While Bitcoin investors have generally remained profitable in recent months, the current market is still facing downward pressure. Among them, the short-term holder group is currently in serious losses and is one of the main risks in the current market.

Summary

Compared with previous cycles, the current unrealized losses of Bitcoin investors are relatively small. This shows that the overall situation is not as bad as some people think.

However, short-term holders still suffer high unrealized losses and are the main group bearing market risks.

Recently, Bitcoin trading has basically maintained a "break even" situation, but the abnormal movement of key indicators such as the seller risk ratio suggests that volatility may increase in the near future.

Bull Market Continues to Adjust

In the previous six months, Bitcoin prices stagnated, which led to generally low investor sentiment. However, three months ago, the market suddenly took a sharp turn and experienced the worst decline in this cycle.

From a macro perspective, the current spot price is about 22% lower than the historical high. But compared with the declines during the historical bull market, this decline is relatively small.

Figure 1: Price decline during bull market correction

Current market pressure

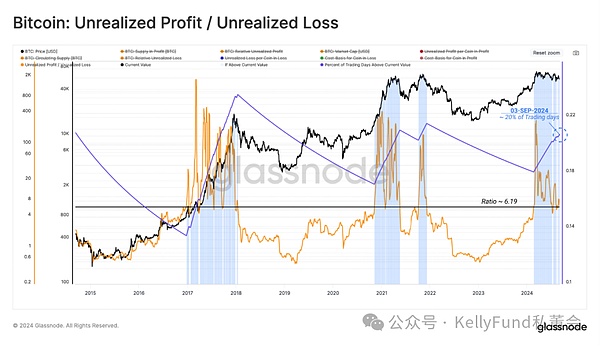

Given the increasing downward pressure on prices, we can estimate the unrealized losses suffered by investors to get a glimpse of how much financial pressure they have been under during this decline.

From a broader and longer-term perspective, compared with historical bull market declines, unrealized losses are still very low at this time - equivalent to only 2.9% of the current Bitcoin market value.

This shows that even with the recent continued price decline, investors are still profitable on the whole.

<span yes'; mso-bidi- font-size:10.5000pt;mso-font-kerning:1.0000pt;">

Figure 2: Unrealized losses in the Bitcoin market

If we calculate the ratio of unrealized profits to total unrealized losses, we can find that the former is still 6 times the latter. What's more, on about 20% of trading days, it is higher than 6 times, which highlights how unexpectedly robust the financial situation of ordinary investors is.

Figure 3: Unrealized Profit and Unrealized Loss Ratio

Short-Term Holders’ Concerns

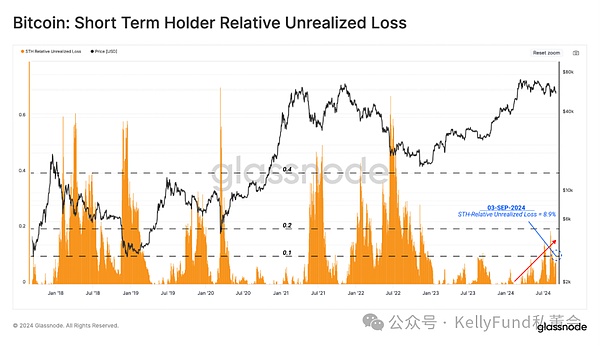

Short-term holders often represent new demand in the market, and they are now in a difficult situation. Their unrealized losses have continued to increase in the past few months.

However, even for those who have suffered the most, the scale of their unrealized losses relative to market value has not yet reached the bear market level, but is more similar to the period of market volatility in 2019.

Figure 4: Unrealized Losses of Short-Term Holders

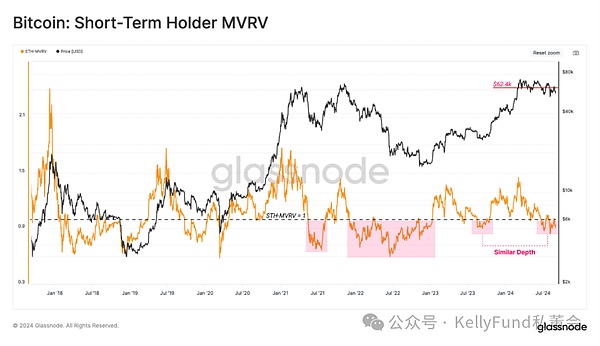

From another perspective, this also shows us that new investors are generally losing money. Generally speaking, the market is expected to weaken further before spot prices rebound to their cost basis, the $62,400 line.

