After we put the money into Huma Finance Arf Pool, these assets will be stored by Arf in a bankruptcy-isolated SPV (special purpose entity, a legal entity created for a specific or temporary purpose, mainly for risk isolation).

After we put the money into Huma Finance Arf Pool, these assets will be stored by Arf in a bankruptcy-isolated SPV (special purpose entity, a legal entity created for a specific or temporary purpose, mainly for risk isolation).

As a service provider, Arf Financial GmbH provides services to SPV. Lending, cross-border payments, transaction settlement and risk management are carried out here. After a transaction is completed, SPV will return the money and profits in the Pool to the chain. Arf Financial GmbH has no control over the corresponding Pool funds.

6/ Fill in the gaps

Here are two additional points:

1. Circle's official website has a very detailed introduction to Arf:https://www.circle.com/en/case-studies/arf

Arf does a good job in risk control, but this also leads to some problems, such as the need for KYC before depositing, which is not friendly to many DeFi players. And, I personally think that Huma Finance's UI/UX still has room for improvement.

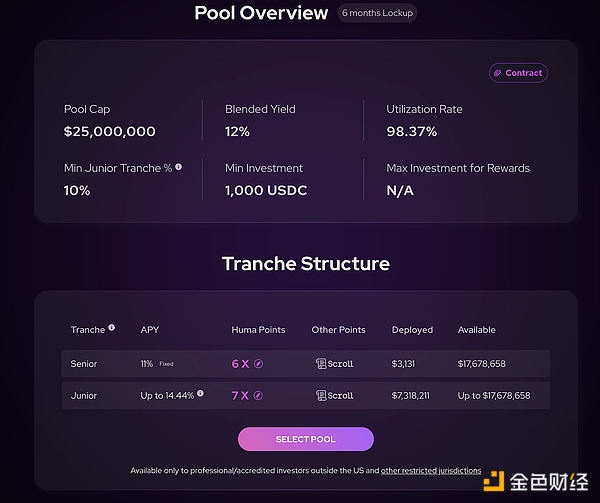

2. Cooperation with Scroll

Currently, we can deposit USDC into Huma on Scroll, and achieve three benefits from one fish - 10% + financial management income + Huma points + Scroll points.

7/ Finally

Why have I been looking at this kind of financial products recently? Because after I cleared my position some time ago, most of my assets were U, so I wanted to find a good place for these U to manage their wealth.

From my personal point of view, before the market shows a potential upward trend, I will not be fully invested or leveraged, and at most do some short-term swing operations.

JinseFinance

JinseFinance

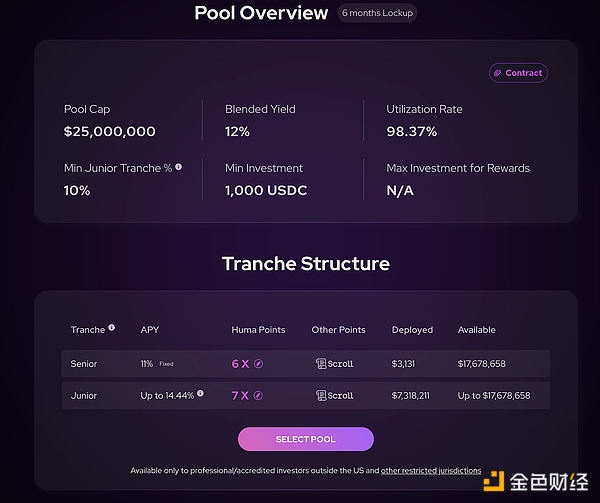

On the product side, v2 implements a more complex product structure, such as the addition of Senior, which we will mention below. Tranche, Junior Tranche, and First Loss Cover. Simply put, this upgrade is a subdivision of the functions to meet the needs of users with different needs.

On the product side, v2 implements a more complex product structure, such as the addition of Senior, which we will mention below. Tranche, Junior Tranche, and First Loss Cover. Simply put, this upgrade is a subdivision of the functions to meet the needs of users with different needs.  After we put the money into Huma Finance Arf Pool, these assets will be stored by Arf in a bankruptcy-isolated SPV (special purpose entity, a legal entity created for a specific or temporary purpose, mainly for risk isolation).

After we put the money into Huma Finance Arf Pool, these assets will be stored by Arf in a bankruptcy-isolated SPV (special purpose entity, a legal entity created for a specific or temporary purpose, mainly for risk isolation).