Is MeMe coin really swallowing up VC coins?

Meme, Crypto Market, Market, Is MeMe Coin Really Swallowing VC Coins? Golden Finance, We are here to invest, not to gamble.

JinseFinance

JinseFinance

Author: Paul Timofeev, Shoal Research; Translator: Yangz, Techub News

Decentralized applications refer to blockchain-native products and services that have been around since the advent of smart contracts and Ethereum. However, user adoption of decentralized applications has been slow relative to Web2 applications and services.

The convenience and choice brought by Netflix's transition from physical DVD rentals to digital and streaming services enabled it to surpass Blockbuster. The convenience of "the world at your fingertips" brought by smartphones has promoted the adoption of mobile applications, changed the way people interact with the Internet, and greatly benefited social networks. In the current AI environment, ChatGPT surpassed Instagram and Tiktok to become the fastest growing application, providing a simple and powerful way to use AI for almost everyone through a simplified chatbot user experience that leverages natural language processing (NLP).

What these breakthrough products and services have in common and what they succeeded in is that they offer a better user experience than any incumbent or competitor. For decentralized applications to achieve similar success, the on-chain user experience must also be as seamless and convenient as possible, away from the various mnemonics and fragmented blockchain ecosystems that are currently common.

The ultimate goal of the on-chain user experience is to allow anyone to do anything on any blockchain without the user having to understand any underlying blockchain infrastructure, without complex barriers and subsequent cumbersome cross-chain processes. In order to better understand the significance of this design, it is necessary to understand the current on-chain account status below. The on-chain account is the bridge between the user and the blockchain, storing assets on the chain and defining all activities and interactions with any blockchain native program. As of now, most blockchains use the externally owned account (EOA) model, which consists of two parts, including the public key (wallet address) as the reference point for identity and receiving assets and the private key (mnemonic) as the master password for access. Technically, wallets act as account abstraction services that simplify the management of one or more on-chain accounts.

While EOA has been widely adopted for its simplicity and the power it gives anyone to self-custody, it also greatly hinders the on-chain user experience. The most common drawback of EOA is that anyone who gains access to the mnemonic can access the wallet (a threat that exists for those who store their mnemonics on cloud services such as iCloud), and anyone who loses access to the mnemonic or forgets the mnemonic can no longer access their on-chain assets.

The key to improving this on-chain user experience lies in the emergence of abstract primitives, that is, many products and services built around abstracting away as much friction as possible in the on-chain user experience. They can be toolkits and frameworks for developers to implement in their own networks or applications, or they can be products and services directly for users. As Vitalik said, as development in this area continues to heat up, more teams are launching their own abstract primitives, and the time to achieve a seamless on-chain user experience may be faster than most people think. But what exactly led to this breakthrough? Account abstraction refers to separating the management of on-chain accounts from end users. This concept was proposed as early as 2017, but it did not gain traction until ERC-4337 was proposed in 2021. Efforts around account abstraction initially led to the development of smart contract wallets, commonly known as smart accounts. In this model, on-chain accounts are managed by smart contracts, so they can be more programmable and optimized according to user needs. This opens up new possibilities, such as being able to register accounts using familiar social logins, paying gas fees with the same assets on different chains, and executing multiple cross-chain transactions with one click. The key to achieving account abstraction is the development of execution abstraction services, which outsources the execution of on-chain transactions to professional service providers called solvers (also known as fillers or executors) to obtain the best solution and execute transactions on behalf of the signers. Here, the user's signature on the off-chain information is called an "intent", which contains instructions to perform on-chain operations (i.e., transaction execution requests). By separating transaction execution from signatures, users can more easily express their needs, and back-end solutions such as private mempools or competitive solver networks help provide users with the best settlement and value.

In addition, another key element to achieving the ultimate on-chain user experience is the ability to communicate and interact across different blockchain environments. Historically, users have relied on cross-chain bridges to meet this need, but over time, cross-chain bridges have proven to be highly risky and insecure. Chain abstraction promotes the development around account and execution abstractions, while introducing new infrastructure at the network layer, eliminating the complexity of communicating and interacting across different blockchain environments. For a comprehensive overview of the basic principles of the concept and the broader chain abstraction ecosystem, see Shoal's chain abstraction in-depth analysis.