Figure 5: MVRV of Short-Term Holders

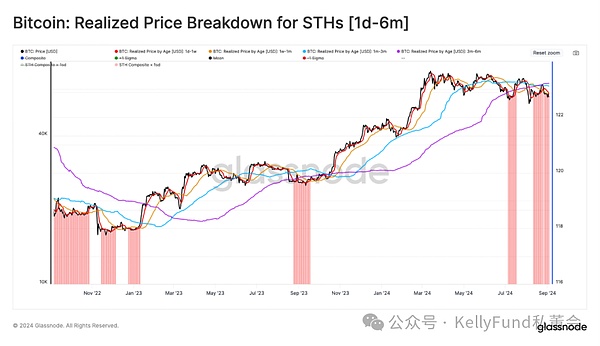

Next, we will further illustrate our conclusions by breaking down the various subgroups of short-term holders. Based on the different holding periods, we can see that various subgroups of short-term holders are suffering losses to varying degrees, with their average cost basis as follows:

Holding period 1 day to 1 week: $590,000

Holding period 1 week to 1 month: $599,000

Holding period 1 month to 3 months: $636,000

Holding period 3 months to 6 months: $652,000

Figure 6: Realized price breakdown of short-term holders (1 day-6 months)

Investor reaction

By assessing investors’ unrealized losses, we can gain a deeper understanding of the pressure they are facing. Next, we will continue to analyze their locked-in profits and losses to better show how they are coping with this financial pressure.

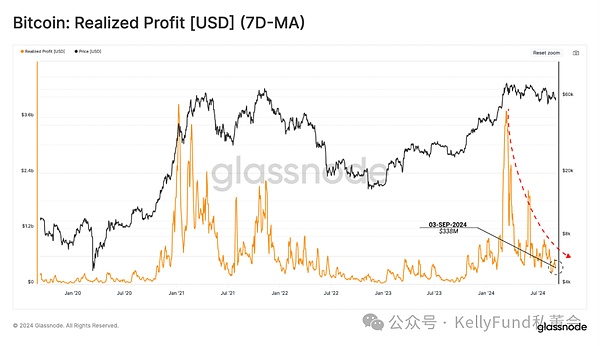

We choose the realized profit indicator as our gripper. We can see that after the price of the coin exceeded the historical high of $73,000, it immediately fell sharply. This shows that since then, selling Bitcoin has become less and less profitable.

Figure 7: Realized Gains (7-Day Moving Average)

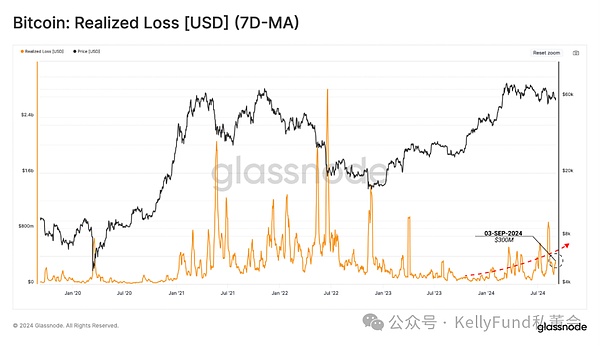

Next, we discuss the realized losses suffered by investors. In recent times, there has been an increase in loss events, and as the market downtrend intensifies, trading volume has also risen.

We must point out that although the current losses have not reached the extreme levels during the massive sell-off in mid-2021 or the bear market in 2022, the amount of losses does continue to rise. This shows that there is indeed a panic sentiment spreading among the investor community.

Figure 8: Realized Losses (7-Day Moving Average)

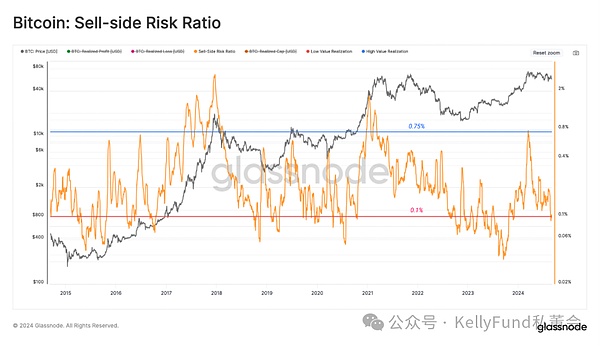

Next, we analyze the Seller Risk Ratio. We see that the total amount of realized profits and losses is relatively small compared to the size of the entire market. We can analyze this metric in the following framework:

High values indicate that every time an investor sells a coin, they are making a huge profit or a huge loss. This situation indicates that the market is in urgent need of rebalancing and usually exhibits high volatility in price movements.

Low values indicate that most Bitcoins are sold at prices close to their cost basis. In this case, the market has reached a certain degree of equilibrium. This situation usually also indicates that the profit and loss potential within the current price range has been exhausted and the market volatility is very low.

