Author: Lucius Fang; Compiler: Shenchao TechFlow

Optimistic Rollup (ORU) is currently winning the L2 war

As the Celestia-led modular narrative advances, the competition for Ethereum L2 is becoming fierce, almost every month New chain launches will be announced as transaction costs can now be significantly reduced by using Celestia as the data availability (DA) layer.

Many projects are considering whether to launch their own L2, as this may help reposition themselves as a company that may gain higher full circulation value in a bull market ( FDV) chain. Some DeFi projects were the first to hop on the express train, and their idea was to internalize the Maximum Extractable Value (MEV) for themselves while reducing transaction costs. These include Aevo (converted from Ribbon Finance), Lyra Finance and Fraxtal by Frax Finance. It is worth noting that all of the above projects choose Optimistic Rollups (ORU), specifically OP Labs’ OP Stack, as their chain instead of ZK Rollup.

The trend in favor of ORU continues even among new chains in other areas such as Coinbase’s Base, Blur’s Blast, and Bybit’s Mantle. In addition to ORU giant OP Stacks, Arbitrum is also gaining attention by including Xai and ApeCoin into its Arbitrum Orbit ecosystem. Looking at the TVL of the Arbitrum and Optimism mainnets, ORU’s dominance is obvious, accounting for 75% of the market share of all other rollups.

Does this mean ZK Rollup will never catch up?

ZK Rollup (ZKR)

As a review, Rollup is an Ethereum L2 solution, It bundles multiple transactions outside of the Ethereum mainnet and submits them to Ethereum as a single transaction, helping to reduce transaction costs while inheriting the security of Ethereum. There are two main types of Rollups, ZK Rollups (ZKR) and Optimistic Rollups (ORU), which use validity proof and fraud proof respectively.

The comparison between ZKR and ORU is as follows:

The advantages and disadvantages of ZKR relative to ORU are as follows:

Advantages

Transactions can be completed almost instantly by using proof of validity, rather than by requiring The ORU has a 7-day challenge period for fraud prevention. Enable shorter fund withdrawal periods.

In contrast to all transactions in ORU, only the transactions required to calculate the state difference must be settled on Ethereum.

Disadvantages

Require more computing resources and require specialized hardware to generate effective sex proof.

Not well suited for EVM, so migrating existing EVM-based projects requires additional effort, while ORU is EVM equivalent.

In essence, ORU is easier to build, with the advantage of facilitating the migration of existing EVM-based projects. The main limitation is the 7-day challenge period required for transaction finality, which affects withdrawing funds from L2. This is why many believe ZKR is a better solution for Ethereum scaling, as it provides instant transaction finality with validity proofs, also known as zero-knowledge proofs (ZKP). However, ZKP is still a relatively emerging technology, and research is ongoing on how to optimize the production of ZKP and make ZKR more EVM-friendly.

Types of ZK-Rollup (ZKR)

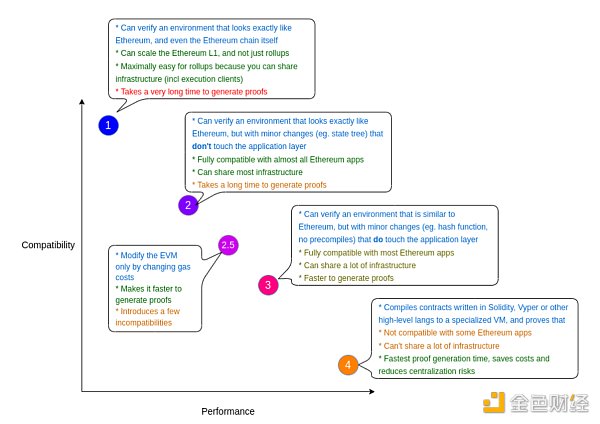

ZKRs are usually classified into 4 types zkEVM, which provides a trade-off between EVM equivalence and proof requirements. zkEVM refers to a virtual machine that is compatible with both EVM and ZKP.

4 types of zkEVM

EVM is not designed to be compatible with ZKP, so proving all parts of an Ethereum transaction by ZKP is lengthy and expensive. To make proofs faster and cheaper, the solution is to create a custom virtual machine (VM) optimized for ZKP and then create a compiler to translate the EVM language.

In short, projects must decide between optimizing existing EVM-based applications for portability or transaction costs.

Type 1: completely equivalent to Ethereum, able to extend Ethereum L1, but proves It's too long.

Type 2: Full EVM equivalence, existing EVM-based applications can be migrated without modification, but proof long time.

Type 3: Almost equivalent to EVM, existing EVM-based applications can be migrated with some modifications, but the proof Time flies.

Type 4: High-level language equivalent, requiring a compiler to convert the EVM language into a custom zk-friendly VM, but it takes time to prove Super fast.

Type 1 ZKR is the most difficult to produce, but has the greatest potential to scale Ethereum itself. Due to its complexity, it may take many years to become operational. Therefore, the currently operating ZKRs are mainly Type 3 (Polygon zkEVM and Scroll) and Type 4 (Starknet and zkSync Era). It's worth mentioning that projects that are in type 3 all want to become type 2, so this is more of a transition period for them to make them more EVM compliant.

Due to technical difficulties in releasing production-ready ZKR, ORU launched the Arbitrum and Optimism mainnets in 2021, taking a first-mover advantage. Meanwhile, zkSync 2.0 and Polygon zkEVM will be launched in 2023 respectively. This gives ORU a significant head start and the ability to attract capital and projects. The launch of ARB and OP tokens will also help retain users through ongoing liquidity staking projects and funding.

But the trend may reverse in the coming months.

Polygon: ZKR's aggregation layer

Of all ZKR, Polygon may have the most potential Replace ORU. Let’s take a look at what advantages they have.

Strong ZK foundation

Polygon team in the past cycle (2021-2022) It has attracted attention mainly through business cooperation with traditional companies, such as Nike, Starbucks, Mastercard, Adobe, Disney, Adidas, Mercedes, etc. What is often overlooked is Polygon's strong focus on ZK technology, which includes the acquisition of Hermez ($250 million) and Mir ($400 million) in 2021.

Hermez contributed to the current version of Polygon zkEVM, providing a high degree of EVM compatibility and aiming to be a type 2 zkEVM. Mir later became Polygon Zero, specifically dedicated to improving ZK proofs.

Polygon has been releasing various groundbreaking research results in ZK, the most recent of which is Circle STARK, a rapid proof system in partnership with Starkware. The white paper was released on February 22, 2024, and Circle STARK will be incorporated into the Plonky3 proof system, which is expected to be 10 times faster than Polygon's current Plonky2 proof system.

StarkWare co-founder Eli Ben-Sasson said in an interview with CoinDesk: "I think this will lead to the most efficient proof system in a while, ”

Multi-pronged marketing strategy

With the rise of modular storytelling , the choice of data availability (DA) solution has become an important differentiating factor. Hosting DA off-chain will result in cheaper transactions and higher throughput, but at the expense of security. Rather than choosing one specific arrangement, Polygon decided to use three strategies.

1.Polygon PoS will be transformed into zkEVM Validium

EVM equivalent

Transaction data is available off-chain (Validium)

Suitable for high-frequency and low-value transactions, such as games and social projects.

2.Polygon Miden, based on STARK

Miden VM optimizes ZK and supports Rust and Typescript

Provides non- EVM features, such as native Account Abstraction (AA), allow users to control the information they want to keep private

Ideal for new types of applications, Such as order book exchange

Sponsored Business Content

3. Polygon zkEVM

At first glance, Polygon's strategy seems diffuse and without a specific focus. But as ZK technology takes off, betting on all potential possibilities may prove to be the right strategy. Regardless of how ZK technology eventually makes its way to Ethereum, Polygon will be involved.

