After hitting new highs continuously, Bitcoin has continuously staged "high dives" in recent days.

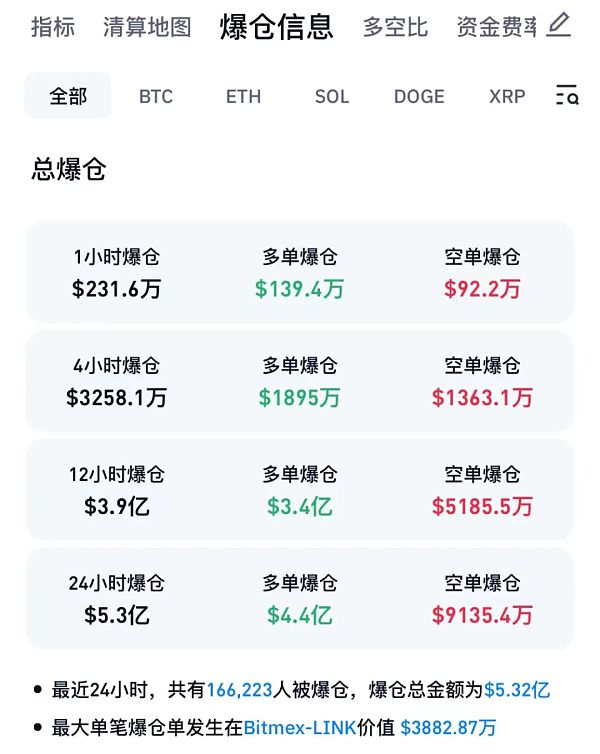

On March 17, Beijing time, Bitcoin fell sharply again, once falling below the $65,000 mark, with the largest intraday drop exceeding 6%. CoinGlass data shows that in the past 24 hours, a total of 166,200 people liquidated their positions in the virtual currency market, with a total liquidation amount of US$532 million (approximately RMB 3.8 billion).

Since the beginning of this year, the price of Bitcoin has continued to rise, and it has reached new highs since March. CoinGlass market data shows that the price of Bitcoin hit a high of $73,881.3 on March 14. However, the price of Bitcoin subsequently experienced a series of sharp corrections. As of press time, the price of Bitcoin has fallen back to around US$66,500.

Institutions have different views on the future trend of Bitcoin. Analysts at Bernstein, a well-known American investment management and research company, believe that Bitcoin’s rise has just begun and is expected to rise to $150,000 by the middle of next year. JPMorgan Chase issued a warning, believing that the price of Bitcoin may plummet to US$42,000 per coin, a potential fall of more than 36% from the current price.

Bitcoin staged another "high dive" and more than 160,000 people liquidated their positions

On March 17, Beijing time, Bitcoin fell sharply during the session, once falling below the US$65,000 mark, with the lowest price at US$64,750, and the largest intraday drop was more than 6%.

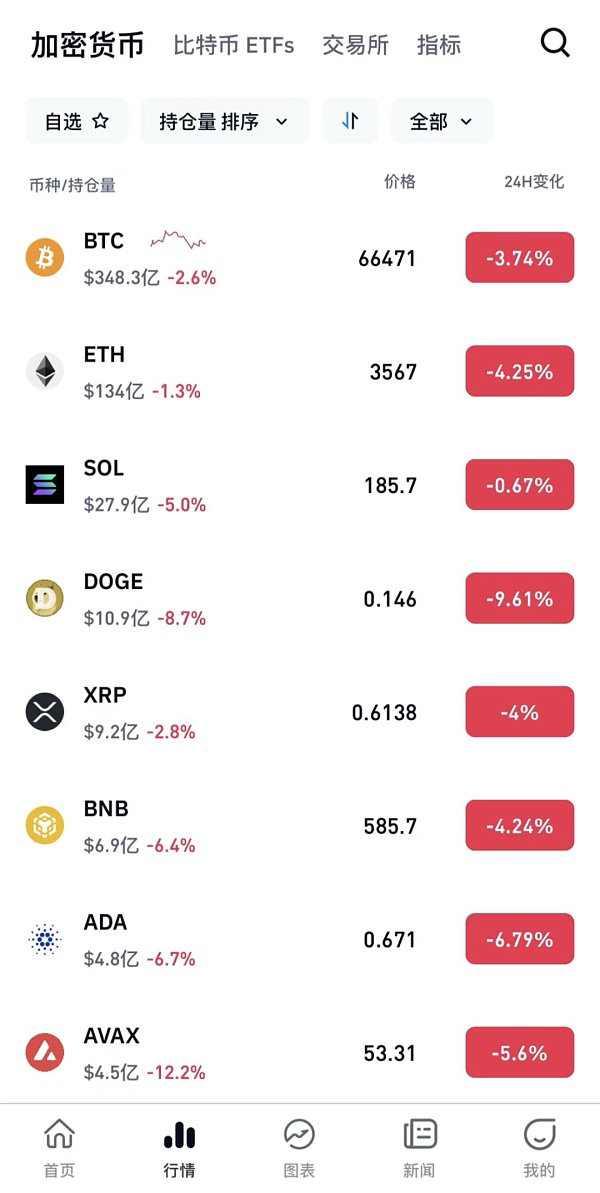

Affected by this, virtual currencies as a whole have experienced significant adjustments. As of press time, Bitcoin fell 3.74% on the day to US$66,471; Ethereum reported US$3,567, down 4.25% on the day, once falling below US$3,500; Dogecoin fell 9.61%.

CoinGlass data shows that within 24 hours, more than 166,200 people liquidated their positions in the virtual currency market, with a total liquidation amount of US$532 million (approximately RMB 3.8 billion).

Since the second half of last year, the price of Bitcoin has continued to rise. Since February this year, the price of Bitcoin has accelerated its rise, rapidly exceeding US$70,000 from less than US$40,000.

Since February 28, in half a month, Bitcoin has exceeded the US$60,000 and US$67,000 mark, and exceeded 6.9 on the evening of March 5. million, hitting a record high for the first time. On the evening of March 8, Bitcoin exceeded US$70,000 in intraday trading. On March 11, Bitcoin exceeded US$71,000 and US$72,000 in succession. On March 12, Bitcoin exceeded US$73,000 in intraday trading. On March 14, Bitcoin hit an all-time high of $73,881.3.

Market analysts believe that the logic behind this wave of Bitcoin’s rise is relatively clear.

First, the issuance of Bitcoin spot ETFs brings more incremental funds to the market. On January 11, 2024, the U.S. Securities and Exchange Commission officially approved 11 Bitcoin spot ETF applications, including BlackRock and other institutions. Since its listing, the Bitcoin ETF has been attracting gold at a rapid pace. Farside Investors data shows that as of March 12, the Bitcoin spot ETF has accumulated a net inflow of US$10.1003 billion since its launch. This rate of inflow fully reflects the market’s strong interest and demand for Bitcoin ETFs, and it also drives spot Bitcoin prices higher.

The second is that "halving" and other factors are good for fermentation. It is understood that Bitcoin’s “halving” is the halving of mining rewards, which occurs approximately every four years. The specific time depends on the block generation speed of the Bitcoin network. This will reduce the supply of Bitcoin, expected on April 23, 2024, when the block reward will drop from 6.25 BTC to 3.125 BTC.

In addition, the Federal Reserve’s mid-year interest rate cut expectations have also added fuel to the skyrocketing price of Bitcoin. A previous report released by Goldman Sachs showed that the Federal Reserve will begin to significantly cut interest rates in 2024, at least four times, and the first interest rate cut will begin in June.

The market outlook is divergent

However, in March After hitting a record high on the 14th, Bitcoin has experienced continuous corrections in recent days, with the highest correction exceeding 12%.

Market institutions also have differences regarding the future trend of the Bitcoin market.

Analysts from Bernstein, a well-known American investment management and research company, believe that Bitcoin’s rise has just begun and is expected to rise to 200,000 by the middle of next year. $150,000.

"We built an institutional flow model of Bitcoin in our estimation to derive the price of Bitcoin. We estimate that the Bitcoin market will have an inflow of 100 million in 2024 billion US dollars, with an inflow of another US$60 billion in 2025.”

After the Bitcoin ETF received regulatory approval in January this year, its capital inflow has exceeded US$9.5 billion. , which further strengthens Bernstein’s confidence in Bitcoin’s steady rise to $150,000. In the past 30 days alone, Bitcoin ETFs have seen an average of $370 million in daily inflows.

"At this rate, in just 166 trading days of the remainder of 2024, Bitcoin ETF inflows will exceed our expectations for 2025. Inflows are still high," the analysts added.

However, JPMorgan Chase believes that the upcoming Bitcoin halving event in April may have a serious negative impact on the profitability of Bitcoin miners.

The report warns that the price of Bitcoin may plummet to US$42,000 per coin as a result, a potential drop of more than 36% from the current price.

JPMorgan analyst Nikolaos Panigirtzoglou estimates that the Bitcoin network’s computing power will drop by 20% after the halving, which will lead to Bitcoin’s estimated production costs and The underlying price rises.

Michael Hartnett, chief investment strategist at Bank of America, said that amid the record surge of the so-called "Rose Seven" stocks in the technology industry and the all-time high of cryptocurrencies, the market is Shows characteristics of foam.

A listed company has made huge profits and plans to buy another US$100 million

In this wave of Bitcoin prices, some listed companies have made huge profits.

Boya Interactive, a Hong Kong-listed company, announced on the Hong Kong Stock Exchange on March 8 that on December 22, 2023, the extraordinary general meeting of shareholders has approved the plan within 12 months. The purchase authorization for the total purchase amount of cryptocurrency does not exceed US$100 million. The company is currently close to completing the investment layout and has achieved certain growth. According to the announcement, the company has purchased a total of 1,110 Bitcoins at an average price of approximately US$41,790. A total of 14,855 Ethereum coins have been purchased, with an average price of approximately US$2,777. Purchase approximately 8 million Tether coins. Calculated based on the latest price, Boyaa Interactive’s floating profit on its books is approximately US$39.13 million (approximately 280 million yuan).

Boya Interactive stated that in order to further promote the group’s business development and layout in the Web3 field, the board of directors seeks approval from shareholders at the general meeting to further grant purchase authorization for potential cryptocurrency. , authorizing the board of directors to continue purchasing cryptocurrencies in a total amount not exceeding $100 million.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Coindesk

Coindesk Nell

Nell Cointelegraph

Cointelegraph 链向资讯

链向资讯 Ftftx

Ftftx 链向资讯

链向资讯 Ftftx

Ftftx 链向资讯

链向资讯 Cointelegraph

Cointelegraph