Chain abstraction is the culmination of efforts around a common goal, that is, to provide a seamless user experience that allows users to perform on-chain operations without knowing which chain they are using at a particular time. The following article will take Particle Network as an example to explore how to promote on-chain user experience through a new chain abstraction stack.

Particle, originally launched as a wallet abstraction service provider by co-founders Pengyu Wang and Tao Pan in 2022, launched a stack for developers to create non-custodial, DApp-embedded wallets, and can log in with social accounts through MPC-TSS technology. With the advent of ERC-4337 account abstraction, the protocol incorporated the AA protocol stack into the existing WA protocol stack, enhancing the account structure with smart contract wallets. This also laid the foundation for the later launch of BTC Connect, which brought AA services to the Bitcoin ecosystem through local Bitcoin signatures. Currently, Particle is launching its L1 as part of its comprehensive, multi-chain abstraction stack.

Particle Network has a global development team of over 30 full-time employees and has partnered with companies such as Berachain, Avalanche, Arbitrum, zkSync, etc. The protocol has raised $25 million in seed rounds led by Spartan Group and Gumi Crypto, and recently received investment from Binance Labs.

Particle Network is a modular L1 built on the Cosmos SDK, designed to act as a coordination and settlement layer for cross-chain transactions in a high-performance EVM-compatible execution environment.

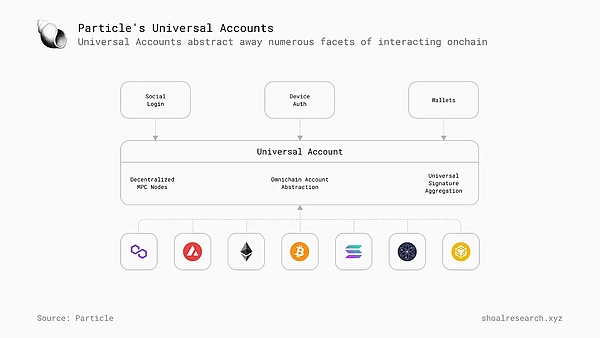

Particle L1 is a component of Particle's broader chain abstraction stack, which consists of Universal Accounts, Universal Liquidity, and Universal Gas. Universal Accounts provide a simple interface for unifying token balances on different chains, Universal Liquidity enables users to use Universal Accounts on the backend, and Universal Gas enables users to pay Gas fees with any token they hold.

The ultimate goal of Particle Network is to unify all on-chain users at the account level, facilitate seamless cross-chain interactions through a single balance and account on L1, L2, or L3, and allow anyone to easily pay Gas fees in any token they wish.

Universal Accounts

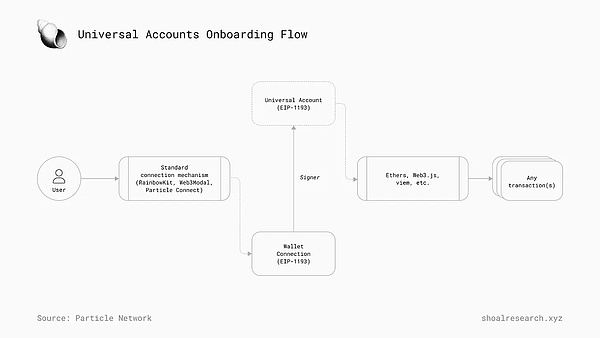

Universal Accounts (UA) refers to the new account structure supported by Particle L1 and is the key to the Particle chain abstraction stack. At its core, UA is an ERC-4337 smart account attached to an existing EOA (externally owned address) that unifies token balances on multiple chains by automatically routing and executing atomic cross-chain transactions. For end users, UA provides a single interface for managing funds and transacting between different dApps, eliminating the friction of setting up and funding new accounts on new chains (which often also requires purchasing the Gas token for that native chain).

