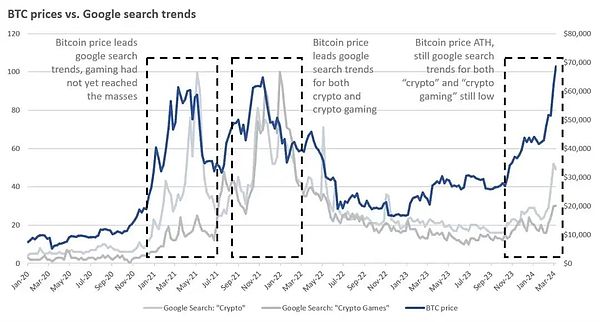

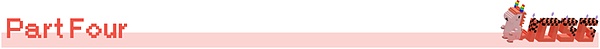

As a product directly facing Retail, games have always been expected to have a high level of mass adoption in this cycle. However, since 24 years ago, the performance of the entire secondary game sector has been lackluster. In addition to the overall sluggish market, it is also because we are still in the early to middle stages of the bull market cycle. Retail will come later in the cycle. Historically, the leading order of indicators is BTC price > Crypto interest > Blockchain game interest.

When they finally arrive, whether it is game content or Infra, who really has PMF (Product Maket Fit) will be clear at a glance.

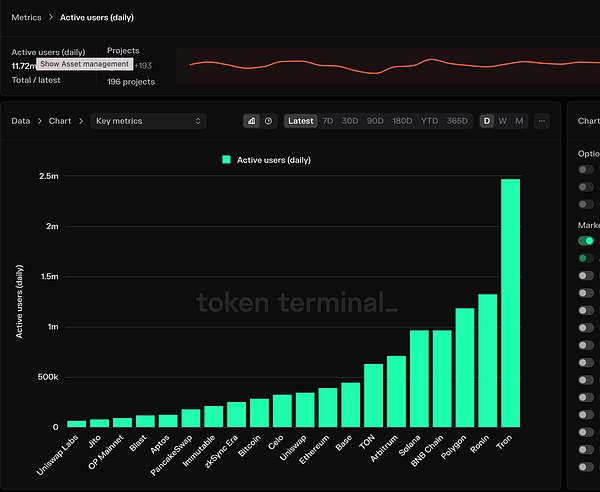

