Author: Stella L ([email protected]) , Data source: Footprint Analytics Public Chain Research page

In July, the cryptocurrency market was active and volatile, reflecting the overall trend of the global financial market. The listing of the Ethereum spot ETP in the United States, coupled with the high praise of Bitcoin by former US President Trump, shows the resilience and huge growth potential of the cryptocurrency industry. The market situation is complex and volatile. Bitcoin prices have gradually stabilized, while Solana has become one of the most outstanding currencies; at the same time, Ethereum has encountered a certain degree of downward pressure after the listing of the ETP. During this wave of volatility, the total market value of public chain cryptocurrencies has achieved a small increase, mainly driven by key projects such as Bitcoin and Solana. As competition in the Layer 2 field becomes increasingly fierce, the emergence of innovative projects and emerging forces is reshaping the competitive landscape of the industry.

The data in this report comes from the public chain research page of Footprint Analytics. This page provides an easy-to-use dashboard containing the most critical statistics and indicators for understanding the public chain field, and is updated in real time.

Crypto Market Overview

In July, volatility increased across financial markets. Large-cap tech and AI-related stocks, which led the gains in the first half of the year, underperformed. The crypto industry saw important developments, including the launch of spot Ethereum exchange-traded products (ETPs) and a positive endorsement of Bitcoin by former Republican presidential candidate and former President Trump.

Price performance in July showed a divergent trend. Bitcoin fluctuated during the month but ended July with small gains, as the impact of the German government's Bitcoin sales weakened at the end of the month (which ended on July 13) and Mt Gox's repayment distribution to its users had limited impact on the market. In addition to Bitcoin, Solana performed particularly well, gaining 25% during the month. In contrast, Ethereum's price fell after the launch of spot Ethereum ETPs in the US market. Although the launch of these ETPs supported Ethereum prices before, the subsequent selling pressure caused prices to fall.

Overview of Public Chains

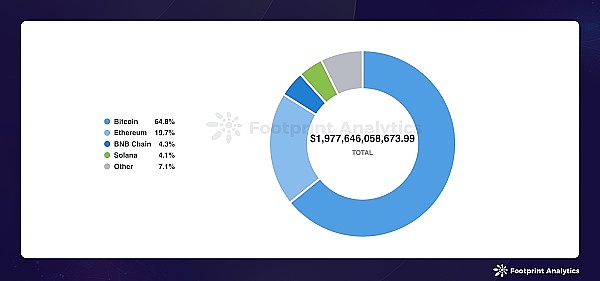

By the end of July, the total market value of public chain cryptocurrencies had risen by 1.2% from June to $1.98 trillion. The market leaders were Bitcoin, Ethereum, BNB Chain, and Solana, with market shares of 64.8%, 19.7%, 4.3%, and 4.1%, respectively. Bitcoin's share increased by 1.5% in absolute terms, Solana increased by 0.6%, and Ethereum decreased by 1.5%.

Data source: Market capitalization of public chain tokens in July 2024

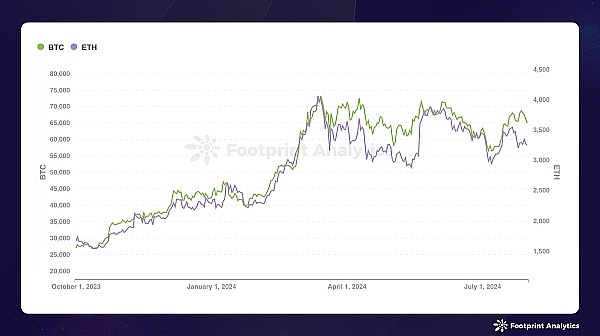

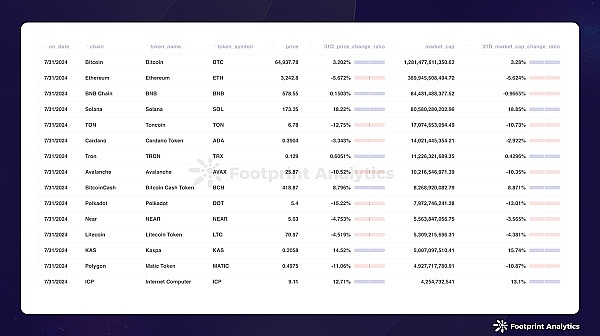

In July, the cryptocurrency market experienced significant fluctuations. Bitcoin started at $62,923 at the beginning of the month and closed at $64,938 at the end of the month, achieving a 3.2% increase. On July 5, Bitcoin hit a monthly low of $56,608, and on July 27 it reached a high of $68,806. Ethereum opened at $3,438 and fell to $3,243 at the end of the month, a drop of 5.7%. On July 7, Ethereum hit a monthly low of $2,939 and reached a high of $3,542 on July 21.

Data source: Bitcoin and Ethereum price trends

Solana's token price rose by 18.2% and its market value increased by 18.9%. The craze for meme coins continued, and on-chain activities were active. For example, several Neiro tokens surged after the owner of the Doge Memecoin-inspired token announced the adoption of a 10-year-old rescue Shiba Inu dog named Neiro.

Kaspa continued its strong performance, with the token KAS price rising by 14.5% and the market capitalization increasing by 15.7%. KAS hit a new all-time high of over $0.2 in July. The blockDAG (Block Directed Acyclic Graph) technology has received increasing attention, especially after Bitcoin miner Marathon Digital (MARA) announced last month that it would diversify its mining operations and expand to Kaspa.

Data source: Public chain token price and market value at the end of July 2024

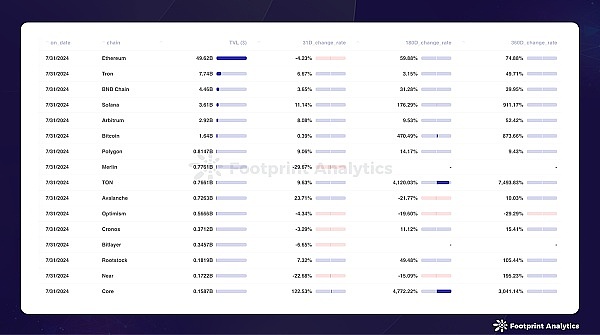

In terms of total locked value (TVL), the TVL of public chains reached US$76.5 billion at the end of July, which was basically the same as in June. Ethereum, TRON and BNB chains continue to lead in TVL.

TON has become the fifth largest chain by token market value, but there is still a lot of room for growth in its DeFi field. Its TVL ranks ninth among public chains at US$770 million. Two decentralized exchanges, STON.fi and DeDust, account for more than 60% of TVL.

The Core blockchain’s TVL grew by 122.5% throughout the month, thanks to the launch of the Dual Staking model, which rewards users who stake Bitcoin in Core for a long time, increasing their BTC staking rewards when they also stake CORE.

Data source: TVL of public chains at the end of July 2024

In a month of volatility and mixed price performance, Polymarket, a decentralized prediction market on Polygon, stood out. Polymarket allows users to build portfolios based on their predictions and receive returns if the predictions are correct. Using blockchain technology, Polymarket ensures that transactions on a wide range of topics such as current major events, politics and public health issues are transparent, secure and tamper-proof. The US election brought additional attention to Polymarket, and its TVL doubled in July.

Development of major Layer 1 public chains in July 2024

BNB Chain

On July 18, BNB Chain officially announced that it will hold the "Become a Champion Builder" hackathon in the third quarter of 2024, with a prize pool of more than $500,000.

The second Sunset fork plan of BNB Chain has been completed,

Solana

NEAR

Sui

Polygon

Move language developer Movement Labs joins Polygon's AggLayer.

Ronin

Sky Mavis released a review of the first half of 2024. In the past 6 months, more than 3 million users have downloaded the Ronin wallet, and RON's daily active addresses have soared to a record high of 1.5 million.

Ton

TON Foundation and Mocaverse, a subsidiary of Animoca Brands, have partnered to launch a $20 million ecological development plan.

Core

Core announced that Animoca Brands has launched a verification node on the chain to support Core's security and decentralization.

Core Foundation announces dual staking model to boost Bitcoin staking returns.

Layer 2

Ethereum Layer 2 experienced minor volatility in July as Ethereum prices retreated after the launch of spot Ethereum ETPs in the U.S. market. Arbitrum One, Optimism, and Base led in terms of TVL market share, holding 59.8%, 20.2%, and 8.27%, respectively, but all grew less than 5% month-over-month.

Blast’s TVL fell 14.3% and zkSync Era’s TVL fell 11.5% as on-chain activity declined following the end of the airdrop.

Scroll’s TVL grew 13.2%, driven by activity on Scroll Canvas, a platform for collecting and displaying achievements, statuses, and on-chain certificates in the Scroll ecosystem. Users can interact with various projects in the ecosystem to earn achievements in the form of “badges.”

Data source: Ethereum Layer 2 Overview in July 2024 - Rollups (Bridge Related Indicators)

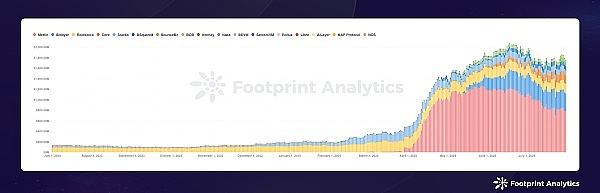

On the other hand, Bitcoin scaling solutions, including Layer 2 and side chains, continued to grow in July, although the total TVL was lower than the high point in June. Merlin, Bitlayer and Rootstock accounted for the largest TVL market share, at 44.0%, 19.6% and 10.3% respectively.

Solv Protocol became the largest DeFi protocol in the Bitcoin ecosystem at the end of July, with a TVL of $570 million, accounting for 32.3% of the total TVL of Bitcoin scaling solutions.

