The two founders of a16z: What is the difference between the AI boom and the Internet boom?

Marc Andreessen, founder of a16z, believes that the Internet is a network, while AI is more like a computer.

JinseFinance

JinseFinance

Source: Tencent Technology

On August 5, 2024, global stock markets experienced a "Black Monday".

The S&P 500 fell 3.1% and the Nasdaq fell 3.4%.

Among them, technology stocks and chip stocks led the decline. Nvidia fell 6%, Apple fell 4.6%, and Tesla fell 4.2%.

The total market value of the "Seven Big Tech Companies" evaporated by $1.3 trillion at the beginning of the session. Although the stock price has rebounded since then, the total market value loss for the whole day is still slightly higher than $650 billion.

In this regard, Sun Lijian, director of the Financial Research Center of Fudan Development Research Institute, said that the decline in U.S. stocks was due to standing at a bubble high where it is cold at a high place.

The most prominent in this bubble is the AI industry, because they have been falling for more than half a month.

On July 18, the market value of the "Seven Big Tech Companies" in the U.S. stock market evaporated by a total of $1.1 trillion in five days.

A week later, on July 24, the "Big Seven" fell collectively again, causing the U.S. stock market to evaporate more than $750 billion in market value throughout the day. This also caused the S&P 500 and Nasdaq indexes to record their largest single-day declines since the end of 2022.

In addition to the stock market, warnings about the AI bubble have continued.

In March of this year, Apollo Chief Economist Torsten Sløk wrote that the "badness" of the AI bubble not only exceeded that of the 1990s, but also exceeded the level of the peak of the Internet bubble.

And Sequoia partner David Chan issued warnings last year and this year, believing that the total annual revenue of AI companies must reach $600 billion to pay for infrastructure construction. This is impossible at the moment.

The most serious concern about the AI bubble comes from the report "Generative AI: High Costs, Low Benefits" released by Goldman Sachs at the end of June. Many experts interviewed in the report said that people have too high expectations for AI and have invested too much, but its existing and potential benefits are too small. At present, AI has a huge bubble risk.

Is AI a bubble that is accumulating? If so, has the bubble burst now? What impact will it have in the future? After reading this article, perhaps you can find the answer.

To judge a bubble, we need to first understand what a bubble is.

Bubbles often originate from the emergence of new technologies. The market is too optimistic about the future development of technology, resulting in over-investment and blind following, making its value exceed the level that the real economy can bear, and then it declines sharply and finally bursts like a soap bubble.

Combining several classic papers on economic bubbles, such as Hyman Minsky's "Financial Instability Hypothesis" and Jordi Galli's "Monetary Policy and Rational Asset Price Bubbles", we have summarized the core conditions for the formation of bubbles.

Mainly include: economic fundamentals are favorable for investment, the emergence of information gaps, and the expansion effect of psychological and behavioral factors. Simply put: the market has money and investors invest irrationally.

The first is that the market must have money, which means that the market must have ample liquidity. In a low-interest rate environment, credit expansion and the basic economic status of excess liquidity can trigger bubbles.

For example, in 2022, we experienced a period called the "bubble of everything". In response to the economic downturn caused by the epidemic, the Federal Reserve implemented near-zero interest rates and quantitative easing (QE) from 2020 to 2021. This move attracted investors to make riskier investments and allowed unsustainable business models to develop on the basis of low-interest loans. Almost all stock market assets are appreciating at a high speed, repeatedly setting historical records in the United States. Until 2022, when the Federal Reserve raised interest rates again to curb inflation, the stock market plummeted. In one year, Google fell 40%, and Tesla and Meta's stock prices fell 60%.

The second is irrational investment by investors. New technologies allow investors to obtain quite high returns through early investment. The monopoly nature of certain tracks themselves makes its potential returns in the future higher. Sufficiently high profit margins lead to blind optimism in the market, causing investors to underestimate risks and overestimate returns.

For example, the Internet bubble that was punctured in 2000. In 1995, a large amount of venture capital poured into Internet-related fields such as e-commerce, telecommunications, and software services, and the return on investment far exceeded other industries such as chemicals, energy, and finance. When speculators noticed the rapid growth of stock prices, they bought in anticipation of further increases. In 1999, the amount of investment in Internet-related industries in the United States reached US$28.7 billion, nearly 10 times that of 1995.

Remember the two prerequisites for the bubble we mentioned above? The first is that the market must have money.

But the liquidity of the current US financial market is not optimistic, which means that the upper limit of the AI bubble cannot be high.

In this regard, Xiong Weiming, partner of Huachuang Capital, pointed out: "The extent of this wave of bubbles is actually far less than the Internet bubble 20 years ago, or even the cryptocurrency bubble in 2017, or the NFT bubble in 2021. The characteristics of these bubbles are that the valuation far exceeds the investment return cycle that can be obtained by actual products and services.

If measured by proportion, I think the extent of this wave of bubbles may be only 20% to 30% of the dotcom or NFT bubble. The extent of this wave of bubbles is definitely not as good as the previous ones."

The financing environment in the past two years has been relatively poor. In order to curb the highest inflation in 40 years caused by monetary easing during the epidemic, the Federal Reserve has raised interest rates 11 times from March 2022 to July 2023.

At the same time, the Fed has also begun a large-scale balance sheet reduction. Starting in June 2022, the Fed will reduce its holdings of Treasury bonds by $60 billion and mortgage-backed securities (MBS) by $35 billion per month.

In a nutshell, during the AI outbreak, the Fed is implementing the most aggressive monetary tightening policy since the 1980s.

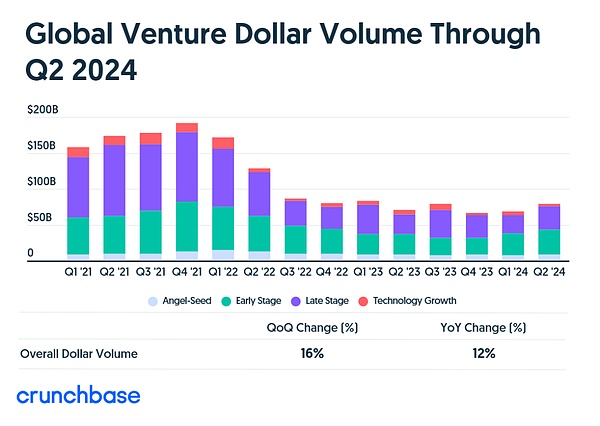

The market has no money. Even if almost all VCs are caught in FOMO, the overall trend of venture capital in the US stock market is still declining. According to Crunch base data, the total global financing in the first half of this year fell 5% year-on-year.

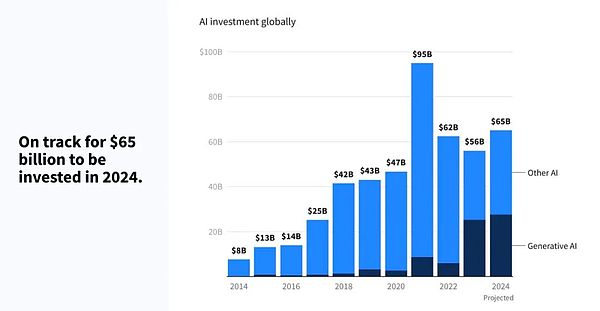

Of course, AI startups among them stood up against the wind, with a year-on-year increase of 24%, and even received the largest quarterly investment of $24 billion in the second quarter of this year, but the total value is still only 70% of that in 2021.

This is because the easing during the bubble period of everything in 2021 brought a huge amount of liquidity, and the aftermath has not yet been eliminated. The market is not as rich as in 2021, but it is still quite rich.

Xiong Weiming said in comparison: "In the past two years, AI may have reached its peak from the perspective of capitalization. In 2021, the United States issued 6 trillion US dollars in half a year, which is the only time in human history. This capital ripening effect is unprecedented."

However, VCs are holding their money much tighter than in 21 years.

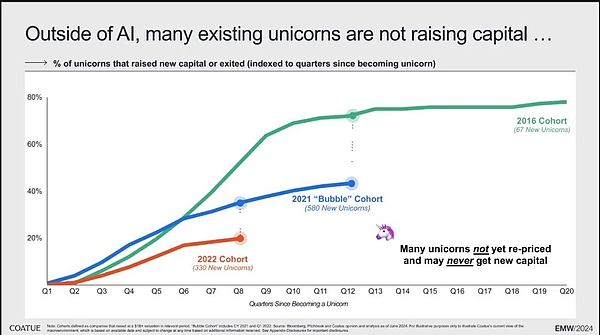

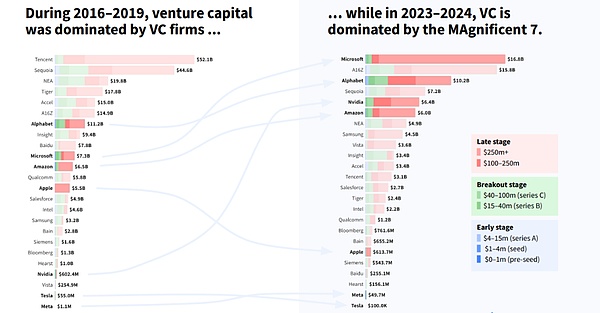

From the data given by COATUE, although this round of AI investment is lively, VCs have not done their best. Private equity firms still have $1 trillion in uninvested funds, which is at an all-time high.

There are two main reasons for this.

First, the exit path is not smooth, and VC investment is very hesitant. After the last round of the "everything bubble", the number of unicorn companies soared, from 67 in 2016 to 580 in 2021. But their refinancing rate has been falling. From 2016 to 2022, the proportion of unicorns that received refinancing in the same period dropped from 50% to less than 20%.

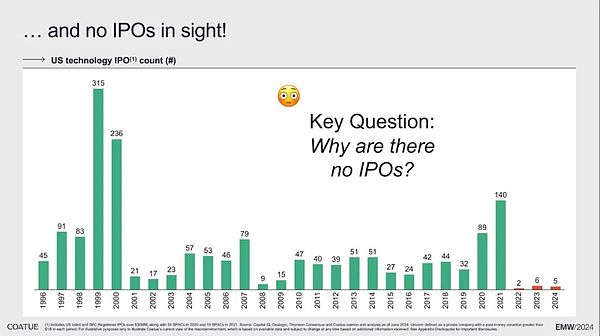

What about IPOs? It's even more terrible. Since 2022, there have been only single-digit numbers.

"In fact, there were 970 IPOs in the US stock market in 2021, but it dropped to 162 in 2022, and only about 44 in the first half of this year. This shows that the contraction of the global capital market is an obvious trend."

In this case, the only way to exit is mergers and acquisitions. This way is too narrow.

Another reason is that the current stage of AI development has a high investment threshold, which restricts many VCs from entering the market.

"The early Internet industry needed to build its own servers and infrastructure, similar to today's AI field. The cost of running a large model ranges from tens of thousands of dollars to hundreds of millions of dollars, and it is in the early stages of new infrastructure construction."

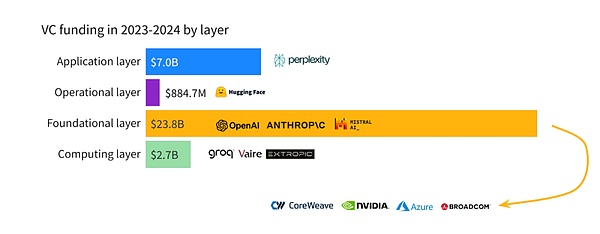

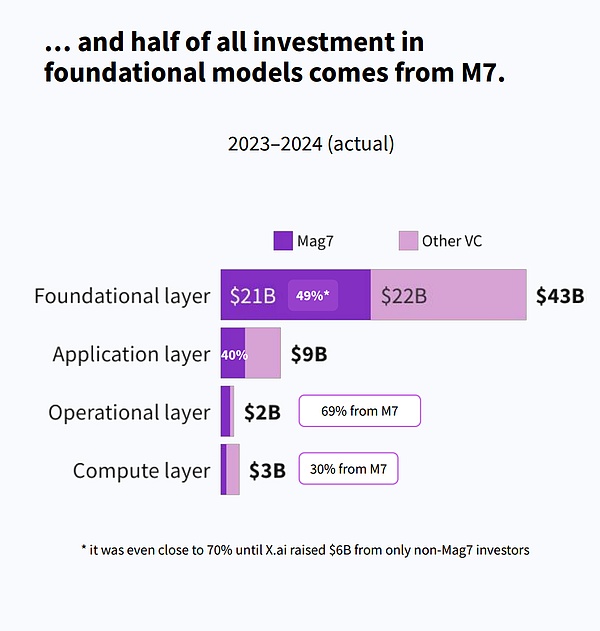

We found that most of the money entering the field of artificial intelligence flows to foundational layer companies, which are the large model companies we are familiar with, such as OpenAI, Anthropic, Gemini, etc.

They then use this part of the funds to purchase chips from computing layer companies such as Nvidia to train their own large models.

Therefore, the current position of the AI industry is more like the infrastructure construction period. It is precisely this stage characteristic that determines that small VCs with insufficient funds are difficult to enter the market.

"Last year and the year before, a large number of AI companies, especially those in Silicon Valley, made early investments, which seemed active, but 80% of the investments were concentrated in the early stages, and many companies were eliminated in the upgrade of large models. Large companies have obvious advantages in the field of NLP because the cost of each test is too high, which is similar to the development of the Internet 20 years ago. At that time, the Internet cost was high, and fiber optic cables and computer rooms were built. Now the investment cost of AI is also high. The change in infrastructure from small parameters to large parameters gives large companies a natural advantage. Therefore, this wave of reduced investment, whether in China or the United States, is mainly dominated by large companies. The United States is also dominated by several major companies. Startups are not the mainstream in this wave of innovation, and the mainstream is still large companies."

Therefore, whether from the overall performance of the financial market or from the enthusiasm of VC participation, there is not too much hot money in the AI pool at present.

There is little money in the market and the investment threshold is high, so who is playing this investment game?

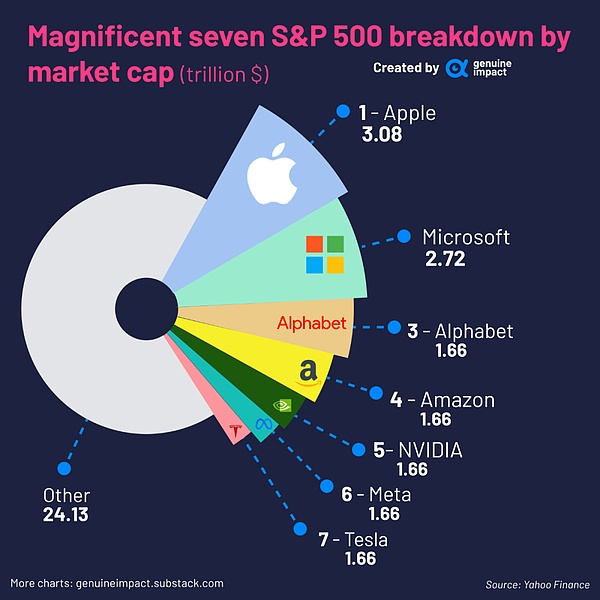

In fact, the core players of this round of AI investment are mainly the leaders of the Internet era, with their own krypton gold physique, among which the most typical one is the "Big Seven in the US Stock Market".

According to a report jointly released by Flow partners and Dealroom at the end of May this year, the combined market value of the Big Seven in the US stock market accounts for 32% of the S&P 500 index, and the economic profit accounts for nearly half of the S&P 500 index.

So much so that in the past year, the Big Seven has become the largest investor in AI, participating in 208 venture projects in 2023 alone.

In the first half of 2024, the Big Seven invested nearly $25 billion, more than the total of all venture capital in the UK, and this money mainly flowed into the field of artificial intelligence.

Whether it is a large model or a chip company, there are seven giants behind them. Even before Musk's X.ai raised $6 billion from non-seven investors, the seven giants accounted for nearly 70% of all basic model investments.

The giants who are so "heavy" in AI, with left-hand investment and right-hand self-research, tell stories to the capital market in person, and the technology stock prices are continuously pulled up by the promised technology myths.

Today, the seven giants with a total market value of 16 trillion have an average price-to-earnings ratio of 45 times (the average of the S&P 500 is 28 times), and the market value of corresponding investment darlings such as OpenAI, Anthropic and other start-ups is also rising.

Is such a market rational? This depends on the reasons why the giants are betting.

The attitude of the giants towards AI is almost a gamble. Huang Renxun said in a recent conference call with Nvidia:

"Let me give you an example to illustrate that time is really valuable. Why is the idea of building a data center immediately so valuable, and why is the training time so valuable. The reason is that the next company that reaches an important milestone will announce a breakthrough in artificial intelligence. And the second company after that will announce something that is only 0.3% better than it. So the question you have to ask yourself is, do you want to be a company that repeatedly delivers breakthrough AI, or a company that only improves performance by 0.3%? ... Therefore, this is why we are building the Hopper super chip system like crazy now, because the next important milestone is just around the corner."

AI is an era technology that is visible everywhere. Whoever seizes the opportunity means who will master the rules of the next game. For the seven giants, whether they are in a bubble or not, the decision they make is the same. Because it does not depend on whether you are willing to distinguish whether it is a bubble or an opportunity, but on whether you can survive in this competition.

And the investment of the giants is not very aggressive compared with the cash flow they create.

From the financial reports, these companies basically achieved revenues of more than $10 billion in the last quarter.

Microsoft achieved a profit of $22.04 billion in Q2 of fiscal year 2024. With such a heavy investment in AI investment, its net profit margin only dropped from 39.44% in Q3 of fiscal year 2023 to 34.04% in Q2 of fiscal year 2024. Alphabet's profit in Q2 reached $23.6 billion, and Amazon's profit reached $13.4 billion.

The overall profits of the seven giants are very healthy. And they also have a lot of cash in their pockets that they can't spend.

Apple's free cash flow has now exceeded $100 billion. Microsoft, Alphabet and Amazon are expected to join the "Free Cash Flow $100 Billion Club" in recent years based on their revenue growth rate. Meta's free cash flow this year may exceed $30 billion.

Nvidia and Tesla's free cash flow is slightly less, but before the outbreak of AI, Nvidia has been able to generate billions of dollars in free cash flow each year. After making a lot of money in the past two years, it should be able to reach the level of tens of billions.

The seven giants now expect to invest no more than $50 billion in AI in 2024, which is completely within their tolerance range from profits to cash.

If this is a life-and-death battle in the next era, are they keeping these profits and cash for retirement?

It is precisely because the giants can afford it that they are not irrational.

The giants with ample cash flow are also investors when they invest in AI.

They are responsible for both investment and self-research. At this time, the stability of the giants' own valuations has become an important indicator for judging the AI bubble. After all, only by stabilizing itself can there be a continuous flow of cash flow to support a virtuous cycle.

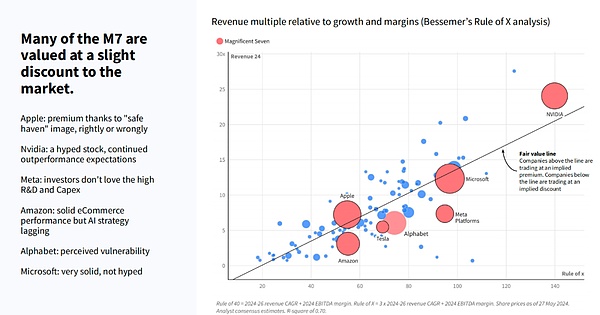

This is a chart that uses the "Rule of X" to evaluate the market value of the seven giants relative to their revenue growth and profit margins.