The interface is built on top of existing wallets, leveraging Particle's Universal Liquidity to perform atomic cross-chain transactions and move funds from user balances to different chains as needed. Transactions are processed by Particle's globally distributed network of nodes, which manages the associated bundling, relaying, and verification tasks.

To better illustrate this, let’s imagine the steps involved in satisfying a user’s need to purchase Dogcoin on an external chain (Chain X):

The user connects to their UA by logging in through an existing wallet or social account.

The user submits a transaction request to Particle L1, expressed as an ERC-4337 UserOp to purchase Dogcoin on Chain X.

The bundled nodes in Particle’s decentralized node network process the relevant UserOp and execute it accordingly.

Then, Particle’s relayer nodes monitor and synchronize the execution status on the relevant chains. Once the transaction is confirmed to be executed, the status is transmitted back from the chain to the relayer nodes, which then transmit the status back to the user protocol and the end user.

In this way, users already have the tokens they want to buy in their UA balance without having to interact with the chain where the token is located.

Of course, there are more internal components in this process that are worth further study. If UA is regarded as Particle's user-facing product, then universal liquidity and universal gas functions are key to achieving a seamless experience.

Universal Liquidity

Universal Liquidity (UL) refers to the layer in Particle Network responsible for automatically executing transactions submitted through UA. This layer is supported by Particle's distributed network of Bundler nodes, which provide specialized services designed to perform user operations (UserOp), such as trading or extracting liquidity from the pool. In addition, a distributed network of relay nodes, the Decentralized Messaging Network (DMN), is responsible for monitoring the status of transactions on the target chain and transmitting their settlement status back to Particle L1.

The main purpose of UL is to enable users to interact with different chains through cross-chain transactions without having to buy and hold any tokens on the relevant chains. For a better understanding, consider the following flow: A user wants to buy 100 USDC of Dogcoin on chain D, while holding 25 USDC each on chains A, B, C, and D.

First, the user signs a UserOp to buy 100 USDC Dogcoin on chain D, bundling their balances on the four chains (chains A, B, C, D) into a single signature processed by Particle L1.

After the signature is executed, the USDC held by the user on chains A, B, and C will be sent to the liquidity providers (LPs).

LP releases all USDC on chain D.

USDC on chain D is exchanged for Dogcoin through the local DEX.

Finally, the Dogcoin balance will appear in the user's UA.

Universal Gas

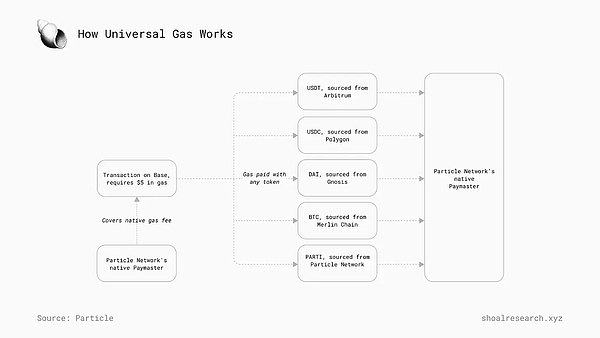

Universal Gas is the third pillar of the Particle chain abstraction stack and is the key to achieving Gas abstraction, allowing end users to pay Gas fees with any token on any chain. For example, Alice can use her USDC on Base to pay for transaction Gas fees on Solana, while Bob can use his OP tokens on Optimism to pay for Gas fees for purchasing NFTs on Ethereum.

When a user wishes to execute a transaction through Particle UA, an interface will pop up prompting the user to select the Gas token, and then automatically pay through Particle's native Paymaster contract. All Gas payments will be settled on their respective source and target chains, and part of the fees will be exchanged for Particle's native PARTI tokens and settled on Particle L1.

