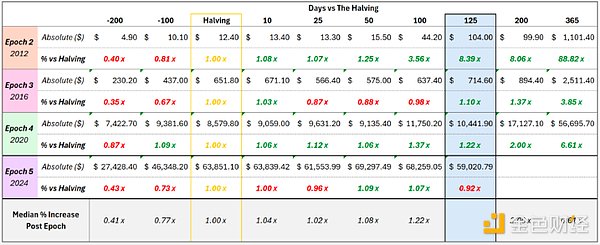

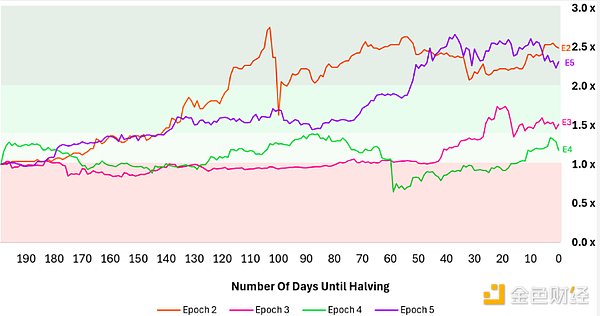

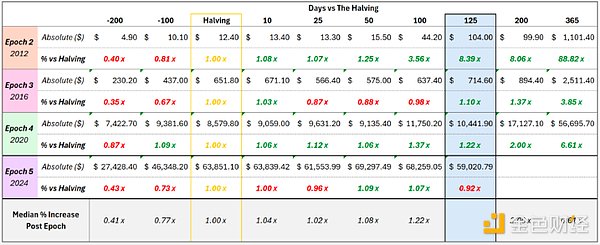

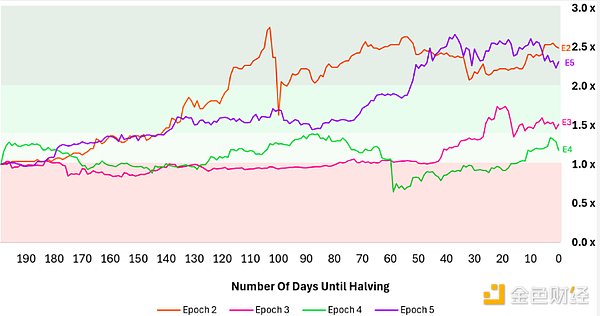

Some people believe that the 4-year halving cycle still holds true in 2024, but the approval of the BTC ETF in January 2024 pulled demand ahead of time, resulting in a strong rise in BTC before the halving. This claim is false. BTC ETF approval is a demand-driven catalyst, while the halving is a supply-driven catalyst, so they are not mutually exclusive. Bitcoin price has a significant impact on the broader market, and therefore founders’ ability to raise capital through equity, SAFTs, and private or public token sales. Given the liquidity that crypto brings to venture capital, it is imperative that founders understand the top-down market drivers to better anticipate funding opportunities and predict their trajectory. In this article, we will unpack the concept of the four-year market cycle to lay the foundation for exploring the true drivers of future work. Debunking the four-year cycle does not mean we are bearish on the overall market. Let’s first look at BTC price performance before and after the halving over the past few cycles. It is clear that in the 125 days after the halving, the 5th cycle (2024) is the worst performing period since the halving, and it is also the only cycle in which the BTC price fell compared to the day of the halving.

Figure 1: BTC price performance before and after halving in different cycles

Source: Outlier Ventures

So what effect does halving have on prices? In short, there are two main reasons.

Fundamentals: Bitcoin halving reduces new supply, creating scarcity, and when demand exceeds limited supply, prices are likely to rise. This new dynamic also changes the economics for miners.

Psychological Level:The Bitcoin halving reinforces perceptions of scarcity, reinforces expectations of a price surge based on historical patterns, and attracts media attention, which can increase demand and push prices higher.

In this article, we argue that the fundamental driver behind BTC price action, the halving, has been overstated and has been irrelevant over the past two cycles. We will combine the numbers to demonstrate that the net effect of the halving is not enough to have a significant impact on BTC prices or the broader digital asset space.

