Investors to Own Tokenized Shares of New Hilton Hotel in El Salvador

Investors can buy tokenized shares of a new Hilton hotel in El Salvador on the Bitcoin Liquid Network, marking a milestone in the country's capital markets.

Weiliang

Weiliang

Reporter: Li Xiaojie; Source: Sanlian Weekly

On October 21 this year, Yadi Zhang (transliteration, real name Qian Zhimin), the core figure in the world's largest Bitcoin money laundering case, appeared in London Southwark Criminal Court via video. During the trial, she denied all charges such as illegal possession and transfer of cryptocurrency. Her formal criminal trial is scheduled to September 29, 2025.

One day later, on October 22, the British Crown Prosecution Service (CPS) issued a "Notice to Victims of the Blue Sky Green Fraud Case", which stated that "the Director of Public Prosecutions (DPP) has initiated civil recovery procedures to recover the property and other assets seized in the UK from Yadi Zhang (also known as Zhimin Qian) and Jian Wen (Wen Jian).

Lawyer Ding Jie of Duan He Duan Law Firm is one of the lawyers representing the case. He participated in the trial against Qian Zhimin in the UK. He told this magazine that this notice indicates that domestic victims of Blue Sky Green investment can hire legal advisers and submit formal written applications to the British High Court. "After resolving the issues under the British legal project of the case, cooperation between the British and Chinese officials may be launched."

Around September this year, this magazine's reporters met some investors in the Blue Sky Green case in Beijing, Hebei and Suzhou. Most of them were between 50 and 75 years old, and the investment amount ranged from hundreds of thousands to tens of millions. It was not until Qian Zhimin disappeared that they realized they knew almost nothing about this former "female god of wealth". How old was she? Where did she come from? Did she have a family? Even what was her real name? There was no definite answer. Until she reappeared in the world's largest Bitcoin money laundering case.

At the end of March this year, Yantai fruit farmer Tang Yi saw several videos on domestic social software. The videos had similar language, with large bold fonts saying "The UK seized 61,000 Bitcoins! A financial Ponzi scheme in China was exposed. The boss behind the scenes swindled 43 billion from China and fled to the UK". "A British-Chinese deliveryman helped British Qian Zhimin launder money. Can the huge sum of money be recovered?"...

"Qian Zhimin", Tang Yi hadn't seen this name for several years. He was a little dazed for a while, but soon realized that this was a case related to himself and more than 100,000 Blue Sky Green investors - if the information in these videos is true.

Blue Sky Green's full name is "Tianjin Blue Sky Green Electronic Technology Co., Ltd.", which was established in March 2014. The company has launched 10 financial products across the country, with content related to Bitcoin and smart pension. Each financial product is priced between 30,000 and 60,000 yuan, with a contract period of 12 to 30 months. It is promised that during each contract period, except for weekends and holidays, the investor's account will receive a dividend of about 160 yuan every day, with only profit and no loss. In this way, after the contract expires, the investor can get about 3 times the principal, and the interest is much higher than banks, commercial insurance and other financial management methods. In July 2017, Blue Sky Green was sealed by Tianjin police for suspected illegal absorption of public deposits. Half a year later, the Hedong Branch of the Tianjin Municipal Public Security Bureau issued a notice stating that in more than three years, Lantian Green has attracted about 130,000 investors, involving 31 provinces, cities, and autonomous regions, and the amount involved exceeds 43 billion yuan.

Tang Yi has seen this notice, and he is one of the 130,000 investors. In 2021, he also saw a verdict. The Hedong District People's Court of Tianjin sentenced Lantian Green's legal person Ren Jiangtao to 10 years in prison and arrested more than 20 other company personnel. But the actual controller of the company, a woman nicknamed "Huahua", was dealt with separately. It was also in this verdict that he first saw that Huahua's original name was "Qian Zhimin".

Seeing Qian Zhimin's name again a few years later, Tang Yi had mixed feelings. In 2015, he invested nearly 600,000 yuan. After deducting the dividends, he lost more than 400,000 yuan. Over the years, he has been working as a fruit farmer to pay off his debts. He has never invested in any projects again, and no longer easily believes outsiders or information on the Internet.

But since April, there have been more and more reports on money laundering cases, saying that this is the largest Bitcoin money laundering case in the UK and even in the world. Most of the information in the articles comes from the continuous reports of the British media Financial Times and the trial documents of the British court: In September 2017, Qian Zhimin entered the UK under the alias Zhang Yadi with a passport from the Federation of St. Kitts and Nevis. Wen Jian (transliteration), a Chinese woman in the UK, became her translator and assistant in September. In the following years, she assisted Zhang Yadi in using Bitcoin to launder money. What made Tang Yi even more excited was that an article directly pointed out that Zhang Yadi, who was arrested, was the actual controller of Tianjin Lantian Ge Rui in China, and owned 61,000 Bitcoins (converted into RMB in April, it was close to 40 billion yuan).

