The explosion of ERC404 makes NFT great again

NFT, contract, ETH, the explosion of ERC404 makes NFT great again Golden Finance, the explosion of ERC404 makes NFT great again

JinseFinance

JinseFinance

Source: Gryphsis Academy

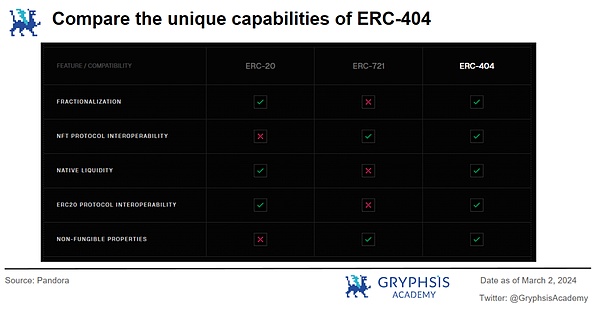

ERC404 will be NFT and FT have formed a corresponding and mutual conversion relationship, and based on the characteristics of the protocol, NFT that can transform built-in attributes has been implemented. It is defined as an experimental technical solution with a hybrid ERC20 and ERC721, with native liquidity and fragmentation. Semi-fungible tokens.

Different from the mainstream NFTFi business path, the 404 standard asset series cleverly integrates the existing facilities of NFT and FT at the standard layer. Thereby establishing bilateral liquidity, it has the new characteristics of "card drawable", "native fragmentation" and "AMM liquidity". If adopted by a large number of projects in the future, there will be more innovative gameplay, greater imagination and development potential. .

ERC404 is still in its early stages and has not been verified for a long time. Destroy multiple NFT uncontrollable defects and are not included in the official Ethereum EIP proposal.

Pandora is only the first project of ERC404 and cannot capture actual value from the possible future development and widespread application of ERC404. Its future development depends more on the persistence of subsequent project parties. operations.

Each round of Crypto’s bull market has new asset issuance methods and corresponding technical standards, from ERC20 on Ethereum to FT, to ERC721 NFT, and then to this round of inscriptions on the BTC chain. Among the inscriptions, the most recognized by the market currently is BRC20. The recent inscriptions are also called semi-fungible tokens SFT (semi-fungible Token).

This article will introduce a new experimental standard ERC-404 on the Ethereum chain and its first asset Pandora.

The assets created based on 404 enable FT and NFT to form a corresponding swap relationship, realizing the simultaneous use of bilateral liquidity of ERC20 and ERC721, that is, each FT will automatically mint an NFT. If less than one is purchased, The corresponding NFT will not be minted.

If the user buys, sells or transfers FT and affects the integer FT change, the NFT will be destroyed and recast, and then the NFT attributes after recasting will be automatically programmed; if the user wants to keep the NFT, he can also trade directly Or transfer NFT, the NFT itself will not change.

ERC404 standard is experimental Theoretically, it should be called EIP404 now, and the number 404 does not meet the EIP submission specifications. Whether it can be formally included in the ETH standard needs to wait for the foundation’s response; Pandora is an early project, and although it is the first asset of ERC404, it The risks are relatively high, so treat the relevant risks rationally.

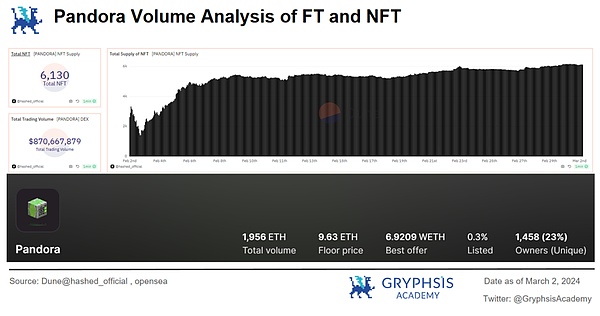

As of March 2, 2024, there are 719 token contracts established based on the ERC404 standard, with a total transaction volume of 1.6B. The main transaction volume is the first asset Pandora, accounting for 55.7% of the transaction volume. .

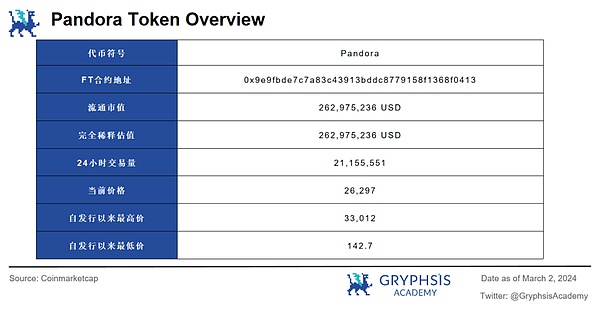

Pandora is the first project built based on the ERC404 token standard. It was launched on February 2. 10k PANDORA ERC20 tokens correspond to 10k NFTs to generate NFT "Replicants" ”, Pandora can be traded on Uniswap or on NFT markets such as OpenSea.

There are five rarities in this series Grades, distinguished by color. When users trade Pandora's FT tokens, Replicant NFTs will be increased or decreased according to the quantity. For example, 1.3 Pandora will generate 1 NFT, and if there is less than 1 Pandora, no NFT will be generated. Every time a Replicant NFT regenerates, the rarity is randomized. When transferring and trading NFT directly, the rarity will not be changed.

The details of the “unboxing” and subsequent empowerment projects have not yet been announced.

As of March 2, 2024, the basic information is as follows:

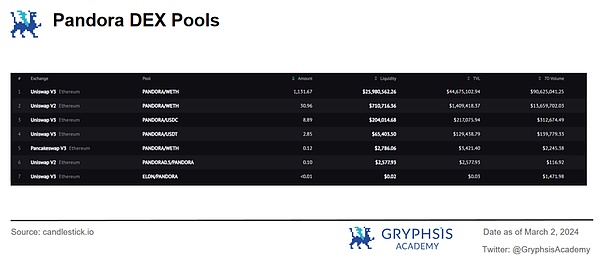

About 67% of the daily trading volume occurs in Uni v3, others are Bitmart, Lbank, gate and other CEX; OKX and Binance wallets already support ERC404, while Pandora has not yet launched OKX and Binance.

Uni v3’s current WETH liquidity is 26M, the total TVL is 44M, the 7-day trading volume is about 90M, the turnover rate is high, and the market is competing on price.

Positions of 100 and above There are 10 addresses in total, the first three of which are the contract addresses of the official multi-signature wallet, Uniswap v3 LP and Sablier V2 LockupLinea. The chip situation is relatively scattered, with the chip range concentrated between 19,000 and 27,000.

Pandora's idea and 404's technical solution are not actually new things. The author believes that the history of such attempts can be The origin is divided into two parts, the "third-party fragmentation protocol" of the protocol layer on the ETH chain and the two standards of the concept called "coin duality" brought by the chain standard level: BTC inscription and Solana's DN .

On the ETH chain, after the birth of 721 NFT, many new ones were derived due to lack of liquidity. Attempts at the protocol level, one of which is called "fragmentation", for example:

NFTX, which was launched as early as the end of 2020, puts NFTs of the same type and similar prices into a vault, and the vault issues corresponding vToken, you only need to hold enough vToken to redeem NFT randomly from the vault.

There is also the star project Fractional that appeared later, which raised 28 million, introduced a new role curator, and obtained income from the fragment auction, while the fragment holders initiated a vote to auction and price the NFT in the vault.

The Flooring Protocol, which was launched at the end of last year, deposits the NFT into the Vault and obtains 1 million μTokens, and then has the option of giving up ownership and randomly redeeming the NFT or retaining the ownership Key to retrieve the corresponding NFT.

Here is a brief summary: The fragmented third-party protocol allows users who hold NFTs to pledge part of the series of NFTs and exchange them for new ERC20 tokens issued by the protocol, and then use token incentives to introduce new Roles, empowering fragmented tokens, redeeming NFTs according to fragmentation ratios, etc. hope to achieve the purpose of splitting NFTs to expand the liquidity of NFTs. After the protocol is launched, the vast majority of NFTs deposited in these protocols are Blue chip NFT.

Chain standards regarding “picture-coin swap”, “picture-coin integration” and “picture-coin duality” The birth of the concept can be thought of as coming from BTC's Inscription Protocol and Deez Nuts, the currency swap protocol born from the Solana ecosystem.

Let’s first talk about the original source, which is the new asset “inscription” of this bull market. Due to the UTXO characteristics and Ordinals protocol and Inscriptions on the BTC chain, after the BRC20 standard is created, users can Arbitrary data is engraved on sat to give it unique characteristics. This implementation can be understood as an abstract protocol corresponding to the currency, which "adds" a certain "uniqueness" on the basis of FT tokens. In NFT tokens On the basis of "adding" some kind of "homogeneity", in the form of: when printing the inscription, you type "one piece", which is 100% an NFT, and "one piece" can be split, and the The fungible tokens inside are distributed one by one, so they can also be called semi-fungible tokens.

Then in January this year, Tiny SPL, a new token standard in the Solana ecosystem that aims to solve the network rent problem, launched the AMM trading mechanism on its own website. Subsequently, its token DN (Deez Nuts) caused a stir In order to overcome the market hype, DN can be split or merged, or the NUTS held can be added to the AMM pool as LP; such a design is clearly another "inscription of currency swap" in the eyes of Degens. ".

At this time, the concept of duality of graphics and currency was initially recognized by the market, and because the technical environment and NFT infrastructure prosperity on each chain were also different, SFT derived its own characteristics in each chain. The new assets with unique characteristics are first the inscription of BTC, and then Solana’s token swap. So what is emerging on ETH, which is the most prosperous DeFi and NFT ecosystem currently?

In early February, an early protocol appeared again on the ETH chain to try to achieve "coin duality". There is a new project called Uniswap Emerald, which will bring NFT liquidity It is built on Uniswap, but the token contract has been replaced many times due to contract vulnerability attacks. The team is still developing and repairing it, and Pandora project team members were inspired by Emerald.

The 404 standard and Pandora assets were built by a current team of 4 people, with only 3 people having their Twitter profiles published.

@maybectrlfreak (ctrl):

Claims to invest in start-ups. Angel investor at Syndicate. Syndicate’s first tweet, posted on January 22, made early investments in BRC20 and Ordinals trading terminal BeFi Labs.

@searnseele (Searn):

No details on Twitter

@0xacme (Acme): Released the ERC404 standard on Github and worked as an engineer at Coinbase.

The ERC404 document defines this as follows: ERC404 is an experimental technical solution with a hybrid of ERC20 and ERC721. Semi-fungible tokens with native liquidity and fragmentation.

First, understand the operation process of ERC20 and ERC721:

User A holds 11.11 B tokens. After the user transfers At that time, the smart contract reduces the corresponding amount according to the balance of B tokens on the A account, and increases the corresponding amount in the target account. The smart contract only needs to manage the balance.

User A holds an NFT in the C series NFT. The ID of the NFT is 1234. At this time, when the user transfers the NFT, the smart contract deletes the NFT from user A and adds the ID to the target account. NFT.

Under normal circumstances, these are two distinct asset standards. Smart contracts need to first determine the type before the actual transaction.

Secondly, ERC404 designed alossy encoding scheme so that the number of ERC20 tokens and the unique ID of ERC721 tokens can use the same data structure "AmountOrId" in contract storage.

Solidity records the ERC20 token balance in digital form according to the smallest unit Decimals. For example, if you have 2.3 Pandora, it is 230000000000000000 (18-bit decimals). When compared, this number is much larger than The Token ID of the NFT, and then the contract compares the ID of 721NFT as a parameter (for example, ID 1123 and ID 1124). The contract detects whether the "amountOrId" containing the two parameters isless than or equal to the current "Minted" value (That is, the number of 721NFT has been minted), if so, operate 721NFT. Otherwise, ERC20 will be operated, so that the contract can distinguish between ERC20 and ERC721 when calling data.

When the lossy encoding scheme allows the smart contract to call the resource to identify the type and perform subsequent operations, the Mapping function will track the account status. If the user processes the transfer of ERC20 tokens through the "transfer" function, 721NFT Will be destroyed (burn function) and rebuilt (mint function); in the "mint" function, each time a new 721NFT is created, the minted variable is incremented and then used as the ID of the new token. This means that each new 721NFT will have a unique, sequentially increasing ID, starting at 1 and increasing by 1 each time.

When a user holds multiple tokens and the corresponding NFT At this time, if the user transfers FT, the smart contract cannot burn the NFT in the optional way. The Burn contract will minimally perform the destruction operation according to the last owned Token ID, which is a last-in-first-out method. (Last In, First Out, LIFO) mechanism. This is likely to delete the NFT that users want more, which is a current design flaw of 404.

As for this flaw, Pandora actually differentiates it by introducing rarity and encourages users to manually separate the FT in the address because of the rarity. Users can first convert the unwanted NFT to another account and then transfer it back. Or place an order to sell in the secondary market, and then operate the FT balance of the account, which can be regarded as solving some of the shortcomings of the protocol itself through the economic model.

Another disadvantage of higher gas fees is that multiple different balances and NFT ownership are stored and monitored in ERC404, so the contract operation will be relatively complex, which will require more on-chain computing resources and generate Slightly more gas cost.

Because the tokens correspond to each other at the same time, when converting tokens The protocol will automatically destroy old NFTs and create new IDs in the order of the entire network's IDs. Therefore, projects can choose to use IDs as the source of pseudo-random numbers and assign them different attributes, thereby realizing the "pseudo-random card drawing" gameplay based on the characteristics of the protocol. And give different attributes and visual characteristics.

Pandora's mechanical rarity is based on applying the keccak256 hash function to the first byte of the NFT's ID and encoding the result to "pseudo-randomly"< /strong>Generated, and because each ID is mapped to a unique Seed value, a number between 0 and 255 is obtained, and each rarity is classified according to 0-255.

In fact, the rarity is because of the ID There is a sequential nature. Users who perform recasting actions on the entire network only obtain the seed values after their IDs are calculated in order. Therefore, this card draw is more like all users "drawing cards" in the preset order and preset cards. , and different cards are drawn due to the order of "card drawing" on the transaction chain.

As can be seen from the above table, a red pandora box will be generated when and only when the seed value is between 241 and 255, and the number of low-number random numbers calculated by the hash function will naturally increase. Few, so rarity can be seen as a result of "luck" and repeated "efforts".

For such a rarity design, in the above case analysis, it can be found that the premium of the pending orders in Opensea and Blur for high rarity boxes such as red is much greater than the price of 1 unit of FT, just like Some players said, "I hit the orange box again, it's really annoying."

As for what the different rarities generated by pseudo-random numbers actually enable, we have to wait for the next step of the project side.

* The initial version of this random number set up by Pandora can eventually turn all existing NFTs into red rarity through infinite pseudo-random numbers. This is the current technology based on random number card drawing. Problems that inevitably arise in logic have been mentioned and will be solved in the project's recent v2 update.

ERC-721 type Token ID is now stored in FIFO (Frist In, First Out, FIFO) queue and reusedinstead of being forever incremented when minted and destroyed. This is a predictable set of NFT token IDs, just like a typical NFT collection.

This means that the possibility of unlimited rarity mentioned above will be changed. A limited Token ID will generate a limited number of red rarity NFTs, and when the ID is generated completely in sequence for the first time, the upper limit of the NFT series is reached. After the number, unless deleted by mistake for the second time, the high rarity will be retained spontaneously due to the user's behavior, and there is no possibility of increasing it. The behavior of drawing cards will become unnecessary and meaningless as the incentive decreases.

Transfers of full ERC-20 type tokens will now transfer ERC-721 type tokens held by the sender to the recipient. In other words, if 3 full tokens are transferred as ERC-20, the 3 ERC-721s in the wallet will be transferred directly to the recipient, instead of those ERC-721s that are burned and new token IDs minted to the recipient By.

Predictable events emitted during transfers, approvals and other operations that clearly indicate whether attribution is to ERC-20 / ERC-721.

Remove the fixed supply cap in the contract, allowing the selective addition of fixed token supply caps as needed.

Simplification and centralization of transfer logic, extensive logic optimization and GAS savings.

Supports EIP-2612 and EIP-165, etc.

The author believes that assets based on the 404 standard cleverly combine ERC20 It is mixed with ERC721, two distinct protocol standards, and the nature of the asset is difficult to define. It can be called "inscription on the ETH chain", "native fragmented variable attribute NFT" or "meme currency with NFT". The refresh attribute brought by the technical mechanism is another unique value.

Fragmentation and native liquidity of the standard layer

404’s FT can be DEXs such as Uniswap provide native liquidity and automatically generate NFT; relying on the long-term development of extremely complete DeFi infrastructure, 404 FT can even directly support lending agreements, perpetual contracts and other protocols on the chain in the future to conduct complex DeFi operations.

The inherent card drawing logic and interchangeability of the NFT series

It is known that the Token ID is limited, then each IDs can naturally be assigned to different attributes and different visual presentations, and 404NFT has programmable functionality and pseudo-randomness.

Therefore, users can use Gas fees to perform "pseudo card drawing" in a circular sequence with less friction in the on-chain environment, thereby obtaining one of the ordered preset NFT series based on pseudo-random numbers. Compared with 721NFT, it has more interesting changes and native experience.

However, in essence, because the rarity is actually fixed from the beginning, it is called pseudo-randomness. Therefore, once a high rarity is refreshed, the refresh will gradually lose its meaning. Pandora actually does not It is not a method of frequent transfer to generate rare NFTs.

The value and pricing power of different attributes of assets are clearly divided

The FT of each unit corresponds to each A quantity unit of NFT allows the underlying value of each NFT to be quantity 1, and users have no cognitive threshold, so they can obtain more adequate pricing and liquidity through AMM.

And because 404NFT can replace random numbers through transfers, Pandora holders will even happily experience "opening" moments similar to 721NFT many times in the early days. Therefore, rare NFTs traded at high premiums in the NFT market clearly reflect the market value of the probabilistic attribute of "luck and multiple refreshes", that is, rarity.

Summary: FT is the "floor price" of the entire 404 NFT series, while 404 NFTs of different rarities are the "floor price" plus "random number value". This is quite different from users' perception of the value of PFP 721NFT in a general sense, such as which PFP clothes and shoes are good-looking, or cultural attributes, etc.

The author believes that if 404NFT is defined as a category in broad NFT, then ERC404 can be regarded as A unique NFTFi approach to this type of NFT.

When Pandora was launched recently, many KOLs expressed that once this paradigm innovation of asset issuance is recognized and adopted by a large number of new projects, some NFTFi will withdraw from the stage of history. The author tries to do some dismantling analysis here:

First of all, according to the needs, we can divide NFTFi into Trading, Lending and Derivatives.

NFT Trading currently has four methods: order book, aggregator, fragmented protocol, and AMM. Examples are Opensea, Blur, NFTX, and Sudoswap respectively.

NFT Lending is peer-to-peer lending, peer-to-pool lending, buy now, pay later, etc. There are not many projects in this type, such as Blend, BendDao, etc.

The NFT Derivatives project has not found a project with a good TVL, and derivatives protocols with higher liquidity requirements may be relatively early at present.

Then we start to understand the many NFTFi projects mentioned above, and we can initially summarize two characteristics:

First, the liquidity and pricing of most NFT series rely on the order book model, AMM Among real-time liquidity solutions such as mechanisms and fragmentation, only Sudoswap accounts for 0.12% of the market transaction share, which means that real-time liquidity solutions have almost no market share.

Second, in terms of NFT Lending , Blend uses point-to-point solutions to dominate. The NFT Lending protocol has several characteristics: the protocol relies on token incentives to attract external funds into the capital pool as lending liquidity; it introduces complex gaming mechanisms or third parties to provide price clearing and other actions; except for Blend, other protocols rely on Blur. It itself has security risks and trust and understanding thresholds for the user side. The NFTs and external liquidity circulating under layers of screening are decreasing layer by layer.

We will release the logic of the 404 project , comparing the business path with mainstream NFTFi, you can find many differences:

After comparison, the author can preliminarily believe that 404, as a new asset class, is quite different from the mainstream NFTFi business path of 721NFT. The asset series of 404 is very cleverly used. It uses the existing facilities of NFT and FT to establish bilateral liquidity, and has the new characteristics of "card drawability", "native fragmentation" and "AMM liquidity". Once it matures, more innovative ways of playing will appear. , with more interesting imagination space and development potential.

ERC404 and its initial project Pandora are still in their early stages, and there are corresponding risks at both the standard and asset levels:

The ERC404 standard itself has the problem of uncontrollable destruction of NFT assets and high gas fees due to complex logic.

The ERC404 standard is complex and has not been verified for a long time. It may have unknown security vulnerabilities, which may lead to the risk of being attacked by hackers or causing unexpected problems.

ERC404 is an experimental standard, and in theory it should now be called EIP404, and the number 404 does not comply with the EIP submission specifications. You need to pay attention to the ETH Foundation's response to this standard.

Pandora is only the first project of ERC404. It cannot capture actual value from the possible future development and widespread application of ERC404, and may capture some emotional value in the future.

Pandora has not yet been "opened". As an NFT series, it still requires the continued operation of the project party, and there is the possibility of being overtaken and replaced by other 404 standard projects.

After the recent popularity of ERC404, some similar standards have appeared in the market Voice, and the future development of these protocols may require attention from the perspective of meme assets such as Ordi and the wealth effect of the protocol. If viewed from the perspective of blue-chip NFTs such as Boring Monkey, it is the community atmosphere and operation style. The author here only discusses similar standards. Give a brief introduction.

Unlike ERC404, which attempts to merge the ERC-20 and ERC-721 standards into a single contract, DN404 utilizes two independent but related contracts - the base ERC -20 contracts and a mirrored ERC-721 contract for unique NFTs.

The current series with the highest trading volume of assets based on this standard is Asterix, with a total of 10,000 PFPs. The operational details are currently uncertain. The project team mentioned that snapshots will be taken until the subsequent "map opening". The current FDV 26M.

A new token standard developed by the PFPAsia team, also known as the REDT protocol. Using controllable state changes, the conversion process between FT and NFT is led by users, and the ERC-1111 protocol can reduce the corresponding quantity ratio of NFT and FT.

The PFPAsia team adopted the ERC-1111 standard and developed 10,000 PFP NFTs in a new Korean and American mixed style. At the same time, the ratio of NFT to FT was 1:10000. It began to be announced in January and released in 2 The monthly FT is on public sale, and NFT freemint is currently being sold in whitelist mode. As of March 2, the FDV is 1.7M, and the conversion of the graphic currency has not been enabled and the chart has not been opened.

In August last year, HashKeyNFT collaborated with NFTAsia and PFPAsia to jointly create and launch a commemorative SBT to commemorate HashKey Exchange becoming Hong Kong’s first Hong Kong-compliant licensed trading platform for retail users.

Available in a standard Using multiple standards (ERC-20, ERC-404, ERC-721, ERC-721 A, ERC-721 Psi, ERC-1155 and ERC-1155 Delta), both ERC-1155 and ERC-721 tokens will be accepted by the protocol Supported and will save gas costs.

The project developed by this standard is MINER. The goal is to make a full-chain mixed token volatility mining protocol based on LayerZero’s standards, encapsulating NFT assets and MINER tokens on the chain, and hoping to draw a commission And share the profits with token holders.

When it was first released, there was a contract vulnerability problem. The vulnerability was fixed on February 19 and has been restarted. As of March 2, FDV 3M.

Developed by the Forge project, the _burnedTokenIds array is added to track all IDs of destroyed NFTs. Once the total supply limit is reached through the Mint function, the contract design will recycle the ID of the new NFT from the _burnedTokenIds array, which is close to Pandora v2 in design ideas.

The current representative project of ERC-404+ is FORGE, which is a series of 6666 PFP NFTs. As of March 2, the FDV is about 520K, and the Forge official website has recently launched Launchpad, and one project has already been launched.

As a new asset class, 404-type assets make very clever use of the existing facilities of NFT and FT to establish bilateral liquidity. , it has the new features of “card drawable”, “native fragmentation” and “AMM liquidity” at the standard level, and it is very interesting to be able to use the mature Defi infrastructure on the ETH chain to conduct more complex financial operations in the future. The new development direction of NFT.

Looking to the future, new “blue-chip” NFT series may appear in a series of future attempts under the 404-like standard, and there are many interesting NFT use cases and scenarios. One of the scenarios the author is imagining is for all Chain Gamefi, and one of the possible use cases is functional NFT or tool NFT. Programmable variable attributes and native fragmentation empower these two types of NFT with more complex value and use DeFi facilities to fully price and even increase financialization. How to play. Imagination is just a suggestion, welcome to exchange and discuss.

NFT, contract, ETH, the explosion of ERC404 makes NFT great again Golden Finance, the explosion of ERC404 makes NFT great again

JinseFinance

JinseFinanceShiba Inu launches SHEboshis NFTs on ERC-404, enhancing liquidity and ownership, despite a minting bug resolved by increasing supply.

Sanya

SanyaERC404, Pandora, open the box of ERC404 and Pandora Golden Finance, the seamless integration of fungible tokens and non-fungible tokens

JinseFinance

JinseFinanceYears ago, ERC404 attracted a lot of attention, which once caused Ethereum gas to surge. Currently, $PANDORA has retreated to more than 10,000. Just when the initial popularity has subsided, let’s have a rational chat.

JinseFinance

JinseFinanceRecommended reading this week: 1. Detailed explanation of Ethereum Dencun upgrade details; 2. What is ERC-404? Why is it important? ; 3. Bull or bear? Analysis of Jupiter's future prospects; 4. The founding team takes you to have an in-depth understanding of the Meson network; 5. Bitcoin is replacing gold;

JinseFinance

JinseFinanceThe craze for ERC404 has raised concerns about “rug pulls” and high gas fees.

JinseFinance

JinseFinanceIt is rare for everyone to realize how "subversive" and "dreamlike" a truly disruptive protocol is when it comes out.

JinseFinance

JinseFinanceAt present, in addition to Pandora itself, there are many token projects minted according to the ERC-404 standard, and OKX Web3 Wallet has a separate column for them.

JinseFinance

JinseFinanceERC404 merges NFT uniqueness with cryptocurrency liquidity, introducing Replicants to revolutionize trading and ownership on the Ethereum blockchain, marking a pivotal evolution in digital assets.

Weiliang

WeiliangPandora, ERC404, Bankless: ERC-404 and its importance Golden Finance, unveils the new experimental token standard.

JinseFinance

JinseFinance