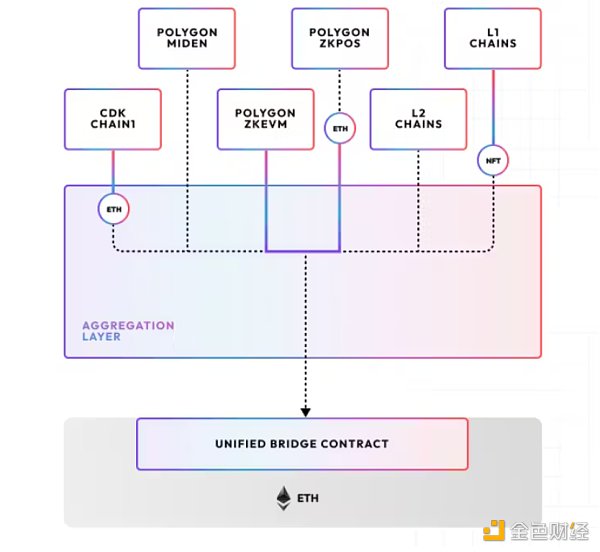

As Rollup introduces isolation state and liquidity, Polygon introduces solutions through the aggregation layer (AggLayer). The aggregation layer provides unified liquidity and shared state for ZKR. It does this by aggregating multiple ZKR’s proofs and then creating an aggregated proof that will be settled on Ethereum. This enables cross-chain atomic transactions between ZKRs. For example, users on OKX’s X1 chain can purchase NFTs directly from lmmutable zkEVM. Polygon also released a Type 1 Prover, allowing any EVM chain to connect with AggLaver.

Polygon Chain Development Kit (CDK)

As mentioned at the beginning, Apps is considering becoming an Appchain itself, with the current leader It's OP Stacks, then Arbitrum Orbit. Polygon CDK is Polygon's answer for creating custom zKEVM chains for applications. So far Polygon has demonstrated its BD prowess not only in traditional companies but also in the web3 space. Notable products include Immutable, OKX's The most valuable gaming blockchain, with a valuation of approximately $7 billion. Manta Network, the third largest L2 by TVL, also decided to switch from OP Stack to Polygon CDK. As a top 5 centralized exchange, OKX chose Polygon CDK to launch its L2, which also proves Polygon’s ZK technology.

Another interesting development is that two well-known Bitcoin second-layer projects have decided to use Polygon CDK. They both received large amounts of pledged deposits at the mainnet launch in anticipation of the airdrop. Merlin Chain has approximately $3.8 billion in deposits, while B² Network has approximately $660 million in deposits. While the market is still hotly debated as to what constitutes a true Bitcoin L2, it’s still impressive to see the adoption of Polygon CDK outside of the Ethereum ecosystem.

Strong token value accumulation

The question now is how all these innovations will benefit Polygon The native token brings value. Using a playbook similar to the 2021 Matic (MATIC) rebrand to Polygon (MATIC), the token is now being renamed to the Polygon Ecosystem Token (POL), this time with a 1:1 migration and a new price chart. The right migration will help regain attention to the project and aid price discovery. The most recent success is the rebranding of Merit Circle to Beam.

After the token name change, POL's positioning has been strengthened and it has become the pledge token of AggLayer and Polygon CDK chain orderers. Validators need to stake POL to begin validating the network, generate ZKP, and participate in the Data Availability Committee (DAC) in exchange for protocol rewards and transaction fees.

POL has been minted on the Ethereum mainnet, but the staking feature has not yet been enabled, and there is no immediate deadline to redeem MATIC for POL. Polygon may be preparing for a massive migration event alongside the mainnet launch of the Polygon CDK chain.

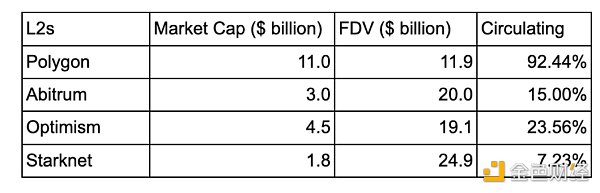

Of all the ZK Rollups, POL/MATIC is the only token that no longer has an aggressive unlocking schedule, with its last unlock occurring on February 22, 2024. Nonetheless, POL has a new token economic model with future annual inflation of up to 2%, half of which will go to the community fund and the other half to validator rewards. This is a much smaller supply shock than other L2 tokens such as ARB, OP, and STRK.