Left: Qian Zhimin borrowed another identity "Zhang Yadi" (transliteration) passport to enter the UK. This is the photo on Zhang Yadi's passport. Right: Qian Zhimin's assistant, housekeeper and translator Wen Jian (transliteration) in the UK

Left: Qian Zhimin borrowed another identity "Zhang Yadi" (transliteration) passport to enter the UK. This is the photo on Zhang Yadi's passport. Right: Qian Zhimin's assistant, housekeeper and translator Wen Jian (transliteration) in the UK

Not only Tang Yi, this world's largest Bitcoin money laundering case has set off more waves among the more than 100,000 domestic investors of Blue Sky Green. Around September this year, I met some Blue Sky Green investors in Beijing, Hebei and Suzhou. They were aged between 50 and 75, and the investment amount ranged from hundreds of thousands to tens of millions of yuan. They are wholesalers, retired teachers, bank employees, and retired people from the public security, procuratorial and judicial systems. They are generally well educated and have active minds. After entering middle age, I have some savings on hand, but I don't want to put them in the bank to earn interest. I was recommended by my colleagues, relatives, friends, leaders and others to invest in Lantian Green. In the interview, in addition to telling about my own investment experience of losing all my money, most people also asked me the same question: Are Huahua (Qian Zhimin) and Zhang Yadi the same person?

Some people believe that Zhang Yadi, who was arrested in the UK, is the "Huahua", "Hua Jie" and "Hua Zong" of Lantian Green. This is mainly because she holds a large amount of Bitcoin, which is one of the core businesses of Lantian Green, and she arrived in the UK just two months after Lantian Green was closed down. In addition, Wen Jian, who assisted Zhang Yadi in the UK, said in the trial that Zhang Yadi had a leg disability, was bedridden all year round, rarely went out, and usually spent time on computer games and Bitcoin transactions, and woke up at night because of nightmares. And Huahua of Lantian Green had a car accident in the summer of 2016, injured her knee, and has since traveled in a wheelchair. These characteristics basically meet.

There are also some people who firmly believe that Zhang Yadi is not Huahua. They said Huahua was extremely smart, a math genius, and a double-degree Ph.D. from Tsinghua University. She loved her country, her customers, and the elderly. She ran a national enterprise day and night and opened hundreds of physical customer service centers in different cities. They called themselves "Green People" and believed that "Lantian Green was illegally closed down" in 2017. "During the company's operation, it never owed investors a single cent of dividends. How could such a company and Mr. Hua be a liar? Why did she flee to the UK?"

Yang Fei, 64, still remembers the first time he met Huahua in October 2015. At that time, he was introduced by a friend to invest in Lantian Green, saying that it was "a good company that can make money for ordinary people." Because he was in the system and had never been exposed to investment, Yang Fei was very cautious and proposed to meet the actual controller of the company first. He was taken by his friend to the 27th floor of Fujian Building near Tianjin Railway Station and met Huahua in an office. "To be honest, I didn't believe Huahua when I first saw her. She was about 1.5 meters tall, chubby, and looked dull, not like someone who was capable of doing business. I thought, 'Forget it, can this person help ordinary people make money?' I thought to myself, but as soon as she opened her mouth, I was attracted by her," Yang Fei said. Huahua's voice was steady and confident, and she never stuttered. She introduced BlueSky Green's Bitcoin business to Yang Fei, saying that Bitcoin is the equivalent of gold in digital currency, will not face inflation, and will definitely continue to rise, with "one coin for one villa" in the future. In addition, Huahua mentioned the international technological development trend at the time, and said that BlueSky Green planned to develop technological products and would become the leader of the fourth industrial revolution in the future. She predicted that in a few years, China and the United States will inevitably have a trade war, a technology war, and a financial war. As long as investors follow her to mine coins and invest in technology products, they will be able to resist the all-round invasion of the United States in the future. "She talked nonstop for nearly two hours, but she didn't say a word to urge me to invest. I didn't feel annoyed and I listened to her." Yang Fei said that he invested more than 200,000 yuan after chatting with Huahua that day.

This extremely charming contrast is the first impression of many investors on Huahua. Investor Ye Houde has been in the home building materials business for decades and invested in Lantian Green as early as the second half of 2014. He had never heard of Bitcoin before, but when he saw Huahua, he saw her using a marker to draw a few simple circles and arrows on the whiteboard to talk about Bitcoin and blockchain. He felt that he understood it and said, "It's a good opportunity to invest in Bitcoin with her." After that, he bought every project, invested more than 10 million yuan, and specialized in Bitcoin investment. Later, he even closed the store and became a small leader, responsible for "popularizing" Bitcoin and BlueSky Green to other investors in Tangshan, Hebei, and "answering their questions".

Perhaps impressed by Huahua's language skills, these investors rarely asked her about her education and background. It was just rumored among investors that Huahua studied mathematics and cryptography at Tsinghua University and stayed in the United States for a period of time. Why did she come back? "Because she found that digital currency will be the most promising field in the world in the future in the United States, so she returned to China to do this business. After making it bigger and stronger and leading the people to common prosperity, she will hand over the company to the country." In the minds of investors, she is a person with a true "family and country feeling". She only sleeps three or four hours a day, and spends the rest of the time reading and studying. Several interviewees mentioned that when talking to investors about the country not being the center of finance and technology, the regret and expectation she showed made the listeners feel that it seemed very real.

