Author: HirokiKotebe; Source: Inception Capital

The RWA space is different from other crypto spaces. When connecting crypto infrastructure with Offf Chain assets and their established regulatory framework, things can get very complicated. There are many obstacles, both technical and regulatory, that must be overcome to enable value flow. This requires more effort than a typical blockchain project that operates "safely" within the crypto-native space on established crypto infrastructure.

For billions of dollars of value to flow into various RWA tokens in addition to stablecoins, projects need to overcome a range of regulatory and technical barriers that currently limit the accessibility and utility of their tokens, just as the first fiat-backed stablecoins issued a decade ago did.

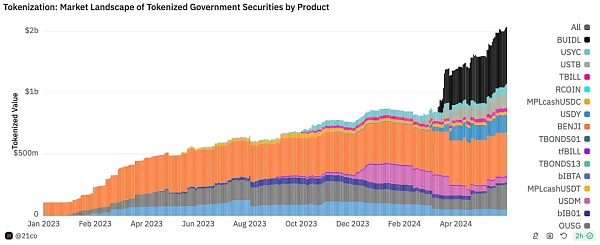

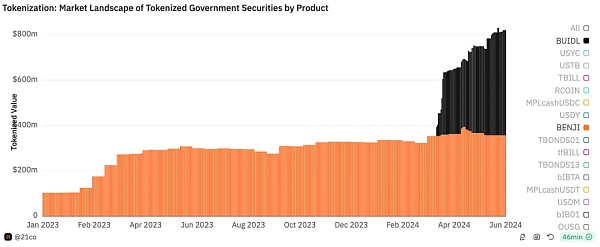

Given these challenges, non-stablecoin RWA projects currently account for only about 3% of the entire RWA industry, and this small market share is mainly occupied by a small number of institutions and wealthy individuals.

So how to break through this situation?

After reviewing dozens of projects in this field, we found that many favorable conditions must occur simultaneously in order for these projects to gain meaningful market share. In the next few years, only a few projects focused on securities, commodities, and asset-based finance have good growth prospects. However, there are also some experimental projects that try to tokenize real estate and high-value collectibles that are also attractive.

The characteristics that distinguish these projects are that they provide some combination of accessibility, utility, and security. How these characteristics are achieved, and the importance of each characteristic, varies from project to project. Some projects perform better because they are associated with trusted world-class institutions (e.g. BlackRock’s BUIDL). Others are more promising because they are more accessible to retail users (e.g. Ondo’s USDY). Still others stand out because tokenized infrastructure has significant advantages over traditional infrastructure for certain purposes (e.g. Centrifuge Pools).

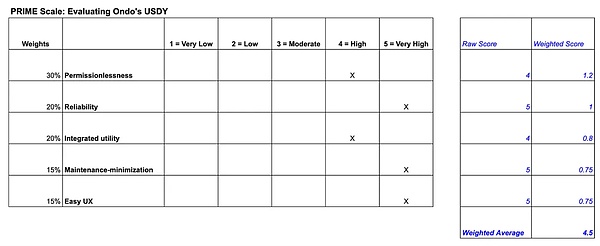

While accessibility, utility, and security are top of mind for consumers in this space, there are specific attributes underlying these traits, which we describe using the acronym PRIME:

Permissionlessness: e.g., retail availability; global accessibility

Reliability: e.g., the reliability of the issuer or protocol and the resulting return-risk profile

Integrated utility: e.g., integration with crypto exchanges and DeFi; crypto-native on-chain diversification convenience; the practical advantages of crypto infrastructure over traditional systems

left;">Maintenance-minimization: e.g., low cost and simple maintenance; digital representation and storage of off-chain assets

Easy UX: e.g., easy redemption process; easy yield collection; easy transfer process

Attributes are not independent of each other (e.g., reliability may be related to licensing). Moreover, the contribution of each attribute to the potential of an RWA project depends on the asset class and target consumers. As a rule of thumb, the more attributes a project meets, the better its prospects. Taking a weighted average score of these attributes can be used as a heuristic to evaluate different RWA projects.