In short, the diagonal line in the figure represents the theoretical fair value. If a company's point is above the diagonal line, it means that its market value is overestimated relative to its revenue, and if it is below this line, it is underestimated.

We can see that Amazon, Tesla, Alphabet (Google's parent company), and Meta (formerly Facebook), which are below the diagonal line, are undervalued relative to their expected revenue. In other words, the possibility of bubbles in the stock prices of these companies is small because their market values do not show signs of over-inflation.

Microsoft and Apple, which are hanging on the diagonal line, have a slight premium, but they rank first and second in market value. One is the largest investor behind OpenAI, and the other can easily establish a deep cooperative relationship with OpenAI. Needless to say, their strength is naturally strong.

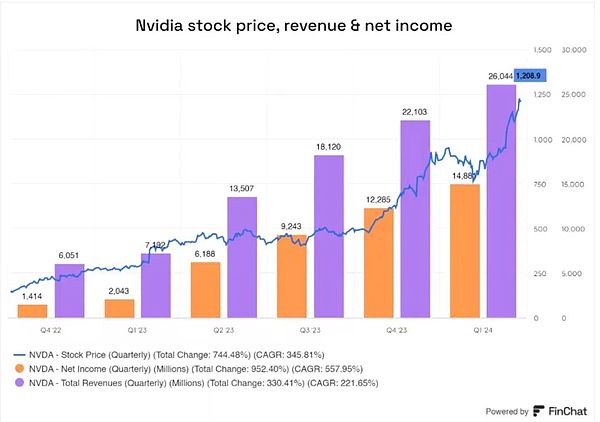

Even Nvidia, which is considered to be the most suspected bubble, has seen its stock price rise by 744% and its profit rise by 330% in the past six quarters as of the first quarter of 2024. It can be said to be the bubble with the most fundamental support.

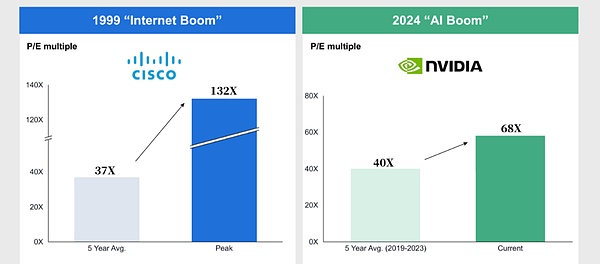

Hedge fund COATUE has also made a calculation. Taking Cisco, which had the most obvious growth during the Internet bubble, as an example, its five-year average price-to-earnings ratio was 37 times, but it was as high as 132 times during the bubble period.

The same calculation method corresponds to Nvidia, whose average price-to-earnings ratio in the past five years was 40 times, and today it has reached 68 times, far from the level of Cisco's bubble period. As an emerging overlord, even in the semiconductor industry, Nvidia's price-to-earnings ratio is only above average.

(Source: COATUE, this version is redrawn with the latest data)

"Recently, the market value of seven large companies evaporated by 1 trillion US dollars in one day. Although this scale is huge, its impact is much smaller than the fluctuation of the same market value 20 years ago.

20 years ago, during the Internet bubble, the decline in market value was distributed among many small companies, and each company fell from 100 US dollars to 2 US dollars. This decline had a huge impact on the market.

Now, the adjustment of market value is mainly concentrated in a few large companies. Therefore, even if the market value of these companies fluctuates greatly, the impact on the overall capital market is relatively small. This is why I think the correction of the AI market will not cause a huge shock to the capital market like the Internet bubble in 2000. "

The reason why giants are giants is that they are large enough and their chassis is stable enough. Even if it becomes a bubble, it is the most fundamental bubble.

Another rational premise is that investment needs to have corresponding returns.

The giants are willing to participate in the arms race. When money is not a problem, what needs to be further responded to is the doubts about the return on investment. This is also the core of the report released by Goldman Sachs and the 600 billion question of Sequoia Capital.

The current stage of AI is more like infrastructure. The return cycle of infrastructure is different from short-term investment. It basically starts from five years. Even the return cycle of data centers is generally around 4.5 years.

"It may take 5 to 10 years for AI to be commercialized. Looking back at the development of the Internet, the initial business models such as advertising and search engines have also undergone a long period of cultivation. Therefore, we need to be patient and have space for the commercialization of AI."

Since this is an investment with a long return cycle, when can the money invested in AI be earned back?