Data source: Bitcoin Ecological Public Chain TVL

The Layer 2 track is becoming more and more competitive. A new project called TON Applications Chain (TAC) is developing a Layer 2 solution for the TON blockchain ecosystem. Backed by The Open Platform, an investor focused on the TON blockchain, TAC will leverage Polygon’s Chain Development Kit (CDK).

Meanwhile, the first Move EVM Layer2 Movement blockchain launched its public testnet Parthenon, which officially launched on July 30. Movement’s MOVEDROP project allows the community to participate in the testnet-to-mainnet process.

Major Layer 2 Public Chain Developments in July 2024

Arbitrum

Optimism

Optimism announced the results of Retro Funding 4, and plans to provide 10 million OP rewards to 207 projects, of which Zora and Layer 3 received 500,000 OPs respectively.

Starknet

Base

Merlin Chain

Rootstock

Blockchain Games

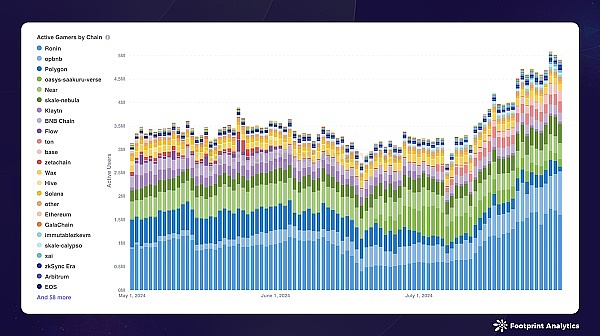

In July, a total of 1,588 games were active on major blockchain networks. BNB Chain, Polygon, and Ethereum dominated the market, accounting for 21.7%, 19.0%, and 15.1% of the market share, respectively.

Ronin, opBNB, and Saakuru Verse lead in on-chain DAU, with daily average DAUs of 1.1 million, 479,600, and 354,500, respectively. Their DAU market shares at the end of July were 32.6%, 18.7%, and 3.4%, respectively.

Data source: Daily active users of public blockchain games

Ronin’s DAU market share increased significantly from 18.6% on July 1 to 32.6% on July 31, thanks to the recovery of Pixels data and the launch of new games Lumiterra and Fight League. In addition, games on Ronin performed well in user retention and frequently appeared on the weekly new user retention rankings. For example, in the last week of July, five games ranked in the top ten for new user retention.

opBNB’s DAU share rose from 13.1% to 18.7% in July, thanks to the growing popularity of its games MEET48 and SERAPH: In The Darkness. In particular, SERAPH: In The Darkness, a dark fantasy ARPG game, has gained significant attention on opBNB since its launch in mid-July.

Oasys Layer 2 Saakuru Verse saw a sharp increase in DAU in the last 10 days of June, but growth slowed in July, with DAU market share falling from 14.1% at the beginning of the month to 3.4% at the end of the month. Despite this, Saakuru still maintained the third highest average DAU among all chains. Saakuru’s unique proxy model, where the chain operator (AAG) bears the transaction costs, enables users and developers to complete interactions without incurring gas fees, significantly lowering the entry barrier.

Base's DAU soared from 8.2K to 222.5K in one month, with an average DAU of 101.6K, mainly driven by the game BLOCKLORDS Dynasty.

For more trends in the blockchain game industry, read "July 2024 Blockchain Game Research Report: Challenges and Opportunities of Market Volatility and Data Differentiation".

Financing

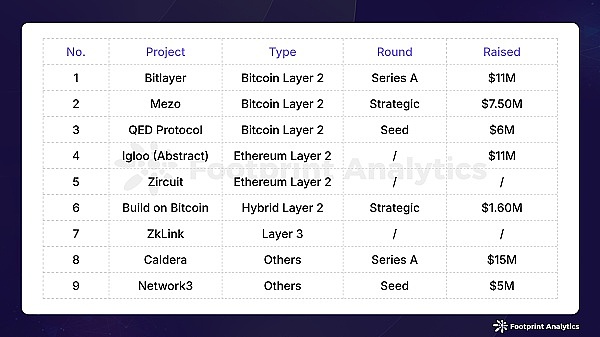

In July, the public chain industry recorded 9 rounds of financing events, totaling US$570 million, a 20.1% decrease from June. Two of the events did not disclose the amount, and no Layer 1 announced a new financing round.

Public chain financing events in July 2024 (data source: crypto-fundraising.info)

Pudgy Penguins' parent company Igloo raised $11 million in a financing round led by Peter Thiel's Founders Fund. Igloo has newly established Cube Labs to develop Abstract, a consumer-oriented Layer 2 blockchain built on Matter Labs' ZK Stack and EigenLayer's EigenDA. This new blockchain aims to make decentralized application development easier, cheaper, and more secure.

As the number of Layer 2 solutions continues to grow, the infrastructure that supports these Layer 2s is becoming a good business. In July, Ethereum Rollup deployment platform Caldera and Web3 AI infrastructure developer Network3 received new financing.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Beincrypto

Beincrypto Beincrypto

Beincrypto Nulltx

Nulltx Nulltx

Nulltx Cointelegraph

Cointelegraph