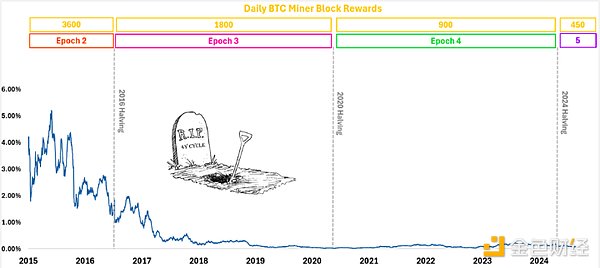

Preliminary Observations — Daily BTC Block Incentives

If you learn one thing from this post, let it be this:

The strongest argument for the halving’s impact on the market is that, in addition to reducing BTC inflation, it also affects miners’ economics, causing changes in their fund management.

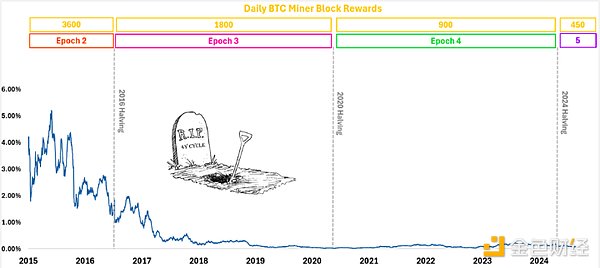

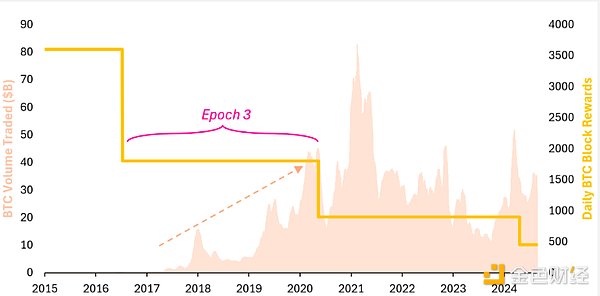

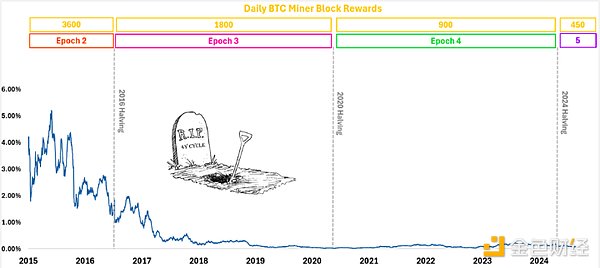

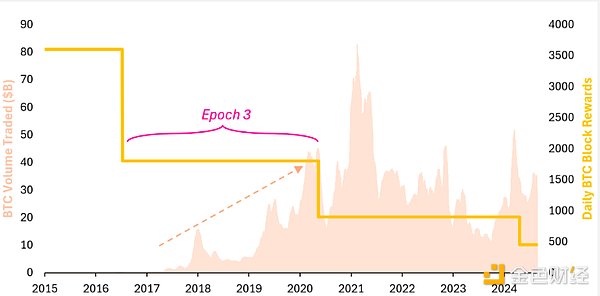

So,let’s consider the extreme case where all mining block rewards are immediately sold on the market. How high would the selling pressure be?Below, the total daily block rewards received by all miners (in USD) are divided by the total volume (in USD) on the market to assess the impact.

Until mid-2017, miners had an impact on the market of more than 1%. Today, if miners sold all of their BTC block rewards, it would only account for 0.17% of market volume. While this does not include BTC that miners previously accumulated, it shows that as block rewards decrease and the market matures, the impact of BTC block rewards has become insignificant compared to the entire market.

Figure 2: Possible impact on the market if all miners sold their daily BTC block rewards

Source: Outlier Ventures

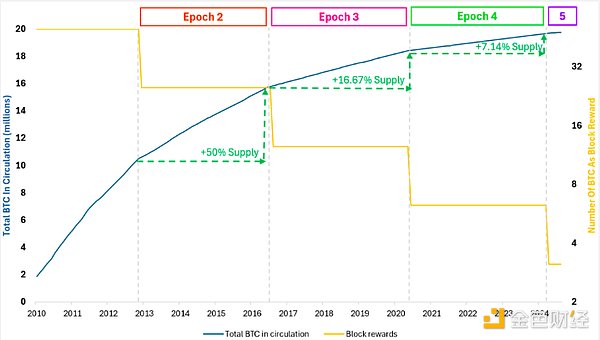

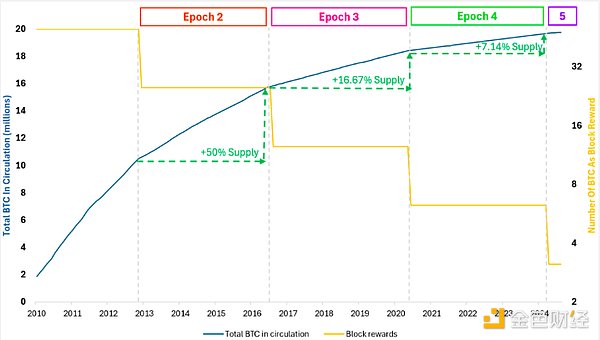

Recap – Halving Impact

Before we go any further, a quick recap. The Bitcoin halving is an event that occurs approximately every four years where miners’ block rewards are cut in half. This reduces the rate at which new BTC are created, thus reducing the amount of new supply entering the market. The total supply of BTC is capped at 21 million, and with each halving, the rate at which this cap is reached becomes slower. The period between each halving is called a cycle, and historically, each halving has impacted the price of Bitcoin as supply decreases and scarcity increases. All are illustrated in Figure 3.

Figure 3: Bitcoin Halving Dynamics, Block Reward, Total Supply and Cycles

Source: Outlier Ventures

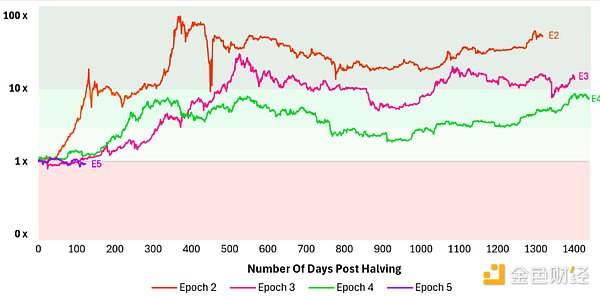

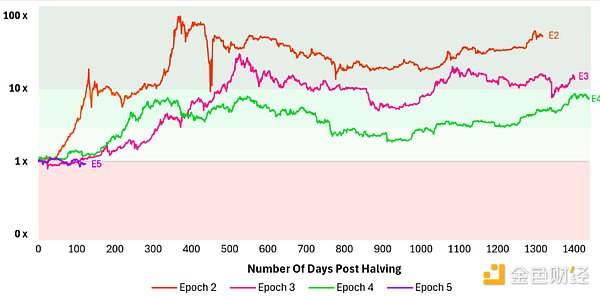

Bitcoin Halving Performance

Starting with what matters most to many of us, the impact on price performance, we find that the performance after the 2024 halving is the worst since BTC’s inception. As of today (September 2, 2024), BTC is trading about 8% lower than the price of $63,800 on April 20, 2024, the day of the halving.

Figure 4: BTC price performance after each halving

Source: Outlier Ventures

“What will the situation be like before the halving in 2024? ” Indeed, we experienced an unusually strong trend before the halving. Looking back at the performance 200 days before the 2024 halving, we see that BTC has grown almost 2.5 times. This is almost on par with the 2nd cycle, when BTC accounted for 99% of the total market value of digital assets, and the halving still makes sense.

