Author: Lim Yu Qian; Source: Coingecko; Compiler: Felix, PANews

Recently, Coingecko released a research report on US crypto enforcement actions. The study is based on official announcements from January 1, 2019 to October 9, 2024, and studies the monetary value settlements reached between crypto companies and US regulators in federal and state court cases, but does not include charges against individuals. The following are the details of the report.

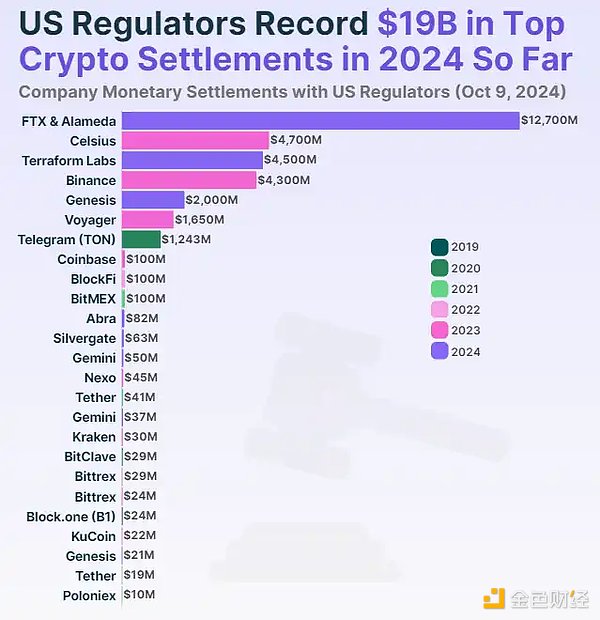

The total settlement amount is nearly US$32 billion, with FTX and Alameda accounting for nearly 40%

The most important crypto enforcement action carried out by US regulators is against the bankrupt crypto exchange FTX and its affiliated trading company Alameda, which together paid the largest settlement fee to date, US$12.7 billion. The FTX and Alameda lawsuit was led by the Commodity Futures Trading Commission (CFTC), and the settlement was announced in August 2024, less than two years after FTX collapsed. While the ruling does not include the CFTC's lawsuit against individual company executives, the $12.7 billion settlement will be used to repay FTX customers and creditors (about $11.2 billion).

The second largest crypto enforcement action by U.S. regulators was against bankrupt crypto lender Celsius ($4.7 billion), former industry leader Terraform Labs ($4.5 billion), and crypto exchange Binance ($4.3 billion). It is worth noting that the collapse of Celsius and Terraform Labs in mid-2022 was a key event marking the crypto market's bull-to-bear transition, which ultimately led to FTX's decline and triggered a new round of regulatory scrutiny in the United States.

Binance's settlement is a milestone victory for U.S. regulators. Although it ranks only fourth in terms of settlement amount, it is the only operating crypto company to pay a multi-billion dollar settlement so far. The world's leading crypto exchange agreed to plead guilty in November 2023 to resolve lawsuits with multiple U.S. regulators, including the Department of Justice (DOJ), the Treasury Department, and the Commodity Futures Trading Commission (CFTC).

U.S. regulators have currently taken 25 crypto enforcement actions, and each settlement amount exceeds $10 million. Overall, the highest settlement amount for crypto companies by U.S. regulators has accumulated to $31.92 billion.

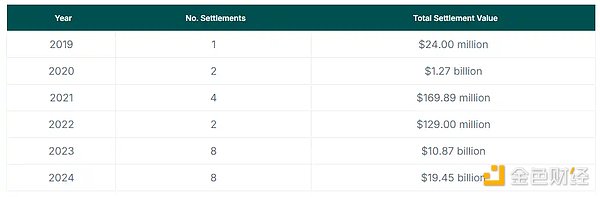

Enforcement actions surged in the past two years, with settlements exceeding $19.4 billion this year alone

Of the 25 major crypto enforcement actions in the United States, 16 were settled in the past two years, reflecting increased regulatory scrutiny since the FTX crash in late 2022. Specifically, U.S. regulators settled eight lawsuits in 2023 for a total of $10.87 billion, a record high, and an increase of 8,327.1% in settlements compared to the previous year.

Subsequently, U.S. regulators have reached another eight settlements in 2024, worth $19.45 billion, accounting for almost two-thirds of the total settlement amount. Even with only a few months left in this year, the settlement amount in 2024 has already increased by 78.9% compared to 2023. Given that U.S. regulators show no signs of slowing down their scrutiny of the crypto industry, 2024 could see more lawsuit settlements than last year.

Between 2019 and 2022, U.S. regulators won eight crypto lawsuit settlements. At the end of 2019, U.S. regulators reached the first major cryptocurrency lawsuit settlement with Block.one (now renamed B1), the company behind EOS. The U.S. Securities and Exchange Commission (SEC) reached a $24 million settlement with Block.one.

The SEC won two more major crypto lawsuits in 2020, with ICO issuer BitClave reaching a $29.34 million settlement in May and Telegram reaching a $1.24 billion settlement over the issuance of Gram tokens under its subsidiary TON Issuer. The $1.24 billion Telegram settlement includes $1.22 billion in disgorgement and a $18.5 million civil penalty.

During the 2021 bull run, U.S. regulators successfully brought three crypto enforcement actions against well-known industry players. Stablecoin issuer Tether reached an $18.5 million settlement with the New York Attorney General (NY AG) in February, followed by a $41 million settlement with the CFTC in October, claiming that USDT is fully backed by U.S. dollar assets. The CFTC also settled with Tether's parent company Bitfinex for a lower fine of $1.5 million for illegal trading. Meanwhile, crypto exchanges Poloniex and BitMEX settled in August for $10.39 million and $100 million, respectively.

In 2022, cryptocurrency lender BlockFi reached a $100 million settlement with the U.S. SEC and the North American Securities Administrators Association (NASAA), while cryptocurrency exchange Bittrex reached a $29 million settlement with the Treasury Department.

Anais

Anais