Leaving aside the mysterious experience of "Huahua" and the patriotism she showed, looking back at the period around 2014 from the perspective of making money, Bitcoin was indeed a good business. This first-generation digital virtual currency, which was born in early 2009, has gradually attracted attention and recognition because of its decentralization, independence from any official institution or country, and ability to avoid inflation. In 2013, the price of Bitcoin soared from about $13 at the beginning of the year to nearly $250 in April. After several rounds of ups and downs, it exceeded $1,200 at the end of the year. The skyrocketing Bitcoin attracted the attention of Chinese buyers, and more and more Chinese players entered the Bitcoin market. Some people called this year China's "Bitcoin Year One" and "Chinese aunts began to pour into the industry." It was also this year that the first Bitcoin mine in China was built. These mines have several mining machines connected to the host, with stronger computing power and a higher probability of mining Bitcoin.

In the first year after its establishment, BlueSky Green attracted investors by relying on the model of "buying mining machines for mining." Yang Fei showed me the agreements for the company's first few financial products, "Blue Sky One", "Blue Sky Two" and "Youliyoubi". A similar model is that Blue Sky Green sells mining machines for 20,000 yuan each. After investors purchase mining machines, they can choose to take the mining machines away for mining, or lease the mining machines to the company for custody for one to two years. During the custody period, the investor's account can receive about 160 yuan in income every working day. The more mining machines purchased, the more daily dividends, and the custody relationship ends after the contract expires. Yang Fei said that almost no one would take the mining machines away, and everyone was willing to entrust them to the company to jointly help the company mine and "accompany the company's development." Investors can receive text messages on their mobile phones every day, and when they hear a "ding" sound, they know that the dividends have arrived.

A mining machine production base in Shenzhen, staff are conducting power-on testing on mining machines (Photo | Visual China)

A mining machine production base in Shenzhen, staff are conducting power-on testing on mining machines (Photo | Visual China)

Relying on the popularity of Bitcoin in China at that time and the "only profit, no loss" promoted under the hosting model, Lantian Green received the first few batches of funds, and indeed established mining farms in Tianjin, Guangzhou, Shenyang and other places, and organized investors to visit the mining farms from time to time. An investor who has been to a mining farm told me that most of the mining farms are located in the suburbs. In the huge warehouse, rows of shelves are filled with mining machines, tens of thousands of them. According to Lantian Green, the company will cut off the power a few days before the investor's visit, and on the day of the visit, the investor will be asked to wear a mask to enter to "prevent radiation damage."

This statement sounds warm, but in the eyes of Bitcoin practitioners who have opened mining farms, "there is no need." "The radiation from the mining machine is similar to that of your desktop computer, and it basically has no effect on people. If you don't turn on the mining machine during the visit, what progress can you see?" Yu Zimo still operates a Bitcoin mine in China. He told me that he would not easily stop the mine unless there was a special inspection. Moreover, the location of the Blue Sky Green Mine also made him somewhat suspicious of its authenticity. "The biggest consumption and cost of the mine is electricity, so it is generally opened in mountainous areas and remote areas with low electricity costs. Even if it is opened in the suburbs of the city, the cost is also very high, and it may even consume all the electricity in the nearby residential areas."

But Yang Fei and some investors still believe in the rationality and legality of investing in Blue Sky Green Bitcoin.Yang Fei is cautious in doing things. Long before he met Huahua for the first time, he had consulted national policy documents and knew that in 2015, the country encouraged mass entrepreneurship and innovation, encouraged the use of the Internet and open source technology, built an innovation and entrepreneurship platform, and guided institutions to invest in technology-based small and medium-sized enterprises. Another reason is that in the following years, Bitcoin experienced sharp rises and falls, but the overall value continued to increase. At its peak, one Bitcoin was worth $69,000, which was not much different from Huahua's prediction of "one coin, one villa". "She saw the problem too accurately. If the company had been operating in compliance until now, how much value could it create for the country?"

At the home of an investor in Hebei, an investor sister put a necklace with an air purifier on my neck, and I immediately felt a cool metallic feeling. The sister was very enthusiastic and told me that I should wear "Little Blue" when I go on business trips and take the bus in the future, which is good for my health. "Little Blue" is the name of this air purifier necklace. The blue pendant on the chest is the size of a matchbox square and is used for charging. There is a letter logo of Blue Sky Green in the center of the square. After turning on the switch, the letters light up, and there is an indescribable smell from the three small round air outlets on the side.