Currently, the seller risk ratio has dropped to a low level, indicating that most Bitcoins traded on the chain are close to their cost price. This also shows that within the current price range, the profit and loss have gradually become balanced and saturated.

From historical experience, this suggests that in the short term, market volatility is likely to increase - similar to the period in 2019.

Figure 9: Seller risk ratio

Market cycle analysis

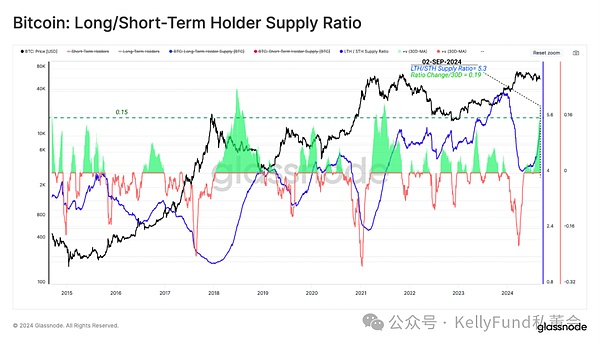

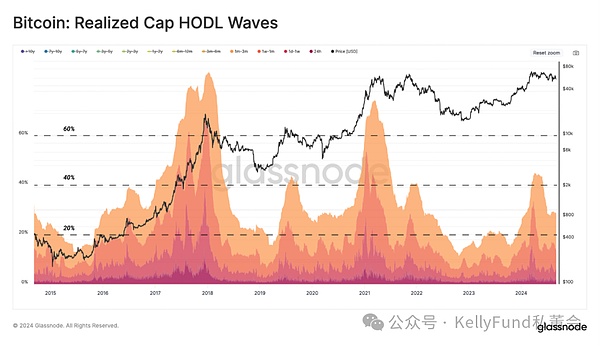

In the downward trend of the market, investors' patient holding behavior has become the mainstream of the market again. Previously, a large number of long-term held Bitcoins were sold in the frenzy of chasing highs in March, which formed a net oversupply in the market.

But recently, long-term holders have slowed down their pace of profit-taking, and during the period when the price of the currency broke through the historical high, the Bitcoin bought by new investors also turned into a long-term holding state over time. But we need to point out that historically, this increase in supply from long-term holders usually occurs during the transition of the market to a bear market.

Figure 10: Proportion of assets held by long/short-term holders

We can see that as more Bitcoins are held for the long term, the assets held by new investors have declined in recent months.

The proportion of assets held by new investors has not reached the peak when the price of the currency broke through the historical high before, which indicates that the peak in 2024 may be more like the medium-term high that appeared in 2019, rather than the macro highs that appeared in 2017 and 2021.

Figure 11: Static Asset Market Bands

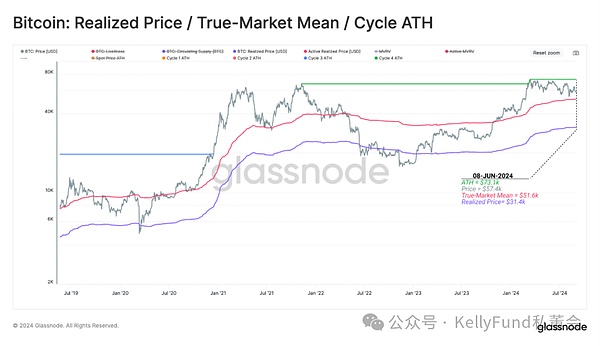

To briefly summarize our views, we will use the key indicator of on-chain pricing level to divide the historical cycles in the Bitcoin market:

Deep bear market: The transaction price is lower than the actual price.

Early bull market: The transaction price is between the actual price and the real market average.

Enthusiastic bull market: The price is between the historical peak and the real market average.

Euphoric bull market: prices are higher than the historical peaks of previous cycles.

In this context, the current price is still within the "enthusiastic bull market". However, if the market continues to experience local downturns, the price level of US$51,000 will become an extremely important watershed, and the price of the currency must remain above this level before it can appreciate further. <span yes'; mso-bidi- font-size:10.5000pt;mso-font-kerning:1.0000pt;">

Figure 12: Actual price/market real average/historical price peak

Summary

Although the price of Bitcoin has fallen, from a macro perspective, it has only retreated 22% from its historical high, which is much smaller than the retreat in previous cycles.

Overall, Bitcoin investors are still making a lot of money, which highlights that their holding decisions are indeed very sound.

In addition, investors' profits/losses in recent transactions are still small. This shows that the market has tended to balance in the current price range. Key indicators such as the seller risk ratio have also reached saturation, suggesting that the market may be pregnant with a storm of violent fluctuations in the near future.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Hui Xin

Hui Xin Clement

Clement Clement

Clement Beincrypto

Beincrypto Beincrypto

Beincrypto The Block

The Block Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph