Author: Crypto Research Source: cryptoresearch.report Translation: Shan Ouba, Golden Finance

Understanding the true cost of trading Bitcoin in a fragmented and often opportunistic market can be complicated. This article explores why prices vary widely across different cryptocurrency markets, including centralized exchanges (CEXs), liquidity providers (LPs), and decentralized exchanges (DEXs). It addresses the lack of an official composite best bid and ask (BBO) for crypto assets, and how some market participants prioritize profit over best execution.

How much does it cost to trade Bitcoin and other crypto assets? This question sounds simple, but unfortunately, it is not, with the vast majority of current markets ignoring other participants and often trading at prices higher or lower than those displayed by other markets. There are several reasons for this phenomenon:

A clear lack of data - there is no "official" composite best bid and ask (BBO) for crypto assets.

Market fragmentation - there are many markets, including centralized exchanges (CEXs), liquidity providers (LPs), and decentralized exchanges (DEXs), with conflicting price oracles.

left;">Opportunism – Many market makers ignore their “best execution” responsibilities to their clients in favor of maximizing profits and reducing costs from payment for order flow (PFOF) arrangements.

Our goal at CoinRoutes, in addition to helping investors navigate this market to achieve best execution, is to provide data to help investors and trading firms understand the market. Despite the fragmentation, we can provide context to understand transaction costs in a way that traditional institutional traders can digest. To do this, we have developed a consistent metric called the CoinRoutes Liquidity Index. However, to understand why we constructed this index, it is useful to look at some raw data showing transaction costs on major centralized cryptocurrency exchanges.

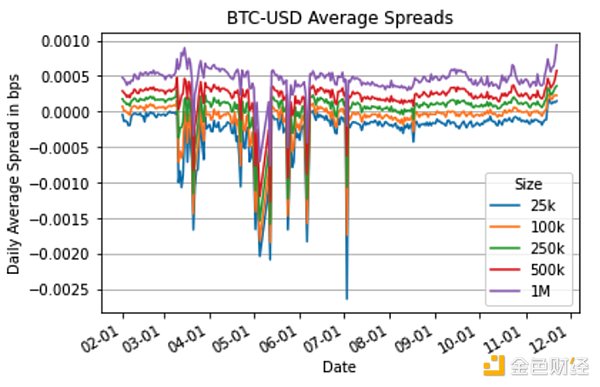

The chart below shows the cost of buying and selling $25,000, $100,000, $250,000, $500,000, and $1,000,000 in USD between February and November 2023. Cost of Bitcoin in USD:

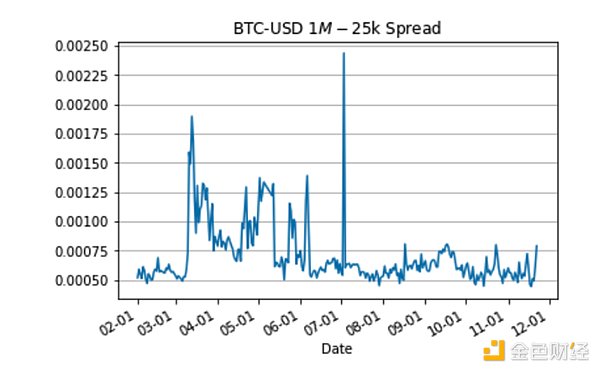

From this chart, you can see that there is a small persistent negative cost for the $25,000 order that became very large during certain periods earlier this year. The persistent negative cost is caused by price differences between exchanges where the bid price on one exchange tends to be higher than the offer price. Traditional financial markets refer to these as “cross-markets” which are very rare in most asset classes but almost always present in digital assets. But it is worth noting that most of the time these differences are lower than the cost of moving assets between exchanges and arbitrage the difference. However, there tend to be meaningful differences during periods of high volatility. This price difference can create a distorted view of potential transaction costs. Therefore, we created the CoinRoutes Liquidity Index to standardize the data and provide traders with a consistent and fair benchmark for understanding liquidity costs. To calculate the CoinRoutes Liquidity Index, we measured the difference in cost between a $25K order and a $1M order based on the best “smart routing” of buys and sells for each size. This is calculated “by the book” because CoinRoutes keeps the full order book of all major exchanges in memory. The calculation uses that order book to add up the cost of selling from all bids (ordered from highest to lowest to achieve a $1M sale), and the cost of buying from all bids (ordered from lowest to highest to achieve a $1M buy). We then calculate a time-weighted average of 5-second samples per day. It’s important to note that this benchmark assumes optimal order routing, which means it assumes all exchanges are always available for trading and have sufficient inventory of USD, stablecoins, or tokens. In reality, this requires advanced routing technology and superior financial management. As such, this is a difficult benchmark for most institutions to replicate without investing in infrastructure or paying providers. However, it is an accurate and fair way to measure liquidity costs before markups or fees that most liquidity providers may charge. CoinRoutes Liquidity Index Results: CoinRoutes calculated the index for Bitcoin and Ethereum denominated in USD, USDT (Tether), and perpetual swaps also denominated in USD and USDT from February to the end of November 2023. There are several important conclusions: 1) If institutions have access to all markets, then the cost of trading Bitcoin and Ethereum at an institutional scale is quite competitive with global stocks of similar market capitalization. (Retail investors in Bitcoin and Ethereum pay much higher fees, which is very different from the stock market, where such traders pay extremely small spreads and are often charged no fees)

2) USD spot trading is more expensive than USDT (Tether) spot trading. Although this trend has moderated over the year, it is still statistically significant.

For Bitcoin, the USD cost of $1 million of liquidity averaged between 5 and 7.5 basis points last quarter, while the USDT cost of $1 million of liquidity averaged between 3.5 and 5.5 basis points, with greater volatility.

For Ethereum, the USD cost of $1 million of liquidity averaged between 5 and 9 basis points last quarter, while the USDT cost of $1 million of liquidity averaged between 4 and 8 basis points.

3) Perpetual contracts have more liquidity and lower transaction costs than spot. This is not surprising, as the swap market reports significantly larger volumes than spot, but the order book data also supports this. This also explains why OTC trading is so popular in the spot market, as market makers are able to hedge in the perpetual swap market to create smaller spreads.

For Bitcoin, the cost of a perpetual swap for $1 million in liquidity averages 3.5 to 7 basis points for a swap denominated in USD and 1 to 2.5 basis points for a swap denominated in USDT.

For Ethereum, the cost of a perpetual swap for $1 million in liquidity averages 4 to 8 basis points for a swap denominated in USD and 2 to 3.5 basis points for a swap denominated in USDT.

The first chart shows the liquidity costs of buying and selling $1m of Bitcoin in USD on major cryptocurrency exchanges. Note that there were spikes during the spring and early summer, mostly on weekends, when banking issues made it difficult to move funds across exchanges, but the average has stabilized between 5 and 7.5 basis points. Since this measures per-item costs, it means that the average bid/ask spread for USD-based liquidity is between 10 and 15 basis points, which is similar to the average spreads anecdotal evidence suggests for institutional-scale players.

In summary, navigating the fragmented cryptocurrency markets to achieve best execution is fraught with challenges, from differing prices between exchanges to opportunistic behavior by market participants. This article highlights the complexities and persistent price differences that can distort trading costs.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance fx168news

fx168news