Figure 5: BTC price performance 200 days before each halving

Source: Outlier Ventures

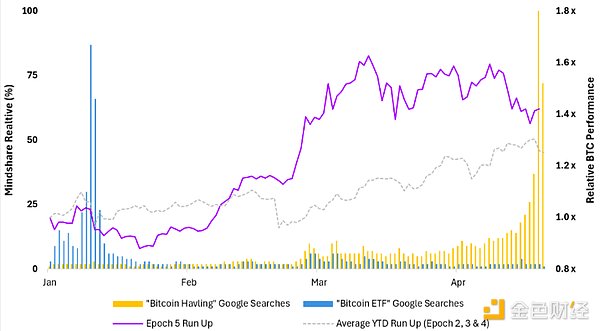

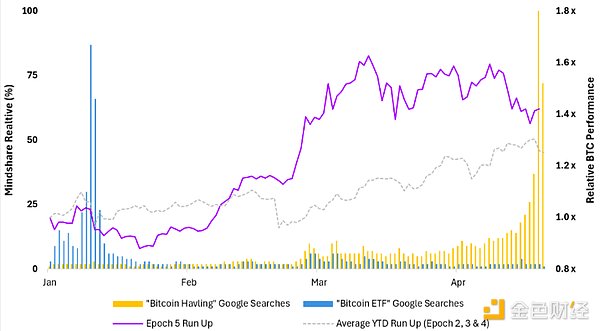

That being said, it’s also important to remember what happened during that time. In early 2024, we got approval for the BTC ETF, which has had a net inflow of 299,000 BTC since January 11, 2024, which has greatly boosted the price. So let's be honest. The rise is not from the expectation of the halving.

Figure 6 shows the performance of BTC between the BTC ETF approval and the halving. The approval of the BTC ETF in January 2024 increased the demand for BTC, causing the 100-day increase in the 5th cycle to exceed the average cycle increase by +17%.

Figure 6: BTC price performance 200 days before each halving

Source: Outlier Ventures, Google

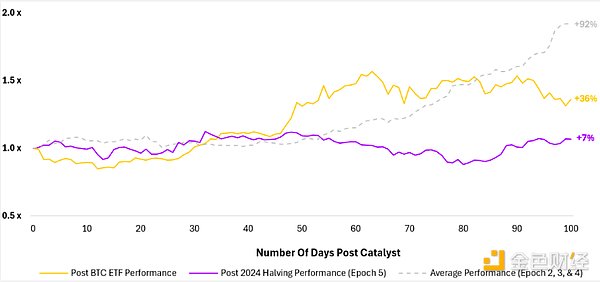

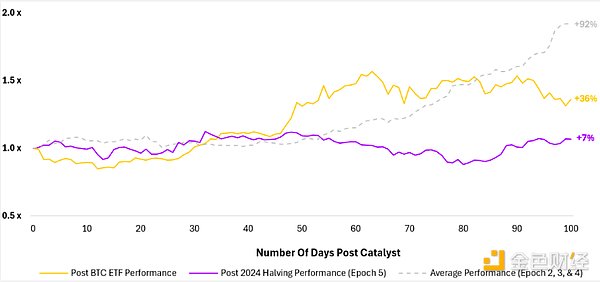

Figure 7 shows the performance of BTC ETF 100 days after approval and BTC halving. Clearly, the ETF approval had a more significant impact on price action than the halving, as evidenced by the ~29% gap between the 100-day performances.

Figure 7: BTC Performance and ETF Catalysts 100 Days Post Halving

Source: Outlier Ventures

“Thus, the BTC ETF is driving demand and price action we typically see around halvings ahead of time! ”

This is a weak argument in defense of the 4 year cycle. The truth is, both of these catalysts are separate and independent of each other. ETFs are a demand driven catalyst, while the halving is considered a supply driven catalyst. They are not mutually exclusive, and if the halving remains significant, we should see significant price action on the back of this dual catalyst. 2016 Was the Last Time I believe 2016 and Cycle 3 were the last times that the halving had a truly significant impact on the market. As discussed in Figure 2, the chart below illustrates the impact on the market if all miners sold on the day they received their block reward. As you can see, this fell below 1% around mid-2017 and is barely above 0.20% today, suggesting that the halving has had minimal impact.

Figure 8: Possible impact on the market if all miners sold their daily BTC block rewards

Source: Outlier Ventures

To understand the declining importance of the impact of miners’ financial decisions, let’s take a closer look at the different variables at play.

Variables:

→ Block rewards decrease over time and the market matures, reducing the relevance of miner influence.

Figure 9 shows BTC transaction volume and BTC block rewards accumulated by miners.The sharp rise in transaction volume is the real reason why the relevance of miner block rewards has become insignificant.

Figure 9 shows BTC transaction volume and BTC block rewards accumulated by miners.The sharp rise in transaction volume is the real reason why the relevance of miner block rewards has become insignificant.

Figure 9: Daily BTC Miner Rewards and Daily Transaction Volume

Source: Outlier Ventures

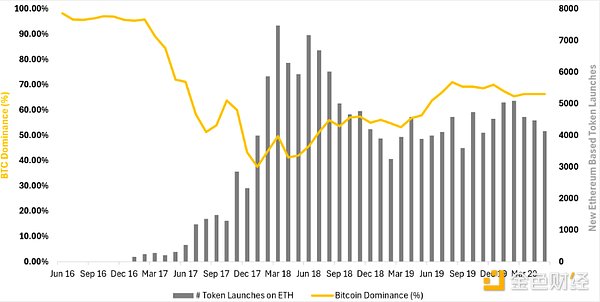

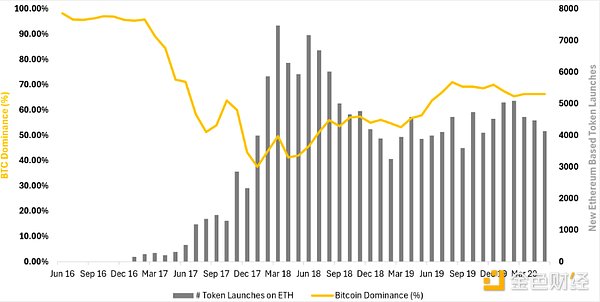

For those who were there at the time, it is obvious what drove the growth in transaction volume during that period. To recap: After Ethereum launched and unlocked smart contract functionality in 2015, the ICO boom ensued, leading to the creation of many new tokens on the Ethereum platform. The surge in new token issuance led to a decline in BTC’s dominance. The influx of exciting new assets (i) drives trading volume across all sectors of the digital asset market, including BTC; and (ii) incentivizes exchanges to mature faster, enabling them to more easily onboard users and handle larger trading volumes.

Figure 10: New ETH token issuance and BTC dominance in Cycle 3

Source: Outlier Ventures

So… what about 2020?

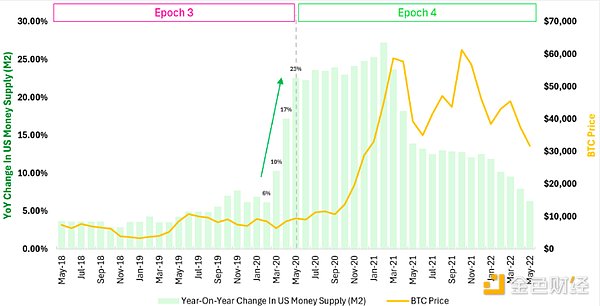

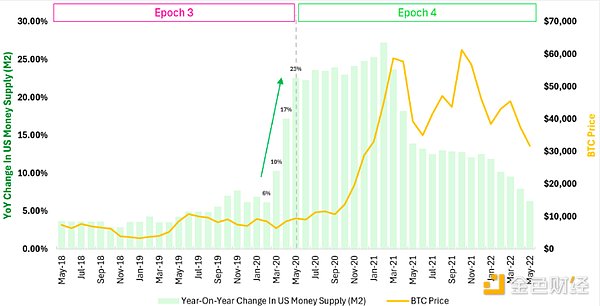

A lot of things happened in the third cycle, which logically reduced the impact of mining fund management and, in turn, the impact of the halving as a catalyst for BTC. What about 2020? That time BTC rose about 6.6 times within a year after the halving. This was not due to the halving, but rather to the unprecedented amount of money being issued in response to Covid-19.

While the halving is not a fundamental factor, it may have influenced BTC’s price action from a psychological perspective. As BTC made headlines around the halving, it provided a target for people to invest their excess capital at a time when there were few other options for spending.

Figure 11 shows the real reason for the rally. Just a few months before the May 2020 halving, the U.S. money supply (M2) surged at a rate unprecedented in modern Western history, sparking speculation and inflation across a variety of asset classes including real estate, stocks, private equity, and digital assets.