Legendary air purification necklace (picture | Internet)

A few minutes ago, investor Ye Houde showed me the "magical function" of "Little Blue". He found a tall transparent glass cup, lit a cigarette, took a puff, exhaled the smoke into the glass cup, quickly covered the mouth of the cup with his palm, and threw a little blue pendant into it. He was a little excited and said to me loudly, "Look carefully." I didn't dare to look away, and stared at the glass cup under his palm intently. After about five or six seconds, the smoke in the cup disappeared. "See it, see it! This is a good thing. Since you are here today, I will give it to you as a souvenir." Ye Houde handed me the "Little Blue" and said that after the COVID-19 prevention and control was relaxed at the end of 2022, during the peak of infection, an investor had been wearing two "Little Blue" around his neck, and he was the only one in the family who did not have a fever.

Investors said that Huahua once claimed that Blue Sky Green would help the country become a center of finance and technology in the future. Bitcoin is benchmarked against finance, and technology is next. This "Little Blue" purifier is a technological product launched by Blue Sky Green at the end of 2015, claiming that it can purify 3 cubic meters of air around it. At the same time, there was also "Big White" - a sterilization instrument the size of a mobile phone. Ye Houde said that if there are wounds or athlete's foot on the skin, it can be disinfected by sweeping it with Big White, "Iodine tincture is saved", and he has seen many female investors sweeping the dishes with Big White before eating. A few months later, BlueSky launched the product "Big Blue", a large air purifier shaped like a standing air conditioner. The company plans to put "Big Blue" in various bus stations in Beijing, Tianjin and Hebei, where smog is serious, and envisions achieving hundreds of millions of profits through cooperation with bus stations.

Promotional materials for various projects of the company (Photo | Provided by the interviewee)

If we don't discuss the feasibility of these product promotion plans, product quality and other issues, Huahua has a strong observation and imagination of social reality. Around 2015, air pollution and smog in the north were hot topics in society. Huahua used these products to promote technology and environmental protection. At that time, another hot topic was artificial intelligence, which was more in line with Huahua's slogan of "strengthening the country through science and technology", and she quickly found a way to connect the company with technology.

In mid-2016, Huahua announced to investors that Lantian Ge Rui had invested in a Shenzhen scientific research team that had just returned from abroad. After communicating with the team leader, she decided to invest tens of millions of yuan in the team every year. The team will use three years to develop a variety of smart products such as in-vehicle smart seat belts, smart toilets, and robot robots. I contacted a R&D staff member of the team, who told me that the domestic investment atmosphere was very hot at that time. The team leader had just returned to China, and soon many investors wanted to cooperate with him. Why choose to cooperate with Huahua? The answer of this R&D staff member was "feelings". He said that the most important criterion for team leaders to evaluate investors is "feelings". "If the other party is just trying to make money, why should we make money for him? We hope to make products that are affordable to all people and promote social progress. After the person in charge came into contact with Huahua, he thought that Huahua had such a sense of patriotism."

"Sentiment of patriotism" has become the "ultimate ideal" of every business of BlueSky Green, but it is expressed in different languages.According to convention, every time BlueSky Green launches a new product, it will hold a new product launch conference in Tianjin. Each launch conference is held in large venues such as big hotels and convention and exhibition centers. Thousands of investors come from different cities with their relatives and friends, and transportation, food and accommodation are all free. After establishing a cooperative relationship with the Shenzhen team, BlueSky Green held another launch conference. At the launch conference, Huahua said, "BlueSky Green is already at the forefront of the fourth industrial revolution." As for what the Fourth Industrial Revolution and the Industrial 4.0 era are, investors’ understanding comes more from Huahua’s narration—“the era of intelligence and informatization” and “leading the country to overtake on the curve”…

A promotion meeting of Blue Sky Green (Photo | Network)

Investors are willing to believe in this grand narrative. Many investors I have come into contact with were born in the 1960s and 1970s. Some participated in the self-defense counterattack against Vietnam, some themselves or their families served in the army, and some worked in the public security, procuratorial and judicial systems until retirement. In the interview, “the Party and the country” is a word they often talk about, and the fate of the nation and the individual are closely linked. An investor told me that an investment institution wanted to invest in BlueSky Green, but Huahua refused, "Huahua said that the investment institution had foreign capital." This has become another example of many investors "respecting" Huahua.

With very down-to-earth products, feelings and a technology team with the same "feelings", BlueSky Green developed rapidly in 2016 and entered its golden period, often holding promotion meetings in Tianjin, Shandong and other places. An important procedure at these promotion meetings is to listen to Huahua's speech. Investors are required not to bring mobile phones, cameras and other electronic video and recording equipment, and they must go through a security check. Many investors recalled that the scene was "like subway security, small bags passed through the machine, and the security guards held a stick to scan the whole body." The interviewed investors understood that because Huahua was a high-tech talent who returned from the United States, "she was afraid that she would attract attention, so she had to protect herself."

In mid-2016, Huahua encountered an accidental car accident on the highway, injured her knee, and the driver died on the spot. Since then, Huahua often sits in a wheelchair and is pushed into meetings by her assistant. She wears a mask outside of speeches and never takes photos with others, which makes her look more mysterious. But this does not affect the enthusiasm of investors at all. An investor in Beijing told me that she went to Tianjin for a meeting at that time. After the meeting, investors lined up in a long queue, waiting to swipe their cards to pay. "Do you know that there are people fighting because of cutting in line to pay? I was shocked after watching it, and I was also excited and bought a lot."

On March 25, 2016, Lantian Ge Rui cooperated with the Baodi District Government of Tianjin and signed the "Smart Bracelet Project". This is the only product that "Huahua" has tried to land during my interview - a physical store opened in different urban communities, and together with a smart watch (orange strap, the dial has three buttons, which can locate the location, emergency call, and use WeChat) to serve the elderly at home.

Smart bracelet project promotional image (Photo | Internet)

This is another project that hits the pain point of society. Elderly care is not only a need of individual families at present, but also a focus of government work. The "Smart Elderly Care" project directly brought the most important government cooperation to Blue Sky Green. "Baodi News" played a video of Blue Sky Green's legal person Ren Jiangtao shaking hands and signing an agreement with Chen Zheming, then secretary of the Baodi District Committee. The local newspaper also published the news, which mentioned in the report: "The Blue Sky Green Smart Bracelet Project settled in the Dakoutun Town Industrial Zone, with a planned total investment of 1.5 billion yuan, focusing on the construction of the Life Ring Operation Headquarters and the Big Data Center, Customer Service Center, R&D Center, etc. After full operation, it can increase the annual tax revenue of Baodi District by 20 million yuan." This cooperation has also become the biggest reason for all investors to trust the company. Investors have successively mortgaged their properties, taken out loans, and swiped their credit cards to sign multiple contracts with Blue Sky Green. "Because this project is endorsed by the government, is it wrong for us to believe in the country?" said an investor.

The customer service center mainly recruits newly graduated college students, technical secondary school students, etc., with a monthly salary of three to four thousand yuan. Sun Peng was one of the first ten batches of trainees. In the spring of 2016, after completing the training in Tianjin, he was assigned to work as a clerk in a Life Ring Customer Service Center in Minhang District, Shanghai. He was only 28 years old at the time. His mother was an investor in Blue Sky Green. When he heard that the customer service center needed employees, Sun Peng went to apply. The customer service center has opened 6 stores in Shanghai. The Shanghai 2 store where he is located is located on the second floor of a commercial building, serving several nearby communities.

"Except for one employee on duty who lives in the customer service center and is online 24 hours a day, the rest of our employees work from nine to five, and sometimes go out to provide services, so we have more free time." Speaking of services, Sun Peng remembered that each city was generally similar. Elderly people over the age of 55 could receive a life ring for free, and their children could check the location of the elderly through the life ring after downloading the corresponding app. Some customer service centers provide free fruit, and some provide free porridge and mung bean soup. Sun Peng's Shanghai 2 store provides free chess and card rooms and billiard tables. There is also a small venue indoors with amusement facilities for children to play for free. Sometimes, there are elderly people in the nearby community who need door-to-door cleaning, so he brings the cleaning staff to the door. They also accept the needs of parents of nearby elementary school students to pick up and drop off their children to school, and they only charge much lower fees than the market.

Life Ring Customer Service Center Established (Photo | Internet)

Sun Peng worked at the customer service center until the end of July 2017 when the company was closed down. He heard that in the end, only more than 270 customer service centers were opened, far from the "10,000 in the first year" in Huahua's plan. In addition to the fact that it was difficult to recruit young employees because it was "dirty and tiring", Sun Peng felt that it was also related to the profit model. At that time, the customer service center could only charge cheap fees for housekeeping, home delivery and other services. Among the more than 200 stores, few stores could be self-sufficient and relied entirely on company subsidies.

Although this only project that was implemented was not successful in practice, Lantian Green still relied on the beautiful imagination of "smart elderly care" to attract countless investors to follow. An investor in Suzhou remembers that in July 2016, he listened to Huahua's speech at a customer service center promotion meeting. It was the first time he met Huahua. He sat in the last row. At the end, there was a question-and-answer session. An older woman in the same row with him stood up and took the microphone and said that in her hometown, many relatives and friends thought she was doing pyramid selling. She asked Huahua with tears in her eyes: "Can you open a Life Ring customer service center in my hometown? So that I can prove to them that I am a serious investor?"

"I will give priority to your area when I open a physical store later." The older woman got Huahua's verbal promise. Huahua received the admiration of the Suzhou investor and the money of more investors that day.

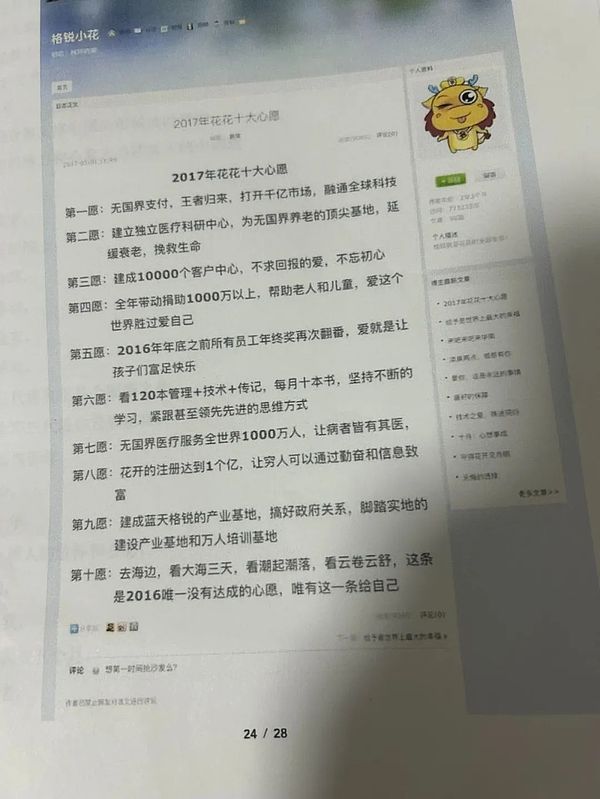

On New Year's Day 2017, Huahua updated an article "Huahua's Top Ten Wishes" on her blog.

“First wish: borderless payment, the king returns, opens up a trillion-dollar market, and integrates global technology.

Second wish: establish an independent medical research center, a top base for borderless elderly care, delay aging, and save lives.

Third wish: build 10,000 customer centers, love without asking for anything in return, and never forget the original intention.

…

Tenth wish: go to the beach, watch the sea for three days, watch the ebb and flow, watch the clouds roll and unfold. This is the only wish that has not been fulfilled in 2016, and this is the only wish for myself.”

Huahua's blog post "Huahua's Top Ten Wishes" (Photo provided by the interviewee)

This blog is in Huahua's usual style. She updates it every few days, using a lot of words such as love, original intention, global technology, etc., arranged in lines of short sentences, which are called "long poems" by investors. An investor told me that Huahua is very cultured and loves reading. The walls of her home in Tianjin are full of books. "She has a driver when she goes out, and she also takes a book to read when sitting in the back of the car. She also recommends books to our employees. I still have the "Silicon Valley Iron Man" about Musk that she recommended at home." In 2017, one of Huahua's wishes written in her blog was to read at least 10 books a month.

During this period, among BlueSky Green's Bitcoin, smart technology, and pension financial products, the physical business was not smooth, but the Bitcoin business was increasingly sought after. In May 2017, when the price of Bitcoin reached a peak of $1,800, BlueSky launched new "Digital One" and "Digital Two" financial products, which were also the last two most profitable products before the company went bankrupt.

According to the promotional documents of that year, these two financial products belonged to the new company "Britain Nice Life Insurance" registered in the Cayman Islands, UK. "The only insurance company in the world that provides property insurance for digital currency, allowing your digital assets to win steadily and continue to increase in value." "Reduce the potential risks in digital currency investment and let digital currency enter the homes of ordinary people. Preserve and increase value, and promote new wealth creation effects in society."

Stills from "Forensic Heroes 6"

Stills from "Forensic Heroes 6"

The registration information of this company can no longer be found. Yu Zimo, a Bitcoin practitioner, told me that this kind of Bitcoin insurance, which claims to "maintain and increase value", is absurd to anyone with a discerning eye, because the biggest feature of Bitcoin is its unstable rise and fall. Even if it rises strongly in a short period of time, it may plummet next month due to factors such as policies and other currencies.Someone once used a similar trick, claiming that he had established an online Bitcoin bank that could provide customs clearance services for players, but a few months later, it was proved to be a scam to steal players' Bitcoins, and there was no way to track the other party. After that, few people would believe in this "insurance model".

However, the publicity of "British Aisheng Insurance" for maintaining and increasing value is still attractive to Blue Sky Green's investors.Since the end of 2016, Bitcoin has started a round of "bull market". For more than half a year, the end of each month has basically risen by at least $100 compared with the previous month. Following the rise of Bitcoin, every new contract is like a stimulant, a business that can only make money and not lose money. "This is much more profitable than running a physical store." An investor who has opened a supermarket told me, "When running a physical store, we have to consider labor, decoration, product shelf life, etc., but this only requires waiting for dividends."

At the same time as the product, Lantian Green also launched a "key customer" mechanism. As long as an investor invests more than 6 million yuan at a time, he can become a "lifelong key customer" and receive 2 million yuan in dividends every year in the future, as well as shareholder status after the company goes public. During that period, the slogan "If you give Green three years, Green will give you three generations of wealth" often appeared. An investor told me that the last time he saw Huahua was at a promotion meeting in Zhejiang. Huahua wore a crown on his head and was sought after by investors more than ever before. The atmosphere was a bit crazy.

The one wearing the mask is Qian Zhimin, and the other two are two of the seven district leaders (Photo|Provided by the interviewee)

The one wearing the mask is Qian Zhimin, and the other two are two of the seven district leaders (Photo|Provided by the interviewee)

According to the public verdict information of the relevant personnel of Lantian Green, the case-handling agency audited that Green Company has absorbed more than 40 billion yuan in funds in more than three years, of which more than 20 billion yuan was absorbed from January to July 2017, which was the company's craziest half year.Some small leaders in the company imitated the company's new product recommendation meetings, often holding meetings in county towns and district hotels, or handing out flyers at the railway station to promote Lantian Green. Some small leaders' cultural level was written as "none" in the verdict, but they were able to attract tens of millions of yuan in investment.