Finally, Polygon has named its DA solution Avail. Due to Celestia’s high valuation, it’s reasonable to speculate that Avail could debut at a similar valuation range and potentially airdrop its native token into the Polygon ecosystem. Although many existing Polygon CDK chains already have their own tokens, it is reasonable to speculate that future Polygon CDK projects may also choose to airdrop their tokens to POL stakers. If so, POL would be able to have a "stake to receive airdrop" narrative, significantly increasing its value. Celestia and Dymension in particular have benefited greatly from the same narrative.

Notable ZKR

Starknet

Starkware was once hailed as a leader in the ZKR space as it attracted projects such as dYdX, ImmutableX, and Sorare Launch its StarkEx chain. StarkEx is an Ethereum second layer that supports specific types of Ethereum transactions, such as trading and NFT minting.

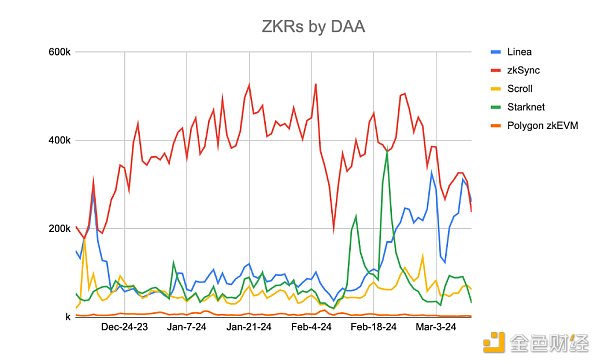

They took a long time to launch their universal ZKR, known as Starknet, resulting in some key projects, such as dYdX and Immutable, migrating to other ecosystems , such as Cosmos and Polygon. Additionally, as a Type 4 ZKR, their decision not to be compatible with standard Ethereum wallets like MetaMask likely creates a lot of friction barriers for users to get started. This was evident on Starknet prior to the launch of STRK on February 20, 2024, which had a total value locked (TVL) of only around $50 million and daily active users (DAA) of less than 200,000, both of which lagged behind zkSync Era and Linea. But now, due to STRK’s high valuation and its new DeFi activities, its TVL and DAA are on par with the zkSync Era.

Starknet's recent distribution of its initial STRK token sparked dissatisfaction within the community due to strict airdrop requirements designed to curb "airdrop sybil attacks." Tensions escalated when a core Starknet team member called these users electronic beggars. Tensions grew when users realized that STRK’s unlocking was scheduled to begin in 2022 instead of the initial distribution in February 2024, effectively reducing the lock-in period for the team and investors to just two months. In response to this reaction, the team has adjusted the token unlock amount to make it more gradual.

Starknet has its own L2 SDK and plans to introduce L3 (application chain). But so far, nothing noteworthy has been announced publicly, only Paradex, an order book perpetual protocol, has gone live.

zkSync Era

As a type 4 ZKR, zkSync Era is among all ZKRs Ranked second in TVL, reaching US$185 million, and has the highest average daily active users, reaching 237,000. However, the high usage may be due to anticipation of its native token airdrop. But compared to Starknet, it is easier for users to use zkSync Era because it is compatible with standard EVM-based wallets such as MetaMask. The team also highlighted that projects can be deployed on zkSync Era by using popular EVM languages such as Solidity, Vyper, and Yul along with its LLVM-based compiler.

In their roadmap, they plan to introduce zkPorter, an off-chain DA solution to increase transaction throughput. zkSvnc Era also has its own L2 SDK called Hyperchain, and upcoming products include Crypto.com’s Cronos zkEVM, GRVT (hybrid cryptocurrency exchange) and Tradable (private credit).