Permissionless

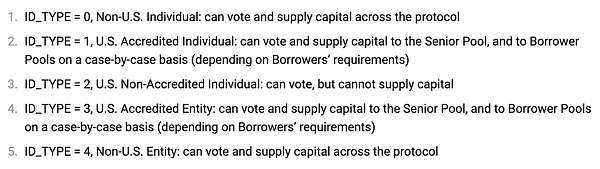

Currently, most non-stablecoin RWAs are generally highly permissioned, requiring KYC/AML compliance, large bills, accreditation, or geographic restrictions, and are only transferable on proprietary platforms and only between other pre-approved investors. In practice, access to and use of cryptocurrencies is often limited to institutions and wealthy individuals, and often to specific groups and regions - not to mention, only a subset of the already small circle of crypto users. This is a small addressable market.

Compare to stablecoins, which can be purchased and traded by anyone anywhere on permissionless secondary markets. This is a huge addressable market.

Retail Availability

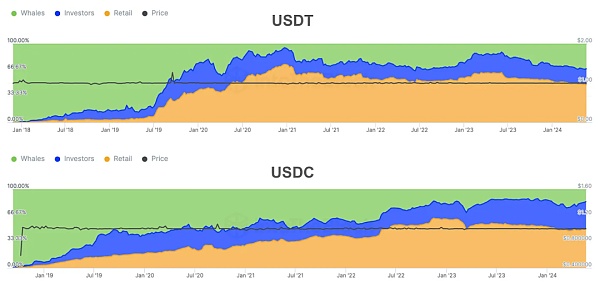

To understand the importance of retail contributions in RWA, let’s look at the history of estimated retail ownership of the top stablecoin supplies:

“Retail” is defined here as addresses owning less than 0.1% of the circulating supply; Source: IntoTheBlock

The growth in retail holdings, especially for USDT, coincided with the massive growth in stablecoin supply from mid-2019 to 2021. Around that time, retail investors flocked to centralized exchanges to purchase stablecoins and trade them for a variety of other tokens.

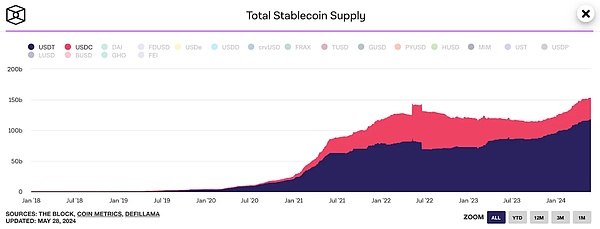

Source: The Block

Right now, retail investors own about 50% of USDT and USDC. In other words, if retail investors are not taken into account, their supply will be reduced by half as defined here.

While retail accessibility is an easier problem to solve in situations where the SEC does not have direct oversight (e.g., currencies, commodities), there are projects in the securities space that are finding workarounds to achieve greater retail accessibility, and the benefits are becoming apparent.

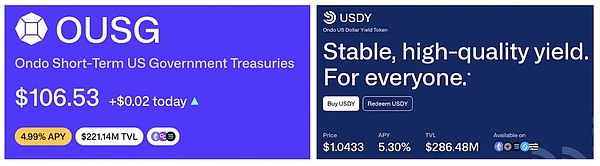

Case Study: Ondo Finance’s OUSG vs USDY

Ondo Finance’s two core products, OUSG and USDY, are a good case study in demonstrating the importance of permissionless accessibility for retail investors, as they align on the issuing authority but differ in retail accessibility.

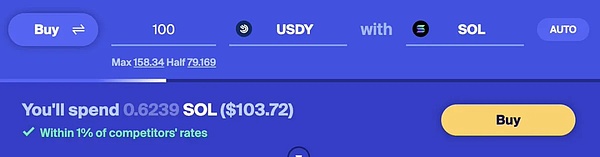

OUSG is targeted at institutions and wealthy individuals, while USDY is an alternative for retail investors. Both now offer accumulation and rebasing versions. While both OUSG and USDY require KYC/AML compliance to mint (note: this is also true for USDC, while USDT is only issued by Tether), one key difference is that USDY can be traded permissionlessly on DEXs (such as Orca) on Solana (just like USDC and USDT).

