After ten years of arduous approval of BTC ETF, the road to approval finally ushered in the dawn of victory. At 4 a.m. on January 11, 2024, the U.S. Securities and Exchange Commission (SEC) simultaneously passed 11 spot BTC ETFs, including: Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, Invesco, Ark, VanEck, WisdomTree, Fidelity and Franklin.

All of this should be attributed to Grayscale’s victory. A U.S. federal court ruling on August 29, 2023 gave Grayscale victory in its lawsuit against the SEC’s refusal to apply for a spot BTC ETF. The move accelerates applications for BTC ETFs from traditional financial giants such as Blackrock and Fidelity over the past few months.

This article will look at the change in the SEC's attitude after Grayscale won the case (actively identifying market manipulation risks) from the perspective of legal supervision, and then through the logic of BTC ETF, and Subsequently, the SEC still considered other crypto assets to be securities, suggesting a cautious stance on market risks.

1. The court referee asked the SEC to take the initiative to speed up the approval process

SEC’s previous reason for not approving BTC ETF was concerns about market fraud and manipulation. All rejected ETF applications cited the securities law's rationale that "the products were not designed to prevent fraudulent and manipulative acts and practices."

SEC allowed the trading of futures BTC ETF for the first time in 2021 and stated that futures products are more difficult to manipulate because the market is based on the Chicago Mercantile Exchange (CME) ) futures prices, while the Chicago Mercantile Exchange is regulated by the U.S. Commodity Futures Trading Commission (CFTC).

In the case, Grayscale said: The logic of approval of futures BTC ETF should be equal to the logic of approval of spot BTC ETF, otherwise all applications for futures BTC ETF should be revoked . The judge agreed, finding that the SEC's rejection of Grayscale's application was acting arbitrarily and capriciously because the SEC failed to explain how it treated similar ETF products differently. The court held that this disparate administrative action violated administrative law, granted Grayscale's request, and reversed the SEC's denial of the application.

It was not until the Grayscale case that the SEC's attitude completely changed, from passive disapproval to active review, and stated in the 22-page approval document: This order approves the Proposals on an accelerated basis.

2. What does the SEC tell us about the risks of BTC ETF?

ETF itself, as a long-standing compliant financial product, has no legal obstacles. BTC is also the only one defined by US regulations (especially SEC) as " "Non-Securities" assets. So what are the risks with BTC ETFs?

In the 22-page approval document, the SEC told us:The risk comes from the uncontrollability of the underlying asset trading market of the ETF - that is, the risk of manipulation in the BTC spot market .

Although each ETF has signed a Surveillance Sharing Agreement (Surveillance Sharing Agreement) with a compliance regulatory exchange (such as CME) to monitor the BTC futures market Risk, but BTC spot itself is not traded on CME, and monitoring cannot cover the BTC spot market.

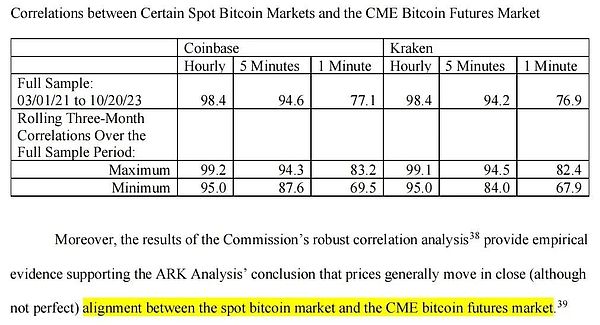

BTC futures are already compliant products on CME. Therefore, proving the price correlation between BTC spot and BTC futures in CME is the best option. As a result, the SEC compared the correlation between the price of BTC and the futures price of CME futures on two crypto exchanges, Coinbase and Kraken, starting in 2021. The two were found to be highly correlated. This means that if fraud or manipulation occurs in the BTC spot market, these behaviors are likely to also affect the futures market and be detected by CME's monitoring system, so that supervision can enter to control risks.

3. Market manipulation in the BTC spot market

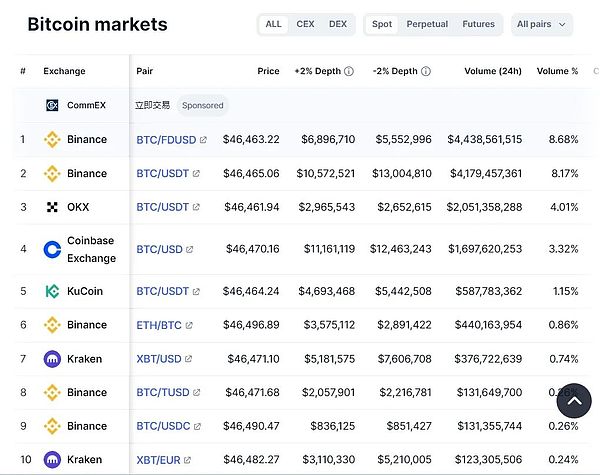

BTC The market manipulation risk in the spot market mainly comes from the transactions of market makers or market participants on CEX. If US supervision can cover the supervision of CEX, then the risk can be relatively controlled.

In this regard, the US regulatory approach is to cover the two crypto exchanges Coinbase and Kraken through implementation of regulatory compliance, and at the same time "fixed-point blasting" of the trading volume The largest Binance, with smooth entry and compliance control.

4. Neutral SEC and Cautious Gary Gensler

Thus, the neutral SEC filed a The rules will be evaluated for compliance with the Securities Exchange Act and its provisions, including whether they are designed to protect investors and the public interest. At 4 a.m. on January 11, 2024, the SEC simultaneously approved 11 spot BTC ETFs, including: Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, Invesco, Ark, VanEck, WisdomTree, Fidelity and Franklin.

(https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023)

More importantly, the SEC Statement in the press release:

"This SEC's ETF approval is limited to ETFs that hold a "non-security" commodity (BTC) (holding one non-security commodity, bitcoin). It should in no way indicate that the SEC is willing to approve listing standards for any other crypto asset securities (Crypto Asset Securities). The approval also does not indicate that the SEC is willing to approve listing standards for other crypto assets under the securities laws. the status of the asset or the perception of the status quo that certain cryptoasset market participants do not comply with securities laws.

As I have said in the past, the vast majority of cryptoassets are investment contracts and are therefore subject to securities laws.

Although the SEC is neutral, I would note that the underlying assets in precious metals ETFs have consumer and industrial Uses, by contrast, BTC is primarily a speculative, volatile asset that is also used in numerous illicit activities, including ransomware, money laundering, sanctions evasion, and terrorist financing.

While the SEC approved the listing and trading of the spot BTC ETF today, we have not approved or endorsed BTC. Investors should remain cautious about BTC and crypto-asset-related products."

< p style="text-align: left;">

5. Pressure on Coinabse - Characterizing crypto assetsGary Gensler The speech was very clear: BTC is not a security, and market risks can be controlled and approved. Other crypto assets are securities, which is another story and has nothing to do with whether the BTC ETF is approved or not.

This still goes back to Gary Gensler, who has so far avoided answering the question "What crypto-assets are securities" head-on. This is an issue of the SEC’s regulatory compliance with the three largest exchanges, Kraken, Coinbase, and Binance. It is also a political game issue that the SEC requires the U.S. judicial and legislative bodies to respond to.

Coinbase has always been a leader in fighting the SEC, and it is incumbent upon us to shoulder this burden. Judge Katherine Polk Failla previously directly called ETH a commodity (Crypto Commodities) in the Uniswap case. Considering that the judge is also hearing the SEC v. Coinbase case, her response to whether crypto assets are “securities”: “This situation is not decided by the court, but by Congress”, throwing this ultimate question to the United States. Legislative body - Congress.

However, the legislative process in this Congress will be very long, and the 2024 election year will be worth looking forward to.

6. GM BTC ETF

No matter how the SEC puts on a show , the adoption of BTC ETF is of great historical significance, allowing those of us with cryptopunk ideals/fantasies of getting rich overnight to be part of it, adding a strong and colorful color to the rolling torrent of history.

As Wang Chuan said: "The significance of January 10, 2024 in the history of world currency, looking back in the future, may be the same as that of August 1971." On the 13th (Nixon announced the separation from gold), January 18, 1871 (Germany was unified and led European countries and the United States to join the gold standard system within a few years)."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine JinseFinance

JinseFinance Alex

Alex Huang Bo

Huang Bo JinseFinance

JinseFinance