BEVM is developing a decentralized indexer to support cross-chain functionality for Runes and Ordinals assets, solving the centralization and single point of failure issues of existing indexers. The new scheme ensures the accuracy of transaction information through cross-validation of decentralized nodes and open source indexers.

BEVM's indexer development aims to achieve decentralized cross-chain functionality for Runes and Ordinals assets.

For BEVM, it is a vital mission to enable $BTC and native Bitcoin assets to be used in a secure, efficient and decentralized manner.

A native decentralized cross-chain bridge is required for this. By leveraging SPV, Taproot Schnorr signatures, MAST, and BFT POS, BEVM has developed a truly decentralized Bitcoin cross-chain custody solution called Taproot Consensus.

Each validator in BEVM is elected through the Byzantine POS consensus mechanism and serves as a custodian of the Bitcoin network. To ensure the authenticity of user asset deposits, each validator must run its own Bitcoin SPV to verify transactions bridged from the Bitcoin mainnet to BEVM. When 2/3 of the validators reach a consensus on $BTC cross-chain deposits, users will receive $BTC on BEVM.

However, due to the unique nature of Runes and Ordinals assets and the limitations of SPV, the original Taproot Consensus cannot achieve decentralized cross-chain functions for these assets. Although BEVM can obtain any transactions from the Bitcoin network through SPV, it cannot determine whether these transactions correspond to BRC20/Ordinals/Runes assets. In addition, SPV cannot identify the type of Ordinals or Runes being processed, the amount of assets, or the recipient.

In this case, the information in the Runes/Ordinals transaction must be identified and parsed by an external indexer.

Current Development of Mainstream Indexers

The key to the indexer is to accurately identify the Runes/Ordinals transaction information.

Unlike Bitcoin light clients, mainstream indexers such as Unisat (non-open source), OKLINK, BINANCE, and ORDISCAN are not protected by the Bitcoin network. This introduces the risk of centralization and means that there may be errors in the identification of Runes/Ordinals transaction information.

In 2023, $SATS and other Ordinals had problems with users buying fake Ordinals because the indexer mistakenly identified symbols in different formats as the same. The lack of cross-validation and single point of failure of single-node indexers that could lead to loss of user funds are the main criticisms of the centralization of Runes/Ordinals assets.

To address this issue, some Bitcoin ecosystem contributors run different indexer codes and cross-validate a large number of Runes/Ordinals transactions to identify the indexer code that is consistent with the market consensus and integrate it into OPI (Open Protocol Indexer).

BEVM's Decentralized Indexer Solution

BEVM aims to upgrade Taproot Consensus to achieve decentralized cross-chain functionality for Runes and Ordinals assets. BEVM proposes its decentralized indexer solution to solve the problem of single point of failure and authenticity of indexed transactions.

1. Decentralized Indexer Node

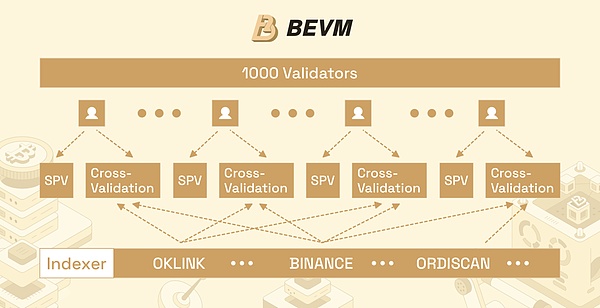

Each BEVM validator must introduce its own Runes/Ordinals indexer based on Bitcoin SPV. BEVM validators are elected through the Byzantine PoS consensus mechanism, staking $BTC and BEVM tokens, with a maximum of 1,000 validators. This fundamentally solves the single point of failure and centralization problems in existing indexers.

2. Open Source Indexer Cross-Validation

BEVM has developed an indexer based on the OPI open source protocol, adding a parsing step for Runes/Ordinals transfer information. In addition, BEVM plans to use other open source indexers for auxiliary verification.

However, different indexers use different databases, and multiple copies of $SATS cross-chain information need to be stored in the database of each indexer. Writing all indexer codes into the node will make the node code too large, which will affect the speed of consensus and block production.

To maintain user experience and security, BEVM uses multiple well-known open source indexer libraries such as OKLINK, Ord, and OPI for cross-validation. Validators only run the cross-validation process on the BEVM node, which significantly reduces costs.

The process is as follows:

Each validator's SPV obtains the Bitcoin transaction and verifies its authenticity.

Validators place transactions on the indexer, retrieve corresponding information from different data sources (such as OKLINK, ORD, and OPI) to cross-validate on the BEVM chain, and reach consensus on the BRC20/Runes information.

Ideally, there will be many excellent open source BRC20 indexer libraries, and each validator uses a different cross-validation path, forming hundreds of cross-validation combinations.

This part of the code has been integrated into the BEVM framework. Stay tuned for follow-up progress!

Original link: https://bevm-blog.webflow.io/post/why-is-a-decentralized-indexer-important-for-runes-ordinals-assets

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Wilfred

Wilfred Alex

Alex JinseFinance

JinseFinance Bernice

Bernice Coinlive

Coinlive  Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx