Author: Revc, Golden Finance

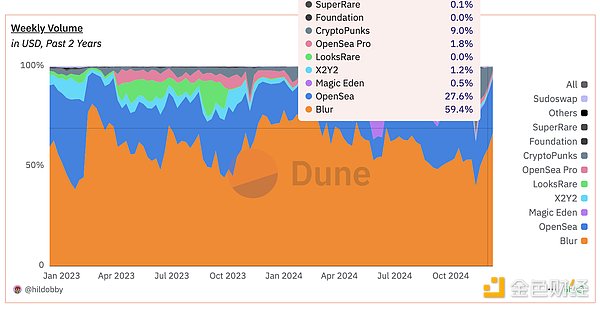

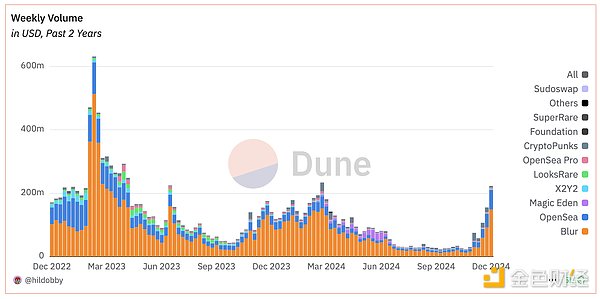

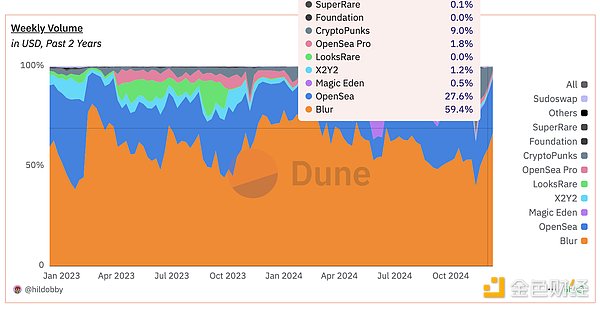

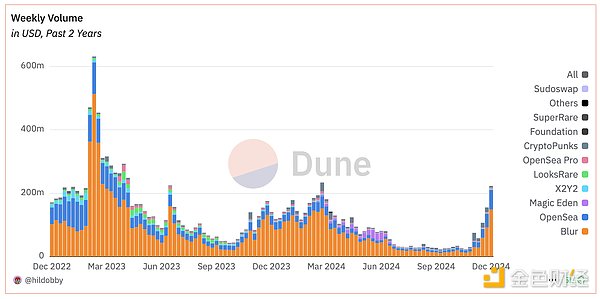

Bull market liquidity begins to moisten the dry riverbed of the NFT sector

Recently, Mike Dudas, co-founder of TheBlock, posted on social media that OpenSea has registered a foundation in the Cayman Islands, and Waleswoosh, an anonymous researcher of the Azuki NFT series, also released a screenshot of OpenSea's registration in the Cayman Islands. Usually, Web3 projects register foundations to prepare for coin issuance, which has sparked speculation about the upcoming launch of tokens and user airdrops. However,OpenSea still facesSEC's regulatory enforcement, which makes its coin issuance prospects full of uncertainty. In addition,OpenSea previously adopted a traditional financing model, which also limited its coin issuance process to a certain extent. However, facing the incentive competition from platforms such as Blur and Rarible, it is difficult to gather liquidity without a points system. It is expected that OpenSea will use a relatively compromise solution to benefit users. The listing of Magic Eden has injected some confidence into the NFT market. However, the current NFT trading market has been far away from the core narrative of the crypto industry. Although its token price once hit a high of $10, it has now fallen back to $3.68. A large number of "zombie projects" in the crypto industry have recently rushed to the market, and the negative impact on the industry is still borne by users. According to SosoValue data, the price of MOCA soared 380% due to the launch of MOCA on Upbit, driving the short-term sentiment of the NFT market to warm up. The current logical chain of the token triple jump is further strengthened, which is worthy of investors' attention. Most MEME and Token market value growth follows the following path:

Solana&BaseOn-chain fermentation——Binance&BitgetListing——Coinbase&UpbitListing

Former KingOpenSea

OpenSea was founded in 2017 by Stanford graduates Finzer and Atallah as a Wi-Fi sharing startup project. After being exposed to the concept of NFT, they quickly turned to the NFT market and received their first round of financing in 2018. With the outbreak of the NFT market in 2021, especially the popularity of artworks such as Beeple, OpenSea quickly became the industry leader, occupying more than 90% of the market share. The platform valuation was once as high as 13.3 billion US dollars.

However, OpenSea's success did not last. There were frequent problems within the platform, including insider trading scandals and platform crashes. At the same time, external competition has become increasingly fierce, and the rise of emerging trading platforms such as Blur has diverted a large number of users. With the decline in the overall trading volume of the NFT market and the bear market in the cryptocurrency market, OpenSea's revenue and valuation have also shrunk significantly.

In order to meet the challenges, OpenSea has launched a series of initiatives, such as layoffs and the launch of version 2.0. But the market's confidence in OpenSea is no longer as high as before. In addition to market and internal challenges, OpenSea is also facing close scrutiny from regulators. The U.S. Securities and Exchange Commission (SEC) has launched an investigation into OpenSea and asked it to provide a large number of documents. The SEC's investigation focuses on whether OpenSea sells NFTs as securities. If it is identified as a security, OpenSea may face serious legal consequences. In addition, tax authorities in many countries around the world have also investigated OpenSea's tax issues. OpenSea's legal team is actively responding to these challenges, but regulatory risks remain the sword of Damocles hanging over the company's head.

OpenSea2.0

Previously, Devin Finzer, co-founder and CEO of OpenSea, announced that the NFT market is planning a comeback. Although Finzer revealed limited details, he promised that the new version of OpenSea will be launched in December.

In addition to the regular user interface upgrade, the new version of OpenSea pays more attention to the optimization of the trading interface to cater to the habits of NFT professional investors and attract a large amount of liquidity into the market.

From the preview of the points mechanism, OpenSea V2 is designed to encourage users to provide NFT liquidity through collection and trading. In addition, the platform has designed a points bonus for the liquidity guidance of specific projects. But at present, the mechanism is relatively conventional.

Blur’s Airdrop Rules Review

Blur uses multi-stage airdrops (called “Seasons”) to increase platform participation and introduces differentiated token distribution rules. It is expected thatOpenSea will refer toBlur’s mechanism and combine it with current market trends and incentive goals.

Season 1Airdrop

Wave 1: For traders who were active in any Ethereum NFT market within 6 months of Blur’s launch. Users must list at least 1 NFT on the Blur platform within 14 days of the announcement to be eligible for the airdrop.

Wave 2: Reward users who actively list NFTs on Blur. Listings are scored based on likelihood of sale and collection activity, with double points for listings with full royalties. Additionally, users are rewarded for trading activity (5% for completing 3 sweeps, 50% for completing 6 sweeps).

Wave 3: Reward users who bid on NFTs on Blur, aiming to increase liquidity and engagement on the platform.

Season 2 Airdrop

Blur introduces a loyalty rating system to encourage users to trade exclusively on Blur. User loyalty and NFT listings determine reward distribution. The airdrop distributed 300 million $BLUR tokens, worth approximately $146 million. Season 3 Airdrops are powered by Layer2 Network Blast, where users accumulate points through listing, bidding, and lending NFTs. In addition, users who hold $BLUR can also receive points as rewards.

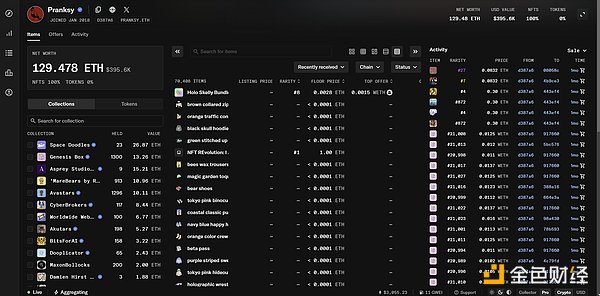

Referring to Blur's airdrop experience, users can prepare from the following aspects to obtain OpenSea's potential token airdrops:

Provide liquidity for NFT projects with stable floor prices and active trading volumes, and pay attention to the return expectations of potential coin issuance projects.

List NFTs, even if the price is set far higher than the market, and try to reduce the situation where NFTs stay in the wallet for a long time.

Focus on NFT projects that interact frequently with OpenSea, especially those with higher royalties, because OpenSea intends to attract more creators.

Actively participate in the use scenarios of OpenSea points or tokens to promote token circulation and ecological applications.

NFTProject Token Issuance Wave

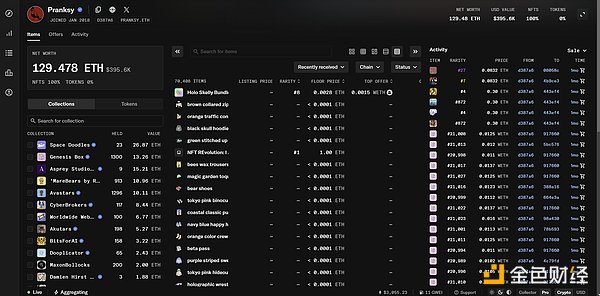

As the NFT floor price rises, the transaction threshold is also constantly increasing. Token issuance has become an effective tool to expand the community audience and increase market liquidity. By combining NFT with tokens, project parties use token incentive mechanisms to form an ecological closed loop, attract user participation, and improve liquidity. Data shows that the project's token market value and trading volume are usually higher than the NFT itself, reflecting the high demand and liquidity advantages of tokens in the market.

Note: Due to the complexity of the NFT ecosystem and IP rights, the rights of NFT and tokens are not completely matched. The above data is for reference only. Participating in such projects requires full assessment of potential risks.

Summary

Currently, the activity of the NFT market is recovering, and the recent trading volume has exceeded 200 million US dollars, but there is still a lot of room to reach the peak of trading volume in the previous cycle. If blue-chip NFT projects are regarded as Alpha assets to be discovered at this moment, the new version of OpenSea and the points incentive plan are expected to inject new capital flows and user vitality into the NFT market.

Kikyo

Kikyo