Author: Teng Yan, Delphi Digital NFT Research Director; Translation: 0xjs@金财经

Pandora/ERC404 was born from a runaway.

It all starts with a new token, EMERALD. It was conceptualized as a mix of ERC-20 (fungible) and ERC-721 (non-fungible) tokens, but was attacked due to lack of developer capabilities.

From the ashes emerged a determined trio: 0xacme (a former Coinbase engineer), ctrl, and learnseele , who worked to turn this idea into a reality.

< /p>

< /p>

My mother told me to be careful when opening the box

They do arrive. Since its launch on February 2, Pandora—the first ERC404 token—has experienced meteoric growth, soaring from obscurity to a market cap of over $100 million.

Its rise has sparked feverish interest in launching new 404 tokens. In just 2 weeks, we have already witnessed the emergence of other 404 token standards. For example, cygaar, a well-known developer in this field, launched DN404, an enhanced open source token standard with similar characteristics to ERC404.

But why all the fuss?

(For simplicity, I will refer to ERC404, DN404 and similar token standards as "404".)

NFT fragmentation has failed

NFT Fragmentation is nothing new. People have been fascinated with NFT fragmentation for years.

The idea is simple: a CryptoPunk NFT is worth $150,000 today. Very few people can afford a punk.

What if you could get 1/100 of the same Punk for just $1,500? Suddenly, opportunities become more accessible. If Punk triples in value during the next NFT bull market, a $1,500 investment could surge to over $4,500.

However, previous fragmentation attempts have always struggled to gain traction:

NFTX has been trying to fragment the vault for years to do this (deposit Punk NFTs and receive PUNK fungible tokens), but it is not widely adopted even today.

Flooring Lab launched a similar idea a few months ago: deposit Azuki NFTs and receive 1,000,000 uAzuki tokens that can be traded like meme coins. It’s doing well, mainly because it uses a new token, FLC, to incentivize liquidity and bootstrap the protocol.

In my humble opinion, despite the best intentions, these types of agreements are pretty much dead by the time they come out.

In order to start using these fragmented protocols, users need to approve multiple transactions. Each transaction incurs a fee. In terms of money spent and mental effort required to master every step, this adds up quickly. There have been concerns that errors could lead to the loss of valuable NFTs. For most people, NFT perpetual bonds (nftperp or Tribe3 ) may be a more efficient way to earn income from NFTs.

The difference is: 404 solves the user experience issues associated with fragmentation by defaulting to fragmenting each NFT but being able to be seamlessly combined into a whole.

Yes, it’s an old adage in the tech world: fewer steps = more conversions.

I considered two complementary angles of potential use cases for 404:

Can NFTs benefit from a larger Benefit from qualitative analysis?

Can fungible tokens benefit from NFTs?

1. Can NFTs benefit from greater homogeneity?

Liquidity reigns supreme in cryptocurrencies.

Fragmentation can greatly enhance liquidity by allowing investors to buy and sell affordable NFT shards and expanding the market for potential participants.

In addition, fragmentation makes price discovery faster. The slow downtrend for many NFTs in 2023 stems from their inherent illiquidity, extending the time it takes for fundamentals to align with price.

< /p>

< /p>

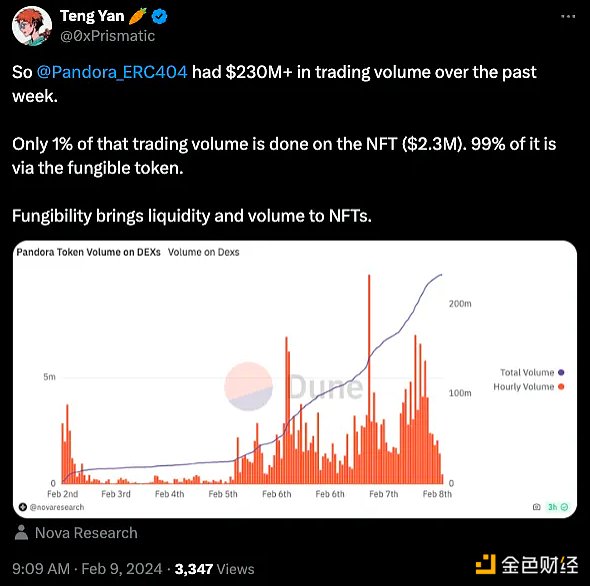

To illustrate how homogenization increases liquidity: just look at what happened with PANDORA. 99% of trading volume is done via fungible tokens, not NFTs.

Sponsored Business Content

< /p>

< /p>

@Ctrl believes that by making NFTs homogeneous, the valuation of NFT collectibles (top ~$1 billion) can be closer to that of top meme coins ($60 billion) due to increased capital flows Valuation.

This creates some interesting use cases for 404 tokens:

1. High-value art and collectibles. Usually these are very scarce and valuable. Paradigm-backed Tessera tried to do this with its fragmented platform but had to shut down last year due to limited adoption. A key hurdle is efficiently reorganizing NFTs after they are split and resold—a process that is often bogged down in complex DAO governance. 404 tokens alleviate this problem.