"Are you not worried about these publicity?" I asked several investors this question.

"It's impossible (to worry). We know that Green wanted to 'quickly increase the allocation' because it was still investing in scientific research enterprises, which is the most expensive. We can't see the return for a while. We are supporting this and waiting for this. Once it succeeds, this enterprise will be really successful." said an investor.

July 27, 2017, is a date that every Blue Sky Green investor interviewed can blurt out. On this day, they no longer receive daily dividends.

At first, quite a number of investors were still waiting and watching. The WeChat group owner or small leaders from all over the country "maintained stability" in the group, saying that "affected by the national financial policy, in order to ensure the stable development of the company and the stable income of everyone, the company is changing the financial system and upgrading it comprehensively." The company will distribute dividends before the end of August. Ye Houde drove with several small leaders at his own expense that year. "We drove all the way west for 17 days, to different cities, to hold meetings with team leaders, talk about Green's ideals, and let everyone not mess around and believe in the company's plans." But the dividends never arrived. Investors reported to the police one after another, and then people learned that Lantiange Rui was sealed up by the Hedong Branch of the Tianjin Public Security Bureau in July, and the company's management, including Huahua, were on the run.

Stills from "Hou Lang"

Stills from "Hou Lang"

Yang Fei told me that after Lantiange Rui was sealed up, the police never announced the specific reason, and only arrested dozens of relevant staff members for the crime of illegally absorbing public deposits. An investor said that this might be related to the country's strict crackdown on illegal fundraising that year. In April 2017, 14 state agencies including the Supreme People's Court, the Supreme People's Procuratorate, and the China Banking and Insurance Regulatory Commission held an inter-ministerial joint meeting on the disposal of illegal fundraising, mentioning that virtual currency financial management has the characteristics of illegal fundraising and pyramid selling. Less than half a year later, on September 4, the issuance and trading of virtual currencies in the country were completely stopped, and Bitcoin plummeted.

Huahua may also be aware of this financial environment and the dangers of Lantiangerui's business. As early as March 2017, Lantiangerui established seven major regions, including Beijing-Tianjin-Hebei, Northeast China, North China, and South China, to manage the sales of financial products. Each region has a person in charge, and there are several small team leaders under the region. The small leaders are not affiliated with the company. They are some people with good organizational and speaking skills who are "authorized" to hold their own sales meetings from time to time. The testimony of a small leader in the verdict is: "Sister Hua ordered the seven regions to set up their own companies. If something goes wrong, they can sever their ties with the company."

In the years when Lantiangerui was developing rapidly, Huahua could always find loyal puppets and hide in relatively safe corners.The verdict of Ren Jiangtao, the legal person of Lantiangerui, shows that he met Huahua through playing online games. Because he completely obeyed Huahua's command in the game, Huahua asked him to serve as the legal representative of Lantiangerui. In 2014, the two verbally agreed that if Ren Jiangtao worked for three years, he would receive a monthly salary of 30,000 yuan, and a bonus of 1 million yuan. Ren Jiangtao rented the server for the company's website from Alibaba Cloud, Tencent Cloud, and Amazon, and Huahua was in charge of all the money for financial products. If something happened to the company, Ren Jiangtao would have to shoulder the responsibility, but he believed that Huahua would have a way to "rescue" him.

Huahua did "rescue" key members of the team. A verdict showed that Wu Xiaolong, general manager of Lantian Gerui, was arrested and investigated by the Linghai City Public Security Bureau of Jinzhou, Liaoning Province in August 2016 for suspected pyramid selling. Huahua asked someone to find a relationship and spent 15 million yuan to "rescue" Wu Xiaolong. It was not until a year later when Lantian Gerui was closed down by the police that Wu Xiaolong was arrested again. This time, he did not wait for the protection of his master, and Huahua himself began to flee. According to British court documents obtained by the Financial Times, in July 2017, Qian Zhimin converted the property of Blue Sky Green Company into Bitcoin, and obtained a passport of the Federation of Saint Kitts and Nevis under the alias "Zhang Yadi". A month later, he bought a fake Myanmar passport under the name of NAN YIN, and used multiple identities to travel to Laos and entered London in September.

According to British court documents, after arriving in London, Zhang Yadi found Wen Jian as a translator and housekeeper. She told Wen Jian that she had a multinational jewelry company. Less than three weeks after the two met, they moved into a six-bedroom mansion in Hampstead, a wealthy area in northern London, with a monthly rent of up to 17,300 pounds (about 163,000 yuan). After that, Wen Jian helped Zhang Yadi buy jewelry and other luxury goods worth tens of thousands of pounds in different countries, and also exchanged Bitcoin for local currency in Dubai to buy two properties. While enjoying these wealth, Zhang Yadi still maintained her usual mystery. Although she lived with Wen Jian and often went out together, she never left any group photos.

On February 20, 2014, at Boston South Station, a transportation hub in Massachusetts, staff at Liberty Teller helped customers buy Bitcoin from a newly installed Bitcoin ATM

On February 20, 2014, at Boston South Station, a transportation hub in Massachusetts, staff at Liberty Teller helped customers buy Bitcoin from a newly installed Bitcoin ATM

According to the Financial Times, British police seized a digital diary that had been written since 2018. In the diary, Huahua showed her greater imagination: she hoped to buy Liberland - a 7 square kilometer, unrecognized and uninhabited microstate located on the Danube River between Croatia and Serbia - and build a huge Buddhist temple there, as well as infrastructure including airports and ports, and rule Liberland, thereby having diplomatic immunity.

After Lantian Ge Rui was closed down in July 2017, Hua Hua disappeared. More than 100,000 investors realized that they knew almost nothing about this former “female god of wealth”. For more than three years, they have transferred the contract money to the bank account of the legal person Ren Jiangtao. Regarding Hua Hua, how old is she? Where is she from? Does she have a family? Even what is her real name? There is no certainty. In April this year, the discussion about Hua Hua reappeared, and there was a slightly more specific answer - according to the Financial Times, Qian Zhimin was born in 1978 and came from a city in the south. Several investors said that she had a family.

Stills from "Anti-Fraud Police"

Stills from "Anti-Fraud Police"

Now, seven years later, almost every investor I contacted has debts of varying sizes. Some people who once invested tens of millions are cleaning toilets; some have retired, their pensions have been frozen by the government to pay off debts, and their children help pay back part of the money every month, and they have to work as temporary workers, picking up plastic bottles and cartons; some people say they can't bear to eat fruit that costs more than one dollar, and wait to pick up vegetable leaves after the market closes, and some elderly people have passed away.

Ye Houde has paid off most of his debts in the past few years, and no longer does building materials business, and often drives a small van for wholesale and retail. He still firmly believed that Huahua was not Zhang Yadi who was arrested in the UK. He and his companions kept making requests to the Supreme People's Court, the State Council and other national institutions, waiting for the system to give an explanation, explaining why Lantiange Rui was seized and when to return the losses of investors. At a dinner party in early September, he drank some wine, his square face flushed, and he spoke emotionally about Huahua's accurate prediction of Bitcoin that year, and she was the "goddess of the currency circle", "I am willing to die for Huahua". On domestic social platforms, some investors kept leaving messages: "Lantiange Rui benefits the country and the people, and I hope it will return."

Some investors found a glimmer of hope to recover the principal from the British Bitcoin money laundering case. They found several domestic law firms to represent this cross-border financial case. Li Yinyao, one of the lawyers, told me that on July 10, the British High Court officially accepted the overseas wind-up petition (Winding-Up Petition) of Lantiange Rui from Chinese creditors, which means that the case officially entered the civil judicial procedure. Because of the huge amount and number of people involved in the case, and the fluctuation of the value of Bitcoin, she expects that the company's wind-up trial may take three to five years or even longer.

But the latest news is that it is still unclear whether the application for overseas liquidation will be approved. On October 16, the UK Bankruptcy and Company Court held a hearing and finally decided to postpone the hearing of the liquidation application to mid-November.

(This article is selected from "Sanlian Life Weekly" 2024 Issue 42. In order to protect the privacy of the interviewees, Tang Yi, Yang Fei, Yu Zimo, Ye Houde, and Sun Peng are pseudonyms in the article. Intern reporters Jiang Wenxin and Qu Zihan also contributed to this article)

Investors can buy tokenized shares of a new Hilton hotel in El Salvador on the Bitcoin Liquid Network, marking a milestone in the country's capital markets.

Weiliang

Weiliang91Porn官推显示AVAV即将在Bitget创新区上架交易

铭文老幺

铭文老幺The SEC filed a summons order in the U.S. District Court of the District of Columbia today ordering Zhao to appear within 21 days of receipt.

Others

OthersHe reiterated that the agency is equipped to provide regulation over much of the crypto market, including the two largest crypto, BTC & ETH.

Others

OthersThe cryptocurrency world continues to develop and expand, with innovation being a critical part of the industry. Despite the recent ...

Bitcoinist

BitcoinistCrypto donations platform Engiven’s page for the archdiocese includes the option to send funds anonymously using many tokens, from Ether to 0x.

Cointelegraph

CointelegraphWith the support and guidance of relevant departments and the Xi'an Branch of the People's Bank of China, various pilot operating agencies continue to optimize the digital RMB acceptance environment. Xi'an has initially established a digital RMB ecosystem with both application scenarios and consumer groups.

Ftftx

Ftftx Bitcoinist

BitcoinistAs Earning Games build their community, they also present new opportunities to give back to those less fortunate.

Cointelegraph

CointelegraphGrayscale wrote: "Ethereum is like New York City: it's big, expensive, and crowded in some areas. However, it also has the richest application ecosystem."

Cointelegraph

Cointelegraph