Of the top five products that tokenize US securities, USDY is the only one that offers live trading pairs on popular DEXs, making it the most suitable major player in the space for retail investors. It is also available on the most blockchains in this list, including Ethereum, Solana, Sui, and Aptos.

Despite launching half a year after OUSG, USDY has gained a lot of momentum this year and has already surpassed OUSG in terms of supply. Ondo Finance has an AUM of over $500 billion, making it the tokenized financial protocol with the largest market share and the second largest in the entire non-stablecoin RWA space (after Tether’s xAUT).

Just three months ago, USDY had a supply of about $3.5 million, while OUSG had about $105 million, a 30x difference. Now, USDY supply has grown by almost two orders of magnitude, while OUSG supply has roughly doubled.

At this rate of growth, we may see USDY surpass Franklin Templeton’s BENJI this year. BENJI was one of the first tokenized financial products and until recently was a leader in the space. It has grown relatively little over the past year and now has a supply of $357 million.

Note: USDY supply is artificially reduced here because data excludes supply on Sui and Aptos; Source: Dune (@21co)

While there are obviously many factors at play, one of the main factors driving USDY's momentum is its less permissioned accessibility to retail investors. Currently, USDY is the only tokenized financial product that can be minted, deployed on major DEXs and CEXs (currently available on Bybit), and can be purchased and traded by retail investors against other tokens. This means it is starting to share some of the main demand drivers for stablecoins.

Global Access

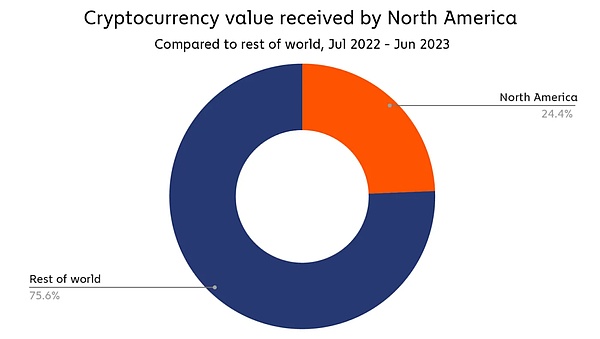

The United States is the world's largest cryptocurrency market. A Chainalysis study estimates that almost a quarter of the value of cryptocurrencies received can be attributed to North America.

Source: Chainalysis

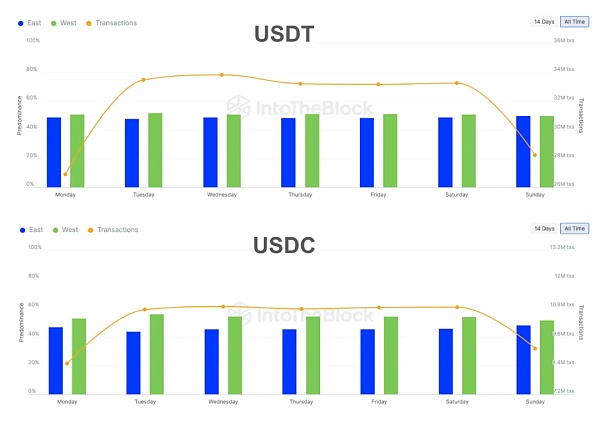

If we look at the number of USDT and USDC transactions, about 45-50% of transactions occur during trading hours in Western markets.

East: % of transactions from 10:01 PM to 10:00 AM (UTC) since token inception. West: % of transactions from 10:01 AM to 10:00 PM (UTC) since token inception; Source: IntoTheBlock

Similarly, Arcane Research found that up to 43% of Bitcoin trading volume occurs during US market trading hours.

The key point is that strictly prohibiting most Americans from trading RWA tokens means excluding a large amount of potential trading volume and transactions. However, this is the current status of non-stablecoin RWA tokens.

A typical example: Non-US people are free to participate after passing KYC/AML; Only US institutions and wealthy individuals are approved after a strict approval process. Source: Goldfinch

Therefore, when evaluating non-stablecoin RWA projects and estimating their future trading volume or availability, it is key to consider the restrictions of US securities regulation on the world's largest cryptocurrency market. The extent to which US market activities are restricted will be directly related to the nature of the underlying assets and how they are used.

