Author: Chandan, web3 Research, Translation: Vernacular Blockchain

This is a brief introduction to AVS and node operators, as well as the various LRT protocols, and the latest developments in the field.

To become an Ethereum validator, you need two resources: 32 ETH and the hardware required to run the node software. If you lack the required 32 ETH, you can entrust your funds to liquid staking solutions. These platforms will replenish your ETH and operate the node on your behalf, sharing the rewards earned with you.

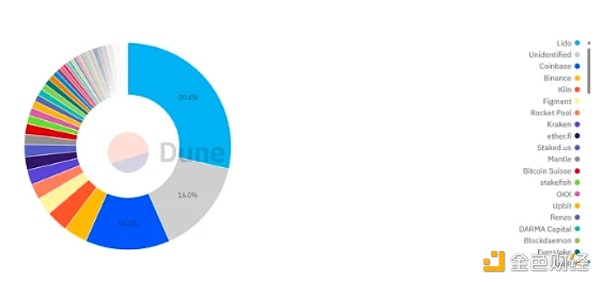

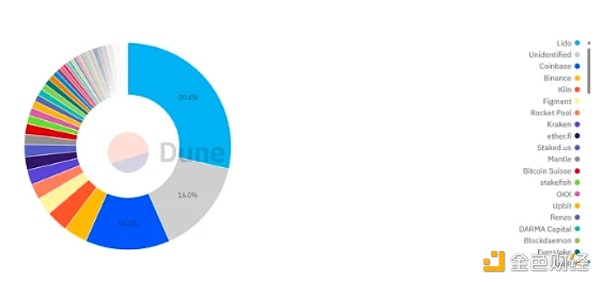

Currently, in the Liquid Restaking solution market, Lido has a 30% market share, followed by Coinbase with 14%, Binance with 3.88%, and other providers.

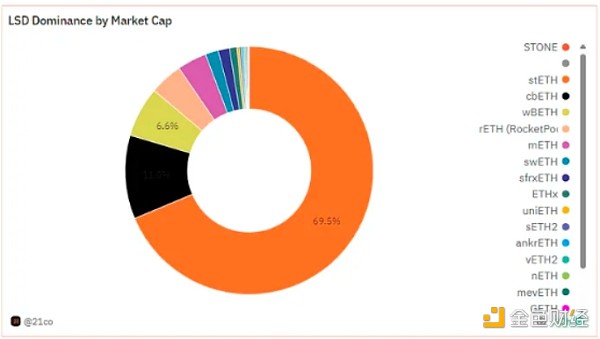

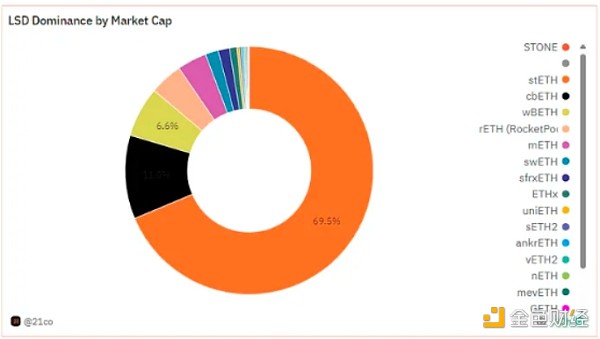

LiquidStakingSolutions such as Lido, Coinbase, and Rocket Pool offer derivative tokens that represent user staked ETH.Lido offers STETH, Coinbase offers cbETH, and Rocket Pool offers RETH. These liquid staked derivative tokens function in the DeFi ecosystem similarly to other ERC20 tokens, enabling users to provide liquidity on decentralized exchanges (DEXs), participate in lending protocols, and participate in various other DeFi activities.

1. EigenLayer

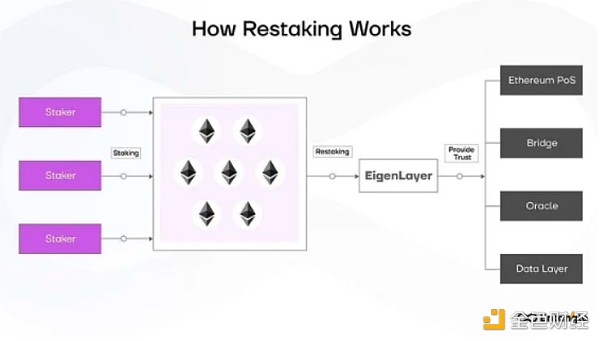

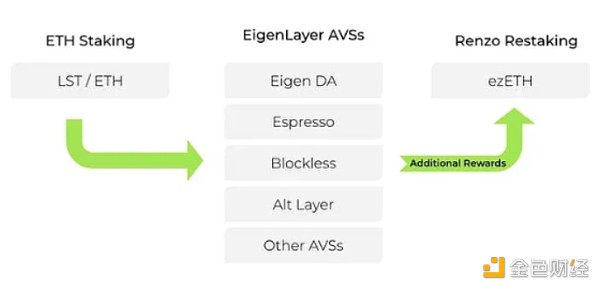

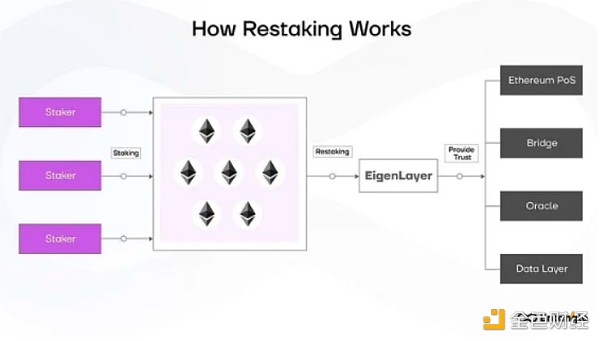

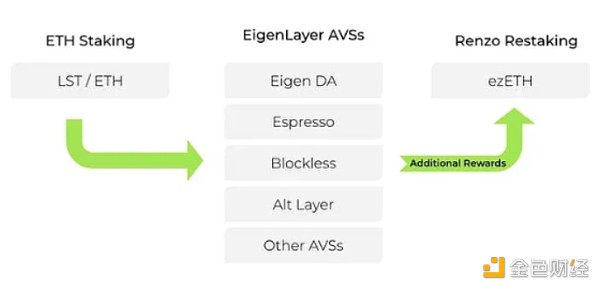

EigenLayer is a re-staking protocol that promotes liquid staking protocols. While liquid staking allows users to use their staked tokens in other DeFi protocols, EigenLayer makes it possible for ETH to be re-staking in other protocols that require security. The protocol that uses EigenLayer's re-staking ETH for security is called Active Verification Service (AVS).

The Active Validation Service (AVS) uses the EigenLayer protocol to integrate with Ethereum's security mechanisms, enhancing the verification of blockchain applications that do not have their own consensus mechanisms.

ETH is staked on both the Ethereum network and the Active Validation Service (AVS). Well-known projects such as AltLayer, Celo, Espresso, EigenDA, Hyperlane, Mantle, and Polyhedra plan to participate in EigenLayer as early AVS.The staked ETH can earn rewards from both staking types, although it is subject to different penalty conditions.

How can ETH be staked on the Ethereum network and other AVS protocols simultaneously?

Ethereum validators can set withdrawal vouchers to allow ETH withdrawals, including EigenLayer's smart contracts. This allows Ethereum validators to participate in AVS validation through EigenLayer's re-staking, run the required client, and set the withdrawal voucher to EigenLayer's smart contract. If the validator meets the AVS penalty conditions, EigenLayer has the right to punish ETH, making the re-staked ETH subject to both penalty conditions at the same time.

2. Node operators within EigenLayer

Node operators secure AVS transactions by re-staking their ETH on EigenLayer and receive additional validation rewards from AVS's operations on top of Ethereum rewards. This provides an ecosystem with economic incentives for validators to support the AVS network.

1) What is the Liquid RestakingToken protocol?

The Liquid Re-collateralized Token (LRT) protocol aims to unlock liquidity for ETH re-collateralized on EigenLayer, similar to how Liquid Collateralized Tokens unlock ETH staked on Ethereum. From an end-user perspective, the Liquid Re-collateralized Token protocol solves several inconveniences encountered when interacting directly with EigenLayer.

2) Inconveniences when using EigenLayer directly

Node operator selection: End-users find it challenging to select a node operator on EigenLayer due to the complexity of risk and reward that needs to be considered.

Interest compounding: Users must manually compound rewards in EigenLayer to benefit from compounding interest, which incurs expensive gas fees.

Lack of liquidity: ETH re-collateralized on EigenLayer lacks liquidity and cannot be easily used elsewhere.

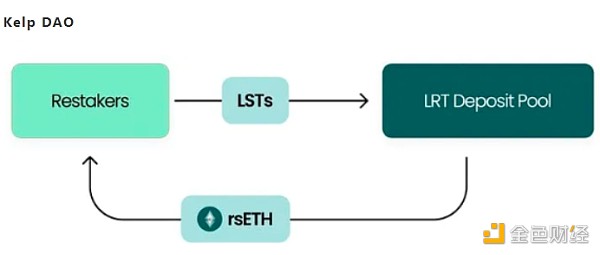

The LRT protocol solves these problems by re-collateralizing deposited ETH in EigenLayer to various operators, thereby standardizing reward and risk profiles. Additionally, it provides users with a tokenized representation of their re-staked ETH and rewards, enabling them to leverage these tokens in other DeFi protocols for additional benefits

3. Different types of LRT protocols:

1) Native Liquid Staking:

The native Liquid Restaking protocol requires all the functionality of a traditional liquid staking protocol and adds an extra layer to create EigenPods for re-staking with different EigenLayer node operators.

This protocol enables users to mint eETH, the first native liquid re-staking token on Ethereum, by staking their ETH. By minting eETH, users can benefit from the rewards generated by staking and re-staking activities conducted through Ether.fi.

Ether.fi is the only protocol that gives stakers control of keys, reducing counterparty risk for node operators and the protocol.

Ether.fi runs Operation Solo Staker, further decentralizing Ethereum by launching nodes in different geographic regions.

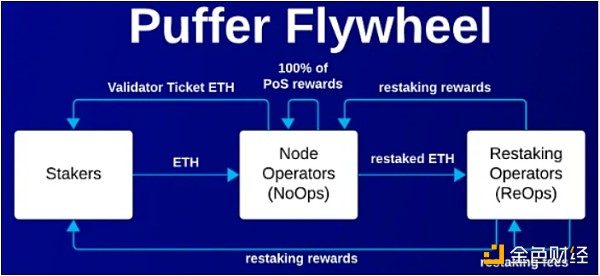

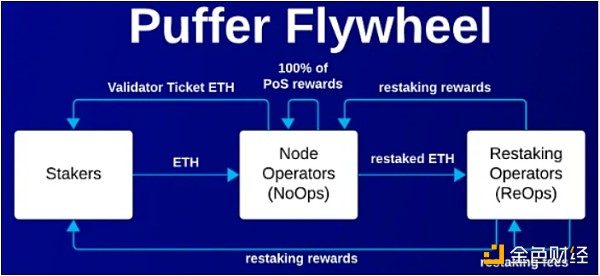

Puffer is a decentralized native liquid staking protocol (nLRP) built on EigenLayer, making native re-staking on EigenLayer easier. It allows anyone to run Ethereum's Proof of Stake (PoS) validators and increase their rewards at the same time.

Capital Efficiency:Less than 2 ETH is required to run a validator. Slashing Protection: First anti-slashing hardware support. MEV Autonomy: Node operators can choose their own MEV strategy.

Swell allows users to earn passes by staking or re-staking ETH, while receiving blockchain rewards and re-staking AVS rewards. In return, users will receive a yield-generating liquid token (LST or LRT) that can be held or participated in the broader DeFi ecosystem for additional yield.

2) Basket-based LRTs:

Allows users to stake various tokens and receive a single certificate token representing a basket of Restaking Liquid Staking Tokens (LSTs). Exposure to different tokens exposes users to multiple counterparty risks.

Eigenlayer’s strategy manager, guiding users in their re-staking strategies.

Key Product: ezETH, a liquid token representing the user's restaking position.

Function: Users can deposit liquid staked tokens (stETH, rETH, cbETH) in exchange for ezETH. For every LST or ETH deposited on Renzo, it will mint an equal amount of ezETH.

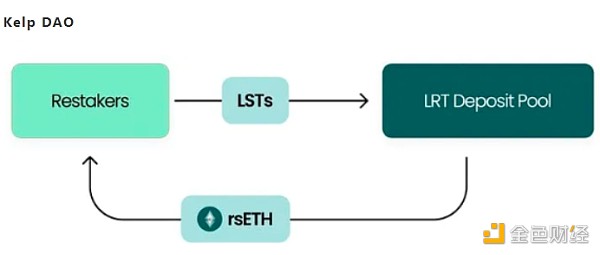

rsETH is a single liquid re-pledge token for all accepted ETH LSTs. Kelp's rsETH is a liquid re-pledge token (LRT) that provides liquidity for illiquid assets deposited into re-pledge platforms such as EigenLayer.

3) Segregated LRTs

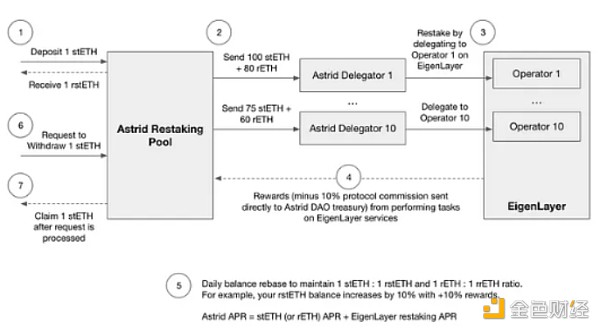

Involves exchanging a specific type of Liquid Staking Token (LST) for a corresponding specific type of Liquid Restaked Token (LRT). By isolating the relationship between LSTs and LRTs, counterparty risk is minimized.

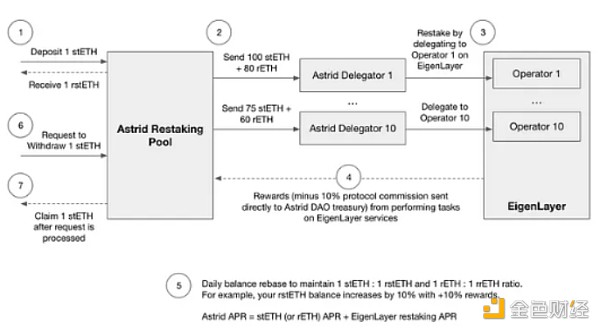

Users deposit LSTs (stETH, rETH or cbETH) into the re-staking pool and receive the corresponding Astrid Liquid Re-staking Token or LRTs (rstETH, rrETH, rcbETH). The pooled LSTs will be re-staked on EigenLayer and delegated through multiple operators voted by Astrid DAO. The rewards obtained are compounded and distributed through balance rebase, automatically adjusting the user's balance.

These protocols meet different user preferences and risk profiles, provide flexibility in managing pledged assets, and take into account factors such as counterparty risk and reward structure.

4. Latest progress in the field of LRT protocol and EigenLayer

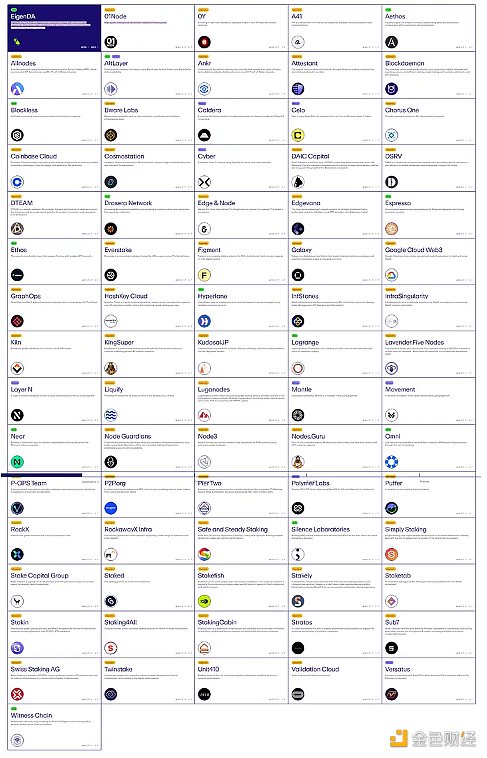

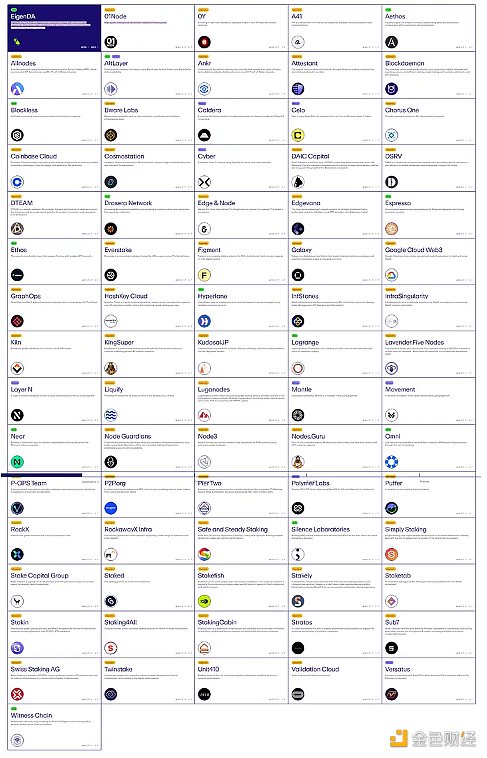

1) Expansion of AVS providers

The number of AVS projects listed on the EigenLayer website has reached about 76, with new ones launched every day.

2) Growth of Liquid Restaking Protocols

The Liquid Restaking Protocol has been widely welcomed and adopted in projects such as Ether.fi, Puffer, and Swell, attracting more than $5 billion in total locked value (TVL).

3) EigenLayer's TVL Growth

EigenLayer's total locked value (TVL) has increased fivefold from $2 billion in January to $11 billion.

4) Innovative Token Models

Various types of LRT protocols have emerged, including local liquidity re-pledge (e.g. Ether.fi), basket-based LRTs (e.g. Kelp DAO), and segregated LRTs for specific Liquid Staking Tokens (LSTs). These diverse models provide users with multiple options for re-pledge assets while managing counterparty risk and maximizing returns.

5. Conclusion

Similar to how we saw Liquid Restaking Token become the most commonly used token in decentralized trading platforms and lending protocols, we can expect the same to happen with LRTToken. Many projects have created different types of liquidity re-pledge tokens with different advantages and disadvantages.

While this does introduce additional leverage, the core increased risk comes from the new reduction conditions leading to unlocking. This risk is not as complex or dangerous as the community may think. If the LRT protocol becomes more active, it can still generate huge value despite Ethereum's huge market capitalization, and we can expect the Ethereum DeFi ecosystem to become more active.

JinseFinance

JinseFinance