2. Real estate: Real estate is being tokenized on the blockchain with the help of the RWA trend. Various startups have explored different approaches, from using NFTs to directly represent property (Roofstock ) to using fungible tokens to conduct ICO-like fundraising to acquire properties (CitaDAO ). 404 It is possible to merge these methods.

Palette is one example: a collection that uses 404 to introduce native fragmentation into generated art, and provides a "re-roll" functionality for the artwork in its collection. It makes art collecting more interesting with new interactive layers.

2. Can fungible tokens benefit from NFTs?

While the focus of 404 has been primarily on greater homogeneity of NFTs, there is another side to the story: fungible tokens can also benefit from converting to NFTs.

Here’s how various types of fungible tokens can get major upgrades via 404:

Governance tokens grant holders voting rights in the DAO. By enabling these tokens to also become NFTs with different reputational statuses (in metadata) based on the holder’s contributions, a new governance dimension can emerge. Imagine a governance NFT that grants different levels of access to exclusive features based on the holder’s historical participation in the community. This incentivizes active participation and fosters a more meritocratic model of governance.

Utility tokens can be combined with unique characteristics to provide users with a personalized experience. For example, a gaming platform’s tokens could be tied to NFTs with unique in-game assets or abilities based on characteristics and rarity. This not only enhances community engagement around the token, but also creates new utility for it.

Memecoins (such as WIF, DOGE, PEPE) are often associated with Internet culture and hot trends and can use NFT mechanisms to better participate in and develop their communities. By introducing rare traits and loot box mechanics, they can gamify user interaction. The 2021 NFT bull cycle shows how much we love “altcoins with pictures.” The fusion of Memes and NFTs not only enhances fun, but also fosters a greater sense of belonging.

Aevo is an options and perpetual contract DEX and a pioneer in integrating 404 tokens. It uses the back-end 404 mechanism to make DeFi liquidity mining more fun. When users farm AEVO airdrops by trading on the platform, they have the potential to receive a 100x farming boost.

What is the future of 404?

The 404 community may work to improve their token standards and solve issues such as gas fees. Working with protocols and ensuring exchanges and block explorers understand these standards will be key priorities. Open source encourages wider participation in 404 development.

However, it will take time for real use cases to emerge. We’ve seen this story about the new token standard before:

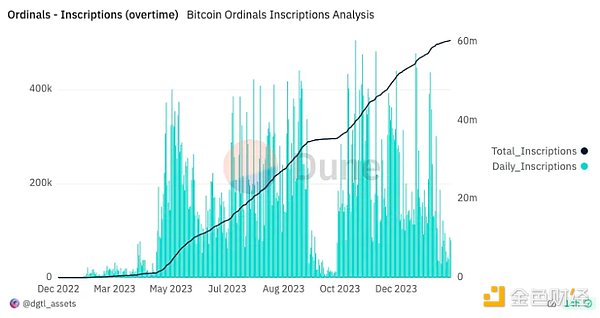

Ordinals (Bitcoin NFT) launched in December 2022, but the inscription It did not start going parabolic until 4 months later in April 2023.

< br>

< br>

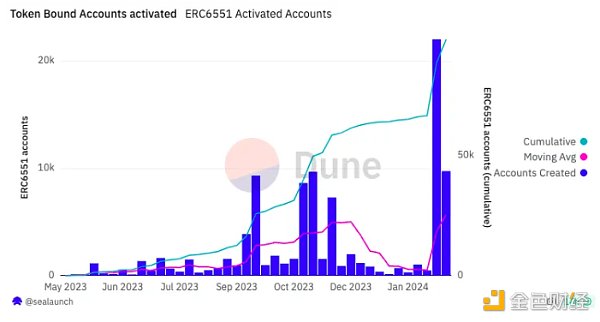

Similarly, ERC-6551, a groundbreaking standard that allows NFTs to have wallets, appears to be growing in popularity six months after its launch in May 2023.

Building new use cases and introducing users to the potential of 404 will undoubtedly take time. However, these are important steps toward realizing the 404’s long-term vision.

But what about Pandora?

Although Pandora is the first creator of 404 tokens, it lacks any direct value accumulation mechanism. There are no fees for using the 404 criteria. After all, 404 is designed to be open source and accessible to everyone.

< /p>

< /p>

The market is realizing this: Amid speculative enthusiasm, PANDORA's price initially rose to $32,000 and has since fallen 60% to $12,600.

However, two compelling stories may emerge from Pandora in the next few days:

1. Memecoin :As the first 404 token, If 404 tokens gain wider adoption, Pandora may attract widespread attention, reminiscent of ORDI's staggering $1.5 billion market cap purely because it was the first BRC-20 token.

2. "TIA":Similar to the TIA index price growth driven by stakers anticipating Cosmos protocol airdrops, the new 404 project may allocate airdrops to Pandora holders Yes, because its holder may be a strong supporter of 404. For example, Palette plans to airdrop 5% of its tokens to Pandora holders.

There is no denying the excitement of tokens supporting new features. Innovation like this is exactly what our cryptocurrency needs to thrive.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Miyuki

Miyuki JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Others

Others Ftftx

Ftftx