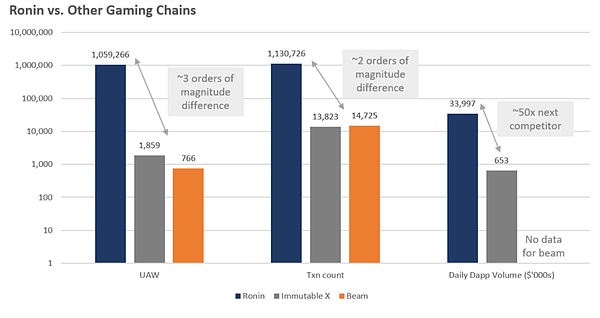

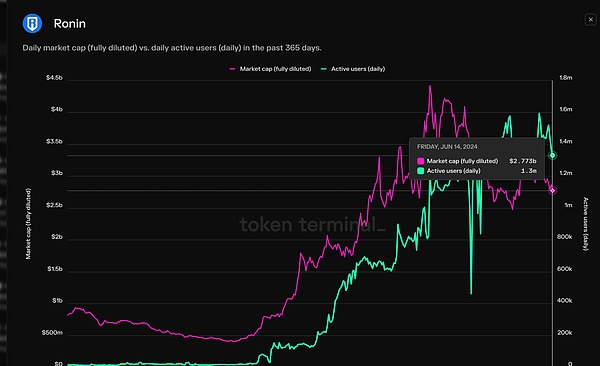

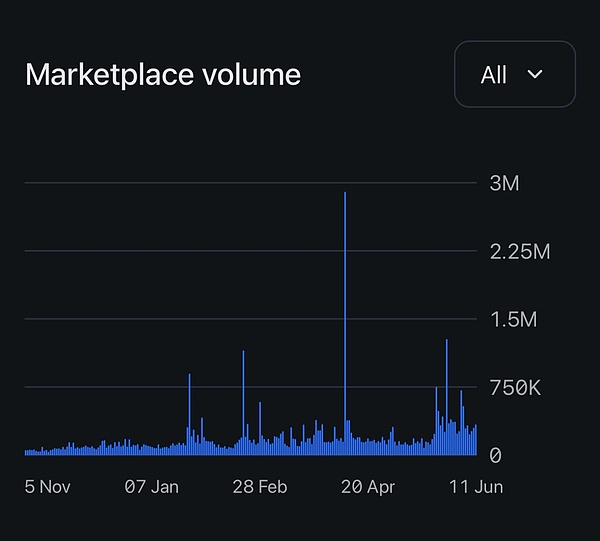

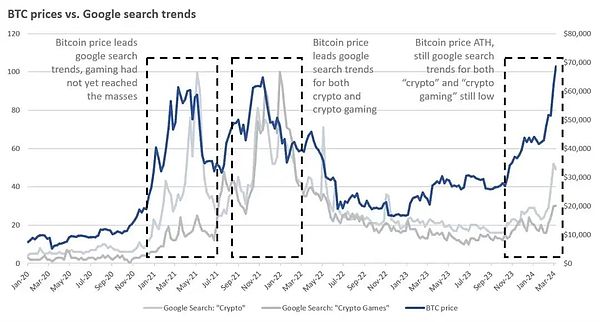

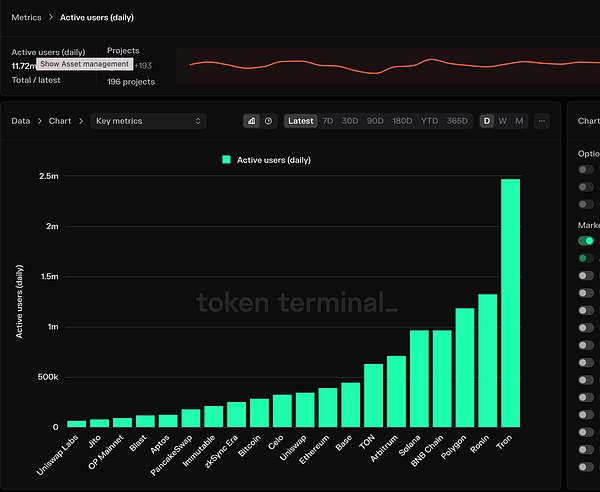

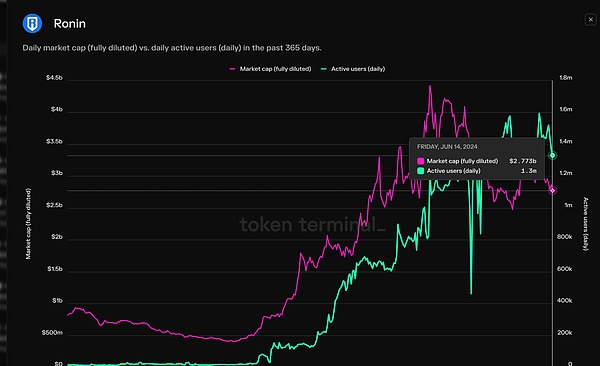

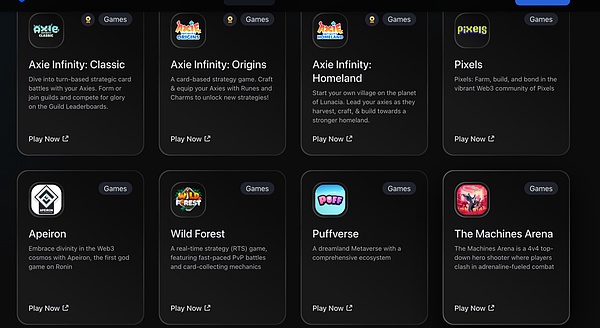

During this period when there are not many incremental users, there is an Ecosystem that has maintained a very high user base and growth, that’s Ronin (Sky Mavis behind it is also the developer of GameFi Axie, which was a hit in the last cycle. Currently, the most popular game on Ronin is Pixel)

Ronin is essentially a side-chain of the previous generation, but its technology is not very good. The market may have only given these two a spotlight when $RON and $PIXEL were listed on Binance.

This article will explore the real competitiveness behind Ronin - Sky Mavis's localized issuance and operation capabilities. Among the numerous Ghost Chain ghost towns, if everyone suddenly finds that your property, although not vigorously promoted as being close to the mountains and the sea, and having school district facilities, actually has quite a few residents, how do you think the market will re-price it?

1. The rise and fall of crypto games

Whether in crypto or the real world, the evolution of bubbles generally has a very typical cycle. The same is true for chain games.

1. The first cycle 20-21: When a new thing appears, Narratives > Fundamentals, a sexy narrative with a high enough ceiling will attract countless hype funds and attention. We are already transforming traditional finance, why not transform traditional Internet? Why not make Web3 games? Simple and easy-to-understand narratives + the entire track is in the ascendant, there are not many hype targets to choose from, and the market value of GameFi's leading project has been blown up by attention.

2. The second cycle 21-22: The success of new things attracted countless people to join. The enthusiastic funds and entrepreneurs will not explore the deep reasons for the success of new things, but only blow bubbles around narratives. Among many entrepreneurial projects, some people have discovered the deep reasons for the success of new things, and intend to add various levers to overplay this opportunity. Due to various reasons, the bubble bursts.

People are disenchanted with narratives, and the market's perception slides to another extreme. Play to earn is so dead.

3. The third cycle 23-24: Because there are still large amounts of financing and projects under development in the previous bubble, and the entire track has not been completely falsified, people always have fantasies about reviving a bubble. So they continue to produce products and bring them to the market, but find that the market no longer buys the narratives of the old era.

So the projects tried to align other new narratives…. Countless gaming layer2, countless 3A games, countless AI games.

However, when a track is no longer fresh and there are a variety of target options, the question is often, ok, good points, but what’s so special about it?

Currently, it is the third cycle of crypto games. The market is more rational, and attention and funds will be focused on projects with real moats and. For game projects, if they cannot find their own unique PMF and only rely on narratives to follow the crowd, failure is a high probability.

2.What is the Value pro of Crypto games? Who are the real game users?

There is a big misalignment in the perceptions of project owners, VCs, players, and retail investors. VCs think it is FOCG (Fully On-Chain Gaming), and think it is ground-breaking gameplay innovation. Project owners think it is 3A, exchanges think it is the increase in web2 users, players think it is making money, and retail investors think it is a super high multiple. We are in it for very different things, which has also led to the lack of synergy in the performance of the game in the first and second levels since 2023. All the hype does not last long.

Looking back at the P2E craze in 2021, what is Axie's real PMF, and what is the moat of Sky Mavis/YGG?

In fact, the answer is not complicated, but it is covered by a more fancy and sexy narrative. Crypto natives turn a blind eye to this very Web2 logic.

The real core competitiveness is the localization channel/localized operation capability in Southeast Asia.

Without a steady stream of low ARPU (Average Revenue Per User) and new users, there will be no asset precipitation, and without asset precipitation, any positive flywheel will be difficult to operate continuously. —- Whale Big R studios are all smart money, and the rate of return is clearly calculated for you, and they all plan to withdraw before you.

Under the prisoner's dilemma, the game economy will not even have the opportunity to grow into a big R treasure pavilion and will already be in decline.

The fact is:A small incentive + simple and easy to use without any threshold + a large number of users who are strong in gambling and pursue small profits are the secret formula of all successful Crypto games we can see. It just doesn't sound high-end, so all parties pretend to be confused.

