

First, let's clarify what we mean by a bull market. Although an exact definition can be difficult, a practical approach is to view a bull market as a cycle of approximately three to four years that begins from the lowest price point of the previous cycle (Chart 2). Typically, these cycles are characterized by a gradual rise in prices that peaks at a cycle high, followed by a period of stability or small decline

Chart 2: Cryptocurrency bull market cycle visualization

Identifying the elements of a bull market can be challenging: what factors have driven us to this point? What can we expect in terms of duration and sustainability?

Leading the Way: Bitcoin’s Growing Dominance

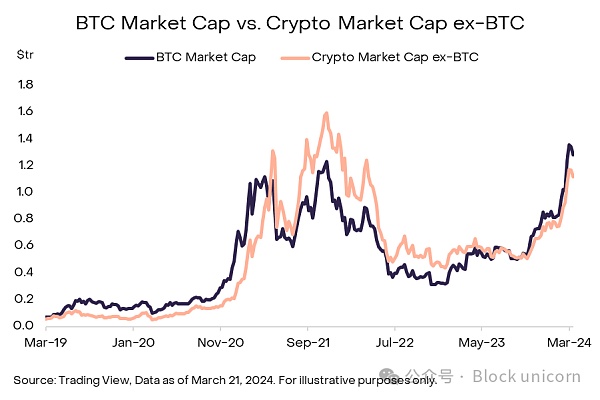

Historically, the beginning of a cryptocurrency bull market has often been marked by a surge in Bitcoin’s “dominance,” or the ratio of Bitcoin’s market capitalization to the total cryptocurrency market. This trend underscores Bitcoin’s role as a leading indicator for the broader crypto market. Typically, Bitcoin’s gains precede broader gains in altcoins. Investors, encouraged by Bitcoin profits, may venture into riskier cryptocurrencies in search of greater returns. This dynamic can be observed during the 2021-2022 bull run, during which Bitcoin’s gains quickly led to a sharp rise in altcoin valuations (Chart 3).

Chart 3: Bitcoin’s gains often precede those of altcoins

While the current cycle presents a familiar pattern of Bitcoin’s growing dominance paving the way for altcoin rallies, the distinguishing factor of this cycle lies in its unique catalysts. As we have explored previously, key drivers such as Bitcoin spot ETF inflows and strengthening on-chain liquidity have not only contributed to the momentum of the current bull run, but also marked a departure from the traditional dynamics observed in previous cycles.

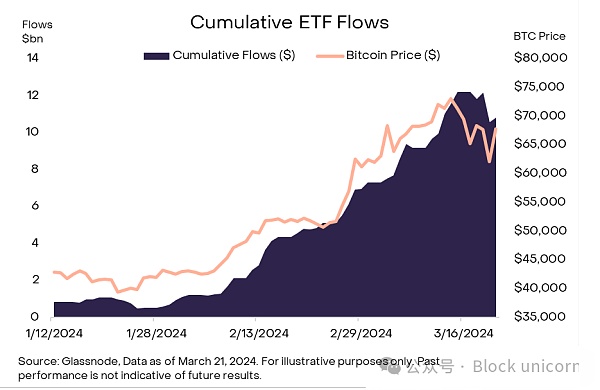

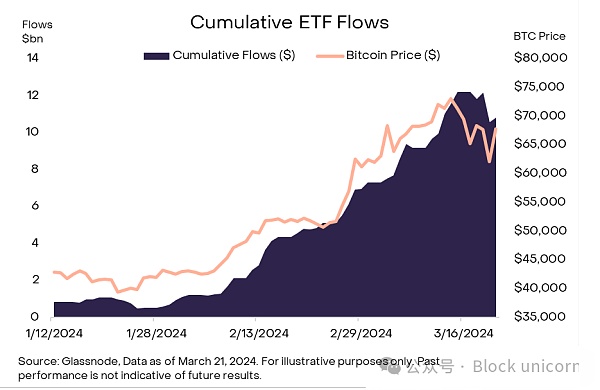

Catalyst #1: Bitcoin Spot ETF Inflows

The first difference in this bull run compared to previous bull runs is the rapid change in positive market dynamics, which is largely influenced by inflows into Bitcoin spot ETFs. Since the ETF was approved in January, these inflows have consistently exceeded Bitcoin issuance by more than 3 times as of mid-March, which has also put upward pressure on prices (Chart 4).

Chart 4: Bitcoin spot ETF cumulative inflows drive Bitcoin price higher

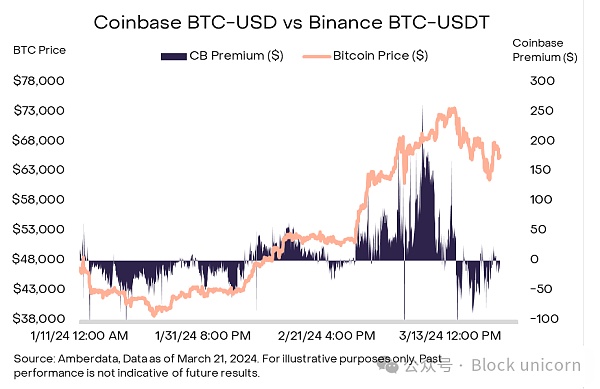

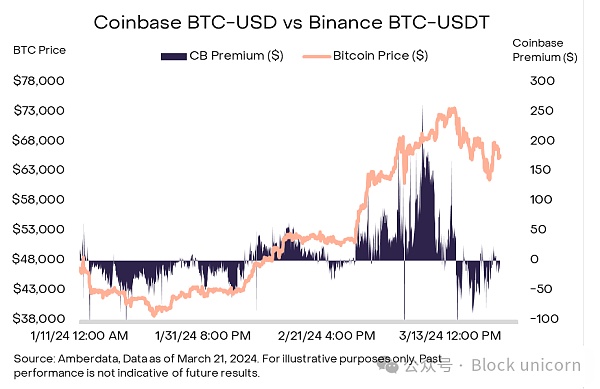

At a high level, when a Bitcoin spot ETF issues new shares, the ETF needs to procure Bitcoin from the spot market and deliver the Bitcoin to the fund. In other words, the issuance of new shares results in the need to purchase Bitcoin to match the increase in fund assets. In short, cash needs to be converted into Bitcoin to meet the demand for primary market issuance. This dynamic is evident when analyzing the hourly premium of Coinbase's BTC-USD to Binance's BTC-USDT (Chart 5). Coinbase's higher premium indicates increased spot buying pressure from U.S. investors, an indicator of the presence of ETFs in market dynamics.

Chart 5: Coinbase (CB) BTC-USD is trading at a premium to Binance BTC-USDT, indicating US buying pressure

Catalyst #2: Healthy On-Chain Fundamentals

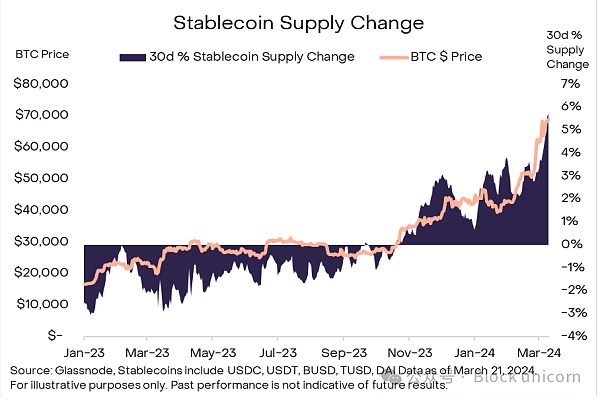

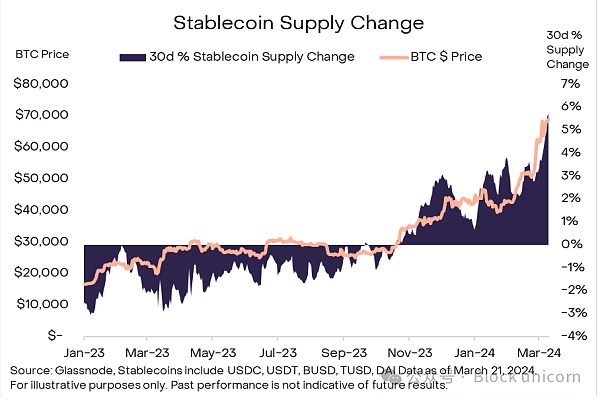

On-chain metrics also point to increasing liquidity. A key indicator of on-chain data is the positive shift in stablecoin inflows. Stablecoins, digital currencies pegged to a stable asset such as the U.S. dollar, play a vital role in the cryptocurrency ecosystem. They are designed to provide a stable medium of exchange and serve as the primary base currency pair for trading on most centralized and decentralized exchanges.

Increased stablecoin liquidity means more funds are available for trading, whether buying or selling cryptocurrencies. As indicated by the growing reserves of stablecoins on exchanges, the influx of stablecoin capital often drives bullish momentum (Chart 6).

Chart 6: Stablecoin inflows correlate with BTC price

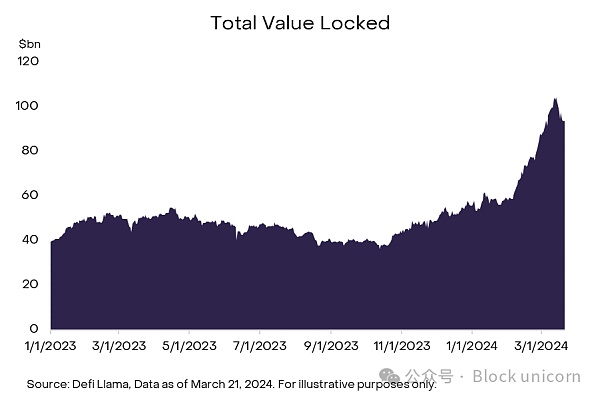

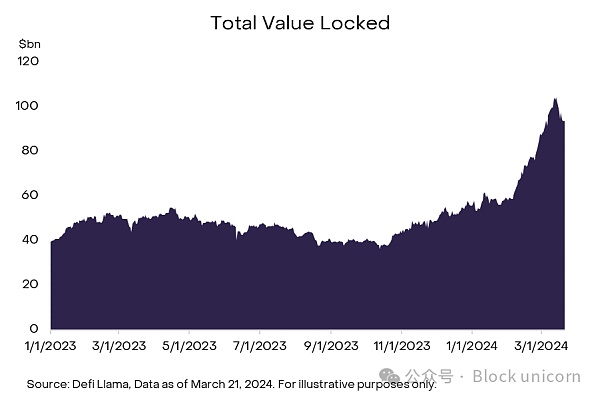

Relatedly, on-chain liquidity also appears to be growing substantially, as evidenced by the total value locked (TVL) in decentralized finance (DeFi) applications (Chart 7). TVL aggregates the total value of assets deposited in various DeFi protocols and serves as another metric for assessing ecosystem liquidity. The increase in TVL not only means greater liquidity within DeFi platforms, but also indicates growing user engagement with the ecosystem. Increased liquidity is critical to the vitality of DeFi, helping to facilitate smoother transactions and broader financial activities. Looking back at underlying on-chain activity, it’s notable that the TVL of decentralized applications has more than doubled since early 2023, when it was around $40 billion, to around $100 billion by mid-March 2024.