Reliability

Another important consideration is the reliability of the issuing institution. Currently, RWA tokens are mainly issued by institutions in a centralized manner. This is because there is no established way to do identity verification and compliance checks in a decentralized manner (although some early projects are addressing this, such as E Money).

If the issuer has a good reputation, buyers will have more trust in the tokenization process, the risk profile of the token, and the source of its returns.

The best example is BlackRock's BUIDL.

BlackRock partnered with Securitize to launch their first tokenized asset fund, BUIDL, on the Ethereum blockchain in March 2024. In just six weeks, BUIDL captured nearly a third of the $1.3 billion tokenized financial market, with a total of $380 million in tokenized financials, surpassing Franklin Templeton's BENJI. Currently, BUIDL's assets under management have reached $462 million, while BENJI's assets under management are $357 million.

BENJI remains the second largest tokenized financial product in terms of AUM, which means that the two largest tokenized financial products are completely centralized and issued by one of the world's largest asset management companies.

The main reason is simple: customers trust these institutions, their tokenization process, and their compliance. For BUIDL, the "reliability effect" is particularly evident, as Blackstone is the world's largest asset management company, with more than $10 trillion in total assets under management.

Comprehensive Utility

Back to Ondo's USDY, its integration in the cryptocurrency and DeFi fields makes it stand out. Among the top five tokenized financial products, USDY is available on the most blockchains, can be traded on major DEXs and CEXs on these chains, and even has a live governance token. This gives USDY three major utilities that other cryptocurrencies do not have:

Crypto Trading: Cryptocurrency is still a relatively isolated world, and arguably its main utility lies in trading tokens in an attempt to sell at a higher price or to extract yield. Stablecoins have also gained a lot of utility and demand due to their denominated nature with numerous trading pairs and the liquidity they can provide. While USDY is far from this level of popularity, I see it gradually infiltrating more exchanges and DeFi.

Yield: Another major activity in the crypto space is the search for yield opportunities. Unlike stablecoins, tokenized financial products like USDY provide this opportunity.

On-chain Diversification: RWA tokens like USDY provide an on-chain diversification strategy for crypto-native users. In the cryptocurrency market, assets tend to be highly volatile and highly correlated. Now, without leaving the crypto ecosystem, crypto-native users can choose to diversify their assets into non-yielding stablecoins or yielding stablecoins USDY.

In addition to this, the use of governance tokens makes Ondo a more crypto-native product, attracting crypto users who care about decentralization and community.

For tokens pegged to the US dollar, the practicality of crypto trading and yields should never be underestimated. If this sounds familiar, you may be thinking of Ethena's USDe, which has soared to over $3 billion in supply just four months after its public launch, surpassing Solana's total stablecoin supply, fully demonstrating how much demand there is for stablecoins (or similar stablecoin products) with yields.

USDY vs. BENJI Comparison:

Due to the minimum investment threshold of $20, BENJI is also suitable for retail investors to a certain extent. However, there are some important limitations that may explain why it has not grown as rapidly as USDY:

Can only be purchased on its proprietary mobile app

Only available to US residents

Can only be transferred within the mobile app

No BENJI-denominated trading pairs

Only available on the Stellar and Polygon networks

In short, while BENJI also has benefits, it lacks in terms of overall utility.

Experimental RWA categories that are beginning to demonstrate general utility:

Asset-based finance: Centrifuge pool share tokens compared to expensive and slow traditional asset-backed finance

US Real Estate: Villaso’s USH token compared to US Real Estate REITs/ETFs

Gold: Paxos’ PAXG and Tether’s XAUt tokens compared to gold ETFs/certificates

Minimized Maintenance

For the usability and viability of RWAs, the ease of storage and low-cost maintenance of the off-chain assets represented is critical. The nature of the asset significantly affects the complexity and cost associated with its maintenance. For example, tokenizing physical assets such as watches or fine wines requires significant resources to store and protect (e.g., climate-controlled environments, large vaults, expensive security measures, and insurance). These factors result in high maintenance costs, which is a problem for these projects’ business models.

In contrast, U.S. Treasuries, home equity investments (HEIs), or other digital off-chain assets are generally easier and less costly to maintain. As government securities, U.S. Treasuries are inherently low-maintenance. They are stored electronically in existing secure systems, and they require less physical space or physical securities than large physical assets. The reliability of these systems and mature infrastructure help reduce maintenance costs.

Similarly, home equity investments involve digitized ownership records, which simplifies management and reduces the risk of document loss or damage.

Projects that effectively reduce maintenance challenges can not only reduce operating costs, but also improve the overall efficiency, scalability, and security of their products.

Ease of Use

The crypto space has a user experience problem. It is still too complex and technical to attract mainstream users. Hence the continued push for chain abstraction and account abstraction. Ease of use is the first rule used by behavioral scientists to get people to do what they want, and has been proven effective in a variety of contexts in business, policy design, and intervention design. I believe that ease of use is equally important for the mass adoption of RWA tokens. Here are some major examples:

Ease of Redemption

While RWA tokens can be divisible and liquidly traded, their underlying assets may not be. The difference may pose a significant challenge to maintaining market stability and investor confidence. Rational investors will not put a large amount of investment into RWA tokens that cannot be easily redeemed.

Take Tangible's "Real Dollar" (USDR) depeg as an example. The immediate trigger for the USDR depegging was a surge in DAI redemption requests, which depleted the USDR’s liquid reserves. This made the USDR unable to meet further redemption demands, causing its value to plummet from its anchor value.

The fundamental problem lies in the illiquid collateral portfolio. The USDR is backed by tokenized real estate, and dedicated special purpose entities (SPVs) are actually responsible for managing and maintaining these physical assets. Although the USDR is liquid, its collateral is extremely illiquid, not to mention high maintenance costs.

The inability to quickly liquidate these real estate assets to meet redemption demands led to a crisis of investor confidence, triggered a bank run, and exacerbated the depegging situation - very similar to what happened with Terra’s UST.

In contrast, let’s look at the current market leaders: the US dollar, US Treasuries, and gold. They all offer more liquid alternatives. Currencies, especially major currencies like the US dollar, are very liquid and can be exchanged or traded in large quantities around the world. As a government-backed security, the US Treasury market is very liquid and active, with huge daily trading volumes. Likewise, gold is one of the most liquid investments. It can be quickly and easily converted to cash due to its universal demand and mature infrastructure.

Yield Convenience

Getting yield on RWAs should be as simple as possible. For example, yield-bearing RWA tokens like Ondo’s USDY and Mountain Protocol’s USDM automatically reprice while maintaining a peg to $1. This means that all accumulated interest is automatically distributed in the form of additional tokens whose value is fixed to $1, without the psychological and operational complexity of manually redeeming yields or using accumulated value to adjust to a non-USD peg.

Transfer Ease

Going back to the USDY vs. BENJI comparison, one RWA token is permissionlessly transferable across multiple chains (e.g. USDY on Ethereum, Solana, Sui, and Aptos), while the other has strict transfer restrictions (BENJI can only be transferred between approved parties on its mobile app). Imagine if stablecoins couldn’t flow freely across multiple blockchains, we’d hardly see the same usage we have today.

PRIME Evaluation Metrics

Now that we’ve explored the parameters of the PRIME evaluation metric, let’s see how it can actually be applied to evaluating RWA projects.

How to use PRIME evaluation indicators:

1. DYOR

The most important step is to first research the project and understand the importance of each PRIME evaluation indicator for that specific project.

2. Assign weights

Based on your research results, assign a percentage weight to each attribute. The sum of all weights should be 100%.

3. Give a rating

Based on your research results, give each attribute a rating on the PRIME evaluation indicator. Ratings range from 1 (very low) to 5 (very high). Mark the rating of each attribute in the corresponding column and include a note to keep track of your rationale.

4. Calculate the weighted score

Multiply the rating of each attribute by its assigned weight to obtain a weighted score. Add the weighted scores together to calculate the overall score for the project (maximum score is 5).

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Ftftx

Ftftx