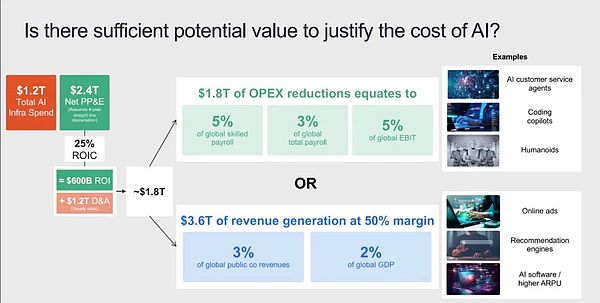

Couteue helped us do the math. AI is expected to cost $1.2 trillion during the infrastructure construction period, that is, by 2030, which is about 25 million GPUs plus related expenses. This seems huge, but it only accounts for 18% of global IT spending.

According to a 25% ROI, that is, an expected profit of $600 billion, plus $1.2 trillion, by 2030, AI investment must convert into $1.8 trillion in revenue to break even.

This can be achieved in two ways. One is to reduce costs. As long as AI can reduce the total salary of technical personnel worldwide by 5% or the salary of all workers by 3%, it can achieve a profit of $1.8 trillion. The other is to increase revenue. If AI can bring about a 2% increase in global GDP and increase the revenue of all listed companies by 3%, then AI companies only need to earn half of the revenue from it, which can reach $1.8 trillion.

Then the question is, can AI bring about the result of reducing costs and increasing efficiency?

In a Goldman Sachs report, Daron Acemoglu, a professor at MIT, pointed out that the economic benefits that generative artificial intelligence can generate in a short period of time are very limited. Even though he does not deny the potential of artificial intelligence technology, he still asserts that artificial intelligence can only affect 4.6% of all work tasks within 10 years, and the GDP growth it brings is very small, only 0.9%.

Such doubts are not unreasonable. Looking back at the history of technology, we will find that it does take a long time for a new technology to enter the market and penetrate the lives of ordinary people.

For example. The suitcases we often use actually took shape as early as 1887, but it was not until 1972 that the patented design of installing wheels on the suitcase appeared, and it was not until 1991 that the most common roller trolley suitcases were available.

Even a simple invention like a suitcase took 100 years to find the right "opening method" from its design to its universal use, not to mention the complex principle of artificial intelligence technology, which is still a black box.

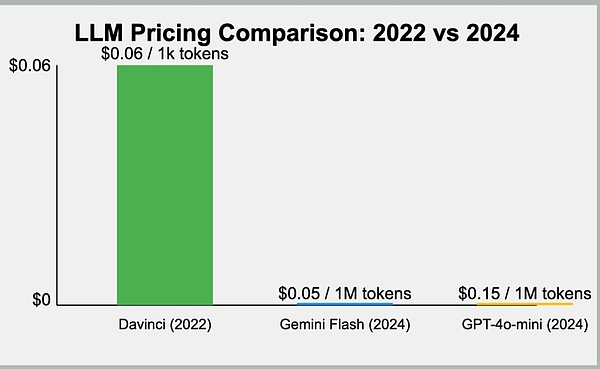

But is AI really as ineffective as Acemoglu said? In order to figure this out, we specifically looked through the papers published by Acemoglu himself and the two studies he cited.

It turned out that Acemoglu's argument was difficult to stand up.

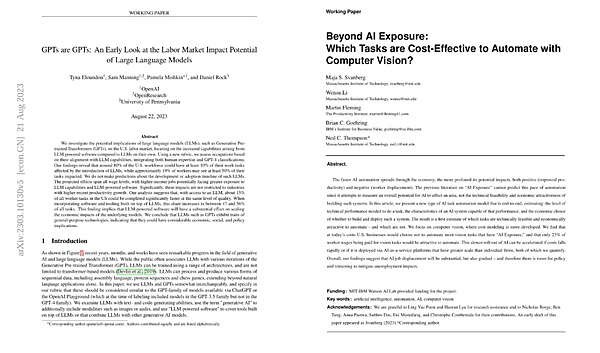

His argument cited data from two studies, using the proportion of tasks that may be affected by AI in the future (20%) × the proportion of tasks that will actually use AI (23%) = the proportion of work tasks affected by AI in the future (4.6%), and concluded that AI has little benefit. And use this to calculate the ultimate impact of AI on GDP.

But Acemoglu used the most pessimistic predictions about the development of AI in his cited research in his paper. First, he believes that there will be no software that can effectively integrate large language models in the market in the next ten years. Second, he believes that the cost of using AI will not decrease in the short term.

For the first point, in the paper cited by Acemoglu, the author clearly pointed out that if GPTs can be used, about 15% of all worker tasks in the United States can be completed significantly faster while maintaining the same quality. But when integrating software and tools built on LLMs, this proportion increases to 47% to 56% of all tasks.

Acemoglu only uses the value of 15% for calculation. However, almost all technology giants are currently trying to integrate AI into their own software. For example, Microsoft's Copilit and Adobe's Firefly are continuously updated, and software integrating LLMs is not uncommon.

