This article is only a technical analysis and does not constitute any investment advice, please read with caution.

Coins generally refer to chain-native Tokens or homogeneous Tokens similar to the ERC20 protocol, common ones such as BTC, ETH, USDT, etc.

The picture refers to non-fungible tokens (NFT) that comply with the ERC721 protocol, such as CryptoPunks, Boring Ape, mfers, etc., domestic digital collection platforms (such as 3D model assets released by Whale Explorer are also considered drawings.

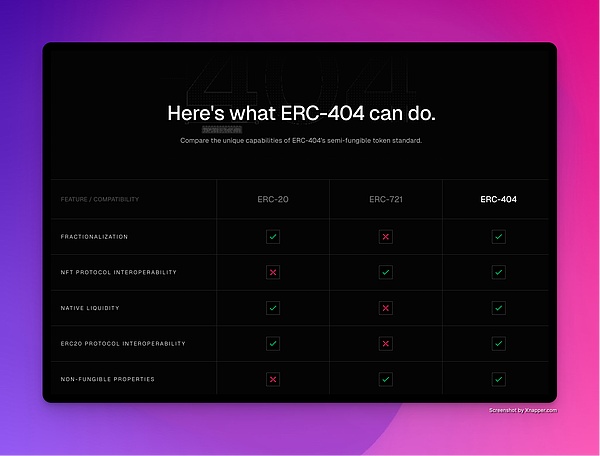

Token and NFT have their own limitations. For example, Token has relatively strong liquidity, but it has no hype value, while NFT has rarity and uniqueness. But liquidity is often very poor, and most of them are blue-chip projects or concentrated at floor prices.

< p style="text-align: left;">Token duality refers to the specification of mixing Token and NFT in some way.

Let’s take Ethereum as an example, a project that supports the duality of tokens. It should be both homogeneous and non-homogeneous. It can be both Enjoy the high liquidity brought by Token, and achieve rarity and uniqueness, with hype value.

But does such a thing really exist? The price of NFT is linked to its rarity. Why can it be homogeneous?

During the Spring Festival in 2024, a project called ERC404 The experimental protocol and its first project, Pandora, quickly took off.

Buy 1 Pandora Token, You will automatically get 1 Pandora NFT

If the balance is less than 1 Pandora Token, your NFT will be automatically destroyed

Buy 1 Pandora NFT, and your wallet will automatically have 1 more Token. Similarly, if you sell it, it will automatically decrease

Use a picture to express the current mixed logic of ERC404:

ERC404 Game Rules

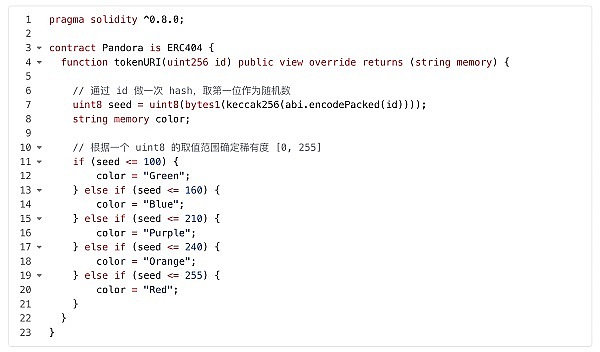

The following are the current 5 types of Pandora's Box, which have different rarities. Implemented according to Contract(https://etherscan.io/address/0x9e9fbde7c7a83c43913bddc8779158f1368f0413#code#F1#L43)We can calculate the probability:

< img src="https://img.jinse.cn/7190886_image3.png" alt="aSZL0E4riUnI5T6xNWzcTUXbTHDmdfjezzTvKwMu.png">

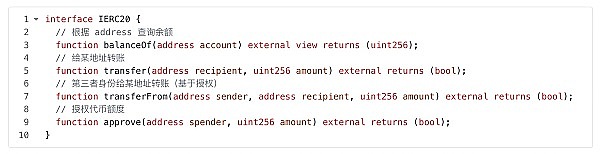

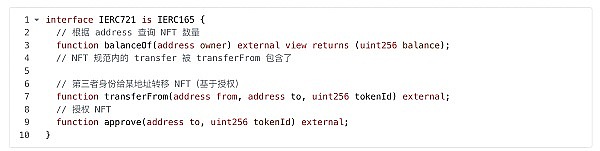

Implementing an ERC404

The first version of ERC404 code was not well written, or it was very unsatisfactory. But it solves one of the main problems - how to implement the ERC20 and ERC721 interfaces at the same time in one contract.