Linea

Linea, developed by Consensys, is the default Ethereum L2 network on MetaMask. As the largest web3 wallet in the space, native integration with MetaMask significantly increases its user base. Frequent activity on Galxe also helps increase its on-chain statistics in anticipation of the airdrop.

Linea has not announced any public plans for the L2 SDK or L3.

Scroll

Scroll in partnership with the Ethereum Foundation’s Privacy and Scaling Exploration (PSE) group Development, focusing on zkEVM research. Like the other projects mentioned above, its usage is high due to airdrop anticipation.

Scroll has not announced any public plans for the L2 SDK or L3.

Taiko

Taiko is the first dedicated platform outside of the Ethereum Foundation Project that becomes Type1 zkEVM. It also calls itself Rollup-based, where the role of the orderer is taken directly by the Ethereum L1 validators, making it a decentralized orderer from day one.

Currently, it is still in the testnet stage, and the mainnet is expected to be launched in the first half of 2024. Taiko has not announced any public plans for the L2 SDK or L3.

Competitive landscape

Currently, zkSync Era, Starknet and Linea stand out with the highest TVL and DAA among all other ZKRs, but when Polygon PoS in 2024 That could change quickly when it upgrades to zkEVM Validium in the first half, absorbing its existing $1.1 billion TVL and 1 million DAA.

Polygon zkEVM's upcoming catalyst revolves around its diverse lineup of projects that will compete in various sub-fields. For example, in the L2 space of centralized exchanges (CEX), OKX’s X1 will compete with Coinbase’s Base and Bybit’s Mantle, both of which use ORU. In the game L2 field, lmmutable, the currently highest-valued game chain, will compete with Xai from Arbitrum Orbit and Redstone from OPStack. Last but not least, in the general L2 space, Manta Network has accumulated the third largest TVL among L2 solutions ($650 million). Together, these projects contribute to the strong Polygon ecosystem, ultimately bringing value back into the POL token.

Final thoughts

From the perspective of technical advantages, ZKR is safer and more reliable than ORU Efficient and more economical. But ORU can still choose to use a hybrid proof system to achieve validity proof. So it remains to be seen whether ZKR's delaying the launch and opting for better technology is the right strategic choice. Polygon is a rare case in that it started attracting a large number of users due to its early involvement with Ethereum as its sidechain and is now able to onboard those users to its ZKR ecosystem once it is ready.

L2’s key to winning adoption is having exclusive apps in its ecosystem. Arbitrum is currently leading the DeFi sector, with GMX, Hyperliquid and various perpetual Dex being launched there. Optimism has also seen significant adoption, with Frax launching Fraxtal and Synthetix on the Optimism mainnet. On the gaming side, Arbitrum is also ahead, with Xai, ApeCoin, and TreasureDAO. Social apps also appeared first on ORU, FriendTech on Base, and Farcaster on Optimism.

Still, there is hope for ZKR, especially Polygon. Polygon zkEVM is coming for the DeFi season. In addition, several heavyweight Polygon CDK chains such as OKX’s X1, |mmutable zkEVM and Astar zkEVM are about to launch their mainnet in the first half of 2024. Coupled with the transition of Polygon PoS to Polygon zkEVM Validium and the migration of POL, Polygon has many upcoming catalysts to regain dominance. market attention. Additionally, most ZKRs have yet to launch their tokens, so there are still plenty of opportunities for ZKRs to stake their claim. Similar to the last cycle, these ZKRs may be able to raise significant ecosystem funding to help increase their usage.

Ultimately, one of Ethereum's ultimate goals is to upgrade L1 itself through zkEVM. As such, ZKR has a lot of potential to push Ethereum’s scaling boundaries. One of the best ways to implement zkEVM is through Polygon, as it has strong business development capabilities, is at the forefront of ZK research, and plans to contribute strong value accumulation back to POL.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  The Crypto Illuminati

The Crypto Illuminati Cointelegraph

Cointelegraph 链向资讯

链向资讯 Cointelegraph

Cointelegraph