To be more abstract, this is a game of speculation. Secondary investors speculate the price of the currency (speculate on the progress of this Ponzi scheme). The project party invests part of the equity and uses the strong US dollar to acquire customers in low- and middle-income countries for retention. Players can make a fortune by simply operating leisure + receiving wages + a certain chance to get company options.

The classic template of airdrops. If we add a game shell and save various on-chain operations, can there be more Normie e-begger? Will everything be more cyberpunk and more interesting?

Of course, if your game is fun and good-looking enough, making a Meme coin to play the attention economy has always been feasible.

3. The market has been overlooked

After clarifying that the player group with the most PMF is actually Normie e-begger, the question is where to find it? Southeast Asia is a market that cannot be ignored. In this market, the culture, language, and economic development level are all different from those in Europe, America, and China. Many of Tencent's self-developed games relied on Garena to distribute them in order to solve the problem of not being able to adapt to the local environment in Southeast Asia. Garena's experience in localization is that you have to make something that users like, you have to make something that they can afford, and you have to come from them and go to them.

So they put on the shelves many skin props that did not conform to the "game world view", extremely light games, sacrificed graphics performance, and maximized the adaptability of low-end machines/poor networks. Products that are too far away from users will eventually be punished by the market.

In reality, many crypto games face GTM difficulties because they don’t understand the market. They don’t know who the users are, where the users are, how to do UA and retention, and ignore the low ARPU (Average Revenue Per User) market. So Degen retail has repeatedly issued Layer2 and 3A for a small cake.

But when you come to the Philippines in Southeast Asia, these are not problems. Here you have the most realistic p2e game scene/educated users and "infrastructure". The per capita income here is less than $11, and 40% of the people do not have bank accounts. During the Axie boom in 21, people could even use SLP to buy snacks at gas stations/restaurants. PESO has depreciated severely, and people are strong in gambling.

Although the collapse of the Axie bubble caused heavy losses to countless local players, as the market recovered, a new batch of P2E games have grown up again in this market. This rebirth after the bubble actually shows that there is a real user demand behind it.

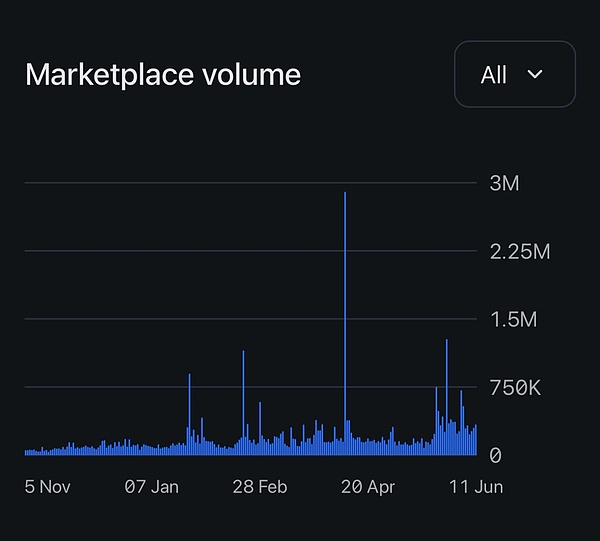

Pixel, the number one game on Ronin, has increased its number of users in the Philippines from 80,000 to 830,000 from November 23 to March this year, and 30% of the world's P2E gamers are based in the Philippines. Interestingly, many pixel players are actually real farmers in the suburbs of Manila. They work in the fields during the busy farming season, and collect vegetables in the crypto world to supplement their income during the slack season. Pixel's founder Luke said that the farmer players in the Philippines even gave him various suggestions in the community to make the game more realistic. For example, fertilizers for crops, sowing and harvesting cycles, etc. . .

People don't understand why a pixel-style Ranch Story web game without a particularly large wealth effect can continue to attract users, and FDV on Binance has reached 1 billion?

In fact, they don't understand

1) Most players don't actually expect to make a lot of money. They collect pumpkins and sell them for as much as they can. They are content with a small fortune and feel full of ownership when they see a full warehouse.