As early as the launch of GPT-4o, OpenAI revealed the idea of developing a system-level application dominated by a large language model. This was confirmed again in OpenAI's two acquisitions this year. Combined with the current development of Agent, we have reason to expect to see LLMOS in the near future.

If it is true as Acemoglu said, there will be no software that effectively integrates large language models and is widely used in the market in the next ten years, then it is not unfair to say that AI is a bubble, but it is obviously not true at present.

For the second point, Acemoglu's judgment on the cost and penetration of AI is not accurate enough. The paper he cited stated that American companies would choose not to automate most tasks that can be AI-ized, and only 23% of the wages of workers used for visual tasks are attractive for automation. But the cited article clearly shows that if costs fall rapidly or are deployed through AI-as-a-service platforms that are larger than a single enterprise, the current situation of slow promotion of AI will accelerate.

What's more, the decline in AI costs is already a more obvious trend at present.

In an exclusive interview with the Daily Economic News, the founding CEO of the Allen Institute for Artificial Intelligence in the United States said that Moore's Law in the chip era is still applicable in the AI era, and the cost of AI training and reasoning may drop by half every 18 months.

Take ChatGPT as an example. Altman said in an exclusive interview at the beginning of the year:

"GPT-3 is our longest-launched and most optimized model. In the more than three years since its launch, we have reduced its cost by 40 times... As for GPT-3.5, I believe we have reduced its cost by nearly 10 times... Among all the technologies I know, our cost reduction curve is the steepest."

From the actual market price, two years ago, GPT 3.5 cost 0.06 US dollars per thousand tokens. Now, Gemini Flash only costs 0.05 US dollars per million tokens. In just two years, the cost of AI has been reduced by 100 times and the capability has been improved by 10 times. ”

In addition, a research report released by McKinsey in May showed that the global AI adoption rate will increase significantly in 2024, and the use rate of generative AI will double compared with last year, which shows that more and more organizations and individuals are beginning to use AI.

JPMorgan Chase's research also pointed out that the proportion of companies expected to use AI for production by 2025 will exceed 55%. The proportion of AI infiltrating companies is much higher than 23%.

Therefore, Acemoglu's judgment can only be said to be an unrealistic and pessimistic statement. The efficiency improvement and cost reduction that AI can bring are foreseeable changes.

Of course, in addition to refuting Acemoglu's point of view, we have more evidence to prove the value of AI.

Goldman Sachs economist Joseph Briggs According to McKinsey, GenAI can automate 70% of repetitive work, bringing $2.6 trillion to $4.4 trillion in benefits each year, while increasing the impact of all artificial intelligence by 15% to 20%. 40%.

In this way, compared with the optimistic estimate that it can contribute 2.6 trillion to 4.4 trillion US dollars of growth to the economy each year, is the $600 billion annual AI infrastructure cost proposed by Sequoia still a bubble?

Secondly, the scale effect caused by technology may be a disruptive impact beyond productivity.

There is no doubt that the Internet is the industry that has created the most wealth in the past 20 years. The last wave of Internet technology brought e-commerce, platform economy, mobile social networking... It is a technological vehicle that connects the world as a whole. But it was originally invented for national defense communications. At that time, few people would have thought that the Internet could shape our current economic behavior and lifestyle so profoundly.

Although it is difficult to define what kind of far-reaching impact AI will bring, humans are always accustomed to overestimating their own judgment and underestimating the influence of technology.

"The Internet solves the problem of interconnection, moving the original offline data online and realizing digital twins. For example, dishes that could not be found on the Internet more than a decade ago, such as Beijing-style shredded pork with soy sauce, are now given an "IP address" for each item, just like the transition from IPv4 to IPv6. Every person and every item has a unique identifier.

AI does not solve the problem of connection, but reorganizes the means of production and improves productivity. AI can play a greater role in the world of digital twins and replace human processing power. It is not just through connection, but through intelligent judgment and automated operation. For example, after air conditioners and refrigerators are connected to the Internet, they still need to set parameters manually, but with AI, these devices can make autonomous judgments and perform operations, such as automatically turning on the air conditioner when the temperature exceeds 28 degrees. This is the role of AI in the economic ecology, which is different from the role of the Internet. In fact, many industries need AI more than the Internet. "

Therefore, our conclusion is: AI has a bubble, but this bubble is limited and does not deviate from its true value. Existing bubble remarks are overly pessimistic.

"In 1995, the first wave of Internet applications such as Yahoo were just beginning to appear, similar to the AI-generated image and video technology we see now.

At that time, the way the Internet content was organized and searched was eye-opening and full of curiosity. Even a modem was a high-tech product at that time, and products like Cisco were only available to large companies.

From an infrastructure perspective, the situation was similar. At that time, companies needed to go to a telecommunications business hall to apply for email services, which was expensive and required shared use. Today's AI technology is also only affordable by large companies. ”

So, we are still in 1995, and it may be too early to talk about the bubble bursting.