Figure 11: US money supply (M2) and BTC price before and after the 2020 halving

Source: Outlier Ventures, Federal Reserve Bank

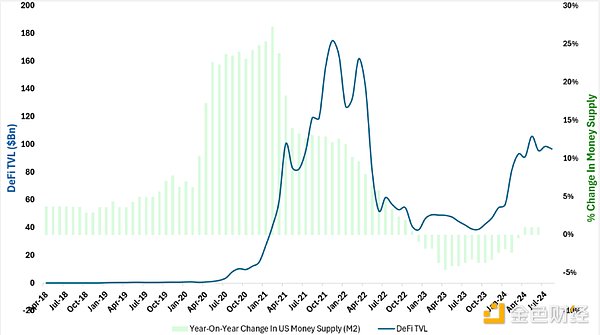

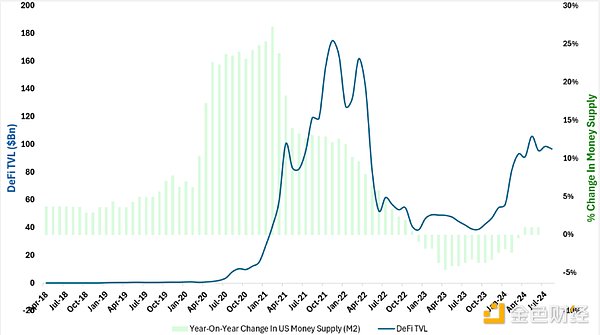

In addition to the inflow of BTC, it is important to recognize that money printing activities are happening in DeFi After the DeFi spring, it subsequently developed into the DeFi summer.Many investors were attracted by the attractive on-chain yield opportunities and put their money into cryptocurrencies and utility tokens to capture this value. Since all digital assets have a strong correlation with each other, BTC naturally benefits from it.

Figure 12: U.S. Money Supply (M2) and DeFi TVL

Source: Outlier Ventures, DeFiLama>

When the halving just happened, 112, 192);">Multiple factors driven by global helicopter money policies have triggered the largest cryptocurrency rally to date, making it seem that changes in block rewards have a fundamental impact on price action.

Remaining Miner Supply

"What about the remaining BTC supply held by miners in vaults? This supply was accumulated in previous periods when hashrate was lower and block rewards were higher. "

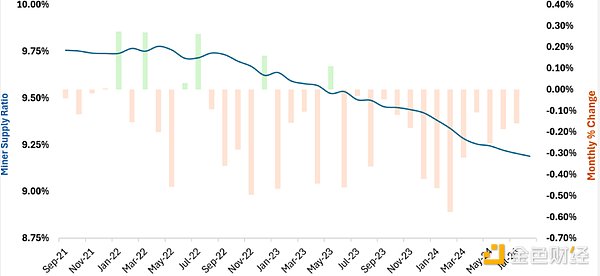

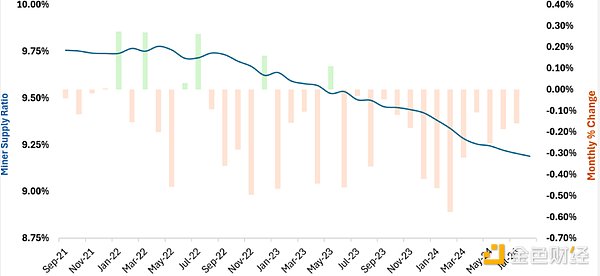

Figure 13 examines the miner supply ratio, which is the total amount of BTC held by miners divided by the total BTC supply, effectively showing how much supply miners control. The impact of miners’ vault decisions on BTC prices is largely a result of the block rewards they accumulated in earlier periods.

As shown, the miner supply ratio has been steadily decreasing and is currently around 9.2%.

Recently, there has been an increase in OTC activity from miners selling BTC, possibly to avoid having too much impact on the market price. This trend may be due to lower block rewards, higher hardware and energy input costs, and the lack of a significant increase in BTC prices - forcing miners to sell their BTC faster to remain profitable.

We understand the impact of halving on mining profitability, and they need to adjust their fund management to remain profitable. However, the long-term direction of development is clear. The impact of halving on Bitcoin price will only continue to decrease over time.

Figure 13: Miner supply ratio and month-on-month change rate

Source: Outlier Ventures, CryptoQuant

Conclusion

While the halving may have some psychological impact, reminding holders to pay attention to their dusty BTC wallets, it is clear that its fundamental impact has become insignificant.

The last time the halving had a meaningful impact was in 2016. In 2020, it was not the halving that sparked the bull run, but the response to COVID-19 and the subsequent money printing.

For founders and investors trying to time the market, it is time to focus on more important macroeconomic drivers rather than relying on four-year cycles.

With this in mind, we will explore the true macro drivers behind market cycles in future token trendlines.

JinseFinance

JinseFinance