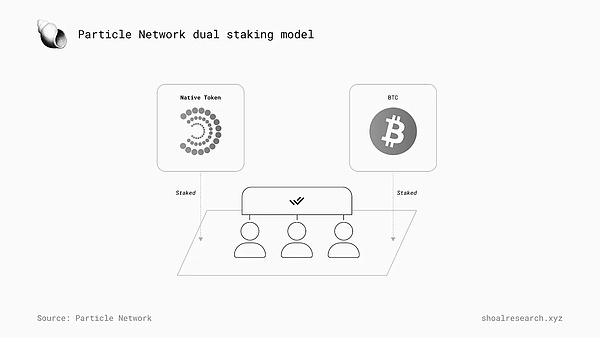

Particle L1 adopts a high-performance execution environment compatible with EVM and a dual-token staking model, including Bitcoin and native token PARTI. Consensus and data availability are outsourced to a distributed node network called Modular Nodes. Particle adopts the Aggregate Data Availability Model (AggDA), which is combined with providers such as Celestia, Avail, and Near DA, and is supported by a decentralized system of aggregated DA node operators.

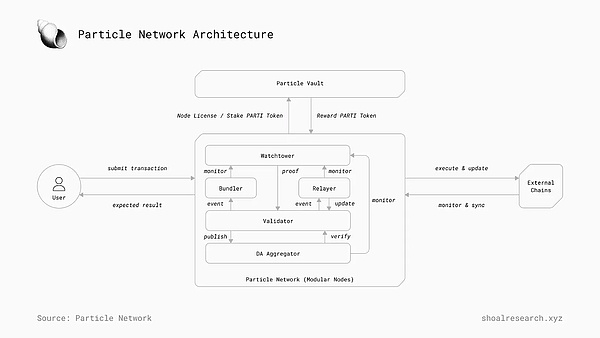

On the backend, Particle's chain abstraction stack is powered by three key modules, including the Master Keystore Hub, the Decentralized Messaging Network (DMN), and the Decentralized Bundler. The Master Keystore Hub is the core information source for the entire Particle L1, responsible for coordinating smart contract deployments on all chains, synchronizing settings between each UA instance, and maintaining synchronization status on all chains. The DMN is responsible for communicating transaction execution status on different chains where users are transacting, and then communicating user operation status to Particle L1 for settlement on Particle L1. This function is supported by the relayer node network. Finally, Particle utilizes the Decentralized Bundler, and the network of bundle node operators is responsible for initiating and executing incoming user operations. The network is built around a distributed, permissionless network of Modular Nodes, between which tasks are delegated and outsourced.

The use of modular nodes allows anyone to participate in running nodes dedicated to facilitating critical L1 operations. These nodes can be categorized according to their respective functions, such as bundled nodes are responsible for executing cross-chain user operations; relay nodes are responsible for monitoring transaction status (such as executed, failed) and transmitting it back to Particle L1 for settlement; watchtower nodes are responsible for monitoring the status of nodes and their respective tasks in the bundled node and relay node networks, and providing execution and fraud proofs for each block and each epoch.

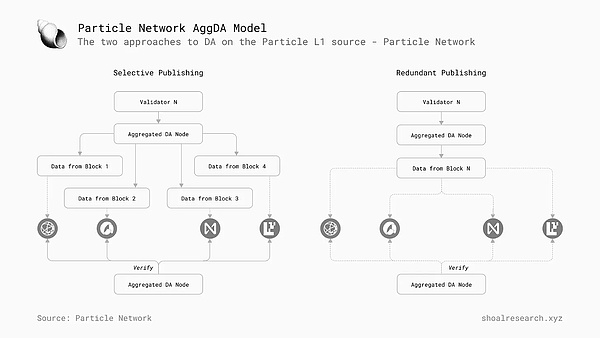

In blockchain, data availability (DA) refers to the ability to verify data that has been published to the blockchain. Typically, blockchains adopt a single data availability solution, which can be an internal solution under an integrated architecture or a solution outsourced to partners or third-party providers under a modular architecture. Particle is building its DA model by adopting an aggregation model to collectively outsource DA to Celestia, Avail, and Near DA to reduce single points of failure in the entire architecture. Particle uses two different DA methods, including selective release (assigning each block to a separate DA provider) and redundant release (sending each block to each DA provider).

As this track develops, we will see whether Particle will expand to other DA providers (such as EigenDA) in the future.

The PoS chain assigns validators to propose and verify new blocks based on the number of native tokens staked by the validators, and rewards them in proportion to the number of blocks they voted for. In the early stages, a major risk for these networks is that price volatility of the native tokens can impact the security and stability of the network. Particle aims to reduce this risk through a dual staking model, allowing staking of native PARTI tokens, as well as staking of Bitcoin through Babylon. The model assigns validation pools to each token.

Particle's Universal SDK allows users to add their existing wallets through providers that support EIP-1193, enabling app developers to create a seamless onboarding flow for UA, allowing users to transact with their UA immediately after logging in.

According to the team, before the development of Particle L1, Particle had more than 17 million wallet activations and more than 10 million UserOps, and had been used with more than 900 decentralized applications.

On May 2, 2024, Particle Network's incentivized L1 testnet was launched, providing point rewards through the Particle Pioneer platform. This public testnet allows users to test the functionality of their general accounts and general Gas, earning points for the upcoming PARTI tokens.

Particle Testnet V2 explorer data shows that the network has generated 1.3 million blocks, with a total transaction volume of more than 7.3 million times and an average daily transaction volume of more than 400,000 times. In addition, according to the Particle Pioneer activity website, the testnet has more than 182 million transactions and currently has more than 1.49 million users, earning a total of 27.3 billion points, with an average of 18,300 points per user. Particle L1 is currently scheduled to be launched on the mainnet in the second half of 2024.

Chain abstraction is expected to become the next major framework for building interoperability platforms. At present, there are multiple projects in this track that aim to become the standard toolkit or stack for building chain abstraction services. Near Network is a sharded PoS L1 that is building its chain abstraction stack through Account Aggregation, a multi-layered structure that allows users' cross-chain interactions to run through a single account. Accounts on Near use two types of keys, where Full-Access Keys have private key capabilities (i.e., can sign any transaction), while Function-Call Keys are granted permissions to specifically sign calls to specific contracts or sets of contracts. Near also leverages its FastAuth login service to allow users to register accounts with emails and use biometrics instead of passwords.

Multi-chain signatures are key to achieving this structure, allowing any Near account to interact with addresses on other chains. This is achieved through the NEAR MPC network, which supports key re-sharing, so that public keys remain unchanged even if nodes and key distributions change. MPC signing nodes in the Near network allow smart contracts to initiate the signing process, creating a large number of remote addresses on any chain. Near also introduced meta transactions through NEP-366, allowing users to transact on multiple chains without holding native Gas tokens. This is achieved by relayers (third-party providers) who attach the necessary Gas tokens to the signed transactions they relay to the network.

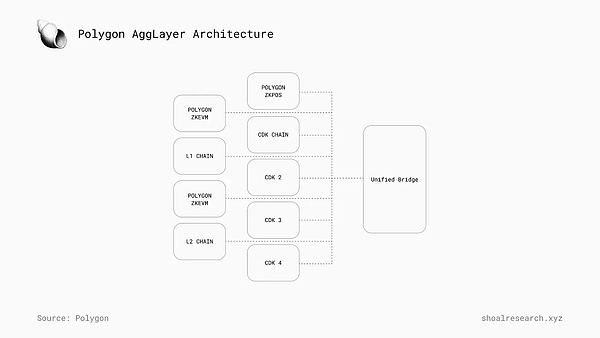

Polygon is developing AggLayer, a unified cross-chain bridge built for L2 using Polygon CDK that aggregates zk proofs and submits them to Ethereum for settlement. In this model, all chains share a cross-chain contract with other supported AggLayer chains, which can obtain more liquidity while maintaining independence, making it easier to launch early networks.

AggLayer uses ZK proofs to create an aggregated environment that allows supported chains to maintain their independence while making users "feel like using a single chain". In addition, application developers can benefit from reaching more users because users from different chains can also interact with their products or services. For end users, the goal is the same as that of chain abstraction, which is to provide an Internet-like user experience. So far, the real-time components of AggLayer connected by Polygon zkEVM include a unified cross-chain bridge connecting to Ethereum and a bridgeAndCall() library for solidity contracts.

Everclear (formerly Connext) is developing a new chain abstraction stack. As the name suggests, Everclear will launch the "first clearing layer" to provide global settlement for cross-chain transactions. Everclear will operate as Arbitrum Orbit L2, powered by Gelato RaaS, and will use Hyperlane and Eigenlayer to connect with other chains. The protocol ultimately aims to act as a shared computer that coordinates cross-chain transactions, settled in the form of invoices and cleared through Dutch auctions. Everclear revolves around the use of its Clearing Layers, with the goal of reducing costs for market participants. Clearing Layers are programmable and can be plugged into any settlement rail, used for any transaction, and can provide permissionless liquidity for new chains and assets from day one.

Socket 2.0 marks the shift of the Socket protocol from cross-chain services to chain abstraction services, and its flagship product, the Modular Order Flow Auction (MOFA) mechanism, is a prominent manifestation of this shift, which aims to provide a competitive mechanism for an efficient chain abstraction market. Traditional order flow auctions involve a network of various participants performing specialized tasks, who compete to provide the best results for end-user requests. Similarly, MOFA aims to provide an open market for execution agents called Transmitters and user intent. In MOFA, Transmitters compete to create and complete chain abstraction bundles or order sequencing of user requests, which require the transmission of data and value between multiple blockchains.

The opportunities in the chain abstraction track are exciting. However, as more and more teams begin to launch their own solutions, VCs begin to invest more funds in any project that mentions "chain abstraction", and users begin to struggle with which solution to choose, there are some important factors worth considering.

Zee Prime Capital pointed out several important considerations regarding abstract primitives in a recent article.

“Without products, chain abstraction cannot truly solve real problems”.

Indeed, while UX remains a critical hurdle for the crypto industry to overcome, it may not be the ultimate bottleneck in bringing more users on-chain. In fact, infrastructure development is precisely in response to the poor user experience caused by high fees and slow settlements. Now, the infrastructure is in place (there are over 200 L1/L2s), but there are not enough successful products and services built on top of it. This coincides with the view recently shared by Mert, who believes that most people currently fail to realize that the obstacles to building strong cryptocurrency applications are not crypto-native (i.e. infrastructure, user experience), but rather unclear regulation and misaligned incentive structures across the industry.

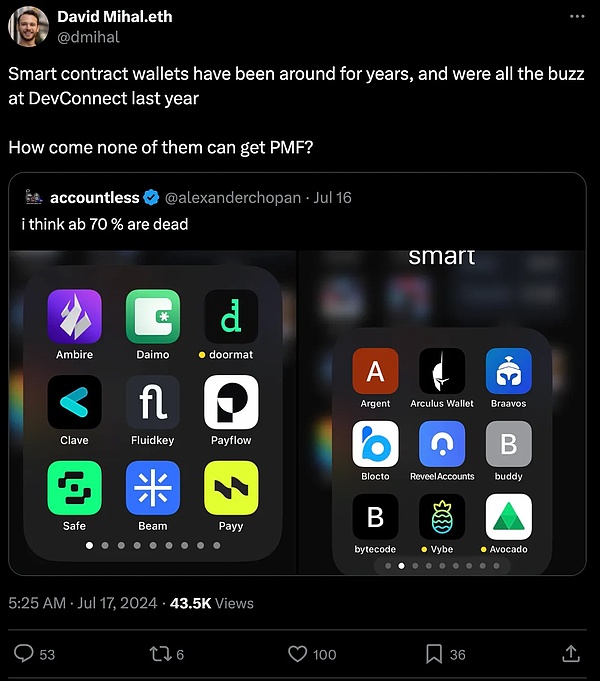

A good example of this is the adoption (or lack thereof) of smart wallets.

Despite the innovation that smart wallets have brought, they have largely failed to gain mass adoption to date. As the memecoin craze hit in Q4 2023/Q1 2024, existing applications such as Phantom hit record downloads, indicating that people are willing to put up with complicated mnemonics and difficult UIs for the time being as long as they can buy a new generation of "Dogecoin".

It is important to point out that it takes time to develop successful products and services using new technologies. The success of web-based applications has been achieved through years of trial and error. As demand for underlying block space grows, more Rollups and application chains may appear in the next few years. With the emergence of RaaS providers and modular infrastructure solutions like Celestia, launching new chains that can communicate seamlessly will only get easier. The need to provide chain abstraction to end users comes from creating a popular application that attracts users of other chains and provides a seamless experience. Chain abstraction aims to solve the fundamental problem of lack of seamless cross-chain functionality, and the current lack of available products and services does not make it invalid.

With this in mind, however, a key challenge that abstract primitives must address is to ensure that state proofs, solver execution, transaction status, block confirmations and other cross-chain guarantees are successfully coordinated across the entire network of solvers/nodes, all of which require consensus. The nature of capital markets means that there will always be the next faster and cheaper solution, which also means that chain abstraction service providers must consider a series of complex back-end processes and their impact, and over time, things like time games and order flow capture will start to play a larger role.

A key question for Particle's distributed node network is how decentralized the network is. Will only a few entities participate in operating nodes, or will Particle be able to gain enough traction to maintain a sufficiently decentralized node network? How can Particle successfully incentivize enough node operators to achieve sufficient decentralization?

To this end, we make two suggestions:

1) Try to lower the entry and participation barriers for node operators

2) Provide a public dashboard through the Particle Explorer to monitor and observe the decentralization of the node network

Particle is building a settlement and coordination layer for atomic cross-chain transactions, which also raises the question of value accumulation. What economic impact will the successful adoption of universal accounts and Particle L1 have on other blockchains and ecosystems? Can they benefit from more user access?

Changing the user experience state of blockchain native applications is not a new demand, and developers have been working on solving this problem for a long time. Chain abstraction can create an easier-to-use on-chain experience for end users, unlock new user groups for applications, and provide lower-cost and more efficient cross-chain communication and routing for L1/L2/L3.

Vitalik said that builders in the industry have "a lot of energy and willingness" to achieve a seamless on-chain user experience. Improving the user experience alone will not bring millions of users to the industry, but it is still one of the most important steps to achieve this goal.

Meme, Crypto Market, Market, Is MeMe Coin Really Swallowing VC Coins? Golden Finance, We are here to invest, not to gamble.

JinseFinance

JinseFinanceWe can attribute this to the fact that retail investors can no longer make any money under the current market structure.

JinseFinance

JinseFinanceOn May 9, 2024, Binance issued an announcement stating that Binance New Coin Mining has now launched the 54th project - Notcoin (NOT), a community token that introduces users to web3 through a click-to-earn mining mechanism.

JinseFinance

JinseFinancePEPE, WIF, MEW, BOME... New wealth codes always seem to emerge in the meme coin sector, but is this really good for the cryptocurrency world?

JinseFinance

JinseFinanceCoinbase lists KARRAT altcoin on Ethereum network, with trading to commence upon meeting liquidity conditions. Users cautioned about potential scams and high volatility. Despite risks, Coinbase's move highlights commitment to diverse asset offerings.

Xu Lin

Xu LinExpanding USDT reach: Tether partners with Celo for low-cost microtransactions. Boosts Celo's ecosystem, aligns with its mission of global prosperity. Positive remarks from Celo co-founder. USDT integration addresses rising Ethereum fees, competition with USDC.

Xu Lin

Xu LinStablecoin issuer Circle is bringing USD Coin (USDC) to the Celo (CELO) blockchain, fostering a strategic alliance to enhance stablecoin accessibility. This move aligns with Celo's vision of becoming a leader in real-world adoption, showcasing potential for further innovations in the evolving crypto landscape.

Joy

JoyExplore the strategic integration of USDC into Celo's blockchain, revolutionizing the digital finance landscape.

Weiliang

WeiliangCoinShares analysts believe that 2024 will be a “pivotal” year for Bitcoin in the stablecoin space, with a successful project even rivaling the “speed and cost” of modern stablecoins.

JinseFinance

JinseFinancePARODY COIN (PARO) Parody Coin (PARO) is a deflationary utility token in its presale stage, it has joined a host ...

Bitcoinist

Bitcoinist