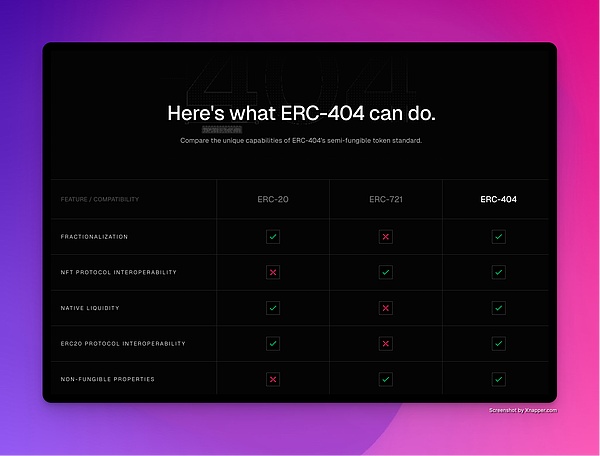

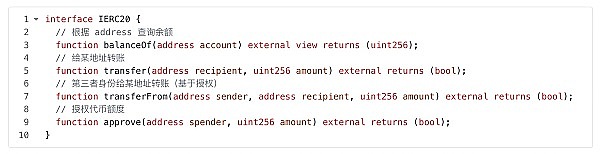

Comparison of three protocols

We define the two interfaces differently Relevant partial shielding, compare which interfaces are crossed or conflicting:

It can be found that the four conflicting interfaces are all related to transfers. The semantics of the last parameter in ERC20 is amount, which is the amount of the token, and The semantics of the parameter in ERC721 is tokenId, which represents the number of the NFT.

In the contract implementation of ERC404, the semantics of this parameter are modified to amountOrId. The method to distinguish when it is amount and when it is tokenId is also very simple: according to the value the size of.

Similar to 1 BTC = 10^9 Sats, in the ERC404 world, the actual corresponding value of 1 Token we are talking about is 10^18, and the tokenId of NFT is generally It is an auto-increasing integer starting from 1, so although amount and tokenId are both integers, their actual magnitudes are much different.

For example, the Pandora contract records how many nfts have been mint (currently 68180). When the value of amountOrId is less than or equal to it, it is considered tokenId, otherwise it is considered tokenId. It’s amount.

Is this logic useful? it works. Is it reasonable?

In addition, when Transfer >= 1 Token, the logic of NFT is not transfer, but the destruction of the original account and the casting of a new account. The advantage of this operation is that it matches liquidity and is simple to implement (think about the situation when the transfer token is less than 1), but it brings exaggerated GAS consumption.

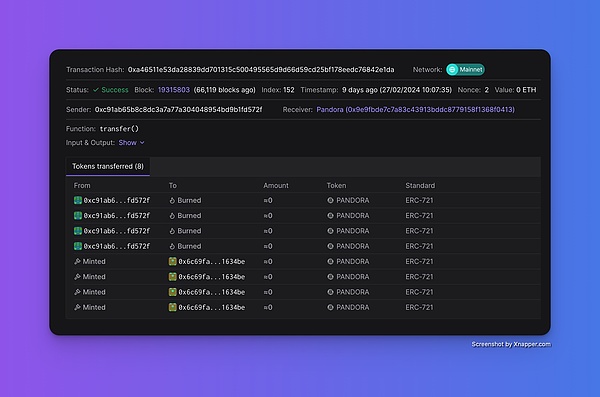

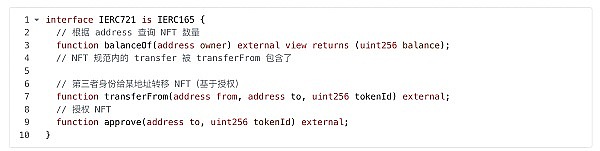

ReferenceThis deal(https://dashboard.tenderly.co/tx/mainnet/0xa46511e53da28839dd701315c500495565d9d66d59cd25bf178eedc76 842e1da),

The transfer of 4 Tokens also resulted in the destruction of 4 NFTs and the casting of 4 NFTs:

The transaction consumed $64 of GAS

New narrative and new opportunities

ERC404’s gameplay brings Several implicit rules:

The price of Token in DEX and the price of NFT in Marketplace The price won't differ much.

NFT is minted in only one situation: 1 Token is collected. In other words, the only way to replace low-rarity NFTs with high-rarity NFTs is to keep trading Tokens.

The total supply of Pandora Token is 10,000, which means the maximum number of NFTs is 1w, and it will increase with the number of holders. decreases as the number increases (the more holders there are, the more common the situation will be less than 1 Token).

If I master the magic of stably casting "Red Pandora's Box", buy Token on the exchange, and then use NFT If the market sells it at a high price, is it possible to make unlimited arbitrage?

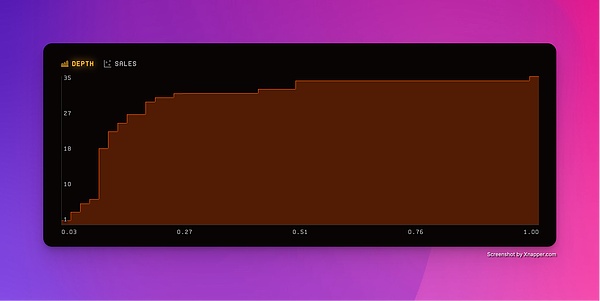

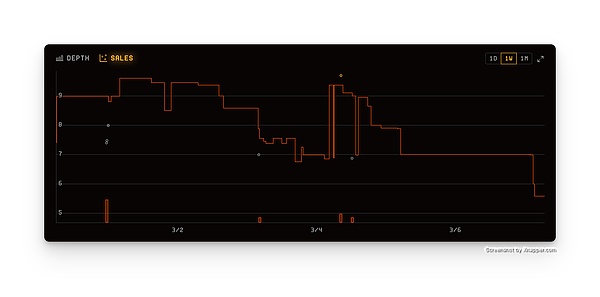

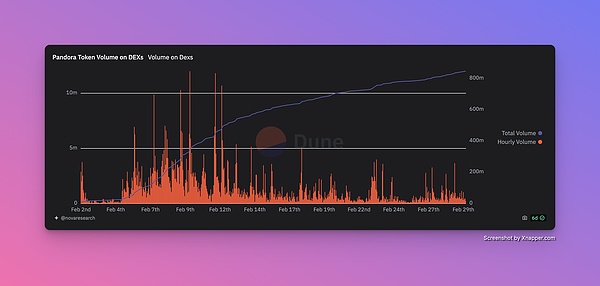

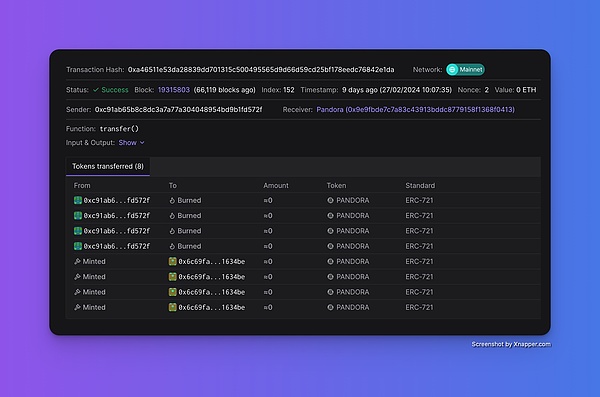

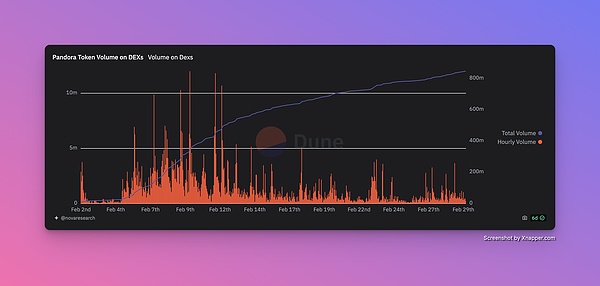

Let’s first look at the price of Pandora. These data provide the theoretical basis for arbitrage:

< img src="https://img.jinse.cn/7190891_image3.png" alt="1709800270244-1afa89c6-2e94-4dcc-acd3-43d56a4400c7.png">

4.7E Buy Token

NFT’s floor price in the past week has been greater than 5E

The above data does not filter the rarity of NFT. In this case, the profit minus wear and tear is around 0.2E. Referring to the invisible rules above, if we can mint the red Pandora with high rarity, will the profit margin be greater?

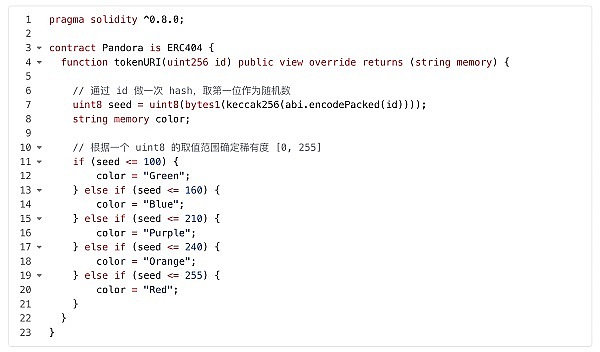

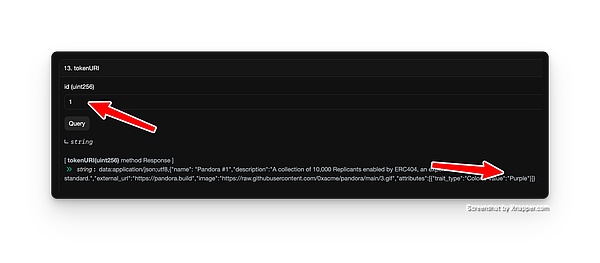

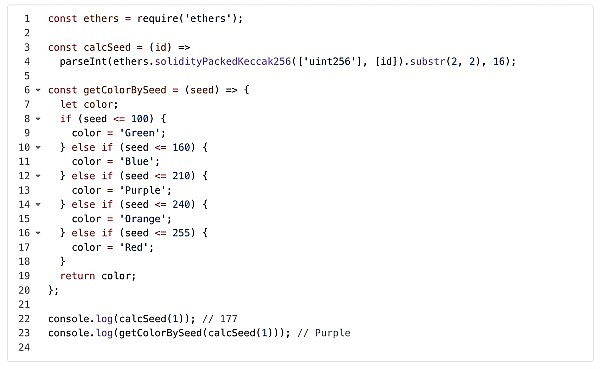

Let’s take a look at Pandora’s contract and see how the “random generation” described by many KOLs is implemented:

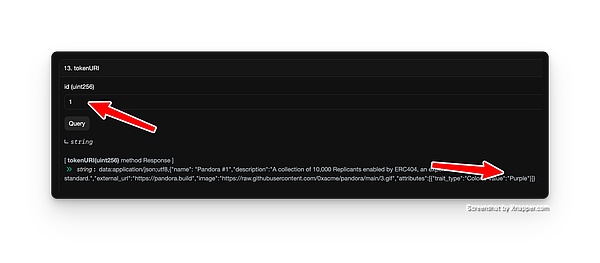

It can be obtained by reading the contract. The rarity of Pandora Box is pseudo-random. Similar to the CryptoFish project we implemented before, the tokenId is self-increasing, so the rarity of the NFT coming out of the next mint is completely predictable.

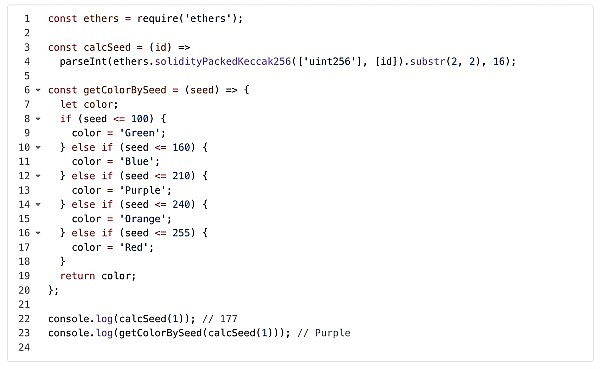

We can make pure local guesses through a JavaScript script, and it has been verified that this logic is completely correct:

The current minted self-increase value of Pandora is 68180, which means that we speculate that among the next 100 NFTs, the ID that hits the red rarity will be:

68186/68201/68213 /68227/68228/68257/68259/68262

If you do not consider the reduced liquidity of the current Pandora project, this will be a very hot financial behavior.

Summary

ERC404 and Pandora are not the first protocol projects to explore NFT liquidity , NFT fragmentation has been discussed a long time ago, including ERC1155, which is also an innovation in NFT.

But why is everyone so excited about ERC404 this time? I think it is - Good name.

Unfortunately, the implementation of the first version of the ERC404 contract is very poor, so the official is also actively promoting the V2 version< /span>(https://github.com/Pandora-Labs- Org/erc404), the community also has third-party implementations of DN404(https://github.com/Vectorized/dn404), and even a new protocol called ERC911, with the naming attribute full.

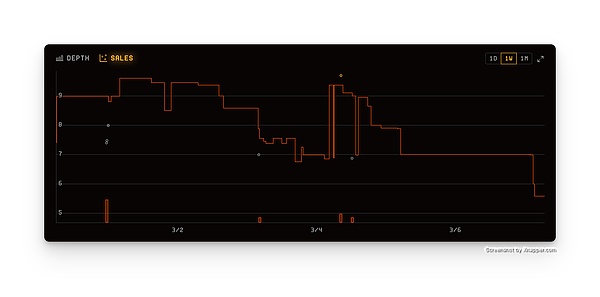

Liquidity reached its peak during the Chinese New Year and is now falling back significantly

The story of Pandora V1 may soon come to an end. The current version has countless flaws that are enough to defeat it, and liquidity and Holders have also dropped significantly. However, more and more projects are currently trying the ERC404 model, and there are 25 of them counted on CoinMarketCap.

I believe there will be more solutions to NFT liquidity problems in the future, and ERC404 can truly bring about the next NFT summer.

JinseFinance

JinseFinance