2) This is one of the few options they can access, play, and trust, and behind each of these subdivided conditions is the moat accumulated by Sky Mavis for 3-4 years of hard work.

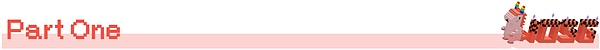

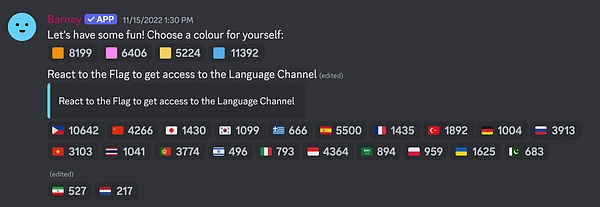

Nationality verification interface on Pixel discord:

In the Philippines, people gather in Internet cafes to play Heroes of Mavia and Nifty Island. Many players are full-time.

And Internet cafes/Mobile cafes in Vietnam are completely unfamiliar gaming scenarios for many Western development teams.

Many people have never tried to stay in a 30-degree Internet cafe in their lives, with the heat and noise of the host computer in their ears, and earn money by leveling up under the sweat and cigarette smell of netizens. How can you ask them to make a blockchain game with real PMF?

In addition to game players, there is also a very complex business ecosystem around p2e games, such as Internet cafes, gold-making guilds, blockchain game education media, software and hardware developers, etc. Players are exposed to new game information through these very local channels and have very local/offline organizational connections with mature player communities, because they may be exposed to a certain game because their friends/neighbors/teachers/colleagues are playing it.

Without localized touchpoints and distribution and operation strategies, game projects in these markets are like sailing in the dark. This is far from a gap that can be filled by asking a few local kols to post soft articles. Guess what? Most Filipino players don’t even use Twitter….

Communication channels are one thing, but for p2e games that require real money, publisher brand/security endorsement is even more important.

Unlike what many outsiders imagine, the collapse of Axie, including the collapse of the entire crypto world in 22 years, has actually had very limited impact on public opinion. The reason behind this is that in addition to the fact that this market is very degenerate, it is also because YGG/Sky Mavis and other players have been investing in PR for many years (such as making documentaries about improving the livelihood of low-income people in the local area, and stories of people from the bottom of society turning over and becoming rich by all-in Axie), which has shaped a relatively positive perception of crypto among local people.

Therefore, in the eyes of players, P2E game = the game I saw on the Ronin platform. Think about it from another perspective. If Chinese players spend a lot of money on games, do they feel more "secure" if they spend money on Tencent games? If you have already put all your assets in the Ronin wallet, how easy is it for you to migrate to other games? Or, do you know there are other games/wallets? In fact, the entire Ronin ecosystem is like an isolated island compared to other chains that focus on interoperability and are eager to open up liquidity, which firmly keeps users' attention and money in the ecosystem.

Therefore, for those projects that want to enter the Philippines, Ronin is the one & only go-to.

4. P2E never die, it only grows on suitable soil

Be it the Philippines, Eastern Europe, or Africa. The recent hot markets for these zero-cost games have the following similarities:

1) Fiat currency faces a certain crisis

2) The population structure is young, with a large number of young people with free time

3) The economy is underdeveloped, and the per capita income is ~10 US dollars

Although these markets have good Crypto adaptability, ARPU (Average Revenue Per User) is low, and they are not traditional Degen retail sources (North America, China, South Korea), and the funds are often involved in gray industries, so they are often ignored by the project parties.

The cake of the sinking market is the elephant in the room.

There are many ways to make things work in the crypto world. You can tell the sexiest narratives or make the most down-to-earth products. If you choose the latter, then please carefully cultivate your sinking market and face your Normie users directly.

Localization of sinking markets and Normie gtm are very lacking in many Crypto native projects. After all, many projects have only two types of users in their cognition, namely, those who speculate on coins, and they are completely free-range in some minority language regions in terms of operations.

Eat up the piece of cake that others despise, and you will find that perhaps others are hungry.

JinseFinance

JinseFinance