Chart 7: Total value locked in DeFi has more than doubled since 2023

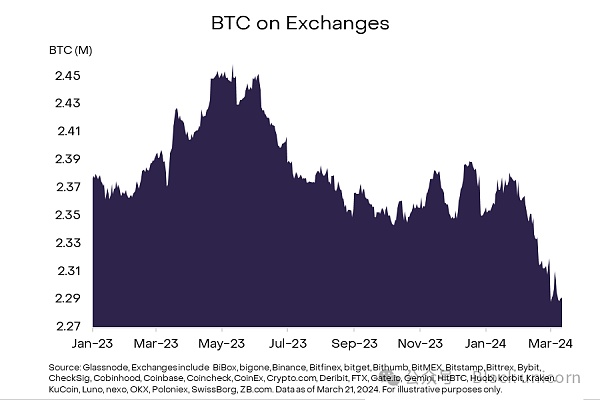

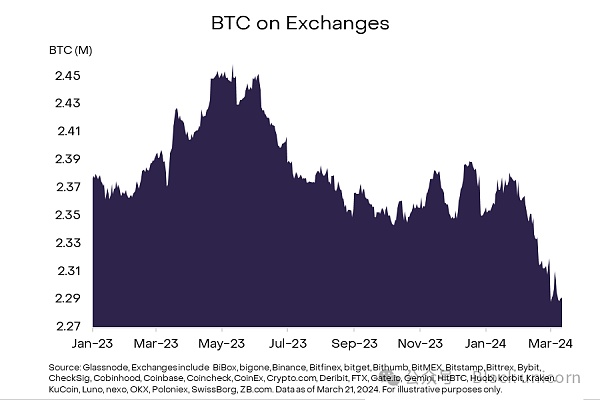

Furthermore, the amount of Bitcoin deposited on exchanges has fallen significantly by 7% since Bitcoin supply’s local peak in May 2023, suggesting supply tightness, in part due to Bitcoin spot ETFs moving BTC to custodial cold wallets for long-term storage (Chart 8). According to research from Glassnode, the total amount of BTC held on exchanges has shrunk to around 12% of the circulating supply, a five-year low. This movement away from exchanges is traditionally seen as a bullish indicator, indicating a preference for holding rather than selling, and investor confidence in the value of Bitcoin. As demand on exchanges gradually outstrips supply, the resulting liquidity crunch not only highlights the influence of these Bitcoin spot ETFs, but also reinforces the market’s bullish outlook for the cryptocurrency market.

Chart 8: Declining Bitcoin Supply on Exchanges

Entering the “Fifth Inning”

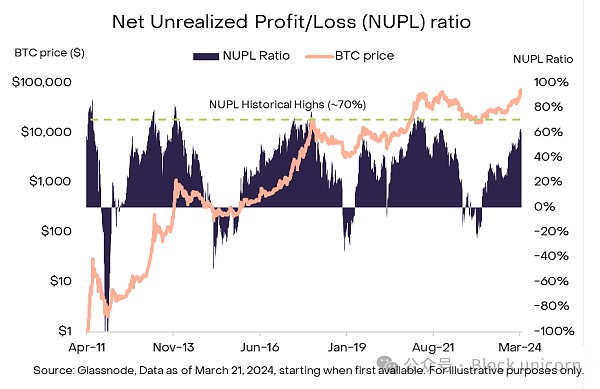

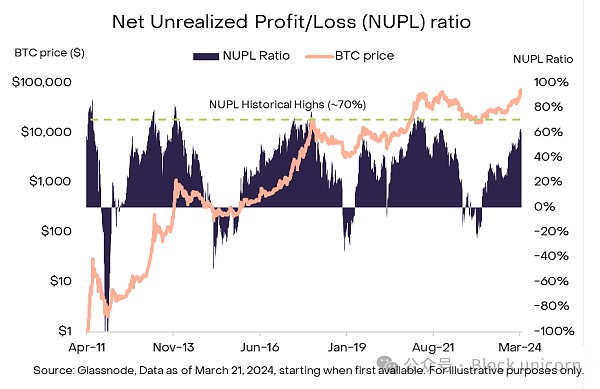

Now that we have identified the drivers of the bull run, we need to assess where we stand. While each cycle is inherently unique, established on-chain patterns and sentiment data lead us to believe that we are currently in the “mid-term” or “fifth inning” of the current bull cycle. Despite the progress that has been made, we believe there is still room to go. The Market Value vs. Realized Value + Unrealized Net Profit/Loss (MVRV) metric compares Bitcoin’s market value to the “realized value,” or the price of all Bitcoins when they last changed hands. Using this difference, the Unrealized Net Profit/Loss (NUPL) calculates the percentage of profit/loss by dividing the difference between market value and realized value by market value. The NUPL ratio rises when Bitcoin prices rise and investors who bought at a lower cost still hold onto their Bitcoin. As of mid-March 2024, the NUPL is around 60%, with historical peaks occurring at profit ratios above 70%, and it appears that we may be approaching a cycle high for this metric (Chart 9).

Chart 9: NUPL reaches historical cycle highs

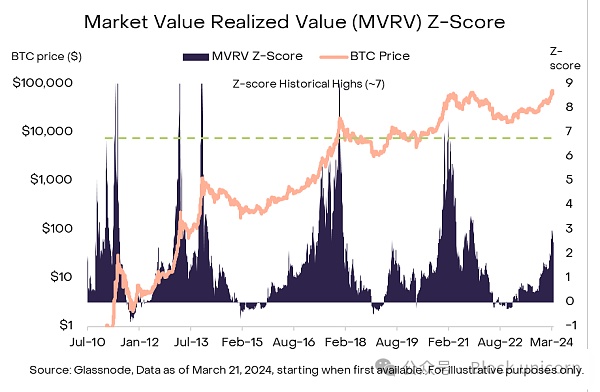

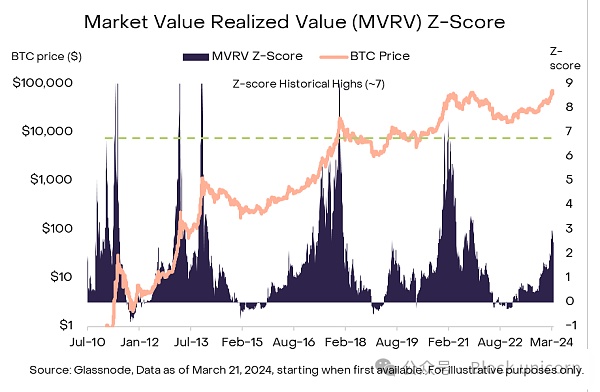

Market Value/Realized Value Z-Score

In contrast, the Market Value/Realized Value Z-Score provides a different perspective, indicating the potential for further growth. This indicator calculates the difference between market value and realized value and adjusts volatility based on the rolling standard deviation of market value. Historically, high Z-scores reflect large gaps between market value and realized value, marking cycle peaks. Currently, the Z-score is around 3, well below the levels of previous cycle peaks, suggesting that the market has considerable room to rise (Chart 10).

Chart 10: Z-scores of market cap/realized value suggest we are not near the peak of the bull run

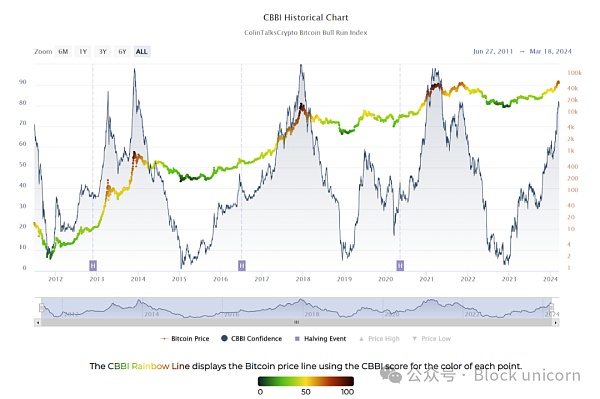

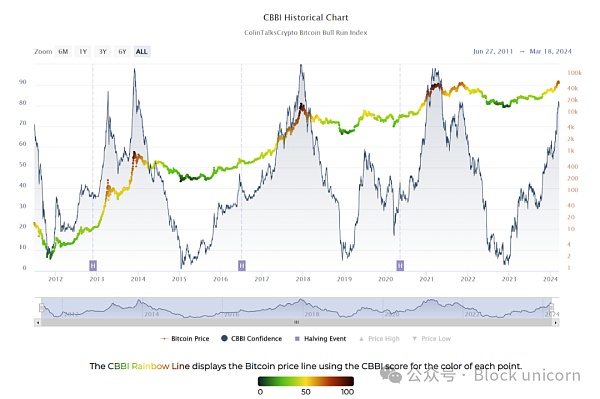

ColinTalksCrypto’s Bitcoin Bull Index

From a broader perspective, ColinTalksCrypto’s Bitcoin Bull Index (CBBI) provides a broader perspective by combining nine different ratios and converting them into a single value to measure the progress of Bitcoin’s bull market phase (Chart 11). These ratios cover a variety of values, including Bitcoin’s price relative to its historical performance, on-chain indicators that reflect investor behavior, and broader market sentiment indicators. By integrating data from sources such as the Z-score of market capitalization/realized value, the Puell Multiple Index, and the RHODL ratio, the CBBI aims to provide a snapshot of broad market conditions. As of mid-March 2024, the CBBI sits at 79 out of 100, suggesting that we are approaching the peak of the cycle, although the market still has the potential to rise further.

Chart 11: CBBI shows that we are approaching the peak of the cycle

Source: colintalkscrypto.com, as of 18/03/24. The index is unmanaged and it is not possible to invest directly in the index. Past performance is not indicative of future results. For illustrative purposes only.

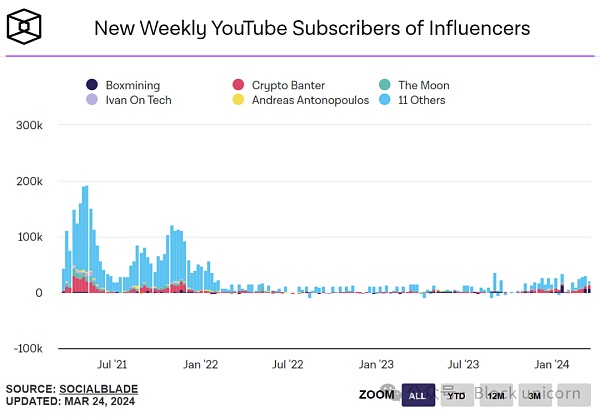

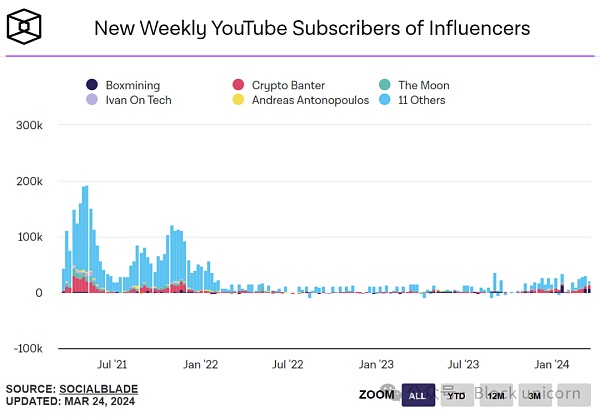

Retail Market Sentiment

However, sentiment data presents a very different picture. Subscription rates for crypto-related YouTube channels, which can serve as an indicator of retail investor enthusiasm, are significantly lower than the enthusiasm during the 2020-2021 bull run. However, the recent increase in subscription growth rates suggests that retail investor interest is slowly growing (Chart 12).

Chart 12: Cryptocurrency Youtube Subscriptions Remain Sluggish

Source: The Block, Social Blade, as of March 24, 2024. For illustrative purposes only.

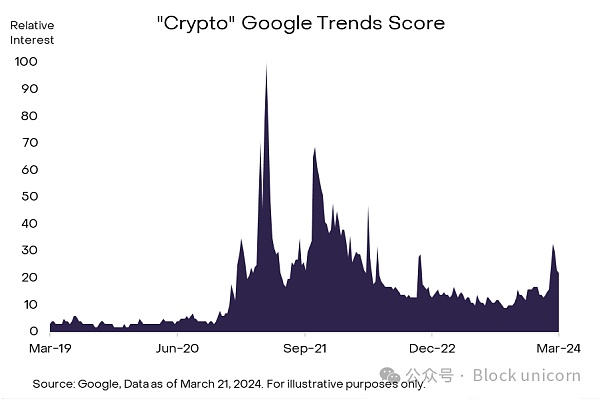

Similarly, current levels of search interest for the term “cryptocurrency” on Google Trends are significantly lower than their 2021 peak, suggesting that the broader public’s curiosity about cryptocurrencies may not have fully rebounded (Exhibit 13). Google Trends displays the popularity of search terms by giving them a score from 1 to 100 (Y-axis). The score is based on a sample of Google searches, selected randomly and without bias. A score of 100 indicates that a term is at its peak at the chosen time and place. This discrepancy raises questions about retail investor participation in the current cycle.

Exhibit 13: “Cryptocurrency” search interest has declined compared to the previous cycle

Source: Google Trends, as of 3/18/24. For illustrative purposes only.

Mobile engagement, as measured by Coinbase app downloads, appears to indicate growing interest from potential investors, peaking around March 5 when it entered the top 100 (Exhibit 14). However, its subsequent decline in ranking suggests a possible cooling or shift in platforms used by market participants.

Exhibit 14: Coinbase app ranking hovers around 300

Source: SensorTower, as of March 24, 2024. Data available only for this time frame. For illustrative purposes only.

To reconcile rising price/on-chain metrics with depressed retail sentiment, it can be argued that the retail investors that drove the last cycle have not yet fully re-entered the market. In our research, the momentum of this cycle may be driven by a different type of investor – one that is less visible on social media platforms such as Twitter or YouTube. The approval of a Bitcoin spot ETF may have attracted investors who are more comfortable with traditional investment vehicles. This shift indicates a wider acceptance of Bitcoin, potentially expanding its appeal beyond typical cryptocurrency enthusiasts to include those who prefer mature financial products.

Untapped Future Catalysts

The outcome of the bull run is yet to be determined. Nonetheless, we remain cautiously optimistic as increased retail and institutional participation could drive bullish momentum forward.

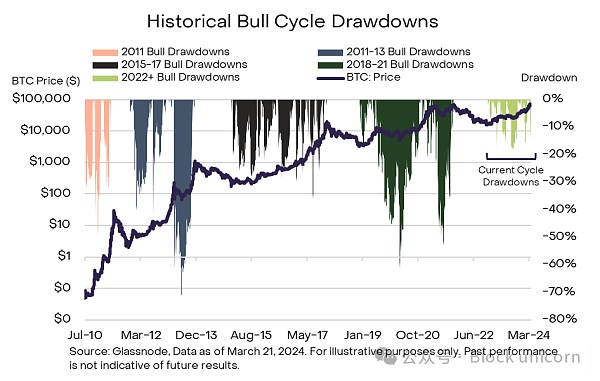

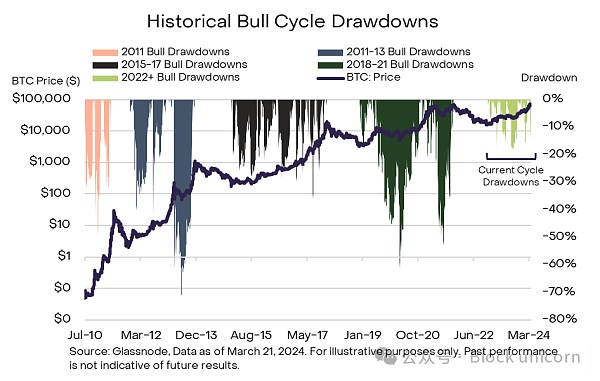

This cautious approach to the behavior of new Bitcoin spot ETF buyers is wise. Historically, Bitcoin has experienced retracements in every bull cycle, so we are unsure how these new buyers will react when faced with a retracement. Encouragingly, the retracements experienced so far in this cycle have been relatively small (see Exhibit 15), and are mildest compared to retracements in past cycles.

Chart 15: The current bull cycle has seen minimal retracements

On the other hand, we recognize that there is untapped demand. In addition to the previously mentioned retail investors who have yet to return to the market, some institutional investors, such as telecommunications companies and wealth management firms, remain on the sidelines. However, one particular organization has moved to approve a Bitcoin spot ETF for inclusion in advisor-managed portfolios. This cautious but hopeful endorsement signals a huge but untapped investment potential that we believe could sustain or accelerate the market’s upward trajectory.

Focus

Bitcoin spot ETF flows and macroeconomic indicators are currently the primary forces determining the near-term direction of the Bitcoin bull cycle, and like two sides of a seesaw, their influence fluctuates over time. At certain moments, Bitcoin spot ETF flows dominate, while at other moments, macroeconomic factors have the upper hand. This ever-changing dynamic ensures that our attention remains focused on these elements, as they are likely to continue to dominate the narrative of Bitcoin's market behavior.

Looking forward, our conviction in Bitcoin's performance as an asset class remains unwavering. Supported by favorable market conditions and its established role as a store of value and hard currency, we believe Bitcoin will continue to succeed. Despite the market's strong rally into early 2024, investors must remember the inherent volatility of cryptocurrencies, which is characterized by periodic pullbacks during bull markets. However, by maintaining a long-term perspective, we believe Bitcoin is clearly in a strong position.

JinseFinance

JinseFinance