Finally, we also need to ask whether it is reasonable to use the current ROI to measure a technological advancement of an infrastructure nature? Or, are the consequences of a bubble burst necessarily bad?

Current AI does face the problems of high investment and difficult application, but if we look further and turn to those infrastructure periods that have been called bubbles in history, we will have different findings.

Before the Internet bubble burst, telecommunications companies raised $1.6 trillion on Wall Street and issued $600 billion in bonds, and built 80.2 million miles of fiber optic cables, accounting for the largest number of infrastructure in U.S. history. 76% of the total digital wiring, laying the foundation for the maturity of the Internet.

Looking back further, the British railway bubble in the 1840s and the railways built as a result laid the foundation for Britain's highly industrial revolution. The mileage of railway plans approved during the economic bubble accounted for 90% of the total mileage of the British railway system.

When we talk about the Internet bubble, we are not referring to Internet technology as a bubble, but a business model that is mainly in the form of e-commerce and is touted by over-excited speculative investments. Similarly, the South Sea Bubble was not the bursting of a maritime trade bubble, but just a specific monopoly.

And artificial intelligence means more, and the wheel of history will not stop because of the bursting of the bubble. Supporters of artificial intelligence are always quick to point out that AI is the new Internet - a fundamental new technological architecture - if this is true, it will not turn into a bubble.

Reference sources (swipe up and down to view):

1. AI Bubble Is Bigger than the 1990s Tech Bubble - https://www.apolloacademy.com/ai-bubble-is-bigger-than-the-1990s-tech-bubble/

2. AI’s $600B Question - https://www.sequoiacap.com/article/ais-600b-question/

3. GEN AI: TOO MUCH SPEND, TOO LITTLE BENEFIT? - https://www.goldmansachs.com/intelligence/pages/gs-research/gen-ai-too-much-spend-too-little-benefit/report.pdf 4. The Financial Instability Hypothesis - Hyman Minsky 5. Monetary Policy and Rational Asset Price Bubbles - Jordi Ghali 6. The Impact of AI on Developer Productivity: Evidence from GitHub Copilot - Sida Peng, Eirini Kalliamvakou, Peter Cihon, Mert Demirer

7. GPTs are GPTs: An Early Look at the Labor Market Impact Potential of Large Language Models - Tyna Eloundou, Sam Manning, Pamela Mishkin, Daniel Rock

8. Apollo's Chief Economist Sounds Alarm On AI Bubble, Warning It's 'Bigger Than The 1990s Tech Bubble' - https://finance.yahoo.com/news/apollos-chief-economist-sounds-alarm-170755863.html

9. M7 Magnificent Seven - dealroom.co, Flow Partners

10. Coatue EMW 2024 - https://drive.google.com/file/d/184tgms_70fL5P0b1l83qSXk8vpFr4kfl/view

11. Research on the risks of this round of "bubble" in the U.S. stock market - Huang Chengyu

12. A new future of work: The race to deploy AI and raise skills in Europe and beyond - McKinsey Global Institute

13. You Know How The Al Bubble Ends - https://www.forbes.com/sites/jamesberman/2024/07/11/you-know-how-the-ai-bubble-ends/

14. Why Al stocks aren't in a bubble - https://www.goldmansachs.com/intelligence/pages/why-ai-stocks-arent -in-a-bubble.html

15. To the Al Bubble Skeptics - https://www.thedeload.com/p/to-the-ai-bubble-skeptics

16. crunchbase.com

Marc Andreessen, founder of a16z, believes that the Internet is a network, while AI is more like a computer.

JinseFinance

JinseFinanceNvidia's stock has hit an all-time high. Should you "panic" or "greed"?

Wilfred

WilfredOn March 6, Solana ecological DePIN protocol io.net announced the completion of a $30 million Series A financing. io.net stated that the funds raised will be used to build the world's largest decentralized GPU network and solve the AI computing shortage problem.

JinseFinance

JinseFinanceGamefi, Web 3.0, 2024 Jiachen Year Web3 Feng Shui Research Report Golden Finance and Metaphysics bring a new perspective and way of thinking to Web3

JinseFinance

JinseFinanceThe project has maintained a low profile for a significant portion of 2023, evident from the inactivity observed on their Medium and Twitter pages.

Brian

BrianMicrosoft has repotedly signed a deal with former Ethereum miner – CoreWeave.

cryptopotato

cryptopotatoThe Federal Reserve stirred up markets last week, but bitcoin was less reactive than plain old stocks.

Others

OthersThe Federal Reserve stirred up markets last week, but bitcoin was less reactive than plain old stocks.

Coindesk

CoindeskAvalanche and Cosmos 2.0 are two cryptocurrency projects at the forefront of connecting cryptocurrency networks, laying the foundation for a new kind of internet.

Cointelegraph

CointelegraphINTERNET CITY, DUBAI, Jul. 20, 2022 – LBank Exchange, a global digital asset trading platform, has listed Crazy Internet Coin ...

Bitcoinist

Bitcoinist